The food & beverage industrial disinfection and cleaning market is anticipated to be valued at USD 3,633.7 million in 2025. It is expected to grow at a CAGR of 5.4% during the forecast period and reach a value of USD 6,148.3 million in 2035.

Key Market Metrics

| Metric | Value |

|---|---|

| Estimated Market Size in 2025 | USD 3,633.7 Million |

| Projected Market Size in 2035 | USD 6,148.3 Million |

| CAGR (2025 to 2035) | 5.4% |

In 2024, the food & beverage industrial disinfection and cleaning market made steady gains due to stringent food safety regulations and rising concerns over foodborne illnesses. Governments in developing regions, especially in Asia, Africa, and South America, stepped up the enforcement of food hygiene standards, contributing to the rising demand for efficient disinfectants.

Environmentally friendly and non-toxic cleaning solutions enjoyed rapid uptake in the food processing sector, reflecting consumer preference for sustainable products without residues. At the same time, leading chains and manufacturers of food service facilities increased investments to install automated cleaning systems for better efficiency and compliance.

Industry growth will be further driven in 2025 and beyond by advances in regulations and technology. AI-supported sanitation monitoring, as well as enzyme disinfectants, will come into widespread use.

In developed industries, waste reduction and sustainable formulations will take center stage, while emerging economies will fuel the need for cost-effective solutions to the burgeoning food safety regulations. The rising emphasis on various disinfection technologies, in conjunction with existing concerns related to antimicrobial resistance, will further propel industry growth until 2035.

Explore FMI!

Book a free demo

A recent survey conducted by FMI with key stakeholders in the food & beverage industrial disinfection and cleaning industry revealed significant industry shifts and evolving priorities. More than 60 percent of those surveyed indicated that regulatory compliance was the most critical factor in adopting advanced disinfection solutions.

Many manufacturers and food processors now strive to have the lowest microbial contamination levels; over half are concerned about pathogen resistance to conventional disinfectants. The survey indicated that consumers would increasingly prefer biodegradable as well as non-toxic cleaners owing to their sustainability aspirations and consumer pull for cleaner food products.

The study also confirmed the pattern toward automation and smart monitoring systems, particularly showcased by large food processing plants. Almost 4 in 10 stakeholder respondents are looking into AI hygiene monitoring application tools to enhance efficiency and compliance with stringent sanitation parameters. The other significant trend is regarding more enzyme and plant-based disinfectants, especially within Europe and North America, where strict environmental regulations are in place.

One other key finding from the survey is the argument about the cost versus the effectiveness. Smaller manufacturers reported that cost was one of the major roadblocks, while larger players are considering long-term efficiency as more important than short-term costs.

According to the survey, over 70% of respondents believe investing in innovative disinfection technologies-such as UV-based sterilization and electrostatic spraying-will become essential in the coming years. These innovations and collaborations must involve other stakeholders, such as the manufacturers, regulators, and technology providers. As global food safety standards become more stringent, early adopters of next-generation cleaning and disinfection solutions will gain a competitive edge.

| Country/Region | Government Regulations & Mandatory Certifications |

|---|---|

| The USA | The FDA standards of sanitation, the Food Safety Modernization Act mandates the highest level of sanitation over food processing plants since 2011. The Environmental Protection Agency (EPA) regulates disinfectants by approving the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA). Organic processing requires USDA Organic Certification, and this certification ensures that approved cleaners might be used. |

| European Union | The EU Biocidal Products Regulation (BPR) (Regulation (EU) 528/2012) regulates disinfectants employed in food processing, making them safe and effective. The Hazard Analysis and Critical Control Points (HACCP) system is compulsory under EU Regulation 852/2004. The EcoLabel Certification is mandatory for environmentally friendly disinfectants. |

| UK | Since post-Brexit, the UK has adhered to the Health and Safety Executive (HSE) Biocidal Products Regulations (BPR) to align with EU requirements. HACCP regulations are enforced by the Food Standards Agency (FSA). BS EN 1276 and BS EN 13697 are the most important standards for disinfectant performance. |

| China | China's Food Safety Law requires high standards of hygiene, with food manufacturers having to adhere to Good Manufacturing Practices (GMP). The National Food Safety Standard for Disinfectants (GB 14930.1-2015) specifies approved cleaning chemicals. Businesses also have to meet China Compulsory Certification (CCC) for chemical safety. |

| India | The Food Safety and Standards Authority of India (FSSAI) regulates food safety and hygiene standards. Disinfectants are required to meet BIS Standards (IS 14364:1996) for food-grade cleaning chemicals. HACCP compliance is recommended but not legally mandated. |

| Japan | The Food Sanitation Act regulates food industry hygiene, and companies are compelled to utilize Ministry of Health, Labour, and Welfare (MHLW)-approved disinfectants. The JAS (Japanese Agricultural Standard) certification is used for organic food processing. |

| Brazil | Disinfectants are controlled by the National Health Surveillance Agency (ANVISA) through RDC 14/2007. HACCP in food processors is enforced by the Ministry of Agriculture, Livestock, and Food Supply (MAPA). |

| Australia | Food Standards Australia New Zealand (FSANZ) Code requires compliance with HACCP. Therapeutic Goods Administration (TGA) controls disinfectants applied to food processing-Australian Certified Organic (ACO) standards for organic food facilities. |

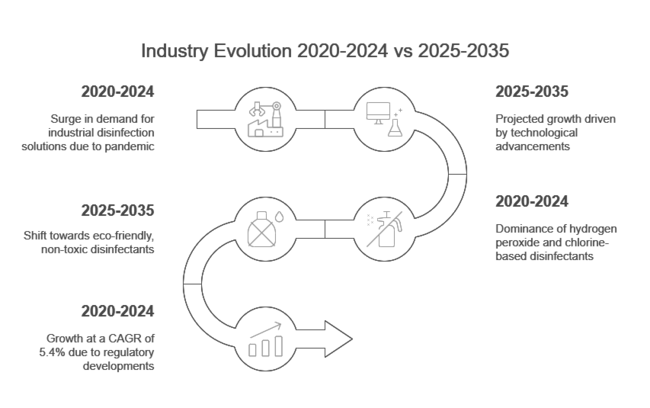

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry saw moderate growth, with a surge in demand for industrial disinfection solutions due to heightened hygiene concerns during the pandemic. Food safety regulations became stricter, driving increased adoption of disinfectants across food processing industries. | The industry is projected to grow at a faster pace, driven by technological advancements in disinfection methods such as ozonation, steam sterilization, and UV technology to meet evolving food safety requirements. |

| Hydrogen peroxide and chlorine-based disinfectants dominated due to their affordability and effectiveness, particularly in meat and dairy processing. However, growing concerns over chemical residues sparked interest in alternative solutions. | Growing preference for eco-friendly, non-toxic disinfectants such as ozone and peracetic acid is expected to drive industry evolution. Regulatory bodies will impose stricter guidelines on chemical-based disinfectants, further influencing this shift. |

| Developed regions like the USA and Europe focused on regulatory compliance and advanced disinfection techniques while developing regions prioritized affordability and accessibility. | Countries such as China, India, and Brazil will witness higher adoption rates due to rising packaged food demand and government-led food safety initiatives. Developed regions will continue emphasizing innovation and sustainability. |

| Companies started investing in automated cleaning solutions and smart disinfection technologies to improve operational efficiency and reduce manual labor in cleaning processes. | The food industry will integrate robotic cleaning systems, AI-driven hygiene monitoring, and automated sanitization processes, optimizing production efficiency while ensuring compliance with stringent safety standards. |

| The sector grew at a CAGR of around 5.4% between 2020 and 2024, driven by regulatory developments and rising consumer awareness regarding food safety. | The industry is likely to witness an improved CAGR, with some regions exceeding the global growth rate, supported by increased investments in food safety technologies and infrastructure. |

The processed food segment is estimated to account for 7.9% of the share in 2024, reflecting steady growth from 2022. The increasing demand for packaged and convenience foods is driving the adoption of advanced disinfection techniques such as steam ultrasound and ozonation.

Food safety regulations have become stricter, pushing manufacturers to adopt non-chemical disinfection methods that ensure microbial control while maintaining product integrity. In China and India, where packaged food consumption is expanding rapidly, companies are investing in cutting-edge disinfection solutions to comply with evolving regulatory frameworks. Agriculture and Agri-Food Canada (AAFC) highlights China as a key region for packaged food growth, reinforcing the demand for enhanced sanitation practices in this segment.

Hydrogen peroxide remains the dominant disinfectant, accounting for an estimated 14.8% of the share in 2024. Its ability to effectively eliminate pathogens while being approved for direct food contact makes it the preferred choice across dairy, meat, and beverage industries.

The shift toward chemical-free and sustainable disinfection has also led to increased adoption of peracetic acid, which complements hydrogen peroxide by ensuring enhanced microbial control. Manufacturers are focusing on reducing chemical residues while maintaining high food safety standards, further fueling demand for these disinfectants in both developed and emerging regions.

Steam sterilization remains a widely adopted disinfection process in the food and beverage industry due to its ability to eliminate pathogens without leaving chemical residues. In 2024, its adoption continues to rise, particularly in dairy and meat processing, where maintaining product safety without altering taste or texture is essential.

The technique is also gaining traction in ready-to-eat food manufacturing as companies seek chemical-free disinfection solutions to align with consumer preferences and stricter regulatory demands. Steam sterilization's energy efficiency and effectiveness in food production environments position it as a preferred method in industries focused on sustainability and operational safety.

| Countries | CAGR |

|---|---|

| The USA | 5.6% |

| UK | 5.2% |

| France | 5.3% |

| Germany | 5.4% |

| Italy | 5.1% |

| South Korea | 5.5% |

| Japan | 5.3% |

| China | 5.8% |

| Australia and New Zealand | 5.2% |

The USA is anticipated to register a growth of 5.6% CAGR (2025 to 2035), led by FSMA regulations and the growing uptake of AI-driven sanitation monitoring. FIFRA regulations by the EPA guarantee disinfectant effectiveness while demand for biodegradable cleaners grows.

Major food processing companies are investing in UV sterilization and electrostatic spraying to comply with stringent hygiene regulations. Automation becomes essential as labor shortages drive businesses to adopt smart cleaning technology. Increasing preference for organic food production is also driving the movement towards non-toxic disinfectants to ensure consistent growth.

The UK is set to expand at 5.2% CAGR (2025 to 2035) due to FSA-enforced HACCP compliance and post-Brexit regulations. BS EN 1276 and BS EN 13697 standards are making their impact felt in business decisions with the use of green disinfectants. The government's goal of becoming carbon neutral is pushing companies to convert to biodegradable and low-residue cleaners.

Electrostatic spraying and UV sterilization are increasingly being used by large food processing plants, with SMEs grappling with adoption cost implications. The shift toward plant-based food production is driving demand for chemical-free sanitization methods, supporting industry growth.

France is projected to grow at 5.3% CAGR (2025 to 2035), supported by EU BPR regulations and HACCP compliance. The nation's organic food explosion is fueling demand for ozone disinfectants and enzyme-based products. Concerns about sustainability are compelling producers to switch to low-toxicity, residue-free cleaning chemicals.

ISO 22000 certification continues to be essential for food processors, who must maintain stringent hygiene surveillance. The bakery and dairy industries are major growth drivers, necessitating specialized solutions. The adoption of smart sanitation technologies is also rising, particularly in large food manufacturing units, as automation becomes essential for regulatory compliance.

Germany is expected to grow at 5.4% CAGR (2025 to 2035), which is in line with the global average and driven by BVL regulations and HACCP mandates. The country's advanced food industry is embracing AI-driven hygiene monitoring to ensure real-time disinfection tracking.

Meat processing, dairy, and breweries require tailored sanitation solutions to comply with stringent microbial contamination limits. Sustainability policies have accelerated the shift to bio-based and enzyme disinfectants. With rising concerns over foodborne illnesses, UV disinfection, and vaporized hydrogen peroxide systems are gaining traction, ensuring continued investment in next-gen cleaning technologies.

Italy is expected to expand at 5.1% CAGR (2025 to 2035), led by EU BPR compliance and HACCP regulations. The country’s fragmented food sector relies heavily on artisanal production methods, slowing automation adoption. However, premium food exporters are prioritizing high-standard hygiene solutions to maintain international competitiveness.

The hospitality sector, fueled by tourism, is driving demand for rapid-action, food-safe disinfectants in restaurants, hotels, and catering services. Wine and cheese industries require specialized solutions to prevent cross-contamination, while government subsidies for food safety enhancements may further boost industry growth.

South Korea is projected to grow at 5.5% CAGR (2025 to 2035), slightly above the global average, driven by KFDA food safety regulations and a tech-savvy approach to sanitation. The country is at the forefront of smart disinfection innovations, with AI-driven hygiene monitoring gaining traction in urban food manufacturing hubs.

The rising popularity of convenience foods has increased demand for automated cleaning systems in ready-to-eat food production. Electrostatic disinfection, UV sterilization, and ozone-based cleaning are being widely adopted, particularly in high-capacity food factories, ensuring a strong industry trajectory.

Japan is set to grow at 5.3% CAGR (2025 to 2035), driven by strict MHLW food safety laws and HACCP adoption. The country’s advanced food processing sector relies on automated cleaning technologies to maintain global hygiene standards. With an aging workforce, businesses are investing heavily in robotic sanitation systems to offset labor shortages.

The seafood and convenience food industries require specialized disinfectants to ensure product safety. Eco-friendly disinfectants are gaining ground due to government-backed sustainability efforts, pushing manufacturers toward low-residue and bio-based solutions.

China is expected to grow at 5.8% CAGR (2025 to 2035), making it one of the fastest-growing regions, fueled by rigorous food safety enforcement under the National Food Safety Law. The country’s massive food processing sector is rapidly modernizing, leading to higher adoption of automated disinfection solutions.

Cost-effective yet high-efficacy disinfectants are in demand, particularly in meat, dairy, and packaged food industries. The government is imposing stricter hygiene regulations, encouraging investment in smart sanitation systems. China Compulsory Certification (CCC) standards are shaping the disinfectant industry, ensuring compliance with new safety benchmarks.

The Australia-NZ region is expected to grow at 5.2% CAGR (2025 to 2035), driven by FSANZ food safety regulations and HACCP compliance. Certified organic food production is expanding, increasing demand for plant-based and residue-free disinfectants. The region’s dairy and meat industries require high-performance, eco-friendly cleaning agents to meet TGA and ACO standards.

Smart sanitation monitoring is being widely adopted in large-scale food factories, ensuring better contamination control. Additionally, electrostatic spraying and UV-C sterilization technologies are being integrated into automated cleaning systems, reinforcing industry growth.

As of 2024, the food & beverage industrial disinfection and cleaning industry is set for strong growth, driven by increasing hygiene requirements, regulatory mandates, and enhanced food production safety measures. Major industry players such as Ecolab Inc., Diversey Holdings Ltd., 3M Company, BASF SE, Evonik Industries AG, and Neogen Corporation are actively expanding their strategies to meet the evolving market demands.

Ecolab Inc. maintains its market dominance with an estimated 25-30% share in 2024. The company has strengthened its leadership by introducing a new range of eco-friendly disinfectants and cleaning agents designed to minimize energy and water usage. These innovations have been widely adopted by food and beverage manufacturers aiming to meet sustainability goals, further reinforcing Ecolab’s position in the industry.

Diversey Holdings Ltd. holds an estimated 20-22% market share in 2024. The company’s focus on digital transformation led to the launch of an AI-driven cleaning and disinfection management platform that optimizes sanitation processes, reduces waste, and ensures compliance with hygiene standards. This technology-driven approach has helped Diversey expand its customer base and strengthen its competitive edge.

3M Company commands approximately 15-18% of the market share in 2024, driven by significant investments in research and development. The company introduced a new range of non-toxic, food-safe disinfectants specifically designed for high-risk areas in food processing facilities. These products have gained popularity due to their effectiveness and compliance with strict regulatory standards.

BASF SE holds an estimated 10-12% market share in 2024. The company has demonstrated its commitment to sustainability by introducing biodegradable disinfectants in collaboration with food industry stakeholders. Its strong focus on R&D and sustainable solutions has solidified its position as a key market player.

Evonik Industries AG accounts for approximately 8-10% of the market share in 2024. The company expanded its product portfolio by launching enzymatic cleaners tailored for dairy and brewing applications. These products have been well-received for their efficacy and environmental benefits, enabling Evonik to establish a specialized market position in specialized cleaning solutions.

Neogen Corporation retains a 5-7% market share in 2024, focusing on strategic partnerships. The company collaborates with food safety organizations to develop advanced disinfection methods and training programs, reinforcing its reputation as a trusted leader in food safety solutions.

The global food & beverage industrial disinfection and cleaning market is heavily influenced by macro-economic trends such as urbanization, globalization of food supply chains, regulatory policies, and sustainability initiatives.

Rising disposable incomes, particularly in emerging economies like China and India, are increasing the demand for packaged and processed foods, necessitating stricter disinfection and cleaning measures. Additionally, global trade in food products has expanded significantly, requiring standardized sanitation protocols to ensure safety across borders.

Inflation and supply chain disruptions have impacted the cost of disinfectants and cleaning agents, prompting manufacturers to seek cost-effective and sustainable alternatives like ozonation and steam sterilization.

Regulatory agencies such as the FDA (USA), EFSA (Europe), and CFSA (China) are enforcing stricter food safety standards, driving investments in automated and eco-friendly disinfection solutions. Meanwhile, climate change concerns and water scarcity are pushing industries toward water-efficient and non-chemical cleaning technologies.

In the future, the industry is poised for strong growth, supported by technological innovation, government mandates, and increasing consumer demand for food safety assurance across developed and emerging economies.

Expansion in Emerging Regions

Rising demand for processed and packaged food in India, China, and Southeast Asia presents significant growth opportunities. Stakeholders should establish local manufacturing units and collaborate with regional food safety authorities to align with country-specific regulations. Investing in affordable and scalable disinfection solutions tailored to high-growth economies can enhance market penetration.

Adoption of Non-Chemical Disinfection Technologies

Regulatory tightening on chemical residues in food is accelerating the shift toward steam sterilization, ozonation, and UV disinfection. Companies should focus on developing and patenting non-toxic, high-efficiency disinfection solutions. Partnerships with food processing firms to integrate these technologies into production lines will offer long-term competitive advantages.

Investment in Automated & AI-Driven Hygiene Solutions

Automation in cleaning and disinfection is becoming essential to meet stringent hygiene protocols while improving operational efficiency. Stakeholders should develop AI-powered sanitation monitoring systems and robotic cleaning solutions that reduce labor costs and human error. Collaborations with food processing equipment manufacturers to embed these solutions will provide a first-mover advantage.

Customized Solutions for Specific Food Segments

Different food categories require tailored disinfection approaches. For instance, dairy and meat processing demand temperature-resistant disinfectants, while fresh produce benefits from water-efficient, chemical-free solutions. Stakeholders should focus on segment-specific innovations, ensuring compliance with safety standards while optimizing cost efficiency.

Stringent food safety regulations, rising concerns over foodborne illnesses, increasing demand for packaged foods, and the need for extended shelf life are key drivers.

Steam sterilization, ozonation, UV technology, and hydrogen peroxide-based disinfectants are widely adopted due to their effectiveness and eco-friendly properties.

Rapid urbanization, expansion of food processing industries, and stricter government regulations in China, India, and Brazil are accelerating market growth.

Automated cleaning systems and AI-driven hygiene monitoring help reduce human error, improve efficiency, and ensure compliance with evolving food safety protocols.

Compliance with FDA (U.S.), EFSA (Europe), CFSA (China), and certifications such as HACCP, ISO 22000, and NSF International are crucial for product approval.

By product type, the industry is segmented into oxidizing disinfectants, non-oxidizing disinfectants, and alcohols & cleaning chemicals.

Based on process, the sector is segmented into coagulation, steam sterilization, pasteurization, carbonation, chlorination, UV technology, ozonation, and others.

Based on the application, the industry is segmented into the food industry and the beverage industry.

The sector is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.