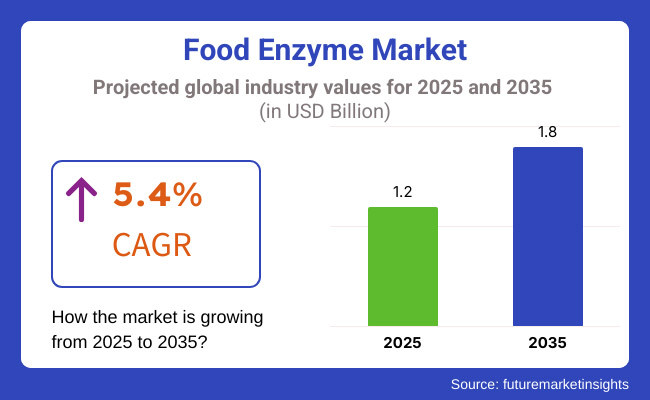

The demand for global Food Enzyme market is expected to be valued at USD 1.2 Billion in 2025, forecasted at a CAGR of 5.4% to have an estimated value of USD 1.8 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 5.1% was registered for the market.

Urbanization rising disposable income environmental concerns and improvements in R&D activities all contributed to the market expansion for food enzymes. Furthermore, technological developments like enzyme engineering and the introduction of genetically modified enzymes have contributed to the expansion of the food industry.

The expansion of the global market is facilitated by elements like the multipurpose advantages of food enzymes in a range of applications and technological advancements that lower chemical consumption.

Food enzymes are in high demand because they enable food manufacturers to create high-quality products with longer shelf lives. In order to improve flavor texture and shelf life they are typically added to food during processing.

Protease amylase lactase and lipase are a few of the enzymes that are frequently utilized in the food and beverage industry. Most often lactase is added to milk products to help those who are lactose intolerant digest them. Protease is used in brewing and meat tenderization amylase is used in baking to break down starches and lipase is used in cheesemaking to break down fats.

Explore FMI!

Book a free demo

Demand for Processed Food is Driving the Market Growth

Due in large part to the expanding economies of the Asian continent the demand for processed foods is rising globally. The two main countries propelling the processed food markets notable expansion are China and India. An increasingly busy lifestyle rising disposable incomes and an expanding middle class all contribute to the markets expansion.

Applications of food enzymes increase the final products freshness extending the convenience foods shelf life while maintaining their texture color and flavor.

During the period 2020 to 2024, the sales grew at a CAGR of 5.1%, and it is predicted to continue to grow at a CAGR of 5.4% during the forecast period of 2025 to 2035.

The industry is benefitting from the growing clean-label trend as well. Consumers today are looking for food items made with natural ingredients. As food enzymes are naturally occurring catalysts that come from plants microorganisms and animals this is leading food and beverage companies to use them.

The growing emphasis on enhancing digestion and gut health is pushing people to choose foods that are easy to digest and contain enzymes. Throughout the forecast period food enzyme sales will increase in tandem with the ongoing demand for these food products.

Growth in the industry will be further aided by developments in genetically modified enzymes and enzyme engineering. Consequently, the industry is expected to gain from the rising demand for super enzymes and the increased accessibility of enzyme supplements.

Tier 1 companies comprises industry leaders acquiring a 55% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 15%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope.

As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and China come under the exhibit of high consumption, recording CAGRs of 4.4%, 4.5% and 6.0%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 4.4% |

| UK | 4.5% |

| China | 6.0% |

It is projected that the food enzyme market in the USA will grow over the course of the evaluation. Rising trends in health and wellness an increase in the demand for convenience foods and the growing acceptance of specialty enzymes are all responsible for this.

Consumers are placing a greater emphasis on their health and well-being which is driving up demand for clean-label and natural products. The use of food enzymes is therefore anticipated to rise since they are frequently seen as natural and less hazardous than chemical additives. Foods with digestive health benefits are also in high demand among American consumers.

Thus, in the countrys functional food and dietary supplement industries enzymes such as probiotics and digestive aids are gaining popularity which boosts sales.

From 2025 to 2035 food enzyme sales in China are expected to grow at a compound annual growth rate (CAGR) of 6.0%. Growing health consciousness and the expanding use of enzymes in the booming food and beverage sector are two major factors propelling this sales growth.

The food and beverage sector are expanding rapidly in China due to the country’s rapidly growing population and rising disposable incomes. As a result, it is anticipated that the nation’s food enzyme producers will have profitable growth opportunities through 2035.

Chinese food and beverage manufacturers are increasingly utilizing enzymes to improve the flavor and texture of their goods while also extending their shelf life. Food enzyme sales will therefore increase in tandem with Chinas growing demand for packaged and processed foods.

A compound annual growth rate (CAGR) of 4.5% is projected for the UK during the evaluation period. The nations expanding bakery industry high consumer spending on convenience foods and rising interest in plant-based enzymes are the main factors propelling the food enzyme markets expansion.

There is a thriving bakery sector in the UK and food enzymes are essential for enhancing the caliber and durability of baked goods. Bakers use them frequently to create high-quality bread products. Therefore through 2034 the nations rising baked goods production and consumption will be a major factor in promoting industry growth.

| Segment | Value Share (2025) |

|---|---|

| Carbohydrate (Type) | 66% |

By 2025 the carbohydrate segment is expected to hold its dominant position in the market with a 66% value share. This can be attributed to the increasing use of carbohydrases in a variety of food applications such as baking brewing and the production of processed foods. Another important factor driving the growth of this segment is the rising demand for processed foods.

Since they convert complex carbohydrates into simpler sugars enzymes that hydrolyze carbohydrates such as cellulases and amylases are essential to the production of processed foods. Additionally, they contribute to the enhancement of food products flavor texture and shelf life.

Enzymes such as amylases are increasingly being used in the baking industry. These enzymes are frequently utilized to improve the quality of the finished product fermentation and dough handling. They are essential tools in the baking industry due to their propensity to enhance the freshness softness and shelf life of baked goods.

Micro-organism Rules the Food Enzyme Market

| Segment | Value Share (2025) |

|---|---|

| Micro-organism (Source) | 47% |

Bacteria and fungi are examples of microorganisms that are easily grown in large quantities using fermentation and other well-established techniques. Compared to plant or animal sources they are therefore a more affordable way to produce enzymes. For a range of food processing uses microorganisms can produce a large variety of enzymes.

Microbial enzymes give end users versatility in a variety of applications such as boosting cheese production or breaking down starches in baking. Enhancing segment growth is another important function of the sustainability factor.

The use of microorganisms to produce enzymes is more environmentally friendly and sustainable. Likewise, the industry and the target market will probably gain from the creation of novel microbial strains that produce distinct enzymes with particular characteristics.

Due to the strong dominance of a small number of important players the market structure is extremely consolidated. The producers are creating cutting-edge goods and acquiring minor competitors in an effort to further consolidate their market. The market is fiercely competitive and heavily dependent on technology.

The major companies are increasing their R&D expenditures in order to produce high-quality goods that satisfy the contemporary consumers desire for clean-label goods. Expansion of product portfolios including novel enzymes specifically for the dairy and bakery sectors is one of the main tactics used by major players to improve their market positions.

The market is expected to grow at a CAGR of 5.4% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 1.8 Billion.

Demand for processed food is increasing demand for Food Enzyme.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include BASF, DowDuPont, Chr. Hansen Holding A/S and more.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.