Food-grade alginate, extracted from brown seaweed, is now used as a thickener, stabilizer, and gelling agent in a range of food products, including dairy, bakery, confectionery, and processed meat. Open-source designs, no patent protection, and broad functional benefits combined with clean-label appeal make it a favoured ingredient for manufacturers.

With consumers increasingly looking for organic and minimally processed food ingredients, demand for food-grade alginate is also set to increase. Due to the surge in the vegan and vegetarian population, the increasing use of alginate as a gelatin alternative in plant-based products is also fueling market growth.

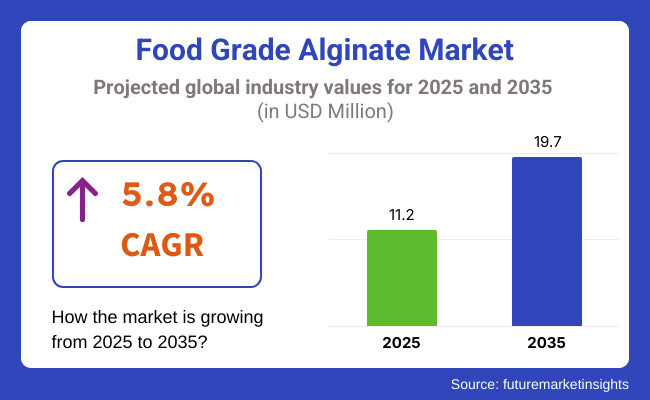

The market is projected to arrive at USD 19.7 million by 2035, at a CAGR of 5.8%, compared to USD 11.2 million in 2025. Long-term market growth will be driven by the expansion of the global food processing industry and increased research and development (R&D) into functional food ingredients.

North America captures a considerable share of the global market owing to the demand for clean-label food ingredients and plant-based ingredients. The USA is one of the largest consumers, with rising applications in dairy alternatives, bakery, and ready-to-eat meals. Market growth is driven by the presence of major food manufacturers and increasing consumer awareness regarding natural additives.

Europe is the fastest-growing market for food-grade alginate due to stringent food safety regulations along with growing popularity of vegan diets. Speaking now, countries such as Germany, the UK, and France are taking the lead, especially in processed foods, confectionery, and functional beverages, he said. Moreover, growing awareness regarding organic and sustainably sourced ingredients is catalysing market growth.

The Asia-Pacific region is expected to witness the fastest growth, influenced by the vast food processing industry and an increasing trend among consumers to seek natural ingredients. The use of alginate in China, India, and Japan is driven by demand in traditional end-use applications, including conventional foods, processed seafood, and bakery products. TelaahDanseaweed production becomes one of the mainstays in supporting the economy. The government has established the Free Trade Area (FTE) as a development area to support trade, and FTE can also encourage local food ingredient producers and customers.

Challenges

Raw Material Price Fluctuations, Stringent Food Regulations, and Alternative Hydrocolloids

Food grade alginate demand is expected to face certain restraints due to a number of factors, including changes in harvest conditions and seaweed availability, which can hamper the alginate supply chain, as well as its pricing. The stricter quality standards enforced on food-grade hydrocolloids by regulatory bodies like the FDA, EFSA, and FSSAI result in compliance costs for manufacturers. Moreover, competitive alternative hydrocolloids, like pectin, carrageenan, and xanthan gum, also constrain the market as food producers look for the most economical and functional components for their products.

Opportunities

Increase in Clean Label Demand and Demand for Plant-based Foods and Functional Foods Coupled With Their Applications

While these challenges exist, the food-grade alginate market is witnessing growth with the growing need for clean-label and natural food ingredients. Alginate's ability to be a thickener, stabilizer, and gelling agent categorizes it as a highly sought-after polymer in vegan and plant-based food products, bakery fillings, and dairy applications.

Furthermore, the growing consumer interest in functional foods & dietary supplements is leading to the rise in uptake of alginate encapsulation technologies to encapsulate probiotics, vitamins & nutraceuticals. Further, innovations taking place in sustainable seaweed harvesting, in addition to enhanced processing techniques, would guide the growth of the market.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and FSSAI food safety standards. |

| Consumer Trends | Demand for natural thickeners and stabilizers in processed foods. |

| Industry Adoption | Use in processed meats, bakery fillings, and dairy stabilization. |

| Supply Chain and Sourcing | Dependence on seaweed harvesting in regions such as Chile, China, and Norway. |

| Market Competition | Dominated by traditional alginate manufacturers and food ingredient suppliers. |

| Market Growth Drivers | Increasing demand for natural emulsifiers and hydrocolloids. |

| Sustainability and Environmental Impact | Moderate efforts are being made to ensure the sustainable harvesting of brown seaweed. |

| Integration of Smart Technologies | Early adoption of improved seaweed extraction techniques and food-grade purity testing. |

| Advancements in Alginate Technology | Development of heat-stable and acid-resistant alginate formulations. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations for sustainable seaweed sourcing and clean-label transparency. |

| Consumer Trends | Growth in vegan, plant-based, and organic food formulations using alginate. |

| Industry Adoption | Expansion into vegan seafood, functional beverages, and nutraceutical delivery systems. |

| Supply Chain and Sourcing | Shift toward sustainable and controlled seaweed farming to ensure a consistent supply. |

| Market Competition | Entry of bio-tech firms specializing in advanced food-grade alginate formulations. |

| Market Growth Drivers | Accelerated by functional food innovations, dietary supplements, and gut health products. |

| Sustainability and Environmental Impact | Large-scale shift toward biodegradable alginate packaging and waste-free processing. |

| Integration of Smart Technologies | Expansion into AI-driven ingredient optimization, blockchain-based sourcing transparency, and enzymatic modification of alginate for enhanced functionality. |

| Advancements in Alginate Technology | Evolution toward bioactive alginate applications in probiotics, encapsulated vitamins, and functional food coatings. |

The declining consumer inclination for artificial food products, an increase in lactose intolerance, a rise in the vegetarian and vegan population, and a growing desire to consume plant-based food products are driving the demand for the food-grade alginate market in the United States.

The growing vegan trend and functional food market are increasing the need for alginate-based thickeners and stabilizers in dairy, sauces, and beverages. Furthermore, the growing application in nutraceutical and dietary supplement formulations, owing to advancements in alginate-based microencapsulation of probiotics, omega-3, and vitamins, has been supplementing the market growth. The country’s emphasis on sustainable food ingredients and biodegradable food packaging is also fuelling investment in alginate applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

The UK Market is slowly expanding, with Demand for natural emulsifiers and stabilizers in the food processing industry. The expanding plant-based and vegan food markets are driving the use of alginate as a clean-label alternative to synthetic thickeners.

Moreover, the country’s strict food safety and sustainability standards are compelling manufacturers to explore sustainable and biodegradable alginate-based solutions. Advances in meat analogs, dairy-free formulations, and bioactive food ingredients are opening up new market opportunities as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

The European food-grade alginate market is influenced by: strict food safety standards; growth in demand for functional foods; and growing investments in sustainable food ingredients. Germany, France, and Italy are at the forefront of adopting alginate-based stabilizers in dairy, sauces, and bakery fillings.

The discard of biodegradable food packaging and switch towards such utilization is also boosting the advancements in alginate-based edible coatings and films. The region’s high emphasis on gut health and dietary fibre fortification is augmenting the growth of alginate in probiotic supplements and functional nutrition applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.8% |

The Japanese food grade alginate market is growing on account of the increasing need for natural hydrocolloids in conventional and contemporary food formulations. Alginate Encapsulation for Probiotics and Active Ingredients in Functional Foods and Dietary Supplements. The country’s growing interest in gut health, functional foods, and dietary supplements is fuelling the demand for alginate in encapsulating probiotics and active compounds.

The strong seafood market in Japan is also encouraging the use of alginate-based coatings to enhance the texture and shelf life of processed seafood products. On top of which, alginate-based food textures and gelling agents are gaining applications with innovations in 3D food printing and precision fermentation.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

South Korea’s food grade alginate market is expanding due to growing demand for plant-based foods, clean-label food ingredients and functional beverages The ever increasing per capita consumption of processed foods in the country is fuelling the demand for alginate-based thickening agents in instant meals, soups, and sauces, across the country, enabling the forecasted growth.

Moreover, the rise of nutraceuticals and dietary supplements is fostering innovations in alginate-based encapsulation for probiotic and omega-3 supplements. The move towards sustainable and biodegradable packaging in South Korea is also creating opportunities for alginate-based edible films and coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

The food grade alginate market by product is classified into powders, liquid, and other forms; in 2021, powders and liquid forms dominated the food grade alginate market. Alginate is widely used by food manufacturers as a natural stabilizer, thickening agent, and gelling agent. By dairy, confectionery, as well as processed food applications, these categories are vital for superior food texture, product shelf life extension, or product homogeneity and consistency improvement.

Today, powdered food-grade alginate is the most prevalent form on the market due to its superior stability, ease of handling, and improved solubility, which allows the diversity of food formulations. Powdered forms offer relatively long shelf life, easier transport, and precise ingredient incorporation in food processing applications, in contrast to alginate in liquid form.

Ascension in the consumption of powdered alginate, with high-purity preparations, short formation of hydrogel, customizable viscosity, etc. Alginate, whether in powdered or gelled form, is one of the most commonly used edible materials, making up more than 65% of alginate-based food products on the market. The broadening of dairy and bakery applications, including powdered alginate-based yogurt, cheese, and gluten-free baked goods, has driven market growth, providing enhanced textural and structural integrity in these processed products.

The adoption has been accelerated by the adaptation of an AI-powered ingredient optimization, such as predictive texture modelling, automated alginate dispersion control, and digital formulation tracking, which contribute to a significant improvement in the consistency of large-scale food production.

Benson Hill's genetically modified crops also point to an environmentally friendly and sustainable way to adapt powdered alginate offerings based on suppliers' processes, non-GMO sourcing, and organic certification. This allows them to stay competitive and better aligned with market trends related to clean labels and sustainable food sources.

While it indeed has benefits in terms of shelf stability, formulation flexibility, and high efficiency against those old-time unruly foods, the powdered alginate segment experiences difficulties with variable hydration, dust control issues, and heat processing can compromise functional properties. Yet new developments in Nano-encapsulated alginate powders, enzyme-assisted hydration improvements, and AI ingredient blending are driving performance, and the powdered food-grade alginate market will continue to progress.

Liquid alginate solutions are seeing high market adoption as ready-to-use ingredient solutions and for large-scale food manufacturing, as industries continue to move towards pre-hydrated alginate to improve efficiency in food production. Unlike the powdered versions of alginate, the use of liquid alginate guarantees fast dispersion and high hydration, and enables easy incorporation in liquid-based food matrices.

The market adoption can be attributed to the increasing requirement for pre-mixed liquid alginate solutions, including viscosity-controlled formulations, shelf-stable variants with enhanced shelf-life, and high-performance emulsification characteristics. Liquid alginate is used in more than 50% of liquid-based food stabilizers and thickening agents due to its homogeneous dispersion and high functional efficiency, according to studies.

Farm-to-Consumer segment analysis, growth demands, and consumption trends have expanded with the development of meat Substitutes, egg replacements, and multiple ready-to-eat food applications. The binding, emulsification, moisture retention, and texture enhancement that liquid alginate-based emulsification provides have resulted in even stronger market growth, guaranteeing linear product uniformity and consumer appeal.

The adoption of integrated AI-assisted food-processing solutions with functionalities like automated liquid alginate dosing, real-time viscosity-based adjustments, and smart ingredient compatibility tracking has also driven adoption by enhancing precision and reducing waste of raw materials.

Asia Pacific was the prominent region in terms of alginate products consumption, due to the demand for cold-stable alginates, which can withstand temperatures of 100°C, and pH-altered liquid alginate solutions that improve gelling in acidic and neutral pH functional beverages and high-acid food products.

Although liquid alginate is preferred for its benefits like rapid dispersion, ease of application, and improved hydration efficiency, the segment faces challenges like risk of microbial contamination, storage stability concerns, and higher transportation costs. Nevertheless, advancements in aseptic liquid alginate packaging, enzyme-modified shelf-stability enhancement, and AI-driven optimization of storage conditions are augmenting market feasibility, resulting in sustained growth for liquid food-grade alginate applications.

The paper bags and fiber drums segments play an integral role, fueling market growth as food manufacturers and ingredient suppliers shift towards innovative packaging solutions that ensure maximum stability of the alginate, reduce handling processes, and improve transportation safety, among other benefits.

The powdered food-grade alginate is mainly packaged in paper bags that provide lightweight, affordable, and recyclable means of storage. Paper bags are a suitable option for high-volume ingredient distribution as they ensure better stackability, greater disposal convenience, and lower shipping costs compared to rigid packaging formats.

Market adoption has been driven by the increasing focus on sustainable and biodegradable packaging, including recyclable paper bag materials, moisture-resistant coatings, and resealable closure systems. According to studies, more than 60% of bulk alginate suppliers prefer cost-effective and environment-friendly paper bag packaging for disposal.

Advancements in bulk food ingredient distribution networks with high-capacity paper bag storage, automated filling systems, and optimized supply chain logistics have accelerated market growth by ensuring upward trends in operational efficiency.

The adoption has been further accelerated through the high adoption of smart packaging technologies integrated with AI-enabled storage condition monitoring, real-time humidity detectors, and QR-code-based traceability systems that provide improved ingredient quality control and regulatory compliance.

The cost efficiency, lightweight handling, and sustainable appeal of paper materials is chipped away, however, by issues with moisture sensitivity, susceptibility to tearing, and offering limited barrier protection from external contaminants. Nonetheless, advancements in multi-layer paper bag coatings, reinforced fiber structures, and moisture-activated sealing technologies are enhancing durability, which will guarantee sustained market proliferation of paper bag-packaged food-grade alginate.

With industrial-scale food ingredient distribution, stronger market adoption of fiber drums is evident while manufacturers focus on durable, high-capacity storage for bulk alginate shipments. Fiber drums offer superior barrier protection compared to paper bags, minimizing contamination risks and contributing to extended shelf life.

Accordingly, increasing demand for high-strength packaging, including tamper-resistant fiber drum lids, reinforced sidewalls, and internal moisture barriers, has continued to boost adoption across high-performance markets. As per studies, more than 55% of big-scale food processing companies choose fiber drum packaging as it is capable of withstanding the rigorous storage and transportation environment.

Global trade in food components is based on the steady expansion of the food industry. This has resulted in the expansion of fibre barrel-packed alginate shipments to multinational companies and specialty food processing industries, supported by market growth and the effective functioning of safe, contamination-free supply chains.

Integration of AI-enabled logistics solutions for real-time drum weight tracking, automatic inventory scanning, and shelf-life prediction monitoring has further accelerated adoption and improved packaging efficiency and better supply chain visibility.

Sustainable and compliant options have led to the development of eco-friendly fiber drum alternatives, composite materials for crafting biodegradable and reusable drum linings, and solvent-free adhesives for drum manufacturing, all of which have contributed to a more practical market growth.

While these qualities make fiber drums more durable, resistant to contamination, and capable of bulk storage, the segment is also seeing challenges such as high packaging costs, cumbersome handling, and limited flexibility for small-scale ingredient distribution. But as improvements in lightweight fiber drum composites, smart drum tracking systems, and AI-enhanced packaging optimization techniques improve feasibility, the progress will not stop; fiber drum packaged food-grade alginate will continue to grow.

Increasing demand for natural food additives is the major driver of food grade alginate market. Representatives from leading industry players emphasize alginates with high levels of purity, techniques such as AI-enhanced texturization, and eco-friendly sourcing from seaweed. The alginate market scope and segment major suppliers include specialty food ingredient manufacturers, biotechnology companies, and food processors exploring alginate-based thickening, gelling, and emulsifying technologies.

Market Share Analysis by Key Players & Food Grade Alginate Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| FMC Corporation (Ingredion Incorporated) | 18-22% |

| DuPont de Nemours, Inc. (IFF) | 14-18% |

| KIMICA Corporation | 12-16% |

| Cargill, Incorporated | 8-12% |

| Algaia S.A. | 6-10% |

| Other Food Grade Alginate Suppliers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| FMC Corporation (Ingredion Incorporated) | Develops high-purity food-grade alginates with AI-optimized texturization for dairy, bakery, and plant-based food applications. |

| DuPont de Nemours, Inc. (IFF) | Specializes in alginate-based stabilizers for clean-label food formulations, AI-driven viscosity control, and improved emulsification. |

| KIMICA Corporation | Focuses on ultra-refined alginates, AI-assisted functional ingredient optimization, and sustainable seaweed-based thickening agents. |

| Cargill, Incorporated | Provides high-performance food-grade alginate solutions with AI-enhanced formulation for meat alternatives, sauces, and dairy stabilization. |

| Algaia S.A. | Offers sustainably sourced alginates, AI-powered rheology analysis, and gelling agents for plant-based and gluten-free foods. |

Key Market Insights

FMC Corporation (Ingredion Incorporated) (18-22%)

FMC Corporation dominates the food-grade alginate market with AI-enhanced ingredient optimization, producing high-performance texturizing solutions for clean-label food applications.

DuPont de Nemours, Inc. (IFF) (14-18%)

DuPont specializes in AI-driven formulation of alginate stabilizers, emulsifiers, and viscosity enhancers for plant-based, gluten-free, and dairy applications.

KIMICA Corporation (12-16%)

KIMICA is a leader in ultra-refined alginates, utilizing AI-powered ingredient functionality analysis to enhance gel formation and water retention in processed foods.

Cargill, Incorporated (8-12%)

Cargill focuses on AI-assisted food formulation, providing high-performance alginate solutions for dairy, sauces, and alternative meat products.

Algaia S.A. (6-10%)

Algaia integrates AI-driven rheology modeling to optimize the gelling, thickening, and stabilizing properties of sustainably sourced food-grade alginates.

Other Key Players (30-40% Combined)

Several food ingredient manufacturers, specialty seaweed processors, and biotech firms contribute to next-generation food-grade alginate innovations, AI-enhanced functional ingredient development, and sustainable production. Key contributors include:

The overall market size for the food grade alginate market was USD 11.2 Million in 2025.

The food grade alginate market is expected to reach USD 19.7 Million in 2035.

The demand for food grade alginate is expected to rise due to its increasing use as a natural thickening and stabilizing agent in food and beverage applications. The growing preference for clean-label and plant-based ingredients is further fuelling market expansion. Additionally, advancements in food processing technologies and the rising adoption of alginate-based edible coatings are key factors driving growth.

The top 5 countries driving the development of the food grade alginate market are the USA, China, Germany, Japan, and France.

Paper Bags and Fiber Drums are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Basket Market Forecast and Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Food Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA