The foil laminates market is experiencing significant growth as industries prioritize durable, versatile, and sustainable solutions for packaging and insulation. Manufacturers are integrating advanced materials, eco-friendly technologies, and innovative designs to meet the demand from food, pharmaceutical, and industrial sectors. This market is projected to surpass USD 13.6 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.1%.

The rising focus on product preservation, regulatory compliance, and environmental sustainability is driving global adoption of foil laminates. Companies are delivering solutions that enhance functionality, branding, and efficiency while aligning with industry standards.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 13.6 billion |

| CAGR (2025 to 2035) | 4.1% |

Explore FMI!

Book a free demo

Summary

The SWOT analysis highlights the strategies and strengths of leading players in the foil laminates market. Companies like Amcor, UFlex, and Huhtamaki leverage innovation, strong distribution networks, and sustainable practices to maintain their leadership. Challenges include fluctuating raw material prices and regional competition, creating opportunities for bio-based materials and emerging market expansions.

Amcor

Amcor leads the market with its innovative foil laminates designed for superior performance. Its strength lies in its global presence and focus on sustainable packaging solutions. However, high production costs for advanced materials pose a challenge. Opportunities include expanding eco-friendly product lines and targeting emerging markets, while intense competition remains a threat.

UFlex

UFlex excels in delivering high-quality, customizable foil laminates. Its robust R&D capabilities and expertise in innovative designs give it a competitive edge. However, limited presence in certain high-growth regions could restrict its expansion. Opportunities lie in developing recyclable laminates and scaling operations in Asia-Pacific, while regulatory challenges could hinder growth.

Huhtamaki

Huhtamaki is renowned for its precision-engineered foil laminates that cater to diverse industries. The company’s focus on sustainability and advanced manufacturing technologies makes it a trusted name. However, reliance on specific markets for revenue may limit growth. Opportunities exist in bio-based materials, while evolving compliance standards present challenges.

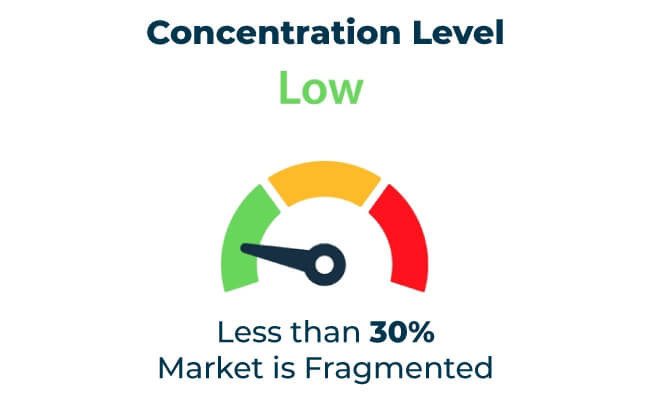

| Category | Market Share (%) |

|---|---|

| Top 3 Players (Amcor, UFlex, Huhtamaki) | 17% |

| Rest of Top 5 Players (Constantia Flexibles, Mondi) | 9% |

| Next 5 of Top 10 Players | 6% |

Type of Player & Industry Share

| Type of Player | Market Share (%) |

|---|---|

| Top 10 Players | 32% |

| Next 20 Players | 38% |

| Remaining Players | 30% |

North America enforces strict packaging standards, emphasizing product safety and sustainability. Europe leads with progressive policies promoting recyclable and compostable laminates. Asia-Pacific is witnessing rapid growth, driven by increasing demand from food and pharmaceutical industries, offering opportunities for region-specific solutions.

Emerging markets in Asia-Pacific, Africa, and Latin America present significant growth potential. Expanding food and industrial production in these regions drives demand for high-quality foil laminates. Exporters focusing on compliance, sustainability, and innovative designs can capitalize on these opportunities.

The regional analysis of the foil laminates market highlights diverse growth patterns shaped by sustainability goals, technological advancements, and industrial applications. Each region presents unique opportunities for manufacturers to align their offerings with local needs and compliance standards.

| Region | North America |

|---|---|

| Market Share (%) | 40% |

| Key Drivers | Focuses on compliance, sustainability, and advanced technologies. |

| Region | Europe |

|---|---|

| Market Share (%) | 35% |

| Key Drivers | Leads with eco-friendly and high-performance laminates. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 20% |

| Key Drivers | Experiences rapid growth from food and pharmaceutical sectors. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 5% |

| Key Drivers | Demand grows for cost-effective and durable solutions in emerging markets |

The foil laminates market will continue to grow through advancements in bio-based materials, enhanced recyclability, and smart packaging technologies. Companies focusing on sustainability, global expansion, and tailored solutions will solidify their market positions. Collaboration with regulators and end-users will further drive adoption.

Summary

This section provides a detailed breakdown of the key players in the foil laminates market by tier. Tier 1 companies like Amcor, UFlex, and Huhtamaki lead with innovative, sustainable solutions and strong global presence. Tier 2 and Tier 3 players focus on niche applications and regional dominance, offering opportunities for growth through innovation and sustainability.

| Tier | Key Companies |

|---|---|

| Tier 1 | Amcor, UFlex, Huhtamaki |

| Tier 2 | Constantia Flexibles, Mondi |

| Tier 3 | Cosmo Films, Toray Plastics |

The foil laminates market is poised for substantial growth as sustainability, functionality, and technological advancements drive adoption. Companies prioritizing innovative designs, eco-friendly materials, and global expansion will lead the industry. Collaboration with stakeholders in food, pharmaceutical, and industrial sectors will unlock further opportunities.

Key Definitions

Abbreviations

Methodology

This report integrates primary research, secondary data, and expert insights. Findings are validated through interviews with industry professionals and end-users to ensure accuracy and reliability.

The foil laminates market encompasses the development and use of advanced materials designed for packaging and industrial applications, prioritizing durability, sustainability, and functionality.

Foil laminates are used for preserving product integrity, extending shelf life, and enhancing branding across food, pharmaceutical, and industrial applications.

Manufacturers use recyclable and compostable materials, along with energy-efficient production methods to minimize environmental impact.

North America and Europe lead due to advanced manufacturing capabilities and stringent compliance standards, while Asia-Pacific is rapidly growing.

High production costs, regulatory complexities, and limited recycling infrastructure are key challenges in the foil laminates market.

Bio-based laminates, recyclable solutions, and smart technologies are driving innovation in the foil laminates market.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.