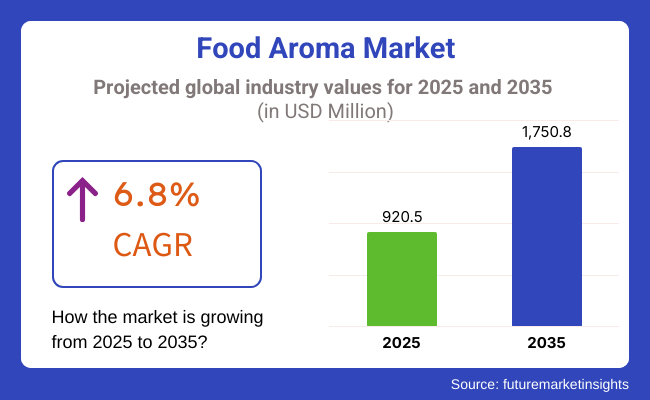

The global food aroma market is estimated to be worth USD 920.5 million in 2025 and is projected to reach USD 1,750.8 million by 2035, expanding at a CAGR of 6.8% over the assessment period 2025 to 2035. There has been a marked increase in the appetite for food and beverage aromas on the global market, directly attributed to a change in consumer preferences towards the use of natural, clean-label, and functional aromas, which, in turn, improve the sensory effect of food and beverages.

Added to the health concerns, the demand for organic, plant-based, and non-GMO food aromas is increasing tremendously, causing major manufacturers to prioritize natural extraction processes along with biotechnological routes for aroma development. The market is also experiencing a fast rate of application of bio-based and fermentation-derived aromas as green and eco-friendly substitutes for synthetic flavoring agents.

The development of plant-based and vegan food sectors has led to the increased necessity of genuine and powerful aromatic compounds, which are alternative ways of replicating meaty, dairy, and umami flavors without the use of artificial additives.

Furthermore, the rise of functional foods and beverages has served as a starting point for the creation of new types of aromatic compounds that come with health advantages, including calming botanical aromas that relieve stress, gut-friendly fermented notes, and energy-giving citrus profiles. The growing regulatory spotlight on synthetic food additives has made it all the more necessary for brands to utilize natural flavoring agents in their products.

Besides, the proliferation of e-commerce and direct-to-consumer brands has also created a new product line of aroma-infused foods and drinks that consumers can cook at home themselves as they crave the luxury of premium, gourmet sensory experiences.

Moreover, the improvement of the encapsulation technology not only enhances the stability and longevity of volatile aromatic compounds but also ensures that the food products are released in a consistent and prolonged way with the desired flavor. With the persistent shift of food brands toward personal flavoring choices, globally, the industry holds the future with a secure development based on clean-label, functional, and biotechnologically increased aromas.

The increasing consumer interest in organic and plant-based aromas has led people to abandon the use of synthetic additives, artificial flavors, and chemical-based aromatic compounds. Food manufacturers are increasingly investing in the development of products made from botanical extracts, essential oils, and fermentation-derived aromatic ingredients to help them keep pace with the rapidly changing health trends and the demand for the clean-label range.

The transition towards plant-based diets and vegan options also plays a major role in this development, as brands are looking to imitate true meaty, dairy, and umami tastes with the help of plant-based aroma solutions.

Explore FMI!

Book a free demo

The market for food aroma grew steadily during the period 2020 to 2024 due to growing consumer interest in natural, clean-label, and real flavors for food and beverages. Consumers interested in their well-being flocked to products with natural aroma compounds extracted from fruits, herbs, spices, and essential oils.

The development of functional and plant foods generated demand for aroma-enhancing products to simulate the taste and smell of traditional meat and dairy foods. New encapsulation and controlled-release technologies improved the aroma stability and shelf life, delivering uniform flavor release.

Regulatory reforms that favored openness and safety in food labeling commenced the disclosure of aroma chemical origin and processing by manufacturers. The growing emphasis on multisensory food enjoyment generated the requirement for high-end technology aroma profiles to enhance the public restaurant experience.

The food fragrance market between 2025 and 2035 will be influenced by biotechnology, AI-based innovation, and sustainable production processes. Bioengineering and precision fermentation will allow for the production of high-quality natural aroma molecules with improved consistency and reduced environmental footprint. Machine learning and artificial intelligence will allow for the accelerated development of customized aroma profiles to meet local and personal taste preferences.

