Increased automation, efficiency, and sustainability in packaging operations are the new drivers being looked upon in the form fill seal (FFS) equipment industry, which is growing rapidly. The food, pharmaceutical, personal care, and industrial sectors' increasing demand is encouraging companies to invest in high-speed sealing systems, precision dosing, and intelligent packaging features. AI-enabled architectures augment quality control, predictive maintenance, actual eco-friendly materials that constitute the majority of optimizing packaging efficiency, and waste reduction.

Manufacturers are integrating more advanced features in their machines for a wider variation of packaging materials that include recyclable films, compostable plastics, and paper-based pouches. The trend toward compact, energy-efficient, and multi-purpose FFS machines minimizes output and environmental degradation.

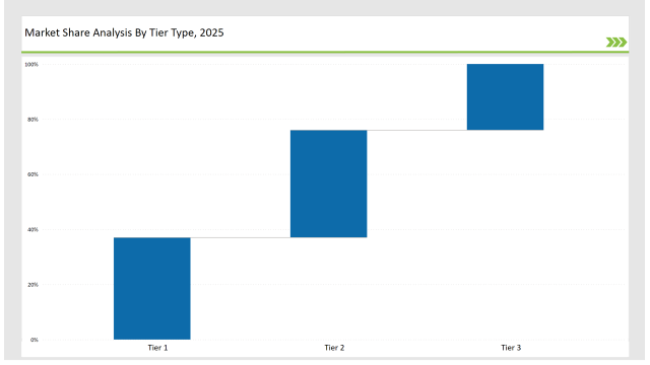

Approximately, 38% of the industry belongs to the Tier 1 player group, consisting of Bosch Packaging Technology, Syntegon, and IMA Group. The Tier 1 classification is attributed to their expertise in advanced automation solutions, high-speed packaging technology, and global distribution networks.

Tier 2 companies account for 39% of the market, offering flexible, cost-effective, and customized FFS equipment tailored to meet the needs of various industries. Coesia Group, ULMA Packaging, and ProMach fall into this category.

Specialized regional niche players predominantly dealing with compact, high-precision, and sustainable FFS solutions make up 23% of Tier 3 of the packaging market. The focus of these companies is on localized production, specialized applications, and advanced sealing technology.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Bosch Packaging Technology, Syntegon, IMA Group) | 18% |

| Rest of Top 5 (Coesia Group, ULMA Packaging) | 12% |

| Next 5 of Top 10 (ProMach, MULTIVAC, Viking Masek, Mespack, Omori Machinery) | 8% |

The form fill seal equipment industry serves multiple sectors where speed, precision, and sustainability are essential. Companies are innovating to enhance packaging reliability, reduce waste, and meet evolving regulatory demands. They are developing energy-efficient sealing methods to minimize operational costs and environmental impact.

Manufacturers are optimizing FFS equipment with high-speed filling, sustainable packaging compatibility, and intelligent automation features. They are integrating precision sensors to enhance packaging accuracy and minimize product waste. Additionally, companies are developing modular machine designs to allow quick format changes for different packaging applications. Businesses are also incorporating AI-driven monitoring systems to improve production consistency and reduce downtime.

Automation and sustainability are driving the transformation of the FFS equipment industry. Companies are integrating AI-powered quality control, robotic product handling, and energy-efficient heating elements to enhance machine performance. Businesses are investing in ultra-thin, high-barrier films to improve packaging sustainability. Manufacturers are developing smart touch interfaces with real-time diagnostics to minimize downtime. Additionally, firms are adopting fully recyclable packaging films to comply with sustainability regulations.

Technology suppliers should focus on automation, sustainable packaging solutions, and smart processing advancements to support the evolving FFS equipment market. Partnering with food, pharmaceutical, and personal care brands will accelerate innovation and adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Bosch Packaging Technology, Syntegon, IMA Group |

| Tier 2 | Coesia Group, ULMA Packaging, ProMach |

| Tier 3 | MULTIVAC, Viking Masek, Mespack, Omori Machinery |

Leading manufacturers are advancing FFS technology with AI-powered automation, sustainable packaging materials, and high-speed processing capabilities. Companies are enhancing sealing precision to improve packaging integrity. Additionally, manufacturers are developing modular designs to allow faster machine reconfiguration for different packaging formats. Businesses are also optimizing film usage to reduce material costs and improve efficiency.

| Manufacturer | Latest Developments |

|---|---|

| Bosch Packaging | Launched AI-powered defect detection for high-speed packaging in March 2024. |

| Syntegon | Developed recyclable packaging film compatibility in April 2024. |

| IMA Group | Expanded automated multi-lane FFS machines in May 2024. |

| Coesia Group | Released energy-efficient compact FFS machines in June 2024. |

| ULMA Packaging | Strengthened modified atmosphere packaging (MAP) capabilities in July 2024. |

| ProMach | Introduced smart IoT-enabled FFS machines in August 2024. |

| MULTIVAC | Pioneered paper-based FFS technology in September 2024. |

The FFS equipment market is evolving as companies invest in smart automation, AI-driven defect detection, and high-speed modular solutions. They are integrating predictive analytics to minimize machine downtime and enhance operational efficiency. Additionally, manufacturers are adopting energy-efficient heating and sealing methods to reduce energy consumption. Businesses are also improving machine flexibility, allowing quick format changes for diverse packaging needs.

Manufacturers will continue integrating AI-driven defect detection, modular machine designs, and ultra-thin film technologies. Companies will refine high-speed automation to enhance production efficiency. Businesses will expand sustainable material adoption to meet regulatory requirements. Smart monitoring and predictive maintenance will improve machine uptime. Additionally, AI-powered analytics will optimize packaging processes and minimize material waste. Firms will enhance sealing technologies to improve packaging integrity and prevent contamination. Companies will also integrate real-time tracking features to improve supply chain visibility and operational control.

Leading players include Bosch Packaging Technology, Syntegon, IMA Group, Coesia Group, ULMA Packaging, ProMach, and MULTIVAC.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include automation, sustainability, high-speed processing, and smart packaging solutions.

Explore Packaging Machinery Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.