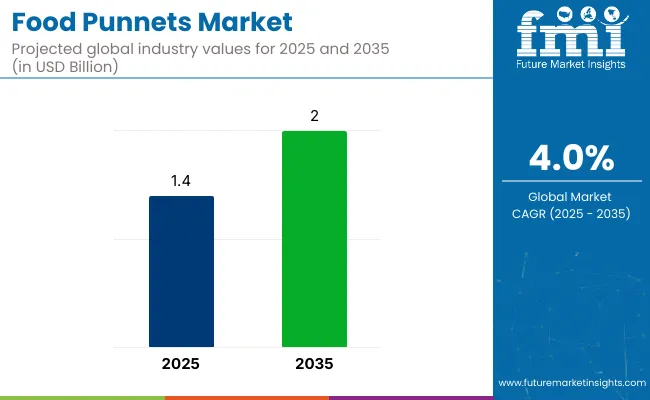

The global food punnets market is projected to grow from USD 1.4 billion in 2025 to USD 2.0 billion by 2035, registering a CAGR of 4% during the forecast period. Sales in 2024 were recorded at USD 1.3 billion. This growth is primarily attributed to increasing demand for sustainable and convenient packaging solutions across fresh produce, bakery, and ready-to-eat food applications.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 1.4 billion |

| Projected Market Value (2035F) | USD 2.0 billion |

| Value-based CAGR (2025 to 2035) | 4% |

Food punnets, commonly crafted from materials such as plastic, paperboard, and biodegradable polymers, are widely preferred for their product visibility, ventilation properties, and capacity to extend shelf life. Rising consumer inclination toward eco-friendly alternatives has further accelerated the adoption of recyclable and compostable punnets across retail and foodservice channels.

In 2024, DS Smith, a leading paper and packaging company, announced an investment focused on developing innovative fiber-based alternatives to plastic packaging, including biodegradable fruit punnets. The initiative is being led by their innovation lab in Suffolk, UK, where R&D is centered on sustainable materials such as seaweed, daisies, hemp, and cocoa shells. “We want them to be liquid-proof when we use them but when we recycle them, we want to be able to repulp them,” stated Wim Wouters, Innovation Director at DS Smith.

Recent innovations in the food punnets market are increasingly driven by material science and biopolymer research. Researchers at the University of Queensland have successfully developed strawberry punnets using biodegradable bioplastics derived from bacteria-fermented polyhydroxyalkanoates (PHAs) and Radiata Pine sawdust.

These new punnets demonstrate the ability to biodegrade in multiple natural environments including soil, freshwater, ocean water, and compost. Such advancements present a viable, scalable alternative to conventional petroleum-based plastics, enhancing circularity and supporting retailers’ plastic reduction goals while maintaining shelf life and product protection.

The food punnets market is anticipated to witness strong growth momentum across Asia-Pacific countries, led by China, India, Japan, and Malaysia. Key drivers include rising urbanization, higher disposable incomes, and increased preference for pre-packaged fresh produce.

Local and global manufacturers are investing in regional production units to develop affordable, eco-friendly packaging that complies with evolving environmental legislation. As sustainability regulations tighten and consumer awareness rises, companies are expected to intensify efforts to incorporate renewable raw materials and recyclable formats, enabling long-term growth and competitive differentiation in the global food punnets market.

The market has been segmented based on material type, thickness (GSM), product type, end use, and region. By material type, paper, plastic, and molded fiber variants are adopted to fulfill sustainability targets, rigidity demands, and food safety compliance across packaging systems.

Thickness segmentation includes up to 150 gm, 151-300 gm, 301-500 gm, and above 500 gm, providing manufacturers and retailers with flexibility for light-weighted to heavy-duty applications. Product types include fruits and vegetables, meat, poultry, and seafood, frozen food, and ready-to-eat categories, highlighting the widespread utility of punnets across fresh, chilled, and processed food segments.

End-use segmentation captures retail outlets, hypermarkets/supermarkets, convenience stores, other retail stores, HoReCa (hotels, restaurants, and cafés), and household use illustrating the channel-specific demand dynamics for functional and attractive packaging formats.

Regional segmentation includes North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa (MEA), taking into account shifting consumer preferences, food distribution infrastructures, and circular packaging policies.

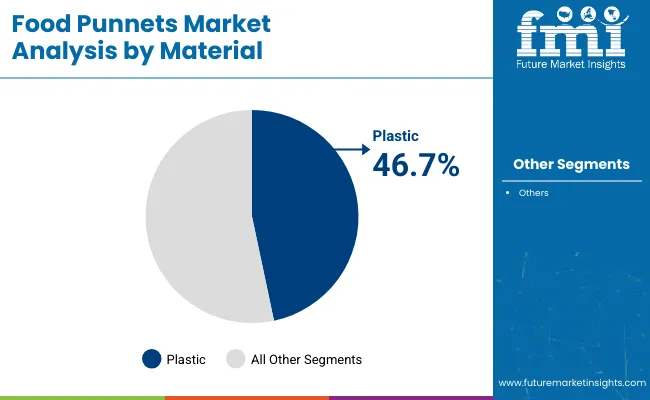

The plastic segment is projected to command the largest share of 46.7% in the food punnets market by 2025, primarily due to its high durability, lightweight properties, and superior product visibility. Plastics including PET, PP, and RPET are widely used in fresh food packaging to ensure structural strength, moisture barrier, and extended product shelf life. Their clarity allows consumers to assess freshness at point-of-sale, making them ideal for high-turnover categories like fresh produce, meats, and ready-to-eat snacks.

Thermoformed plastic punnets can be easily molded into customized sizes, stackable forms, and vented designs to accommodate specific food types. Modified Atmosphere Packaging (MAP) compatibility and heat-sealing properties make plastic punnets especially effective in supermarkets, hypermarkets, and foodservice chains. Moreover, the recyclability of RPET and the integration of post-consumer resins have helped address environmental concerns, particularly in Europe and North America where circular economy regulations are tightening.

With increasing demand for hygienic and tamper-evident packaging solutions in the post-pandemic era, plastic punnets continue to be the material of choice across food processors, retailers, and institutional caterers. Ongoing innovations in biodegradable polymers and mono-material tray designs are further strengthening this segment’s position in the market.

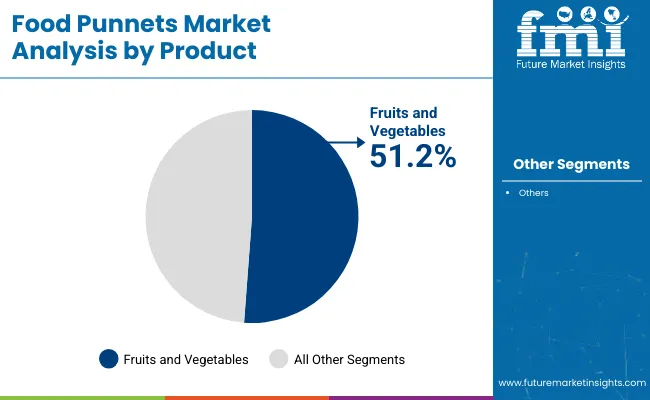

The fruits and vegetables segment is forecasted to lead the product type category with a 51.2% share in 2025, fueled by the rising global consumption of fresh produce and the expansion of organized retail. Punnets have become an integral part of retail-ready packaging strategies for berries, tomatoes, leafy greens, citrus fruits, and pre-cut produce due to their ability to enhance product safety, presentation, and shelf-life management.

Retailers favor punnet packaging for its ability to reduce food spoilage, support portion control, and allow efficient product stacking all key parameters in modern grocery merchandising. These punnets often feature breathable vents, tamper-evident seals, and anti-fog lids that optimize visibility and freshness across diverse climatic zones and transportation systems.

With health-conscious consumers increasingly opting for pre-washed, ready-to-eat fruit and vegetable packs, especially in urban and metropolitan areas, demand for tailored punnet formats has surged. Both plastic and molded fiber punnets are being utilized to meet sustainability requirements without compromising quality. Moreover, advancements in intelligent labeling and digital freshness indicators are gradually being integrated into punnet formats for enhanced product tracking and consumer engagement.

Environmental Concerns and Regulatory Compliance

However, growing regulations to ban the use of plastic and shift to sustainable packaging solutions is expected to pose a challenge to the growth of the Food punnets market. Governments around the world are outlawing or limiting single-use plastics and forcing manufacturers to move to biodegradable or recyclable materials. Production is also complicated by tight food safety and packaging regulations.

In response to these challenges, businesses need to invest in sustainable packaging solutions, eco-friendly raw materials, and advanced recycling processes to comply with changing regulatory frameworks and consumer preferences.

High Production Costs and Material Limitations

The shift from traditional plastic food punnets to sustainable options including molded fiber, bioplastics, and compostable materials has resulted in higher production costs. Manufacturing costs get amplified due to the fact that these materials are usually processed using certain specialized techniques.

On top of this, delivering options that are durable, moisture resistant, and have long shelf-life while being eco-friendly poses technical challenges. All companies need to prioritize on improving production efficiency, reducing material costs as well as investing in research and development (R&D) for high-performance sustainable packaging.

Rising Demand for Sustainable and Biodegradable Packaging

The increasing consumer awareness regarding environmental sustainability is providing growth to biodegradable, recyclable, and compostable food punnets. More and more retailers and food producers are looking for packaging solutions that follow circular economy principles.

Exciting growth potential in plant-based bioplastics, recycled paperboard, and compostable fiber punnets. Business that create environmental friendly, practical, and affordable packaging approaches will lead in the transitioning marketplace.

Expansion in Fresh Produce and Ready-to-Eat Food Segments

The Food punnets market is propelled by the growing demand for convenience foods, fresh produce, and pre-packaged meals. To create food safety, prolong shelf life, and ensure high presentation, supermarkets, food service providers, and ecommerce are favoring packaging solutions that are creative and innovative.

The growth of smart packaging technologies, including QR-coded traceability and modified atmosphere packaging (MAP), will also accelerate growth. Growing demand in these sectors will enable companies engaged in customized, functional, and appealing punnets to equip themselves as contenders.

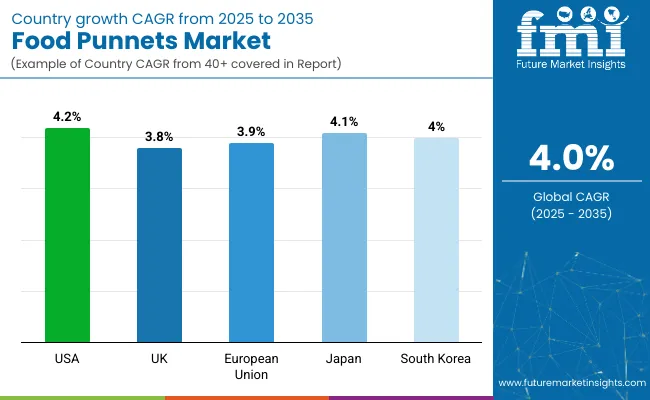

The North American region leads the food punnets market in the United States owing to the growing demand for bio-degradable packaging solutions and the rise in the shift away from plastic rubbish as well as supportive legislations for eco-friendly alternatives. The growing use of biodegradable and recyclable punnets further explains market revenue growth.

Increasing investments in compostable materials and innovations in molded fiber and bioplastic punnets will further fuel the market growth. Moreover, the adoption of intelligent packaging capabilities like QR-coded traceability and freshness indicators is making products more attractive to consumers.

Other companies are also emphasizing lightweight, strong and moisture-resistant packaging solutions that reflect changing consumer and retailer demands. Rising acceptance of food punnets in bakery products, fresh produce, and ready-to-eat meals is driving the USA market further.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The United Kingdom is a significant market for food punnets, primarily driven by strict regulation on single-use plastics, rising need for sustainable food packaging, and increasing awareness amongst consumers regarding environmental effects. Growing focus on alternative options such as compostable and fiber-based options is also fuelling the growth of the market.

Market expansion is further bolstered by government policies that promote circular economy practices, together with innovations in water-resistant, tamper-proof biodegradable punnets. Additionally, advances in clear, plant-based plastic alternatives, heat-sealable fiber trays and recyclable PET punnets are on the rise.

Firms are also pouring in to physical printing technology, particularly to allow companies to have branded products or customized product detail on packages. Further growth in the market is projected due to increasing demand for food punnets made from sustainable materials in organic produce, specialty foods, and supermarket-ready packaging segments in the UK. Moreover, the trend to carbon-neutral packaging solutions is driving demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

Germany, France, and Italy are dominating the Europe food punnets market owing to stringent sustainability mandates, growing investments in compostable packaging materials and increasing demand for premium and eco-friendly food packaging.

The EU's aim to minimize packaging waste and investment in fiber-moulded food punnets and plant-based are contributing to the growth of the fiber moulded food punnets market. Improved durability of products owing to the growing adoption of advanced barrier coatings for longer shelf life and development of recyclable and reusable punnet innovations are other key contributors towards market growth.

The increasing preference for convenient and lightweight packaging in various end-use industries, including fresh produce, deli, and meat, is expected to drive the market growth further. In the EU, expansion of sustainable packaging regulations, including the EU Plastics Strategy, coupled with increasing investments in closed-loop recycling systems are driving higher adoption levels.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

The development of a food punnets market in Japan is being driven by the demand for high-quality food packaging, the growing popularity of sustainable alternatives, and increasing investments in advanced material technologies. Rising demand for light-weight, visually-appealing, and functional packaging in food retail is stimulating the market growth.

Innovation is being driven by the country’s focus on precision packaging engineering and use of biodegradable coatings, moisture-resistant pulp trays and bio-PET materials. In addition, stringent government mandates on reduction of packaging waste and firms investing significantly in smart labeling and freshness preservation are some more factors driving them to develop high-performance food punnets.

Increasing demand for stackable, resealable, and tamper-proof packaging of sushi, confectionery, and fresh fruit is also fuelling market growth of Japan food processing industry. Moreover, Japan is also investing in intelligent packaging technologies like oxygen scavengers and freshness sensors that determine the future of food punnets.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The growing need for sustainable food packaging in South Korea, coupled with high regulatory limitations on the use of plastic waste and a widespread consumer preference for recyclable and biodegradable packaging materials are a few of the reasons contributing to this market growth.

Rising investment in eco-friendly high-barrier punnet materials and strict environmental regulations drive market growth. The country is also making strides in improving competitiveness by focusing on more durable, heat resistant, and lightweight packaging designs with bio-based composites and nanotechnology. The rising requirement for clear, food-safe, and reclosable punnets in fresh produce, bakery products, and seafood packaging is further driving the market adoption.

Several companies are working on zero-waste packaging, smart packaging indicators and supply chain AI-driven optimization to boost food safety and sustainability. With rising premium food packaging trends and surge in online grocery shopping in South Korea the demand for innovative food punnet solutions is anticipated to increase further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

The food punnets market is growing driven by the growing demand for sustainable and convenient packaging solutions across fresh produce, bakery, and ready-to-eat food segments. Companies are turning to biodegradable, recyclable and lightweight materials to meet evolving consumer and regulatory needs. Among its key trends are punnets made of compostable fiber materials, more advanced moisture barriers, and better packaging designs that continually keep food fresh.

The overall market size for food punnets market was USD 1.4 billion in 2025.

The food punnets market expected to reach USD 2.0 billion in 2035.

The demand for the food punnets market will be driven by increasing demand for sustainable and eco-friendly packaging, rising fresh produce consumption, growth in the convenience food sector, stringent government regulations on plastic use, and advancements in biodegradable and recyclable packaging materials.

The top 5 countries which drives the development of food punnets market are USA, UK, Europe Union, Japan and South Korea.

PET and polylactic acid (PLA) punnets drive market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA