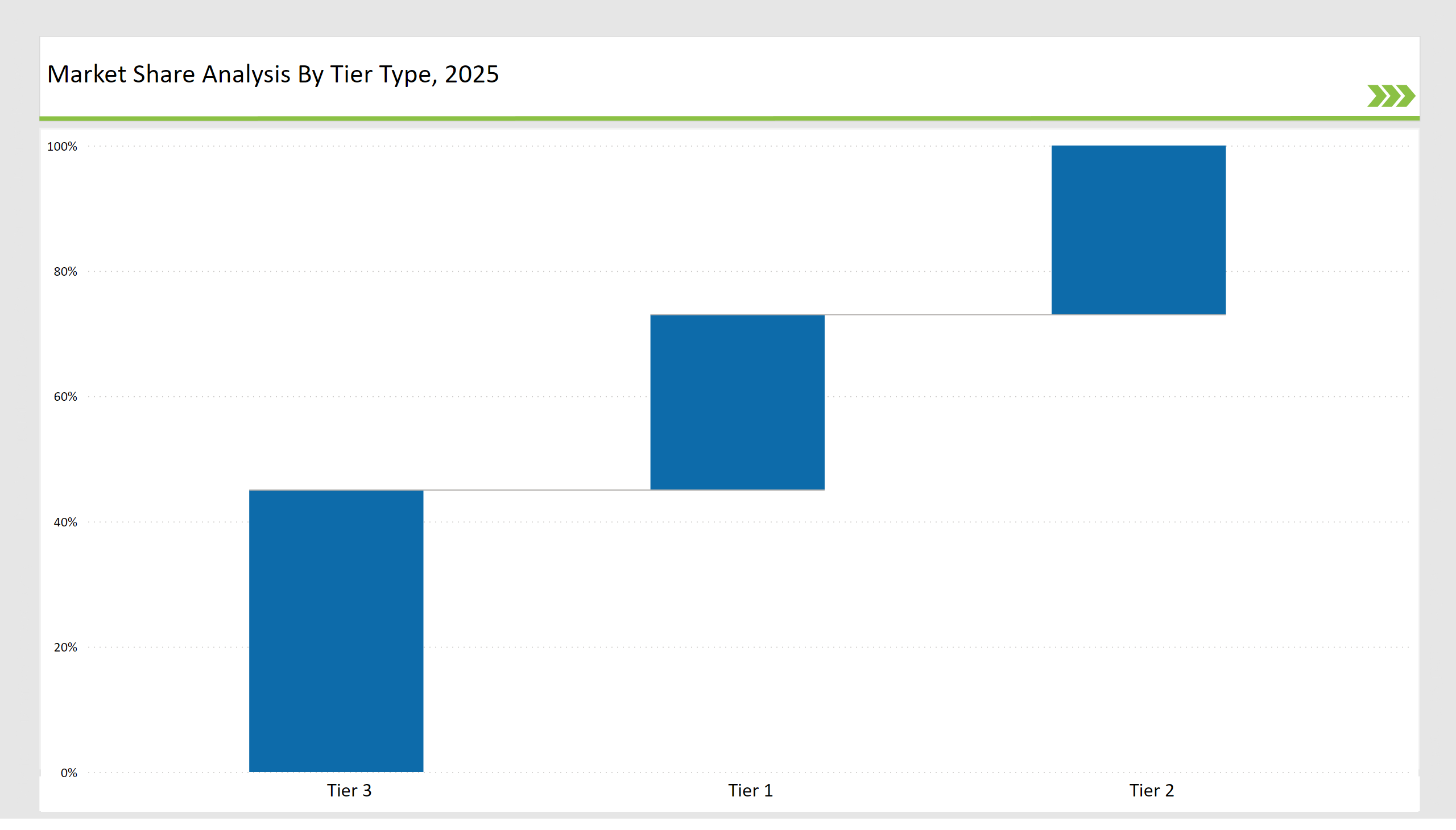

The food powder packaging machine market is categorized into three tiers based on market presence and competitiveness. Tier 1 companies, such as Bosch Packaging Technology, IMA Group, and Viking Masek, collectively command 28% of the market.

These industry leaders manage high volumes in production, strongly invest in their research and development, and own large distributional networks globally. Their core strategic focus is mass-producing low cost, high speed, and precise packaging machines made for the food processing and the pharmaceutical sectors, which continue in the trend toward automated and smart packaging solutions.

Tier 2 players, including GEA Group, Omori Machinery, and Nichrome, hold approximately 27% of the market. These companies operate mainly with medium-sized businesses and regional markets to provide high performance, efficiency, and customized packaging machines. Strong expertise in the modular design for hygiene compliance along with energy efficient solutions has sustained them in such emerging economies.

Tier 3 players, comprising regional manufacturers and niche market startups, collectively control the remaining 45%. These companies specialize in localized demands, offering cost-effective, flexible, and technologically advanced food powder packaging machines. Their agility allows them to swiftly adapt to market changes, particularly in sustainability and smart packaging technologies.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Bosch Packaging Technology, IMA Group, Viking Masek) | 15% |

| Rest of Top 5 (GEA Group, Omori Machinery) | 7% |

| Next 5 of Top 10 (Nichrome, Fuji Machinery, Robert Bosch, Fres-co, Anritsu) | 6% |

Targeted End-User Key Industries

Vendor-Focused Product Categories

The companies that have led the industry through innovation have included Bosch Packaging Technology, IMA Group, Viking Masek, GEA Group, and Omori Machinery. Transformation in packaging solutions is pronounced by changing the industry trend towards more sustainable use of materials, IoT inclusion, and intelligent automation.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Bosch Packaging Technology, IMA Group, Viking Masek |

| Tier 2 | GEA Group, Omori Machinery, Nichrome |

| Tier 3 | Fuji Machinery, Robert Bosch, Fres-co, Anritsu |

| Manufacturer | Latest Developments |

|---|---|

| Bosch Packaging Technology | Expanded AI-powered packaging machine production (May 2024) |

| IMA Group | Launched ultra-fast, vacuum-sealed powder packaging (April 2024) |

| Viking Masek | Focused on precision-based multi-format packaging (March 2024) |

| GEA Group | Introduced modular and sustainable packaging solutions (June 2024) |

| Omori Machinery | Developed AI-driven self-correcting packaging machines (July 2024) |

Bosch Packaging Technology, IMA Group, Viking Masek, GEA Group, and Omori Machinery.

The top five manufacturers collectively control 22% of the market, while the top ten account for 28%.

Low, as the top players hold below 30% of the market share.

They contribute 45% of the market by catering to specialized and regional demands.

Sustainability, automation, and AI-driven packaging technology.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.