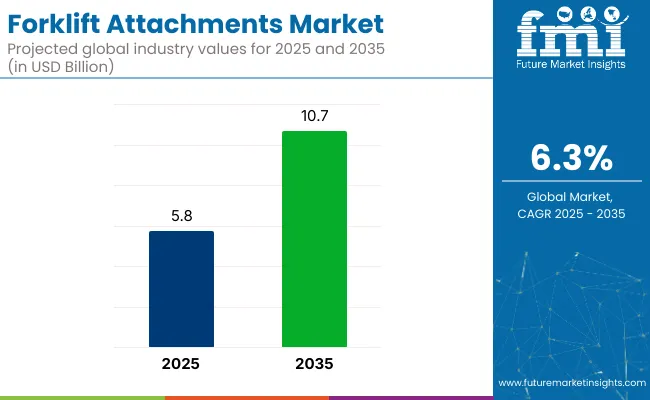

The global forklift attachments market is forecast to grow from USD 5.8 billion in 2025 to USD 10.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 6.3%. The rise is being supported by expansion in warehouse automation, tighter handling regulations, and growing demand for flexibility in material handling.

In 2024, TVH’s CAM attachments introduced the PK TS Fork Positioner, which enables hydraulic fork-width adjustment from the cabin. Hydraulic sideshift and adjustable carriage spacing have been integrated to enhance load precision and reduce operator fatigue.

As stated by Kobe Naert, Chief Product & Procurement at TVH, the hydraulic fork positioners are "increasingly becoming a standard upgrade feature” due to their ergonomic and safety benefits. This launch aligns with user demand for attachments that boost efficiency and safety without impacting equipment downtime.

KAUP has also focused on simplifying attachment changeover. Its PowerMount quick release coupler enables hydraulic attachments to be swapped in under 90 seconds, directly by operators. The system requires minimal residual load loss and maintains hydraulic coupling even under full pressure. Fleet managers have reported reduced idle time and lower operational costs through rapid attachment interchange, as per KAUP documentation.

Broader innovation in attachment types has been noted. Operators are integrating drum clamps, bale handlers, carton clamps, and rotators within single fleets. Electric and telecentric attachments are being advanced to align with electric forklift adoption and sustainability targets. Attachment modularity is being enhanced to support mixed fleets across sectors such as e commerce, warehousing, manufacturing, and construction.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5.8 billion |

| Projected Market Size in 2035 | USD 10.7 billion |

| CAGR (2025 to 2035) | 6.3% |

Regulatory changes in workplace safety have also driven demand for hydraulic interlocks and safety sensors embedded in attachments, ensuring compliance with handling and ergonomic standards. OEMs and dealers are now offering lifecycle service packages and validation protocols tailored to attachment safety.

Regional warehouse expansions in Asia Pacific and Latin America are contributing to demand. Local manufacturing of attachments is being increased to support rising mechanization in logistics and retail distribution.Forecast trends through 2035 suggest that attachment innovation will continue to concentrate on rapid installation, ergonomic design, and integration with automation controls.

Side shifters are estimated to account for approximately 27% of the global forklift attachment market share in 2025 and are projected to grow at a CAGR of 6.4% through 2035. These attachments allow lateral movement of the forks, enabling precise pallet alignment without repositioning the forklift itself-enhancing efficiency and reducing maneuvering time.

Side shifters are standard on most new forklifts due to their versatility in indoor and outdoor material handling tasks. Demand is strong across logistics centers, cold storage, manufacturing units, and distribution warehouses. OEMs and aftermarket providers continue to focus on improving durability, reduced hydraulic leakage, and compatibility with narrow-aisle forklifts and electric trucks to support evolving facility layouts.

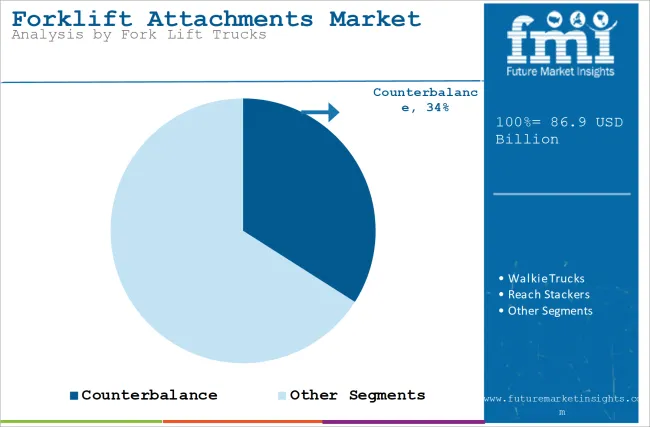

Counterbalance forklift trucks are projected to hold approximately 34% of the global forklift attachment market share in 2025 and are expected to grow at a CAGR of 6.5% through 2035. These forklifts remain the most commonly used across industries due to their simple design, high lifting capacity, and flexibility in handling various attachments.