Mood-enhancing, calming, and mentally refreshing functional fragrances will also gain traction as the wellness and health trend continues. Sustainable sourcing and upcycled ingredients will be the standard as companies vie with each other to minimize waste and maximize supply chain transparency. Real-time aroma profiling with sensor technology will enable companies to control aroma intensity and composition at the manufacturing level, delivering optimal flavor results.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing demand for natural, clean-label, and genuine food aromas. | Precision fermentation and bioengineering for consistent natural aroma production. |

| Use of essential oils, herbs, and spices for flavoring. | AI-based development of personalized aroma profiles. |

| Encapsulation and controlled-release technologies enhancing aroma stability. | Sensor-based real-time aroma profiling. |

| Regulatory drive for transparency and labeling correctness. | Blockchain-based traceability and supply chain transparency. |

| Increased demand for multisensory food experiences. | Functional aromas improve mood and cognitive function. |

The Global industry is witnessing strong growth, fueled by the demand for natural, clean-label, and innovative flavors among consumers. Due to growing health awareness, demand for organic, non-GMO, and allergen-free aroma compounds is seeing a boom.

In the drinks industry, food smells augment the sensory experience, with an emphasis on botanical extracts and fruit notes. The bakery and sweets sector favors intense, lingering vanilla, chocolate, and caramel smells, while dairy products focus on true milk-based flavors augmented with natural additions. Savory and snack segments favor spice mixtures, umami-heavy formulations, and smoky profiles as a response to shifting flavor trends.

Cost-effectiveness remains a primary concern in processed food applications, balancing affordability with high-impact aroma preservation technologies such as microencapsulation and enzymatic extraction. As worries over sustainability grow, manufacturers are reaching out to bio-based, plant-extracted food fragrances to address green consumer trends.

The industry faces compliance challenges that arise from the imposition of strict regulatory norms on food additives, labeling, and safety. Companies are required to comply with the ever-evolving rules, get supply chain certifications, and provide transparency to maintain their credibility and the trust of consumers.

The production of food is unstable and high due to supply chain disturbances, particularly in the areas of raw material availability, transportation limitations, and the price of essential oils and natural extracts. The industry is sensitive to the constantly changing climate and is also affected by political issues. The companies must use various strategies, one of them is supplying goods from different manufacturers, and they should look for solutions that have less impact on the environment.

The leap of consumers to completely clean and natural & organic flavors is a real challenge for synthetic aroma makers. Health risks related to chemical additives that are not produced artificially are becoming more and more popular these days. Companies have no other option but to buy machines that can make natural extracts or hire the best scientists to create new product ideas that match the changing trends.

Competition is on the rise for quickly flavored components such as functional and fermented ingredients, which are taking off the pressure of classic food aroma providers. Being competitive in business is dependent on the focus of research and development, innovative sensory profiles, and individualized formulations addressed to the particular sector.

Businesses should reach the expected deliverables by optimizing production; they can also stay successful by expanding to other international industries and working together with other food producers to create new and customer-oriented aroma solutions.

| Segment | Value Share (2025) |

|---|---|

| Vanillin (Product) | 45.6% |

The benzenoids application segment includes vanillin, benzyl acetate, benzoic acid, cinnamyl, and benzaldehyde, and these compounds are mainly responsible for improving flavor in various food applications. By product, a vast majority of the industry comprises benzenoids, with vanillin expected to hold a 45.6% share by 2025.

Vanillin has sweet and creamy notes that make it become the key flavoring agent used in bakery, confectionery, dairy & beverages. Industry pioneers such as Solvay, Evolva, and Borregaard are now focused on securing a position in the growing natural and bio-based vanillin segment by developing fermentation-derived and biomass/lignin-based vanillin as alternatives to synthetic variants.

Moreover, the rising demand for clean-label and sustainable ingredients is also accelerating the uptake of natural vanillin among food and beverage (FB) manufacturers. The second largest compound in the benzenoid group is benzyl acetate, which comprises a 14.2% share. Benzyl acetate, whose characteristic pleasant fruity and floral aroma, is widely used in drinks, candy, and dairy products flavored with fruits.

It is also an important ingredient in blended flavor formulations that boost citrus, berry, and tropical fruit profiles. Companies such as Symrise and Givaudan are innovating with nature-identical and bio-based solutions of benzyl acetate to meet the growing consumer demand for authentic and natural food aromas.

Aside from benzenoids, the segments of terpene and musk chemicals and condiments are also growing because of the growing use of natural and botanical food aromas. As functional foods gain in popularity, as do gourmet flavors, the industry is gravitating toward sustainable extraction processes and AI-driven aroma formulation for more authentic and meanwhile appealing flavors for consumers.

| Segment | Value Share (2025) |

|---|---|

| Beverages (Application) | 42.6% |

By application, the beverages segment holds the largest share of 42.6% in 2025. The use of natural and synthetic aroma compounds is being propelled by growing popularity among flavored water, carbonated beverages, energy drinks, and plant-based products.

For example, The Coca-Cola Company has expanded its Smartwater and Dasani flavored water portfolios, using botanical and citrus-based notes to stimulate consumer interest, just as PepsiCo's Bubly sparkling water and Nestlé’s San Pellegrino are made with natural fruit extracts and terpene-based aromas to address the clean-label and low-calorie trend.

The bakery segment holds a share of 18.0%, and a growing trend of artisanal and functional baked goods is boosting this segment. Aroma Compounds Involved in Bread AromaVanillin, benzyl acetate, and linalool are some of the important aroma compounds that help improve the overall sensory perception of bread, cake, pastries, and biscuits.

For example, Mondelēz International has reformulated Oreo cookies and Chips Ahoy! By using natural vanilla and cocoa-derived aromas, they meet consumers' demand for authenticity and indulgence. Takasago and Symrise are also using AI-driven aroma development to yield bakery-specific flavor solutions that replicate traditional baked aromas while lowering the time, cost, and effort required for large-scale production and assuring stability and consistency.

With food manufacturers placing greater importance on the use of natural ingredients, the demand for sustainable aroma solutions is increasing. Companies such as Evolva and Givaudan are targeting the fermentation-derived vanilla and bio-based citrus oils industries, similar to those addressing sustainability issues in the food aroma sector and providing high-impact, natural flavors.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 5.9% |

| France | 5.7% |

| Germany | 6.2% |

| Italy | 5.5% |

| South Korea | 6.0% |

| Japan | 5.8% |

| China | 7.1% |

| Australia | 5.6% |

| New Zealand | 5.4% |

The USA will be growing at 6.8% CAGR from 2025 to 2035. There is a continuous evolution with the growing use of biotechnology-derived and fermentation-derived flavor ingredients, particularly in beverages and snack foods. As the trend for functional and plant-based drinks continues, key leaders are launching fermented aroma solutions, enzyme-modified flavorings, and bio-based vanillin to mimic natural sweetness and intense flavor profiles.

Growing demand for snacking for plant-based foods, protein bars, and dairy replacers has also created a growing demand for aroma-modulating ingredients that are applied to enhance mouthfeel and flavor sense. With major USA companies patenting their own propriety technologies for aroma encapsulation, the nation is at the forefront of next-generation aroma formulation, particularly in carbonated beverages, spirit flavors, and protein snacking.

The UK will develop at a CAGR of 5.9% through the forecast period. The industry is also changing with an increase in low-alcohol, craft alcoholic beverages, and top-shelf spirits. The shift towards authentic, aged, and fermented flavor profiles is creating a stronger application of barrel-aged oils, smoky-aroma-smelling aroma chemicals, and botanical distillates to whiskey, premium cocktail formulas, and gin.

Also, the UK fermentation technology industry is spearheading research in the process of aromatization, i.e., using it for kombucha, probiotic drinks, and plant-flavored beverages. British food industries are concentrating on sustainable and upcycled origins of aroma, using residues from spent grains, fruit peels, and fermentation by-products to manufacture unique and sustainable food aroma solutions for bakery and confectionery purposes.

Germany is anticipated to record a CAGR of 6.2% during the forecast period. The country is witnessing high growth, particularly in the dairy and bakery sector, with precision fermentation and enzyme-modified aroma technologies spearheading the way.

To address the increasing demand for plant-based dairy alternatives and blend dairy formulas, companies are using fermentation-based creamy, buttery, and cheesy fragrances to replicate dairy taste in vegan cheese, yogurt, and plant ice creams. Also driving the use of fermented wheat extracts, malted odor substances, and enzyme-bolstered caramelized notes has been a higher demand for premium-quality baked food and artisanal bread.

Germany's focus on bio-certified and high-regulatory-quality odor preparations has established Germany as the front-runner of science-supported, nature-sound odor solutions, thus making the nation the hub of European food odor innovation.

The Chinese industry for food fragrances will post a CAGR of 7.1% between 2025 and 2035. The rapid industrialization of the country and increasing demand for natural and functional ingredients are driving the demand for food aroma solutions.

With growing health awareness, Chinese players are also manufacturing aroma chemicals from fermented tea leaves, medicinal herbs, and spices. The need for new flavor solutions replicating umami, dairy, and smoky flavors is also being driven by the demand for plant-based meat and dairy alternatives.

Locally, companies like Angel Yeast and Huabao International are also broadening their portfolios with other products in the form of high-performance natural aroma solutions, thereby making China a key industry for global aroma ingredient producers.

The food flavor industry of France is expected to expand at a CAGR of 5.7% during 2025 to 2035. The country's food culture of preparation and demand for gourmet foods of superior quality have motivated innovation in natural and artisanal flavor ingredients. French manufacturers are focusing on fermentation-based flavor molecules to develop added authenticity in aged cheese, fine wines, and artisanal bread foods.

The expansion of organic and clean-label food markets has stimulated greater use of plant extracts, citrus extracts, and floral scents. France's key players, such as Mane and Robertet, are counting on bio-based fragrance solutions to position France as a world-leading player for clean-quality food fragrance in the European market.

Italy's food aroma industry will increase at 5.5% CAGR over the next ten years. The growing adoption of classic Mediterranean flavor, characterized by herbal distillate and aged balsamic ingredients, has driven demand for natural aroma solutions.

Italian food manufacturers are using fermentation technologies to concentrate flavor in cheese, cured meats, and coffee beverages. The green supply of scent material, e.g., citrus peels and herbal distillate, is also increasing on Italian labels. Companies such as Firmenich Italy and Capua 1880 are leading the way in developing new aroma encapsulation technologies to stabilize volatile aroma materials in luxury food applications.

South Korea is set to grow at a CAGR of 6.0% between 2025 and 2035. Demand for Korean fermented food products such as kimchi and gochujang has led to technological advancements in umami-flavored and spicy fragrance solutions.

Microbe fermentation technology is being harnessed by South Korean businesses to develop deep umami tastes suitable for plant-based meat items and instant noodles. Besides, the Korean dessert and fruit-flavored drink trend has broadened the application of natural floral and fruity-scents aroma molecules. CJ CheilJedang and Ottogi are two of the leaders in the development of new fermentation-based aroma solutions.

Japan is likely to register a CAGR of 5.8% during the forecast period. The nation's emphasis on the umami taste and traditional fermentation processes is driving demand for miso, soy sauce, and sake-derived aroma chemicals. Japanese food companies are employing enzyme-amplified and koji fermentation technologies to clean up and concentrate natural flavors for upscale food uses.

Citrus-derived and green tea fragrance solutions are also increasing in confectionery and beverage segments. Takasago International and T. Hasegawa are creating environmentally friendly aroma technologies to cater to local and international markets.

Australia is also expected to grow at a CAGR of 5.6% from 2025 to 2035. Indigenous botanical flavors of wattleseed, finger lime, and eucalyptus have fueled demand for locally produced aroma compounds.

Local brands have now begun utilizing fermentation and enzyme-based techniques to derive unique flavor sources for specialty beverages and other dairy alternatives. Plant-based meat and dairy-free products are also seeing growth with the rising consumption of plant-based foods. Treatt Australia and Universal Flavors are introducing locally sourced aroma ingredients into their offerings.

New Zealand is poised to grow at a CAGR of 5.4% during the forecast period. The country's dairy industry is a role model for innovations in aromas, particularly in the arena of premium cheese and yogurt solutions.

Honey-based products and native plant extracts have driven demand for organic and natural fragrance solutions. New Zealand companies are driving natural and organic fragrance solutions to develop unique, locally inspired fragrances using sustainable extraction methods. Dairyworks and Hansells Food Group are leading the way in dairy and honey-based fragrance compounds for local and export industries.

The aroma food industry is already highly competitive and made even more so with the increasing demand for natural, clean-label, and functional aroma solutions. The competitive companies are concentrating on biotechnology-based aroma synthesis, sustainable ingredient sourcing, and advanced extraction techniques to produce aromas in response to new trends in food. With more plant-based, organic, and health-focused products, players further grow their portfolio through R&D, strategic acquisitions, and partnerships.

Various aroma solutions specific for food, beverages, and functional nutrition are dictated by leading players, such as International Flavors and Fragrances (IFF), Archer Daniels Midland (ADM), Kerry Group, BASF SE, and Cargill Inc. The investment in AI-driven flavor modeling, fermentation-derived aromas, and eco-friendly extraction methods would shape the competition in the industry.

Industry changes might also be attributed to regulations that allow the use of natural ingredients, the increasing consumer preference for sustainability, and technological advancements in aroma production. Kerry Group has technologies for aroma solutions derivable from plants for formulating clean-label products, whereas ADM is on the move to further its biotech flavor innovation centers.

Strategic elements that define competition include sustainable ingredient sourcing, regulatory affiliation, and a sprawling distribution network. The firms are entering into alliances with food brands, harnessing digital tools for market insights, and developing really customized aroma solutions to strengthen their market positions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| International Flavors & Fragrances (IFF) | 18-22% |

| Archer Daniels Midland (ADM) | 14-18% |

| Kerry Group | 12-16% |

| BASF SE | 8-12% |

| Cargill Inc. | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| International Flavors & Fragrances (IFF) | Leading provider of biotech-driven aroma solutions, focusing on AI-powered flavor innovations, clean-label extracts, and fermentation-based aromas. |

| Archer Daniels Midland (ADM) | Specializes in plant-derived and fermented aroma ingredients, catering to the beverage, dairy, and alternative protein sectors. |

| Kerry Group | Focuses on sustainable aroma solutions, developing botanical extracts and fermentation-based flavors for clean-label applications. |

| BASF SE | A pioneer in functional aroma compounds and encapsulated flavors, ensuring enhanced stability and prolonged sensory impact in processed foods. |

| Cargill Inc. | Offers natural and organic aroma compounds, investing in fermentation-derived solutions and plant-based extracts to support health-conscious food trends. |

Key Company Insights

IFF (18-22%)

The leader in biotech-powered aroma innovation, combining AI, fermentation, and clean-labeling solutions for a rising consumer.

ADM (14-18%)

A player in plant-based aroma creation, using sophisticated extraction techniques to drive the sensory attribute of alternative protein foods.

Kerry Group (12-16%)

Growing its natural and sustainable aroma business, with a focus on botanical extracts and fermentation-based clean-label flavor.

BASF SE (8-12%)

Leading in fragrance aroma and encapsulation technologies for long-term fragrance stability in foods and beverages when processed and packaged.

Cargill Inc. (6-10%)

Diversifying position in organic as well as plant-based fragrances, taking a stake in fermentation-based innovations for food and beverage applications.

Other Key Players

The global food aroma market is valued at USD 920.5 million in 2025 and is projected to reach USD 1,750.8 million by 2035, growing at a CAGR of 6.8%.

The food aroma market grew at a CAGR of 6.4% from 2020 to 2024, driven by rising demand across food and beverage applications.

Key players include Givaudan, International Flavors & Fragrances (IFF), Firmenich, Symrise, Takasago, and Sensient Technologies.

Europe is expected to hold a 38% market share by 2035, driven by stringent regulations and demand for natural food aromas.

North America is projected to account for 31% of the global food aroma market in 2025, fueled by innovation in plant-based and fermentation-derived aromas.

This segment is further categorized into Natural and Synthetic.

This segment is further categorized into Benzenoids as Food Aroma (Benzoic Acid, Benzyl Acetate, Vanillin, Cinnamyl, Benzaldehyde, Others), Terpene as Food Aroma (Limonene, Pinene, Myrcene, Linalool, Terpineol, Others), Musk Chemicals as Food Aroma (Muscone, Musk Ambrette, Musk Ketone, Others), and Condiments (Mustard, Ketchup, Sauce, Mayonnaise, Table Dressings, Dips).

This segment is further categorized into Beverages, Bakery, Dairy, Confectionery, Snacks, and Other Applications.

Industry analysis has been carried out in key countries such as North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus, and the Middle East & Africa.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.