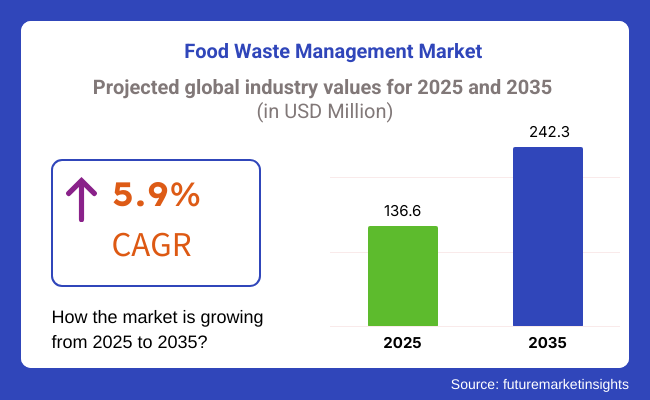

The food waste management market was valued at USD 136.6 million in 2025 and is expected to reach USD 242.3 million by 2035, at a CAGR of 5.9% in the period of 2025 to 2035.

The food waste management industry is driven by regulatory and government initiatives to minimize waste generation. The adoption of innovative food waste recycling solutions has increased due to stringent waste management policies imposed by several nations. Environmental concerns are also on the rise; this has led companies to invest in advanced waste processing technologies like anaerobic digestion and composting.

Due to the increasing attraction for natural and organic ingredients, organizations seek to convert their excess organic material into value-added products such as fertilizers and animal feed, making the food waste management sector one with great demand.

Incoming new investments in biogas and waste-to-energy plants contributed to greater competition in the industry. Recent expansions in organic waste processing plants, for instance, have allowed companies to turn their food waste into biofuel, thus reducing their landfill needs tremendously.

A growing consumer trend toward sustainable living is changing industry dynamics, too. They are more likely to buy from brands using natural ingredients and dispose of their products sustainably.

This trend to reduce food waste has been focused on food manufacturers and retailers, encouraging these businesses to redistribute excess food and take advantage of biodegradable packaging options. The food service industry is also starting to adopt compostable packaging and zero-waste kitchen practices that are aligned with consumers’ demands.

Due to the increasing attraction for natural and organic ingredients, organizations seek to convert their excess organic material into value-added products such as fertilizers and animal feed, making the food waste management sector one with great demand.

This transition is creating new business models based on the circular economy - which, in turn, is further stimulating growth in the industry. The food waste management industry will soar in the next decade with the combined driver of supportive regulations, technological inventions, and consumer-led sustainability.

Explore FMI!

Book a free demo

The food waste management industry is growing with factors such as companies, and consumers seeking eco-friendly disposal methods to manage food waste. Home consumers view cost-saving steps like cutting waste through composting and portion control, and restaurants and hotels take smart waste monitoring systems and partnerships with food recovery initiatives.

The food processing sector has given top priority to innovative waste separation technologies to optimize recycling and bioenergy yield. Retail and supermarkets are implementing AI-based inventory management to reduce excess stock and reroute edible food into donation channels. Meanwhile, farms and agriculture focus on organic waste composting and anaerobic digestion to produce biogas and soil conditioners.

Government policies and business sustainability practices are driving industries towards zero-waste principles, necessitating creative waste management solutions for economic and environmental gains.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2025) and the current year (2025) for the global food waste management industry. This analysis highlights crucial performance shifts and revenue realization patterns, providing stakeholders with a clearer outlook on industry growth trends.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.6% |

| H2 (2024 to 2034) | 5.9% |

| H1 (2025 to 2035) | 5.7% |

| H2 (2025 to 2035) | 6.0% |

The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December. In the first half (H1) of the decade from 2025 to 2035, the industry is projected to expand at a CAGR of 5.6%, followed by a slightly higher growth rate of 5.9% in the second half (H2).

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is anticipated to rise to 6.1% in the first half, while the second half (H2) is expected to sustain a strong growth rate of 5.9%. During H1, the sector experienced an increase of 10 BPS, whereas in H2, the business witnessed a slight increase of 10 BPS.

During 2020 to 2024, the industry for food waste management increased steadily due to augmenting food production and consumption, thus increasing the level of waste. Governments and institutions emphasized minimizing food waste through legislation, enhanced segregation of waste, and recycling practices.

AI and big data were utilized to monitor waste patterns, maximize food processing, and minimize spoilage. Companies embraced anaerobic digestion, composting, and waste-to-energy technology to reduce landfill contribution and create renewable energy. Yet, with the high costs of operations, inefficient waste collection infrastructure, and insufficient public education, industry development was hindered.

With IoT and edge AI for real-time monitoring of food production and consumption, automated reduction methods will be enabled. Blockchain-integrated supply chains will enhance traceability and accountability, reducing food loss.

Quantum computing will enhance the efficiency of waste processing, while biodegradable and recyclable packaging will keep the environment to a minimum. AI-powered waste-to-energy technologies will achieve maximum energy recovery from organic waste.

Governments will implement tougher zero-waste regulations, nudging industries toward circular economy activities. Automation and decentralized processing will optimize waste collection and recycling, making food waste management cheaper and more sustainable. Artificial intelligence-based platforms will enable real-time waste tracking and minimization, propelling a more sustainable food system.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Government-initiated food waste reduction strategies and recycling incentives | Compliance tracking and zero-waste enforcement by AI using blockchain |

| Big data and AI to track waste and develop reduction strategies | Real-time edge AI and IoT for autonomous waste reduction |

| Anaerobic digestion, composting, and waste-to-energy solutions | AI-optimized, quantum-driven waste processing for optimal efficiency |

| Challenges in tracking waste through supply chains | Blockchain-based, transparent waste tracking and accountability |

| Emphasis on lowering landfill contributions and boosting recycling | Circular economy-focused zero-waste approaches using biodegradable substances |

| AI-grounded knowledge for waste management processes optimization | Autonomous, smart waste management systems |

| Exorbitant operation cost and erratic waste collection infrastructure | Decentralized waste collection and recycling with AI-driven infrastructure |

Food waste management industry is a risk where many people are participating in, including regulatory, operational, and financial difficulties. The specific government regulations concerning waste disposal, landfill bans, and carbon emissions are incredibly risky for companies because of compliance requirements.

Should the companies fail to abide by these regulations, they risk incurring heavy fines, facing legal actions, or being forced to shut down operations.One more issue of high concern is high operational expenditures.

Entrenching waste processing technologies, such as anaerobic digestion, composting, and waste-to-energy conversion demands vast amounts of capital investment, including not only the initial price but the ongoing maintenance as well. Such companies as the small ones may face difficulties in terms of cost, advancement, and financial resources required for implementing the solutions of waste management.

Another risk that is equal to the is the inefficiency within the supply chain. The industry is solely dependent on the durable waste pickup, transport, and processing infrastructure. If the logistics do not work due to some labour shortages, fluctuations of fuel prices, or inefficient sorting techniques it will cause waste overflow, dependency on landfills, and consequently, it will cost them more to operate.

Consumer behaviour and awareness also matter considerably. The number of businesses and households that adopt zero-waste techniques is continuously increasing yet, they still do not sort and recycle the waste properly, which leads to contamination of the waste and the processing due to inefficiencies. For the companies to motivate their customers to make the right decisions when it comes to waste disposal, they need to spend money on education and incentives.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 6.6% |

| China | 7.8% |

| The UK | 6.1% |

| Japan | 5.1% |

| India | 5.9% |

The USA holds significant share with USD 28.15 billion in 2025 and a 6.6% CAGR from 2025 to 2035. Sustainability awareness of the environment and effective regulatory policies drive growth. The USA generates an estimated 63 million tons of food waste per annum in the commercial, institutional, and household sectors.

About 32% of these waste materials get recycled as recycling schemes and animal feeds. Funding waste management using intelligent technologies such as anaerobic digestion facilities and commercial compost facilities enhances effectiveness in waste avoidance.

Food-service premises and retail biggies utilize out-of-the-box approaches such as waste-tracking methods with the aid of artificial intelligence and donation-of-surplus-food schemes minimizing waste at sources. All such disparate efforts altogether largely contribute towards growth.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Government Policies | Demanding policies ensure food wastage reduction via recycling and composting in states. |

| Technology Advances | Waste tracking using A.I. technology, anaerobic digestion, and composting works best. |

| Retail & Consumer Actions | Dining restaurants and supermarkets enforce surplus food donation and smart inventory management. |

| Circular Economy Trends | Biz transforms food wastage into biofuel and eco-friendly packaging companies. |

China's industry is expanding at a very rapid rate and will reach a value of USD 20.12 billion in the year 2025, with a growth rate of 7.8% CAGR for the time period of 2035. Industrialization and urbanization are also leading to excessive production and consumption of food, thereby causing wastage.

Chinese government enforces stringent waste segregation programs and policies like "Clean Your Plate," controlling excess consumption from consumers. Advanced waste treatment technologies, like gasification and anaerobic digestion, convert organic waste to energy in sync with sustainability goals.

Smart waste bins and artificial intelligence-driven waste sorters make it more efficient. Increased collaboration between municipalities and private firms accelerates infrastructure construction with sustainable waste management technologies.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| National Policies | "Clean Your Plate" and food wastage segregation rules reduce overconsumption. |

| Waste-to-Energy Conversion | Anaerobic digestion and gasification transform food wastage into energy products. |

| Smart Waste Infrastructure | Artificial Intelligence-based intelligent bins and sorting stations increase the efficiency of waste disposal. |

| Urbanization Impact | Growing food consumption and disposable income result in the need for efficient waste disposal. |

The UK industry is likely to be USD 7.0 billion in 2025, growing at a CAGR of 6.1% during 2025 to 2035. The government has tough policies like landfill taxes and business-to-business waste reporting, encouraging companies to be eco-friendly.

Companies use smart waste monitoring systems that optimize collection and disposal and reduce wasteful landfill input. Excess food redistribution generates new partnerships between charities, food banks, and retailers to reroute surplus food to hungry recipients instead of landfills. New technologies for recycling food waste, like enzymatic breakdown, offer new prospects for recycling organic waste. Enhanced consumer consciousness promotes better consumption habits, which in turn encourages additional strategies for waste reduction.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Regulatory Framework | Landfill tax and mandatory reporting of waste place greater waste minimization obligations. |

| Surplus Redistribution | Food bank-retailer partnerships ensure food availability to vulnerable individuals. |

| Smart Waste Technology | Artificial intelligence monitoring systems enhance waste collection and minimize landfill waste. |

| Recycling Advancements | Enzymatic decomposition of food waste enhances the recycling of organic wastes. |

Industry in Japan is growing at a CAGR of 5.1% for the 2025 to 2035 period, is supported by its advanced technological master plan and strong government policies. The government guarantees the recycling of waste through the Food Recycling Law, which requires businesses to recycle trash efficiently. Greater application of bioconversion processes converts food waste to animal feed and fertilizers.

Japan's cities are densely populated and require compact waste treatment technology, such as city-scale fermentation plants. IoT in waste management enhances efficiency because it records data in real-time regarding the generation of waste and collection routes. The increased application of precision agriculture also reduces the wastage of food at the production level.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Regulatory Recycling Legislation | Food Recycling Law compels firms to treat and recycle food waste. |

| Bioconversion Technologies | The conversion of food waste into animal feed and fertilizer decreases landfill waste. |

| Space-Saving Waste Solutions | Small urban fermentation plants overcome the issue of high population density. |

| IoT Integration | Real-time monitoring of the waste stream optimizes collection and recycling efficiency. |

Indian food waste management industry is likely to grow at 5.9% CAGR from 2025 to 2035 due to rapid population growth and urbanization. India generates over 68 million tons of food waste annually with the help of ineffective chains of storage and distribution.

To promote waste segregation and management, the government has rolled out programs such as the Swachh Bharat Abhiyan. Cold chain logistic innovation reduces post-harvest losses, and decentralization of composting promotes grassroots organic recycling. Niche startups employ blockchain technology to develop transparent supply chains and minimize food wastage. Greater use of food-sharing platforms also dissuades restaurants and parties from wasting surplus food.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Policies | Swachh Bharat Abhiyan and other policies promote waste management solutions. |

| Cold Chain Technologies | Intelligent storage and logistics reduce food wastage after harvesting. |

| Decentralized Composting | Composting programs enhance the organic recycling of waste at the community level. |

| Technology-Based Solutions | Transparency in the supply chain via blockchain technology reduces food wastage. |

| Segment | Value Share (2025) |

|---|---|

| Recycling (By Services) | 35% |

The recycling segment is anticipated to hold the largest share of the overall global industry, with a 35% share value by 2025. Amid increasing regulatory pressure and corporate sustainability targets, recyclers are now placing more emphasis on recycling than on landfilling to mitigate environmental harm.

On the back end, sophisticated waste processing technologies like anaerobic digestion, composting, and bioconversion are turning food waste into biofuels, fertilizers, and compost feeding the circular economy model. For instance, Nestlé and Unilever have embraced waste-to-energy approaches, transforming unsold food into renewable energy channels. Governments in an effort to encourage food manufacturers and retailers to adopt big recycling programs are offering subsidies and tax breaks to them.

By comparison, landfills are still a major way of getting rid of food waste but are under increasing restrictions due to greenhouse gas emissions. Food waste that goes into landfills accounts for 8-10% of the world’s methane emissions, significantly accelerating climate change. The EU Landfill Directive and USA Zero Waste Initiatives are encouraging waste diversion initiatives and decreasing landfilling.

On the efficiency side, businesses are installing AI-powered waste monitoring systems, such as Winnow and Leanpath, that examine the waste flowing through their bins in real time and target ways to cut food waste at the source. With sustainability at the forefront, recycling will be the fastest-growing waste disposal method, led by regulation, economics, and consumers’ awareness of waste reduction programs.

| Segment | Value Share (2025) |

|---|---|

| Food Processing (By Waste Type) | 28% |

Due to the massive waste generation from the bakery, dairy, seafood, and meat industries, this report divides the global industry into segments based on food processing waste (bakery waste, dairy waste, food waste, and meat waste).

It projects that by 2025, the food processing waste segment will account for 28% of the industry. Effective waste management solutions are necessary due to the nature of the food and forest sectors, which generate by-products, rejected ingredients, and spoilage.

The solution is provided by emerging valorisation technologies, such as enzyme extraction, fermentation, and bioconversion. Upcycled dairy by-products have attracted investment from companies such as Cargill and Danone, which are targeting nutritional uses of the ingredients or value-added proteins. Nestlé has partnered with Veolia to develop innovative valorisation processes for food waste that help reduce environmental footprint.

Stringent regulatory requirements are also rapidly driving the need for sustainability. The USA Food and Drug Administration’s Food Recovery Hierarchy describes how to dispose of food waste: prevent, recycle, and upcycle it, don’t landfill it, and the European Union’s Farm to Fork Strategy seeks to halve food waste by 2030.

The agri-produce processing waste segment also accounts for a substantial share of the industry on the pome of waste generated after sorting, peeling, trimming, and processing of fruits, vegetables, grains, and oilseeds. Companies such as ADM and Bühler have poured money into driving grain waste into plant-based proteins and starch derivatives and transforming fruit and vegetable waste into pectin, antioxidants, and dietary fibers for functional foods, cosmetics, and pharmaceuticals.

With consumers increasingly demanding sustainable food production, businesses are introducing artificial intelligence-enabled waste tracking systems and collaborating with waste management companies to convert waste material into bio-based packaging, organic fertilizers, and animal feeds- using a circular economy approach.

The industry is currently booming due to growing environmental concerns that are being manifested in government regulations as well as sustainability initiatives to minimize food loss and optimize resource use. The increased implementation of organic recycling, composting, anaerobic digestion, and waste-to-energy methods has been witnessed in international industries such as food manufacturing, retail, hospitality, and households.

Veolia, Waste Management Inc., SUEZ, Republic Services, and Clean Harbors are top players in that industry scope with an overall waste collection, processing, and recycling solution. Startup entrepreneurs have AI-enabled waste tracking, blockchain-enabled traceability, and on-site food waste processing applications in competition with traditional solutions because they could differentiate their offerings.

The transformation of the industry will largely depend on innovations in technology, such as automated waste separation, improved bioconversion, and smart composting solutions. Similarly, on a very small scale, initiatives devoted to a circular economy create partnerships between waste managers and food producers or retailers to reduce waste at every point in the supply chain.

Strategic factors shaping the competition include compliance with the regulatory frameworks accompanying global sustainability goals, advances in waste valorization techniques, and rising consumer demand for zero-waste and closed-loop food production models.

In this dynamic industry, organizations will gain a competitive edge when data-driven waste analytics, scalable waste diversion strategies, and green processing technologies are integrated into their waste management plans.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Veolia Environnement | 18-22% |

| Waste Management, Inc. | 15-18% |

| SUEZ Group | 12-16% |

| Republic Services, Inc. | 10-14% |

| Clean Harbors, Inc. | 8-12% |

| Other Players | 30-40% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Veolia Environnement | Specializes in integrated waste management, waste-to-energy solutions, and circular economy initiatives. |

| Waste Management, Inc. | Focuses on advanced landfill management, organic waste recycling, and anaerobic digestion technology. |

| SUEZ Group | Offers biogas production from food waste, AI-driven waste tracking, and sustainable waste valorization. |

| Republic Services, Inc. | Strong in municipal solid waste (MSW) processing, composting, and industrial waste recycling. |

| Clean Harbors, Inc. | Expertise in hazardous and non-hazardous waste disposal, with a focus on regulatory compliance. |

Key Company Insights

Veolia Environment (18-22%)

It is a global leader in sustainable waste management solutions, which includes practices of circular economy and innovative recycling technologies.

Waste Management, Inc. (15-18%)

It has a strong market presence in landfill diversion, organics recycling, and waste-to-energy programs.

SUEZ Group (12-16%)

The company specializes in smart waste tracking and biogas generation, concentrating on waste valorization and reducing climate impact.

Republic Services, Inc. (10-14%)

The company places a big emphasis on commercial and industrial food waste solutions and invests in renewable energy projects.

Clean Harbors, Inc. (8-12%)

This company specializes in processing both hazardous and non-hazardous waste according to regulations, assuring safe and sustainable disposal.

Other Key Players (30-40% Combined)

The global industry is projected to grow at a CAGR of 5.9% during the forecast period from 2025 to 2035.

By 2035, the global industry is expected to reach a significant valuation, driven by increasing regulatory measures and sustainability initiatives.

Recycling is anticipated to be the fastest-growing segment, as businesses and municipalities increasingly adopt sustainable waste processing technologies to reduce landfill dependency.

Key factors include stringent government regulations on waste disposal, rising consumer awareness, increasing food production waste, advancements in waste-to-energy technology, and the adoption of AI-based waste monitoring systems.

Top companies in the market include Veolia Environment, Waste Management Inc., SUEZ Group, Republic Services Inc., GFL Environmental Inc., and Covanta Holding Corporation.

The market is segmented into prevention, collection, transfer, recycling, and landfill, with recycling gaining traction due to rising sustainability initiatives and waste repurposing efforts.

The industry covers food production waste, agri produce waste, poultry, meat, and seafood waste, food processing waste, agri produce processing waste, dairy food processing waste, and other food waste sources.

The market is divided into animal feed, fertilizer, renewable energy & biofuels, and others, with increasing focus on converting food waste into alternative energy sources.

The global market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

Algae-based food additive market analysis by product type, source, functionality, application and by region growth, trends and forecast from 2025 to 2035

Cognitive health supplements market analysis by product type, form, sales channel, functionality, and by region – Growth, trends, and Forecast from 2025 to 2035

Ginger Salt Market Trends – Flavor Innovation & Industry Demand 2025 to 2035

Fruit Wine Market Analysis by Platform, By Application, By Type, and By Region – Forecast from 2025 to 2035

Steviacane Market Analysis By Platform, By Application, By Type, and By Region - Forecast from 2025 to 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.