Attachments such as fork positioners, rotators, carton clamps, and single-double pallet handlers are frequently integrated with counterbalance models for use in fast-paced operations like beverage handling, automotive part movement, and container unloading.

As global warehouse automation grows and material handling becomes more specialized, counterbalance forklifts continue to serve as the base platform for scalable attachment integration-especially in Europe, North America, and Southeast Asia. Manufacturers are optimizing attachment quick-connect features and load monitoring systems to enhance safety and minimize downtime during operational shifts.

High Initial Investment

Smart Forklift Attachments or AI enabled forklift attachments are some advanced equipment, which generally need huge investment as compared to forklifts but do not apply to SMEs or SMEs. This, coupled with the high integration and maintenance costs, impedes widespread adoption.

Durability and Maintenance

Being heavy-duty equipment, forklift attachments undergo very aggressive use, increasing maintenance costs. Striking a balance between long-term durability and cost remains a key challenge for manufacturers.

Adoption of Smart Forklift Attachments

The increase in automation, IoT integration, and AI-based material handling are stimulating intelligent forklift attachment opportunities that provide real-time tracking, adaptive control, purpose design, and energy optimization in this market segment.

Expansion of Green Logistics

With the gradual move toward carbon-neutral business operations, there is a growing need for lightweight and energy-efficient solutions in terms of forklift attachments. Advancements in hydraulic performance, sustainable materials, and regenerative braking systems will drive new business opportunities.

America Forklift Attachments Market Is Gaining Traction on the Back of Growing Logistics, E-commerce and Manufacturing Sectors As automation continues to gain traction in warehouses and material handling operations, companies are focusing on advanced types of forklift attachments, including clamps, side shifters, rotators, and multiple load handlers, to boost warehouse uptime.

The e-commerce revolution especially with leading companies such as Amazon, Walmart and FedEx has generated increased demand for high efficient forklift attachments that can enable fast pallet transportation, improved productivity and less manual effort. The switch to electric forklifts, along with the push towards automated guided vehicles (AGVs), is further increasing demand for customized and sensor-enabled forklift attachments that can be interfaced with warehouse management systems (WMS).

With government incentives promoting environmentally friendly material handling solutions, businesses are transitioning to energy-efficient hydraulic and electric-powered forklift attachments that not only minimize fuel consumption, but also cut down on maintenance costs. In addition, rising requirement of the customized attachments for different industries and to increase the durability of forklift are also fuelling the growth of aftermarket demand for replacement attachments.

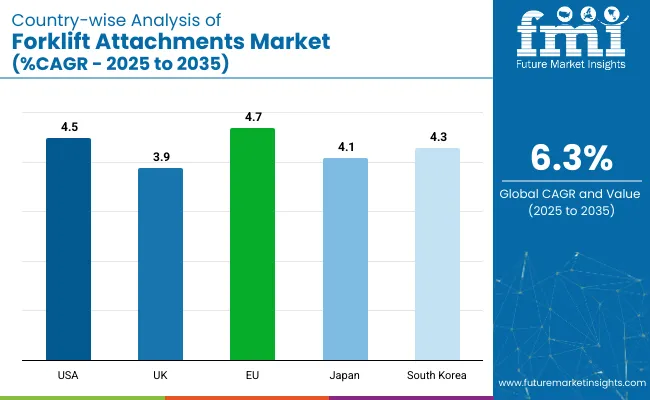

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The increasing investments in automation, logistics infrastructure, and warehouse modernization will boost the growth of the UK forklift attachments market. Since the UK is a key centre for worldwide shipping and distribution, the deployment of high-efficiency forklift attachments becomes increasingly popular to maximize profit margins.

Businesses are pivoting their logistics and warehousing strategies in response to changes in the post-Brexit supply chain, contributing to increased demand for forklift attachments that optimize space, expedite operations, and reduce labour costs. UK government also committed to make industry more sustainable, so companies are now investing in e-forklift compatible attachments which help reduce emissions and also improves effectiveness.

Furthermore, the UK construction boom, with initiatives like the London Cross rail and HS2 rail project, is focusing the demand for heavy-duty forklift attachments that help with the handling of building materials, precast concrete and large industrial loads.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

Supply chain optimization, strict environmental policies and increasing adoption of the automation in logistic are aiding the fast development of European forklift attachments market. As countries like Germany, France, and Netherlands set the standard for warehouse innovations, industries are veering toward smart logistics, such as AI forklift attachments.

Rapid decarbonisation amidst government regulations is resulting in the hastened adoption of electric-powered forklift trucks across several industries driving the demand for forklift attachments and the European Union's Green Deal initiative is significantly impacting this trend. As a result, electric forklifts-and the attachments that are compatible with them-are starting to gain traction on warehouse, manufacturing plant and shipping dock floors.

As a global leader in high-tech manufacturing and exports, high-value goods, precision parts and bulk raw materials growth is placing increasing demand on the EU for customized forklift attachments. The growth of intermodal freight transport is supporting the increasing demand for versatile load handlers and closers that can be used across transport modes.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Evolution of industrial automation, robotics integration, and growth of manufacturing technologies fuel the Japan forklift attachments market. As Japan is home to some of the world’s largest forklift manufacturers, the demandability of its attachments that improve the mobility and manoeuvrability of forklifts is increasing.

Increasing usage of automated guided vehicles (AGVs) in warehouses and manufacturing plants to trigger adoption of smart forklift attachments that are compatible with robotic systems In addition, Japan's high-speed urbanization and infrastructure construction are leading to increasing demand for high-density usage attachments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The market for forklift attachments in South Korea is being driven by growing logistics operations, robust growth of e-commerce in recent years, and high investments in smart warehousing. Managerial demand for heavy-duty forklift attachments at shipping ports and freight terminals is stable, due to South Korea’s latest position in global trade and shipping.

The implementation of AI-based warehouse automation in South Korea has been able to create a high demand for intelligent and sensor-based forklift attachments also. Cold chain logistics are also driving the demand for temperature-controlled storage and transport attachments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

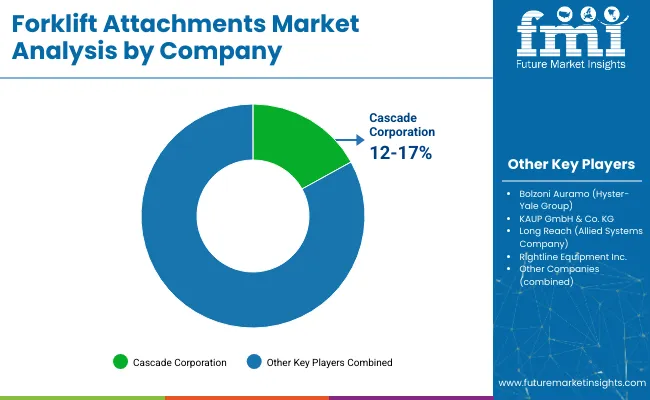

Fortive, Palfinger, Toyota Industries, and others dominate this market although there are plenty of regional players known for certain niche applications. Companies focus on improving material handling capabilities, increasing load efficiency, and lowering operational costs.

The market growth is driven by rising warehouse automation, increasing e-commerce activities, and growing demand for customized attachments in sectors including logistics, construction, and manufacturing.

The overall market size for Forklift attachments market was USD 5.8 billion in 2025.

The Forklift attachments market is expected to reach USD 10.7 billion in 2035.

The increasing demand from various industries such as warehousing, logistics, manufacturing, construction, and food & beverage fuels the Forklift Attachments market during the forecast period.

The top 5 countries which drives the development of Forklift attachments market are USA, UK, Europe Union, Japan and South Korea.

Side shifters are expected to lead the forklift attachments market, driven by their ability to enhance material handling efficiency and operational flexibility. Their widespread adoption across warehousing, logistics, and manufacturing industries ensures optimized load positioning, reduced handling time, and minimized product damage, making them an indispensable attachment in modern forklift applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Forklift Battery Market Size and Share Forecast Outlook 2025 to 2035

Forklift-Mounted Computers Market

Autonomous Forklift Market Growth – Trends & Forecast 2024-2034

Cherry Picker Forklift Market Growth - Trends & Forecast 2025 to 2035

Mixers & Attachments Market

Loader Bucket Attachments Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Attachments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA