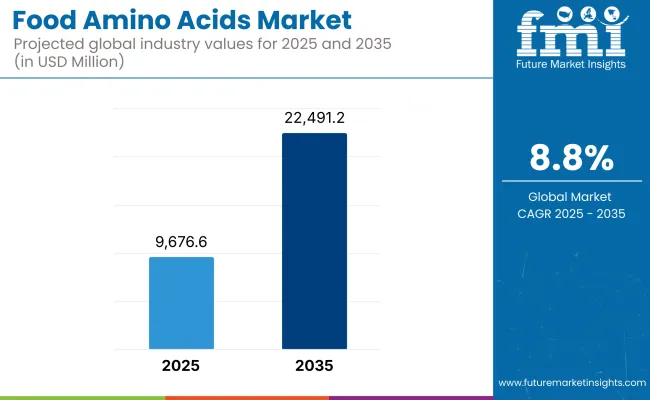

The food amino acids market is projected to expand from USD 9,676.6 million in 2025 to reach USD 22,491.2 million by 2035, registering a compelling CAGR of 8.8% over the forecast period.

This considerable growth trajectory has been attributed to the rising global emphasis on health-conscious eating and the increasing integration of amino acids into functional foods and dietary supplements. The United States is set to dominate the global food amino acids market in value terms by 2025, while China is poised to register the fastest growth, supported by growing investments in sports nutrition, rising disposable incomes, and rapid urbanization in the Asia-Pacific region.

A thorough assessment reveals that the market expansion is being reinforced by multiple intersecting drivers. Among them, the increasing prevalence of protein deficiency and lifestyle-associated disorders has led to a greater reliance on amino acid-fortified foods.

The clean-label movement, along with the surge in consumer demand for scientifically-backed nutritional benefits, has notably enhanced the visibility of amino acids across sports nutrition, energy bars, infant formula, and medical nutrition segments. On the supply side, advancements in fermentation-based production, microbial biosynthesis, and the optimization of protein hydrolysates are enabling better scalability and quality control.

However, the market is not without its constraints-price volatility of raw materials, stringent regulatory frameworks governing health claims, and limited awareness in emerging markets remain notable hurdles. Nevertheless, a consistent uptick in R&D activities and application diversification is shaping future growth.

Looking ahead, the food amino acids market is expected to witness accelerated innovation between 2025 and 2035. The focus is likely to intensify on precision nutrition, where amino acid formulations are tailored to specific demographic or health needs such as metabolic health, sarcopenia prevention, and cognitive performance.

Moreover, sustainable sourcing strategies, such as fermentation-based amino acid production using non-GMO feedstocks, are anticipated to gain traction, particularly among manufacturers aligning with ESG mandates. The market is also expected to benefit from the convergence of amino acids with other bioactives such as vitamins, peptides, and botanicals to offer synergistic functional food solutions.

This ongoing innovation, coupled with increasing consumption of functional and fortified foods, is driving the growth of the food amino acids market through 2035. In 2025, the food amino acids market is estimated at approximately USD 9,676.6 Million. By 2035, it is projected to grow to around USD 22,491.2 Million, reflecting a compound annual growth rate (CAGR) of 8.8%.

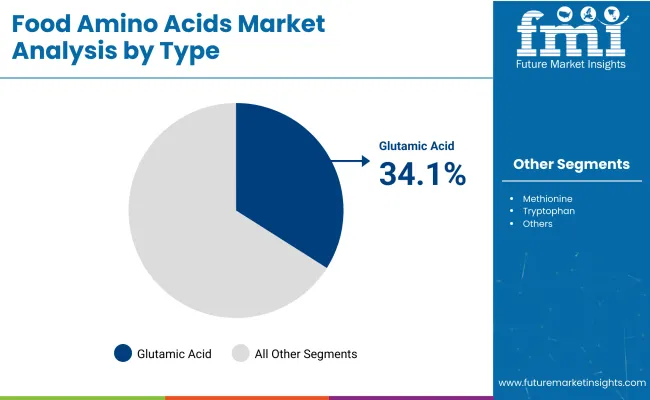

Glutamic acid is projected to hold a dominant 34.1% share of the global food amino acids market in 2025, maintaining its lead throughout the forecast period due to sustained demand across processed foods and umami-driven formulations.

This segment’s strength lies in its entrenched utility as both a flavor enhancer and a metabolic precursor in functional nutrition. While often underappreciated in premium wellness categories, glutamic acid has retained mass-market relevance by bridging affordability, versatility, and sensory performance. Its use has been continuously validated by formulators seeking scalable amino acid profiles that align with consumer taste expectations and regulatory familiarity.

Emerging applications in plant-based protein formulations, sports recovery drinks, and therapeutic nutrition are gradually shifting glutamic acid from mere seasoning agent to bioactive support in neurometabolic functions.

Advances in bio-based fermentation-particularly leveraging sugar beet, molasses, or non-GMO glucose substrates-are enabling low-impact, high-yield production routes, further reinforcing its cost competitiveness.

Looking ahead, this segment’s trajectory is expected to parallel the growth of clean-label processed foods, where recognizable flavor precursors with known physiological roles offer formulation simplicity. While future innovation will prioritize differentiated amino acid blends, glutamic acid’s embedded value proposition in flavor enhancement ensures it will remain a strategic pillar in both mainstream and fortified food systems.

Branched Chain Amino Acids (BCAAs) are projected to exhibit a CAGR exceeding 9.5% between 2025 and 2035, driven by their growing role in sports nutrition, metabolic health, and sarcopenia prevention across aging populations.

This segment is transitioning from niche athletic applications to broader, demographically diversified demand pools, supported by expanding clinical validation of leucine, isoleucine, and valine in muscle protein synthesis, fatigue reduction, and energy regulation.

The post-pandemic wellness paradigm has intensified consumer interest in bioavailable and targeted supplementation, positioning BCAAs as cornerstone components in both preventive and performance-focused formulations. Their inclusion is no longer limited to elite athletes but is gaining relevance among older adults, active lifestyle consumers, and medical nutrition users.

From a supply perspective, fermentation-based production using optimized microbial strains is enhancing purity levels while supporting label-friendly sourcing claims, an increasingly important differentiator in premium and clean-label categories.

While competition from emerging amino acid blends is rising, BCAAs benefit from strong scientific equity and market familiarity, enabling brands to build evidence-backed value propositions. Looking forward, integration of BCAAs into multifunctional formulations-combined with adaptogens, electrolytes, or anti-inflammatories-is expected to accelerate, reinforcing their role as high-impact, precision nutrition assets in the evolving food amino acids market.

Challenges: High Production Costs, Regulatory Compliance, and Raw Material Supply Chain Issues

Issue is regulatory, food-grade amino acids are subject to strict purity and safety standards imposed by the FDA, EFSA and Codex Alimentarius to guarantee things like non-GMO, allergen-free and sustainable sourcing have been met. Moreover, supply chain matters concerning raw materials, especially for plant- and microbial-derived amino acids, are affecting production by way of crop yield variations, climatic circumstances, and geopolitical factors impacting commerce.

Opportunities: Growth in Functional Foods, Plant-Based Nutrition, and AI-Driven Formulation Innovations

Most importantly, despite these threatening detail from food market trends, growing demand for functional foods and eating plants and growing interests for AI-powered formulation study will continue to support Food amino acids market growth.

Growing opportunities for the manufacturers of branched-chain amino acids (BCAAs) and essential amino acids (EAAs) are caused by consumer shifts towards high protein diets, sports nutrition, and amino acid fortified beverages.

Decades of plant-based diet growth are prompting manufacturers to pursue new sources of amino acids such as algae, fermentation and bioengineering. Advanced projects like AI nutrition optimization or precision fermentation are enhancing amino acids bio-availability and formulation efficiency, offering next-gen functional food solutions.

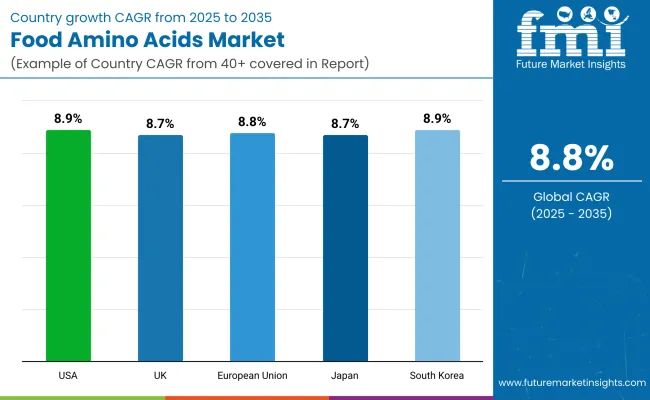

The USA food amino acids market is witnessing a hefty growth, which is attributed to growing consumer awareness of functional foods, dietary supplements and protein-enriched foods.

The growth of the market is driven by factors such as the increase in health conscious consumers, the growing trend of plant based and sports nutrition products, etc. Also, the expansion of the fermentation-based manufacturing of amino acids and increasing applications in flavor enhancement and food fortification are empowering the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.9% |

The UK food amino acids market is witnessing growth due to growing inclination of consumers toward fortified food products and increasing vegan and plant-based diets. In addition, the increasing sports nutrition market and trends for high-protein functional foods are driving demand for essential and non-essential amino acids. The support for clean-label and non-GMO food ingredients also impacts the trends within the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.7% |

The food amino acids market across the EU is growing at a consistent pace with consumers switching towards healthier and functional diet. Branched-Chain Amino Acids (BCAAs), glutamic acid, and lysine have a rising demand for food formulations and sports nutrition. Moreover, advancements in protein hydrolysates and fermentation-based amino acid synthesis are increasing product availability and driving market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.8% |

The food amino acids market in Japan is experiencing moderate growth, driven by the country’s emphasis on functional foods, nutraceuticals, and ingredients rich in umami. Its increasing adoption in the preparation of fermented foods, seasoning enhancers, and dietary supplements is driving the market demand. In addition, research into bioactive peptides and amino acid metabolism will foster long-term growth of the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.7% |

The South Korean food amino acids market includes surging requirements for protein-rich dietary changes, K-health food, and fortified dietary items. Which is only driving the innovation of functional foods and personalized nutrition solutions fueled by the growing biotechnology and fermentation-based amino acid production sector. Moreover, government organizations advocating food fortification and nutritional health is also contributing to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.9% |

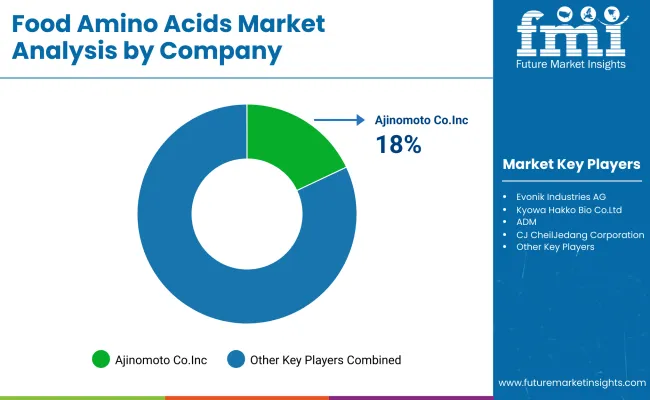

Ajinomoto Co., Inc. (18-22%)

Ajinomoto leads the food amino acids market, offering AI-powered protein fortification, fermentation-based amino acid production, and functional amino acid solutions for dietary supplements.

Evonik Industries AG (12-16%)

Evonik specializes in precision fermentation-based amino acid production, ensuring AI-driven nutritional balance and high-purity amino acid solutions for food applications.

Kyowa Hakko Bio Co., Ltd. (10-14%)

Kyowa Hakko provides essential amino acids for dietary supplements and functional foods, optimizing AI-assisted nutritional enhancements and clean-label amino acid blends.

ADM (Archer Daniels Midland Company) (8-12%)

ADM focuses on plant-based amino acid extraction and bioavailability optimization, integrating AI-powered formulation for protein-rich food applications.

CJ CheilJedang Corporation (5-9%)

CJ CheilJedang develops fermentation-based amino acid solutions, ensuring AI-enhanced amino acid stability and efficiency in food fortification.

Other Key Players (30-40% Combined)

Several food ingredient manufacturers, biotech firms, and functional nutrition companies contribute to next-generation amino acid innovations, AI-powered food formulation advancements, and sustainable protein fortification solutions. These include:

The overall market size for the food amino acids market was USD 9,676.6 Million in 2025.

The food amino acids market is expected to reach USD 22,491.2 Million in 2035.

Growth is driven by the increasing demand for protein-rich diets, rising applications in dietary supplements and functional foods, and growing adoption in food fortification and flavor enhancement.

The top 5 countries driving the development of the food amino acids market are the USA, China, Germany, Japan, and India.

Glutamic Acid and Plant-Based Sources are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA