The Global Food Acidulants industry reached USD 2,126.6 million in 2019. Demand for Food Acidulants registered a 4.9% Compound Annual Growth Rate from 2019 to 2023, indicating that the global industry would reach USD 2,727.4 million in 2024. Over the projection period (2024 to 2034), global sales of Food Acidulants are expected to exhibit a 5.4% CAGR, ultimately totalling a sales value of USD 4,614.8 million by the end of 2034.

The Global Food Acidulants Industry is a vital part of the food and beverage industry whose functions include flavor enhancement, freshness retention and food safety checks. Acidulants are food and beverage additive ingredients that provide a sour taste to the end product and are important for the pH control of the product. Popular acidulants are citric, lactic and acetic acids, which are useful in different forms.

In F&B industry, acidulants find applications in soft drinks and confectionary as well as dairy and meat products, including cooked meats. They assist in preventing spoilage due to certain microorganisms as well as extending the product's shelf life. Incorporation of acidulants also improves the texture and stability of products, thus increasing product attractiveness.

Factors for the rise in food acidulants demand include population increase, increased urban migration and changing eating habits. With more people becoming concerned for their health, there is a wave of preference for natural and organic acidulants. This shifts the burden on manufacturers who are expected to diversify and develop natural and organic acids. The industry is also responsive to self-regulatory and legislative health safety requirements on the use of acidulants.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2024E) | USD 2,727.4 Million |

| Projected Global Value (2034F) | USD 4,614.8 Million |

| Value-based CAGR (2024 to 2034) | 5.4% |

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2023) and current year (2024) for the Global NPK fertilizer industry. This analysis reveals crucial shifts in industry performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the ecosystem growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.9% (2023 to 2033) |

| H2 | 5.1% (2023 to 2033) |

| H1 | 4.8% (2024 to 2034) |

| H2 | 5.6% (2024 to 2034) |

The above table presents the expected CAGR for the Global NPK fertilizer industry over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.9%, followed by a slightly variable growth rate of 5.1% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2024 to H2 2034, the CAGR is projected to change slightly 4.8% in the first half and remain relatively moderate at 5.6% in the second half.

Use as preservative and flavor enhancer making Citrus acid the prominent Food Acidulant

Among various food acidulants, citric acid is the most abundant and essential as it serves the dual role of preservative and enhancing flavor. Citric acid appears in fruits and thus, manufacturers who cater to consumer demand for clean-label ingredients prefer it.

Citric acid also acts as a food preservative which helps to prevent the growth of bacteria and other microorganisms, thereby enhancing the shelf life of many foods and drinks. It is also one of the vital components incorporated in soft drinks, candies and sauces as it takes away any remaining sweetness as well as refreshes the palate.

Growing demand bakery products with extended shelf life driving use of Acidulants

Increasing customer interest in bakery products that can remain fresh for a long time is fueling the demand for the use of acidulants in the industry. Acidulants are used in freshly baked items in order to prevent spoilage and preventing microbial growth, which helps baked goods stay fresh and remain of good quality. They aid in the formation of appropriate texture and flavor so that the appeal of the products is retained for a long time.

Because of the permanent and easily packable character of long-life bakery products, more and more manufacturers are preparing acid application systems to add to their products. This tendency is most noticeable in the packaged bread, cakes and pastry segments of the market, where a long shelf life is a major selling point.

Advancements in fermentation technology enhancing production of Acidulants

Currently, developments in fermentation techniques are revolutionizing the food acidulants industry. There are breakthroughs in the conventional fermentation processes of producing acidulants such as lactic acid. They include enhancing productivity and efficiency by improving the microbial strains and the fermentation conditions.

Acidulants are made in large quantities at a cheaper price by improving the fermentation process, thus making the entire process cost-effective and environment-friendly. Such production not only helps in satisfying the increasing appetite for food acidulants but also caters to the need for industries to reduce their carbon emissions.

Global sales increased at a CAGR of 4.9% from 2019 to 2023. For the next ten years (2024 to 2034), projections are that expenditure on the industry will rise at 5.4% forecast CAGR.

The world market for food acidulants has demonstrated remarkable growth in the last few decades. In the past, the demand for these food acidulants has been on an upward trend mainly due to the growing need for the preservation of food products, enhancing flavors and regulation of pH levels in various food and beverage products.

The rise of ready-to-eat and ready-to-cook products with healthy and safe qualities has increased this requirement as well. Newer players in the industry followed their counterparts' strategies in introducing their products in the market and invested in research that led to multiple applications of acidulants.

When it comes to future prospects, the food acidulants industry is projected to perform well. The trend towards using natural and clean-label ingredients will continue the increasing demand for natural acidulants such as citric acid. Also, the continuous growth of the world population and the rising trend of processed food consumption in developing countries will also support the further expansion of the industry.

It is expected that with the use of new technological developments and new production processes, food acidulants will be of better quality and lower prices than before, leading to further improvement in the adoption of the acidulants. Companies are also beginning to examine all of their activities including adopting sustainable sourcing and production, as in recent years consumers have started to demand more and more eco-friendly products.

The food acidulants industry is estimated to be leaning towards consolidation. This means that despite the presence of a few strongly rooted multinational corporations, there are numerous smaller regional players as well.

Market concentration measures the dominance of firms in the market. In a concentrated market, there are a few players who command a large market share, making it less competitive. On the contrary, fragmentation is characterized by many competitors in the industry and thus, few companies have high market share. The food acidulants industry, which is moderately consolidated, falls in between these two extreme cases since the market has large MNCs and also many small regional operators.

The industry is primarily dominated by transnational firms such as Cargill, ADM and Tate & Lyle. These companies operate with an integrated system of product distribution chains, research and development activities, and product differentiation, which makes them very cost-effective.

However, many local companies operate in the regional markets. These firms are frequently focused on several kinds of acidulants. For example, a small company operating within Asia might produce citric acid-based products from indigenous fruits targeted at the regional food industry.

Tate & Lyle Plc manufactures concentrated citric and malic acids that are designed for flavor enhancement, preservation and pH control in food products. The company is focused on the development of specialty food ingredients as well as a number of its sustainable initiatives, such as the introduction of new biomass boilers with lower emissions of greenhouse gases.

In the future, the company aims to grow its global market share and prepare for efficient growth aided by increasing demand for healthy and responsible foods through more partnerships and acquisitions.

Archer Daniels Midland Company (ADM) presents a wide range of acidulants, in particular, citric acid and sodium citrate, which are included in the composition of the products aimed at food and beverages and defining their taste and shelf life.

ADM has a strategic competitive advantage as it possesses the knowledge and network of plant-based ingredients sourcing. The company has a balanced approach to growing its revenue as it invests in both sustainable growth and innovation. Plans for the coming years include expansion of the market through the acquisition of other companies and development through strategic partnerships.

Cargill, Inc manufactures food acidulants such as citric, lactic and malic acids that aid in flavoring, preserving and fixing pH in food and beverages. The company utilizes agricultural product knowledge and worldwide infrastructure to remain competitive in the industry. Cargill aims to improve sustainability and is developing new technologies that improve the production processes.

The following table shows the estimated growth rates of the top five markets. These countries are set to exhibit high consumption, recording high CAGRs through 2034.

| Countries | CAGR 2024 to 2034 |

|---|---|

| USA | 5.8% |

| Germany | 5.0% |

| China | 6.2% |

| Japan | 5.7% |

| India | 6.7% |

There is a well-established food and beverage industry in the United States, which drives demand for acidulants as well. The food additive uses of citric acid and phosphoric acid are very popular as they go into beverages, processed food as well as sauces. Consequently, the high use of these additives helps in improving taste, extending shelf life and controlling the required pH of the food product.

The major requirements of the population of the USA market in terms of convenient foods & beverages and a highly developed food processing industry ensure a consistent and high influx of acidulants making the country quite significant in the market. The industry for Food Acidulants in USA is projected to exhibit a CAGR of 5.8% during the assessment period and revenue from the sales of Food Acidulants in the country is expected to reach USD 969.1 million with a market share of 21%.

Key reasons for China's dominance in the global food acidulants market include the high production and export of citric and phosphoric acid. Food preservatives and flavor boosters are a necessary part of the food & beverage sector. Coupled with its considerable phosphate reserves, China's large-scale industrial structure allows the capacity to manufacture these acids at a low cost.

The production capacity not only fulfills local demand but allows China to become an important exporter of these products to food manufacturers all over the world which is helping China remain a dominant player in the industry. These trends are leading to a projected value of USD 1,292.2 million by 2034 with Food Acidulants demand calculated to rise at a value CAGR of 6.2% during the forecast period (2024 to 2034) with a value share of 28%.

The growth of acidulants in India has some innovative dynamics such as increasing urbanization and evolving dietary trends. As the population shifts to urban centers, there is an upsurge of ready-to-eat foods and drinks, which include acidulants for preservation and enhancement of taste. Further, the increase in the number of people consuming more processed and packaged foods due to busy schedules and changing eating habits is also causing a rise in the demand for acidulants.

This trend finds backing in India's rising food and beverage industry that is focusing on ready meals which is increasing the market of acidulants in the India. These factors are responsible for the robust projected forecast CAGR of 6.7% from 2024 to 2034, with the country achieving a global value share of 8% in 2034 with a value of USD 369.2 million.

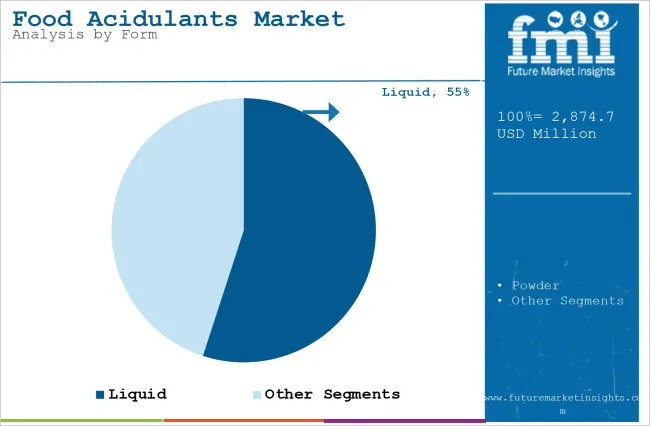

| Segment | Liquid |

|---|---|

| Main Segment | Form |

| Value Share (2034) | 55% |

The food industry prefers liquid acidulants because they can be thoroughly mixed into edible products and are evenly distributed. Due to their liquid nature, they can be easily added to food products to achieve the desired acid and taste levels. This is very critical in drinks, sauces and dressings, since even distribution of acidulants is necessary to maintain the quality of the products and their taste.

Also, their liquid form makes it easier to measure them and therefore, their accuracy in mixing during the actual or final production is less likely to vary. Their effectiveness and ease of use make them the right choice for most manufacturers who wish to prepare their formulations with quality and great reliability. This growth has propelled the segment's value to USD 2,538.2 million in 2034 with a market share of 55% and further projections suggest its growth at a CAGR of 5.2%.

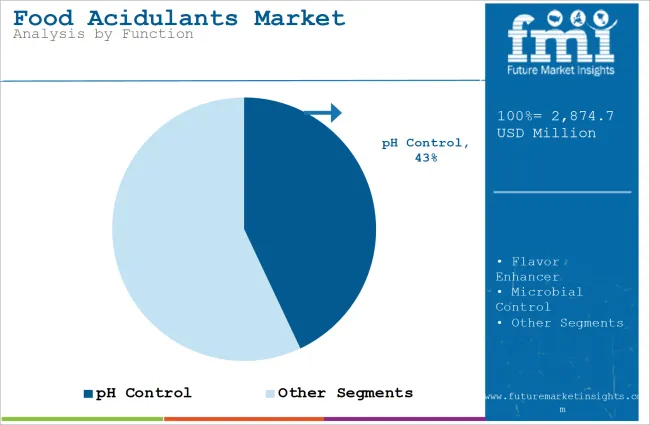

| Segment | pH Control |

|---|---|

| Main Segment | Function |

| Value Share (2034) | 43% |

Acidulants assist food & beverage products in achieving and safeguarding pH levels, which is essential for the prevention of undesirable microorganisms and the enhancement of the products' shelf life. In addition, acidulants change the pH level not only in food preservation but also use preservatives more effectively and increase food quality.

This application is especially important in dairy products, beverages and processed foods where pH control directly influences structure, taste and safety. Bolstering from these trends, this segment is set to achieve a market share of 43% with a market value of USD 1,984.4 million by 2034 due to growth at a forecast CAGR of 5.8%.

The Global Food Acidulants Industry continues to show strong trends such as mergers, acquisitions and new product developments. Economic globalization has led to companies undergoing mergers and acquisitions in order to capture the market and make their product range wider.

Product innovation is also a key strategy as companies have launched new acidulants which are in line with the trend of increasing natural and clean-label ingredients in foods. These launches typically aim for better taste, longer shelf-life and improvement in nutritional value.

As a means of being able to achieve growth and to also strengthen their existing growth, companies are investing considerable resources in research and development in order to develop production practices that are better and more environmentally friendly.

At the same time, they are creating strategic alliances to make use of the available technologies and increase their geographical presence. Companies seek to remain profitable and respond to the changing trends in the food and beverage sector by paying attention to the current industry climate and developing new ideas.

As per Type, the industry has been categorized into Acetic Acid, Fumaric Acid, Citric Acid, Phosphoric Acid, Lactic Acid, Malic Acid and Tartaric Acid.

As per Form, the industry has been categorized into Liquid and Powder.

As per Application, the industry has been categorized into Bakery and Confectionery, Beverages, Dairy Food and Animal Nutrition.

As per Function, the industry has been categorized into Flavor Enhancer, Microbial Control, pH Control, Preservative and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The global market is estimated at a value of USD 2,727.4 million in 2024.

Prominent players in the landscape include Tate & Lyle Plc, Archer Daniels Midland Company, Cargill, Inc, FBC Industries Inc, Hawkins Watts Ltd, Isegan South Africa (Pty) Ltd, Jungbunzlauer Suisse AG and Merko Group LLC.

The Global Industry grew at a Historical CAGR of 4.9% from 2019 to 2023.

The USA sales are projected to hold a revenue share of 21% over the forecast period.

The industry is projected to grow at a forecast CAGR of 5.4% from 2024 to 2034.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Holding and Warming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Food Fortifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA