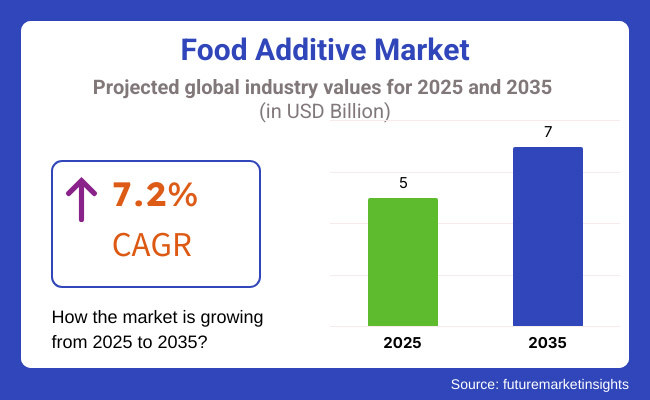

The demand for global Food Additive market is expected to be valued at USD 5.0 Billion in 2025, forecasted at a CAGR of 7.2% to have an estimated value of USD 7.0 Billion from 2025 to 2035. From 2020 to 2025 a CAGR of 6.8% was registered for the market.

Food additives are now necessary ingredients in the food and beverage industry. This is because they can prolong food products shelf life and greatly enhance their freshness flavor and texture.

To keep processed food safe as it travels from the industrial kitchen to warehouses and retail locations and ultimately to consumers food additives are added. Since ancient times some food additives have been used to preserve food. Sulfur dioxide in wine sugar in marmalade and salt in meats like bacon or dried fish are a few examples.

In response to changing consumer demands producers are providing additives derived from a variety of sources such as minerals plants or animals. To maintain the foods nutritional value for example new natural preservatives are being created.

Specialty food ingredients are used in products to improve their texture flavor shelf life and health benefits. The market is divided into functional and sensory ingredients. Enhancing the flavor texture taste and smell of products requires the use of sensory ingredients. Vitamins acidulants antioxidants and other components that give food nutritional value are examples of functional ingredients.

Explore FMI!

Book a free demo

Demand for functional food additives is Driving the Market Growth

The growing consumption of foods with high nutritional value is expected to increase demand for functional food additives which in turn is expected to support the growth of the food additives market. Seaweed derivatives for example are used by food and beverage producers to lower sugar levels by replacing fat and stevia-based sweeteners.

Rich in vital nutrients and antioxidants functional food additives reduce the risk of chronic illnesses and stop cell damage among other health benefits. Consequently, the growing demand for processed foods is expected to drive up demand for food additives over the projection period. Consequently, the food additives industrys revenue is driven.

During the period 2020 to 2024, the sales grew at a CAGR of 6.8%, and it is predicted to continue to grow at a CAGR of 7.2% during the forecast period of 2025 to 2035.

One of the primary factors anticipated to propel the market for food additives is the growth of the processed food and convenience industries particularly in developing nations. In a similar vein rising consumer expenditure on packaged foods will probably boost demand for food additives through 2035.

In areas like the Middle East and East Asia there is a noticeable increase in demand for processed foods with longer shelf lives. This is because of rising per capita consumer income and fast urbanization. As a result, food additive sales are expected to rise quickly during the evaluation period because they are now necessary components of these food items.

Tier 1 companies comprises industry leaders acquiring a 30% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 50%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 20%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope.

As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, Germany and India come under the exhibit of high consumption, recording CAGRs of 5.9%, 4.8% and 9.2%, respectively, through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| United States | 5.9% |

| Germany | 4.8% |

| India | 9.2% |

The fast-paced lifestyle in the United States has led to a sharp increase in the demand for processed and convenient foods. Since food additives are frequently used in these products to improve their taste appearance and shelf life this is anticipated to boost sales of food additives.

The food processing sector is well-established in the USA. The introduction of modified products that satisfy the changing needs of consumers is the main focus of many prominent companies in this industry. Their demand is fueled by the various food additives they use for this purpose.

New ingredients and their possible uses are being actively researched by major manufacturers. For example, research is being done on the use of fibers and carbohydrates as food additives to improve texture bulking and sweetening. In the USA food additive market food fortification is becoming a major trend.

Foods with extra health benefits are becoming more and more popular in the country. Food manufacturers are using food additives as a result of this. Consumers growing health concerns are predicted to increase demand for healthy food additives such as low-calorie sweeteners. Similarly, the United States market share for food additives is expected to grow through 2035 as more attention is paid to extending the shelf life of packaged food items.

As lifestyles change and urbanization increases more Indian consumers are gravitating toward quick and simple food solutions. Foods with longer shelf lives better flavors and higher nutritional content appeal to consumers. As a result, the use of food additives will keep growing.

Manufacturers are being prompted by shifting consumer preferences to use a range of conventional or natural additive sources. Furthermore, more natural and functional additives are being used in food products as a result of rising consumer awareness of the value of health and wellness.

Indias food additive market is expected to grow even more as a result of the expanding food and beverage sector and rising disposable income. The use of additives is then encouraged by regulatory actions to guarantee food safety and quality standards.

In terms of food additives Germany is the biggest market in Europe holding about 20% of the regional market by 2025. The robust food processing industry and strong technological capabilities of the nation are responsible for its market leadership manufacturing of food ingredients. German manufacturers focus heavily on research and development particularly in natural and substances with clean labels.

The country’s market is characterized by high-quality standards innovative product development and a strong focus on environmentally friendly production techniques. The existence of significant research institutes and food processing companies enhances Germanys standing in the European market even more.

| Segment | Value Share (2025) |

|---|---|

| Dairy Ingredients (Product Type) | 54% |

When it comes to thickening and stabilizing fermented milk milk beverages and dairy desserts hydrocolloids are especially crucial. ice cream and cream. The promotion of emulsion in milk beverages and cheese products is also greatly dependent on food emulsifiers. formation and stabilization as businesses put more effort into creating uniform taste profiles. The growth of the segment. is reinforced further by the growing market for creative dairy products.

| Segment | Value Share (2025) |

|---|---|

| Dairy Industry (End-Use Application) | 54% |

Food additives are used in dairy and frozen products including yogurt flavored milk smoothies ice cream whipped cream and sweetened cream cheese among other items. Dairy beverage consumption is predicted to decline due to growing consumer concerns about animal welfare and a shift toward vegan products such as non-dairy substitutes like soy milk and oat milk.

The demand for additives created especially for dairy products is therefore expected to decline as a result.

The market for food additives will continue to grow as a result of major players in the industry making significant investments in R&D to broaden their product lines. In order to increase their market share market players are also engaging in a number of strategic initiatives.

Key market developments include the introduction of new products contracts mergers and acquisitions increased investments and partnerships with other businesses. To grow and thrive in a more competitive and growing market environment the food additives industry needs to provide affordable products.

The market is expected to grow at a CAGR of 7.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 7.0 Billion.

Demand for functional Food Additive is increasing demand for Food Additive.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include Chr. Hansen Holding A/S, Royal DSM N.V., BASF SE and more.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Korea Fusion Beverage Market Analysis by Beverage Type, Ingredient Profile, Distribution Channels, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.