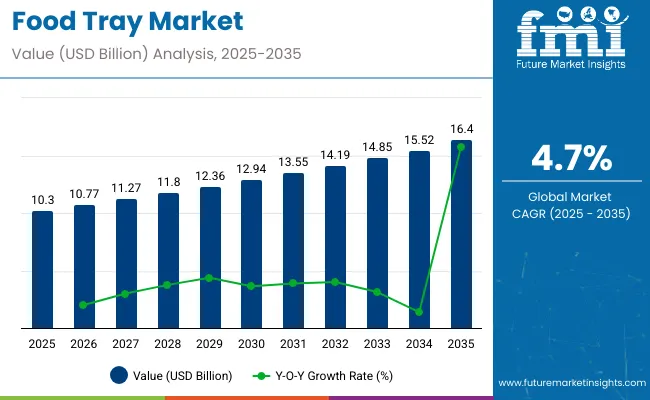

The global food tray market is expected to grow from USD 10.3 billion in 2025 to USD 16.4 billion by 2035, registering a CAGR of 4.7% during the forecast period. This follows a strong foundation, with revenues reaching USD 10.1 billion in 2024. Growth within the food service segment-including hospitals, cafés, fast food outlets, and catering services-has driven demand for food trays used in both food preparation and safe, hygienic packing.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 10.3 billion |

| Industry Value (2035F) | USD 16.4 billion |

| CAGR (2025 to 2035) | 4.7% |

Consumer preferences have evolved, favoring convenience, ready-to-eat meals, and takeaway formats. In response, food tray providers have implemented standardized, sanitary solutions to uphold food safety and reduce contamination risks. Innovation has been stimulated, and new tray formats have been introduced to match changing foodservice demands.

The single-cavity ready-meal tray segment has seen exponential growth. These trays have benefited from broader packaging trends driven by consumer convenience and a preference for ready-made meals. Their efficiency, combined with technological improvements in manufacturing, has helped supply chains minimize damage during transport and uphold food safety, particularly as trays have become fully recyclable.

Traditional materials such as Styrofoam, paperboard, and aluminium have been progressively replaced by recyclable single-cavity trays. These now prevail due to heightened consumer demand for sustainable packaging and robust food safety standards. Fully recyclable trays have been widely adopted across the industry, meeting both environmental and functional expectations.

The rise of biodegradable and compostable overwrap trays has been confirmed by food packaging leaders like Eastman and Sealed Air. In an April 2024 announcement, Eastman and Sealed Air stated that a “certified compostable protein tray…can work on existing, industrial food packaging equipment”. This innovation underlines the ongoing shift toward integrating compostable alternatives without disrupting established packaging systems.

Geographically, demand is rising in mature markets in North America and Europe, driven by stringent regulation and growing consumer preferences for sustainable materials. In the Asia-Pacific region, urbanization, increased disposable incomes, and the emergence of modern foodservice chains are expected to support double-digit growth in ready-meal trays. The global food tray industry is projected to generate an incremental opportunity of USD 6.1 billion between 2025 and 2035.

This is expected to be led by continued adoption of sustainable, single-cavity designs and integration of smart packaging technologies such as RFID, traceability systems, and high-barrier coatings to preserve food quality and freshness. Overall, the food tray market is evolving to meet the dual demands of environmental sustainability and food hygiene compliance. Continued innovation especially in recyclable and compostable tray technologies is anticipated to drive robust growth through 2035.

The global trade of food trays is influenced by the growth of the foodservice, ready-to-eat meals, and packaging industries. As convenience and hygiene become top priorities in both retail and institutional food distribution, food trays are in increasing demand across international markets.

Per capita spending on food trays is influenced by consumption patterns of packaged and ready-to-eat foods, the strength of foodservice sectors, and lifestyle preferences. As demand for convenience, hygiene, and disposable packaging grows, spending on food trays, especially single-use and sustainable variants, is rising globally.

The below table presents the expected CAGR for the global food tray market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.2%, followed by a low growth rate of 4.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H2 | 4.2% (2024 to 2034) |

| H1 | 5.4% (2025 to 2035) |

| H2 | 4.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 5.4% in the first half and decrease to 4.0% in the second half. In the first half (H1) the market witnessed an increase of 20 BPS while in the second half (H2), the market witnessed a decrease of 20 BPS.

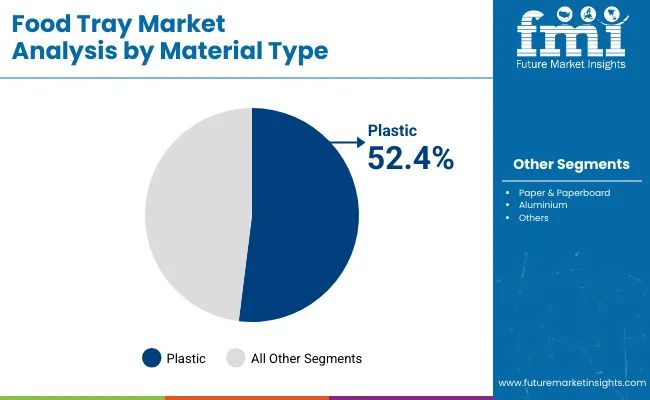

Plastic is expected to retain its position as the leading material in the food tray market, with a projected value share of 52.4% in 2025. Its dominance has been attributed to attributes such as durability, affordability, lightweight structure, and suitability for mass manufacturing. Despite increasing environmental concerns, plastic trays continue to be widely used across various sectors including ready-to-eat meals, meat packaging, bakery goods, and frozen foods due to their versatility and structural integrity.

However, the environmental footprint of plastic tray production remains a concern, with approximately 1.5 kilograms of carbon dioxide being released for every kilogram of plastic trays manufactured. As a response, significant efforts have been directed toward the development of reusable plastic trays and the integration of recycled materials in tray production to minimize ecological impact. Over the next decade, the sales of plastic food trays are anticipated to grow by 170%, driven by product innovations, merger-driven scale economies, and the increased adoption of sustainable production processes.

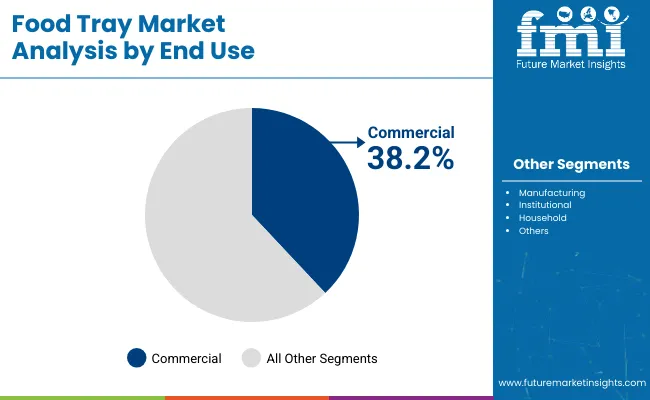

The commercial segment is projected to lead the food tray market by end use, accounting for an estimated 38.2% value share in 2025. This dominance is being driven by widespread adoption across quick service restaurants (QSRs), cafes, catering operations, and foodservice establishments that rely heavily on disposable and semi-reusable trays for efficient service, portion control, and hygiene compliance.

The surge in out-of-home dining and the growing demand for takeaway and delivery formats have significantly increased tray consumption in commercial settings. Moreover, operational efficiency and cost reduction in high-volume environments have made lightweight, stackable plastic trays the preferred option.

Innovations such as compartmentalized designs, heat-resistant materials, and anti-slip surfaces are also being adopted to meet evolving service needs. As food safety and environmental concerns continue to intensify, foodservice operators are gradually transitioning toward recyclable and reusable tray systems, including those made from rPET, polypropylene, and biodegradable polymers. These shifts are expected to support sustainable growth in the commercial food tray segment throughout the coming decade.

Growing demand for sustainable and eco-friendly packaging from the food processing side has become a great driver for the food tray market. Concerns regarding plastic waste and environmental impact among consumers and rigid government rules and regulations in such matters have promoted biodegradable, compostable, and recyclable trays in the industry.

Currently, companies are looking for sustainability through materials such as bagasse, cornstarch, and recycled PET without any compromise on durability and convenience.

Increasing demand among consumers for 'green' brands is compelling food service providers to embrace more eco-friendly packaging. Not only is this move lowering carbon footprints, but also brand reputation and customer loyalty improve in a competitive market.

Innovative advancements in food packaging have greatly enhanced the quality of food trays. Advances in material science have also worked so that microwave-safe, ovenable, and biodegradable trays are now available in order to make it convenient and sustainable.

Active & intelligent packaging, like wise trays with oxygen absorber or temperature indictors, helps maintain food freshness safety. Nanotechnology is being integrated to create antimicrobial surfaces, reducing the risk of contamination.

Also in addition to, automation in tray sealing and feeling processes enhances efficiency in food production. These innovations are not only in relation to shelf life but also related to changing consumer need for a safer more sustainable and high-performance food packaging solution.

The low awareness and adoption of consumers to the environment-friendly food tray alternatives limit the market. Most of the consumers are not aware of the biodegradable and compostable alternatives available, and they generally view them to be as pricey or less durable than plastic trays, a conventional option. Lack of proper labeling and education further prevents widespread acceptance, as people may not fully understand the benefits or disposals methods.

Additionally, businesses hesitate to switch due to higher production costs and limited availability of sustainable materials. Without strong marketing efforts, government incentives, and consumer education campaigns, the shift towards eco-friendly food trays remains slow, limiting their market growth.

The global food tray industry recorded a CAGR of 2.9% during the historical period between 2020 and 2024. The growth of the food tray industry was positive as it reached a value of USD 10,105.9 million in 2024 from USD 9,013.9 million in 2020.

The global food tray market has grown steadily from 2020 to 2024, with increasing consumer demand for convenience and efficiency in food service and catering. The influence of processed and specialty foods on the market has been significant, as consumers look for packaging solutions that enhance the presentation and preservation of these products. Moisture-proof and spill-proof packaging demand has further fuelled the growth, as the food will stay fresh and safe during transportation and storage.

Looking ahead to 2025 to 2035, the food tray market is predicted to continue to rise while upping the ante on sustainable and eco-friendly usage. As consumer environmental awareness builds, consumers will start demanding biodegradable and recyclable food trays.

Advances in packaging technology will be great, where the manufacturer will build trays that would not only satisfy the functional requirements but also respond to consumer's needs regarding options for sustainability. Generally, the market is expected to expand significantly as influenced by changing consumers' behavior and regulatory pressures towards getting environmentally friendly packages.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Market Growth | Moderate growth driven by the rising demand for convenience foods |

| Consumer Awareness | Gradual increase in consumer awareness regarding food packaging |

| Regulations & Policy Changes | Emerging regulations on single-use plastics in various regions |

| Technological Advancements | Improvements in materials and designs, but limited innovation |

| Product Demand | Growing demand in developed markets, with slower adoption in emerging economies |

| Market Segmentation | Primarily segmented into food service, retail, and industrial sectors |

| Price Trends | Prices fluctuated due to raw material costs and market dynamics |

| Competitive Landscape | Competitive market with established brands and new entrants |

| Raw Materials | Limited availability of sustainable materials for food trays |

| Environmental Impact | Growing awareness of the environmental impact of plastic trays |

| Market Growth | Moderate growth due to increasing environmental awareness |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Significant growth expected due to increasing focus on sustainability and eco-friendly packaging |

| Consumer Awareness | Widespread demand for sustainable and eco-conscious food packaging solutions |

| Regulations & Policy Changes | Stricter regulations globally, with more countries implementing bans on plastic trays and promoting biodegradable alternatives |

| Technological Advancements | Enhanced development of biodegradable and recyclable materials, along with more efficient production technologies |

| Product Demand | Increased global demand, particularly in emerging markets as awareness and regulations rise |

| Market Segmentation | Expanding into niche markets such as meal kits, online food delivery, and specialty foods |

| Price Trends | Potential for price stabilization as production scales and sustainable materials become more widely available |

| Competitive Landscape | Highly competitive with a larger number of players, increased innovation, and a focus on sustainability |

| Raw Materials | Improved access to sustainable raw materials, including plant-based and recycled materials |

| Environmental Impact | Significant reduction in plastic waste, with a strong shift towards zero-waste and sustainable practices in food packaging |

| Market Growth | Significant growth driven by stringent regulations and demand for eco-friendly products |

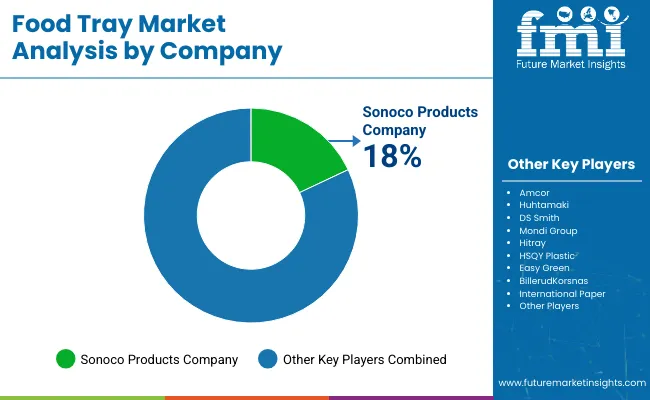

Tier 1 company leaders are distinguished by their extensive portfolio and use of advanced production technology. These market leaders are stand out because of their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They offer a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 include Amcor, Sonoco Products Company, Huhtamaki Oyj ,DS Smith Plc .

Tier 2 companies are defined by a strong presence overseas and in-depth market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in Tier 2 include Mondi Group PLC, Hitray, HSQY Plastic Group, Easy Green, BillerudKorsnas, International Paper Company, Quinn Packaging, Pactiv LLC, Tray-Pak Corporation, Brodrene Hartman A/S, ESCO Technologies Inc., Novolex.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

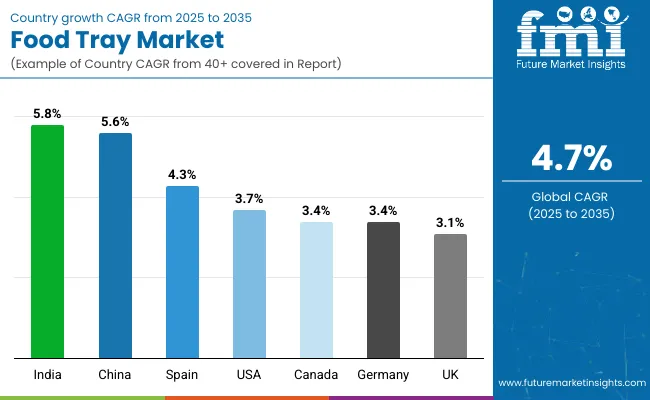

The section below covers the industry analysis for the food tray market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

USA is anticipated to remain at the forefront in North America, with a CAGR of 3.7% through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 5.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.7% |

| Canada | 3.4% |

| Spain | 4.3% |

| UK | 3.1% |

| Germany | 3.4% |

| China | 5.6% |

| India | 5.8% |

Among the key drivers in the USA, food tray market is growing demand for food services. Cities is becoming more and more urbanized and the availability of more hotels, cafes and other food delivering sources within one city drives demand for food services.

The busy lifestyle of individuals living in cities has resulted in an increase in demand for ready-to-eat meals thus making the food service industry grow. In addition, markets have expanded, as food services have become less of a challenge to find with focus on technology such as online payments for purchases, and online ordering.

The food service industry around the world is dominated by North America, which has an opportunity fueled by high standards of living and great dining out culture.

Given the rapid change in consumer preferences towards experience rather than just food, and convenience of food service, associated fast casual and delivery options have become more popular. This aspect is also coherent with the high level of technology embedded within ordering and payment systems.

Europe accounts for a major market share of global trays, 28%. This region is going toward sustainable packaging because of regulations like the EU Plastics Strategy and the Single-Use Plastics Directive. The EU targets all packaging to be recyclable by 2030, and hence, it is going to boost the demand for eco-friendly trays made of paper and plant-based plastics. Leading countries in this regard are Germany, France, and the UK; this change focuses on reducing plastic waste.

Ecologically conscious consumers in Western Europe drive demand for eco-friendly products. Additionally, increasing popularity in online food delivery and take-away services is a demand for one-time use trays that is contributing to the market growth in this region.

Key players operating in the food tray market are investing in the development of innovative sustainable solutions and also entering into partnerships. Key food tray providers have also been acquiring smaller players to grow their presence to further penetrate the food tray market across multiple regions.

Recent Industry Developments in the Food Tray Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2024) | USD 10,105.9 million |

| Current Total Market Size (2025) | USD 10.3 billion |

| Projected Market Size (2035) | USD 16.4 billion |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed (Segment 1) | Plastic (PP, PET, HIPS, HDPE, etc.), Paper & Paperboard, Aluminium, Others |

| Tray Types Analyzed (Segment 2) | Single Cavity, Multi Cavity |

| Distribution Channels Assessed (Segment 3) | Direct Sales, Distributors, Retailers, E-retail |

| Capacity Categories Covered (Segment 4) | Standard, Customized |

| End Uses Analyzed (Segment 5) | Manufacturing, Commercial, Institutional, Household |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, China, India, Japan, Brazil, South Korea, GCC Countries |

| Key Players Influencing the Market | Amcor, Sonoco Products, Huhtamaki, DS Smith, Mondi Group, Hitray, HSQY Plastic, Easy Green, BillerudKorsnas, International Paper, Quinn Packaging, Pactiv LLC, Tray-Pak, Hartman A/S, ESCO Technologies, Novolex |

| Additional Attributes | Dollar sales by material type and end use, plastic material CAGR of 52.4%, distributor tray CAGR of 39.7%, growth in customized tray formats and sustainable packaging solutions |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of material type, the industry is divided into plastic, paper & paperboard, aluminium and others. Plastic is further divided into polypropylene (PP), polyethylene terephthalate (PET), others (HIPS, HDPE, etc.)

In terms of tray Type, the industry is divided into single cavity and multi cavity.

By distribution channel, the market is divided into direct sales, distributors, retailers, E-retail.

By capacity, the market is divided into standard, customized.

The market is classified by end use such as manufacturing, commercial, institutional, household.

Key countries of North America, Latin America, Europe, The Middle East and Africa, East Asia, South Asia, Oceania have been covered in the report.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tray Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Tray Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Tray Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Tray Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Tray Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Tray Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Tray Type, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Tray Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Tray Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Tray Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Tray Type, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Tray Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Tray Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Tray Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Tray Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Tray Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Tray Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Tray Type, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Tray Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Tray Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Tray Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Tray Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Tray Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Tray Type, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Tray Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Tray Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Tray Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Tray Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Tray Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Tray Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Tray Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Tray Type, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Tray Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Tray Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Tray Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Tray Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Tray Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Tray Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Tray Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Tray Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Tray Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Tray Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Tray Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Tray Type, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Tray Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Tray Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Tray Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Material Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Tray Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

The global food tray industry is projected to witness CAGR of 4.7% between 2025 and 2035.

The global food tray industry stood at USD 10,105.9 million in 2024.

The global food tray industry is anticipated to reach USD 16.4 billion by 2035 end.

South Asia & Pacific region is set to record the highest CAGR of 5.7% in the assessment period.

The key players operating in the global food tray industry include Amcor, Sonoco Products Company, Huhtamaki Oyj, DS Smith Plc.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA