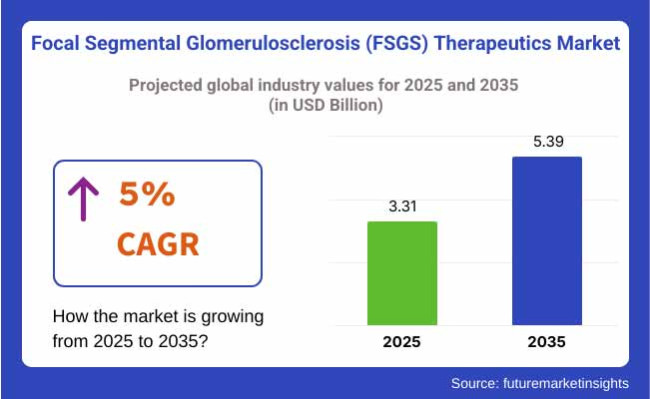

The FSGS therapeutic industry is valued at USD 3.31 billion in 2025. As per FMI's analysis, the Industry will grow at a CAGR of 5% and reach USD 5.39 billion by 2035.

2024 marked a significant shift in the FSGS therapeutics industry, with many regulatory approvals and ongoing investments in residual R&D. Top pharmaceutical companies sped up clinical trials to create new drugs, especially in precision medicine and biologics, as per an FMI report.

Some examples were the widened proven benefit of SGLT2 inhibitors and endothelin receptor antagonists as therapeutic choices. Updated healthcare policies in North America and Europe further enhanced patient access to new treatments.

The FMI analysis predicts that 2025 will be a crucial year due to the conclusion of various late-stage trials and the submission of applications to regulators. The industry will gain from greater acceptance of customised treatment modalities by physicians, leading to greater demand for targeted therapies.

It is expected that rising disease prevalence and government-funded healthcare programs in the Asia-Pacific region will lead to healthier growth in emerging economies. But new initiatives that would be initiated and investments needed for new public-private partnerships (PPP) to create next-generation FSGS therapies with a better side-effect profile will be the major industry driver in the future.

The FSGS therapeutics Industry is poised for consistent growth, spurred by advances in precision medicine and growing adoption of new drug therapies. FMI research opines that drug companies will benefit most from investing in targeted biologics and SGLT2 inhibitors.

This is because traditional steroid-based therapies may become unnecessary. FMI anticipates that developed-Industry patients will experience enhanced treatment outcomes, while access issues in emerging nations could dampen uptake.

Accelerate investment in targeted biologics.

Pharmaceutical companies need to put a lot of money into research and development for biologic medicines, SGLT2 inhibitors, and endothelin receptor antagonists so that they can meet the growing need for personalised medicine in the treatment of FSGS.

Expand Industry Access Through Regulatory Alignment

Firms should actively collaborate with regulatory authorities in major Industries to rationalise approval processes and attain early-Industry access to new therapies, aligning with changing healthcare policies.

Enhance strategic collaborations for R&D and distribution.

Firms should seek partnerships with biotech firms and academic institutions to fuel innovation alongside the development of distribution networks in high-growth Industries, notably in Asia-Pacific and Latin America.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays in Drug Approvals | High Probability - High Impact |

| High Treatment Costs Limiting Patient Access | Medium Probability - High Impact |

| Competition from Alternative Therapies | Medium Probability - Medium Impact |

| Priority | Immediate Action |

|---|---|

| Fast-Track Late-Stage Clinical Trials | Expedite regulatory submissions and secure accelerated approvals |

| Expand Industry Penetration in Emerging Regions | Establish partnerships with local healthcare providers and distributors |

| Enhance Patient Access Programs | Develop pricing strategies and reimbursement models to improve affordability |

To stay ahead, companies must prioritise investing in concentrated biologics and streamlining early regulatory. Growth will facilitate adaptation to evolving healthcare policy and increase strategic alliances, according to research from FMI.

In the next year, companies will need to focus on expediting late-stage therapies to Industry, optimising pricing models to reach a broader pool of patients, and strengthening global distribution infrastructure, according to FMI. This shift away from traditional steroid-based treatments toward innovative precision medicines is essential for maintaining leadership in the industry.

Accelerating drug development: 85% of pharma executives placed faster clinical trials and regulatory approvals as a "critical" priority to meet growing patient demand.

Accessibility and affordability concerns: 78% of healthcare professionals emphasised the need for better models of drug pricing and insurance coverage to make treatment available.

Regional Variance

Diverging Industry Preferences

Innovation Consensus

74% of FSGS respondents worldwide confirmed that precision medicine and biomarker-guided therapies would shape the future of FSGS treatment.

Shared Challenge: 81% concurred that drug price inflation was the largest impediment to all patients being ableto gain access to new treatments.

Regional Differences

Accelerated Approvals: A significant 72% of pharmaceutical CEOs reported that recent regulations - like the US FDA's Real-Time Oncology Review (RTOR) pilot program - are able to streamline securing accelerated approvals for FSGS drugs.

Regulatory Stringency

74% of pharmaceutical firms intend to invest in biomarker-guided drug development to maximise treatment specificity.

Divergence in Focus Areas

Strong consensus exists on these priorities

Accelerating clinical trials, ensuring affordability, and adopting precision medicine.

Key Variances

Strategic Insight

The strategy should be region-specific in order to succeed. As the US and Europe tap into new medicines and biosimilars,Asia-Pacific requires improved diagnostics and government-subsidised accessibility drives.

| Countries | Policy & Regulatory Impact |

|---|---|

| United States | The Food and Drug Administration is viewed through the eyes of FSGS patients, with a focus on expediting the drug approval process for FSGS, particularly for breakthrough biologics, through the FDA Accelerated Approval Program. The Inflation Reduction Act includes price controls, which may impact profitability for pharmaceutical companies. Companies must comply with FDA regulations under the Biologics License Applications (BLA) and Investigational New Drug (IND) frameworks . |

| United Kingdom | The NICE drug approval costs are stringent, giving preference to biosimilars and generics. The UK Medicines and Healthcare Products Regulatory Agency (MHRA) guidelines state that they must comply with UK Good Clinical Practice (GCP). |

| France | Reimbursement in France requires an SMR/ASMR (Assessment of Therapeutic Benefit) by the French National Authority for Health (HAS). The Economic Committee for Health Products (CEPS) imposes aggressive pricing negotiations, which limit premium-priced endeavours. |

| Germany | The Act provides for price negotiations after the one-year Industry introduction under AMNOG. The Federal Joint Committee (G-BA) determines the reimbursement levels for FSGS medications through its benefits evaluation. |

| Italy | Italy requires HTA review to grant early drug access. Treatments for rare diseases have government subsidies, but strict price controls remain. |

| South Korea | The review time for orphan drugs has also been significantly shortened by the Ministry of Food and Drug Safety (MFDS), resulting in accelerated time to Industry for FSGS therapeutics. The NHIS's reimbursement policy favours cost-effective generics. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) requires rigorous post- Industry surveillance for newly approved drugs. The cost-effectiveness analysis system affects payment and often limits access to high-cost biologics. |

| China | To incentivise innovators in the treatment of FSGS, the National Medical Products Administration (NMPA) accelerated drug authorisations through its "Green Channel" for first-in-class and best-in-class drugs. However, the National Reimbursement Drug List (NRDL) mandates price negotiations, which can lead to significant pricing burdens. |

| Australia-New Zealand | FSGS medications undergo rigorous safety and efficacy assessments undertaken by the Therapeutic Goods Administration (TGA) and Medsafe. In Australia, government-subsidised access through the Pharmaceutical Benefits Scheme (PBS) partially compensates for high treatment costs. |

| India | Approvals are run through the Central Drugs Standard Control Organisation (CDSCO), but once again, the organisation has a slow process with approving clinical trials even as they are approved, typically "fast track." The National Pharmaceutical Pricing Authority (NPPA) regulates the price ceilings, making it difficult for high-end biologics to penetrate this Industry . |

Primary FSGS continues to be the leading segment in the FSGS therapeutics Industry due to its greater prevalence and the pressing need for targeted therapies. Primary FSGS constitutes the largest number of diagnosed cases, requiring long-term management options like corticosteroids and immunosuppressants.The ongoing research into new biologics and gene therapies for primary FSGS will sustain its leadership.

Nonetheless, secondary FSGS will remain the fastest-growing segment with a CAGR of 6.5% owing to increasing cases related to diabetes, obesity, and hypertension. FMI analysis found that secondary FSGS is worsening.

This is because it leads to more secondary disorders, which means that sales of ACE inhibitors, ARBs, and diuretics keep going up. FMI opines that drug firms adopting precision medicine strategies to differentiate primary and secondary FSGS treatment protocols will gain a competitive advantage, as healthcare providers increasingly focus on personalized therapy regimens.

Corticosteroids dominate the FSGS drug Industry due to their established role as the first-line treatment for inflammation and proteinuria.FMI research discovered that corticosteroids continue to be prescribed extensively despite their side effects because they provide quick relief of symptoms and are frequently combined with therapies.

The fastest-growing segment is immunosuppressive drugs with a CAGR of 7.2%, and more so calcineurin inhibitors and monoclonal antibodies, because these therapies have greater long-term effectiveness with fewer side effects.

The growing number of biologics that target B cells and T cells will help this segment grow even more, especially since corticosteroid resistance is getting worse. Plasmapheresis is also gaining support as an adjunct treatment for steroid-resistant cases, although high cost and invasive procedures limit wider adoption.

The use of ACE inhibitors and ARBs is increasing due to their protective effects on the kidneys, especially in secondary FSGS. Diuretics also continue to be a vital component of symptomatic management, although they are most often used in combination with other drug classes.

Drug therapy is the most prevalent method of treatment for FSGS, since pharmacological intervention is the first line of defence in the treatment of proteinuria and disease progression.It is expected to remain dominant in the forecast period with a CAGR of 4.8%.

The standard treatment plan includes corticosteroids, immunosuppressants, and supportive therapies such as ACE inhibitors and diuretics, which drive Industry growth.

However, dialysis is the fastest-growing segment due to the increasing incidence of end-stage renal disease (ESRD) among FSGS patients who do not respond to drug therapy. Increased investments in peritoneal dialysis and haemodialysis infrastructure, especially in emerging economies, will drive this growth.

Kidney transplant remains the most definitive treatment for FSGS, but Industry growth is constrained by organ donor shortages and disease recurrence post-transplantation. Improvements in immunosuppressive protocols and precision-matched transplantation methods are making transplants work better, but only a few patients can get them because they are so expensive and risky.

The USA FSGS therapeutics Industry will usher in strong growth with 6.2% CAGR during forecast period, outpacing the global CAGR of 5% owing to rapid drug approvals and vast adoption of newer biologics. Through analysis from FMI, the following were identified as regulatory programs implemented by the FDA to expedite the commercialization of new treatments SGLT2 inhibitors and endothelin receptor antagonists, including the FDA's Accelerated Approval Program and Real-Time Oncology Review (RTOR) policy.

FMI suggests that strong insurance coverage and reimbursement policies from both Medicare and private payers will make it easier for patients to get the drugs they need. However, new drug price regulations from the Inflation Reduction Act may make it harder for drug companies to set high premium prices.

FMI opines that the United Kingdom’s FSGS therapeutic industry will grow at nearly 4.8% CAGR through 2025 to 2035.The UK FSGS therapeutics Industry will expand slightly below theglobal average due to tough cost-effectiveness evaluations made by NICE.

The FMI analysis indicates that new biologics and innovative therapies entering the marketplace must still demonstrate significant therapeutic benefit before they are eligible for NHS reimbursement.

The new post-Brexit landscape is bringing uncertainty, with firmsneeding to comply with MHRA’s stand-alone drug approval processes. But programs like the Early Access to Medicines Scheme (EAMS) can fast-track approvals for breakthrough therapies, catalysing modest Industry growth.

FMI opines that the France’ FSGS therapeutic industry will grow at nearly 4.7% CAGR through 2025 to 2035. The growth of French FSGS therapeutics will be slow but steady, as rough price negotiations within the Economic Committee for Health Products (CEPS) can put extreme-cost biologics onhold. The French National Authority for Health (HAS) prefersbiosimilar agents and generics over innovative therapies unless they provide significant added value, according to an FMI study.

Government-supported healthreimbursement efforts and France's dedication to rare disease research will drive investment in new therapies, FMI said. However, the sector must navigate through pricing constraints as regulatory agencies cap drug prices to control healthcare costs, which can negatively impact the profitability of high-cost therapeutics.

Due to its strong research environment and favourable reimbursement landscape for new drugs, Germany will expand marginally above the global average with CAGR of 5.3% during forecast period. FMI analysis suggests that AMNOG’s free pricing policy for new drugs, implemented earlier than expected, benefits the pharmaceutical industry.

However, price negotiations with the Federal Joint Committee (G-BA) after product launch can lead to pricingpressures. German biosimilar and health technology assessment (HTA) leadership will ensure that a competitive environment exists, and companies will need to demonstrate both efficacyand cost-effectiveness to gain Industry traction.

The Italian FSGS therapeutics Industry is expected to grow at a stable pace at a CAGR of 4.9% during 2025 to 2035, owing to government subsidization of treatments for rare diseases and increased patients' access to newer drugs. High-cost biologics are facing a significant regulatory hurdle due to AIFA’s stringent appraisals ofearly-stage Health Technology Assessment (HTA).

Nonetheless, public healthcare expenditure on orphan diseases will sustain Industry growth. In the near future, considering that price caps andreimbursement schemes will continue to reward cheaper alternatives to high-priced innovativetherapies, firms that invest in affordable biosimilars will remain in the spotlight.

The South Korean FSGS therapeutic Industry will see moderate to solid growth at 5.5% CAGR during 2025 to 2035 due to improvinggovernment support for orphan drugs and accelerated regulation approval under the MFDS. While South Korea is one of the most innovative countries when it comes to biopharmaceuticals, the reimbursement schemes falling under the National

Health Insurance Service (NHIS) tend to prefer low-cost generics over expensive biologics. Intense investments in healthcare and the ascendance of personalized medicine will boost the growth of the Industry, yet price-conscious policies will hinder the commercial success of premium therapy unless they are not highly clinically differentiated.

FMI opines that the Japan’s FSGS therapeutic industry will grow at nearly 4.6% CAGR through 2025 to 2035. FSGS therapeutics in Japan will grow at aslower pace due to cost-containment initiatives and stringent post-Industry surveillance requirements.

FMI analysis showed that the Pharmaceuticals andMedical Devices Agency (PMDA) imposes very strict surveillance for safety and efficacy, leading to delayed time-to-Industry of new drugs.

The FMI explains thatJapan's cost-effectiveness assessment system does not encourage the widespread acceptance of high-cost biologics, and the result is an over-reliance on generics and biosimilars. However, increasing awareness around FSGS, along with advancements and progress inprecision medicine, could drive longer-term Industry growth.

China is expected to be the second-fastest-growingFSGS therapeutics Industry worldwide at a CAGR of 6.5% during forecast period, outpacing the global average on the back of increasing healthcare expenditure and regulation reforms. FMI research shows that the National Medical Products Administration (NMPA) Green Channel" program has sped up services for new drugs.

This has made it easier for new FSGS therapies to get to Industry quickly in the country. Listing FSGS drugs in the National Reimbursement Drug List (NRDL) is expected to improve accessibility and affordability, but mandatory price negotiations will still exert downward pressure on pharmaceutical pricing.

FMI opines that the Australia and New Zealand’s FSGS therapeutic industry will grow at nearly 5.1% CAGR through 2025 to 2035. The Australian and New Zealand FSGS therapeutics Industry will grow steadily owing to the strong reimbursement policies of the government. According to research by FMI, the PBS is very good for Australian patients getting access to new therapies.

However, there are still a lot of barriers to entry, in part because the TGA does such thorough checks on safety and effectiveness. FMI states that companies manufacturingboth affordable biosimilars as well as innovative therapies that present robust clinical data will enjoy strategic advantages as precision medicine gains traction in the region.

Furthermore, risingdiagnosis rates and healthcare expenditure in India, coupled with government measures to increase rare disease drug access, are expected to drive strong growth in the FSGS therapeutics Industry. FMI opines that the India’s FSGS therapeutic industry will grow at nearly 5.8% CAGR through 2025 to 2035.

However, time-consuming clinical trial processes can delay Industry entry, despite the CDSCO’s regulatory authority. These developments will allow India’s price-sensitive Industry to continue gravitatingtowards generics and biosimilars, although public subsidies and public-private cooperation in healthcare may create new opportunities for innovative medicines in urban healthcare institutions, FMI concludes.

The competitive dynamic of the FSGS therapeutics Industry is being affected since prices are propelled by competition, biologic innovation, alliances, and global coverage. Top players in the pharmaceutical sector, according to FMI research, are concentrating on developing new immunosuppressive medicines and precision medicine strategies to tackle steroid-resistant cases.

Biopharma mergers, acquisitions and licensing agreements with biotech firms are accelerating drug pipeline development. Firms are also venturing into emerging Industries, generatingregulatory incentives for orphan drugs. FMI analysis revealed that competitive pricing and reimbursement negotiations became new challenges, with firms emphasisingdifferentiated treatment profiles to command a premium price while maximising broad access.

Travere Therapeutics

Share: ~30-35%

FSGS (IgA nephropathy): Sparsentan (Filspari) is the Industry leader with an approved drug and is in later-stage trials for FSGS. The company has a strong commercial presence and places a strong emphasis on research and development.

Novartis

Share: ~20-25%

The company leverages its SGLT2 inhibitor (finerenone) and other nephrology products to emerge as a leader in FSGS through clinical trials and partnerships.

Chinook Therapeutics (Acquired by Novartis, 2023)

Share: ~15-20%

Chinook had been working on Atrasentan in FSGS before the acquisition. This pipeline now forms part of Novartis' nephrology franchise.

Vertex Pharmaceuticals

Share: ~10-15%

We are stepping into FSGS with its APOL1 inhibitor (inaxaplin/VX-147), which has been promising in clinical trials in genetic FSGS subtypes.

Aurinia Pharmaceuticals

Share: ~5-10%

The company manufactures voclosporin (Lupkynis) for lupus nephritis and is actively pursuing its repurposing in FSGS, although this is still in its early stages.

Other Players (PfizerhBayer, Boehringer Ingelheim)

Share: ~10-15%

These companies have nephrology pipelines, but their direct involvement in the FSGS Industry is expected to be limited in 2024.

Novartis Finalizes Chinook Acquisition (Jan 2024) Novartis expanded its FSGS pipeline with a $3.2B acquisition of Chinook Therapeutics and its candidate, atrasentan. This strengthens Novartis' hand in rare kidney diseases.

Travere's Sparsentan Receives Fast-Track Designation for FSGS (Feb 2024) The FDA has just granted Sparsentan Fast Track designation for FSGS, accelerating the drug's regulatory pathway. In late 2024, Travere is expecting a readout from a Phase 3 trial.

Vertex Reports Encouraging Phase 2 Data on Inaxaplin (Mar 2024) Vertex's APOL1 inhibitor (inaxaplin) showed strong reduction in proteinuria in patients with APOL1 mutation FSGS and is now moving on to Phase 3.

Bayer Steps Out of FSGS Space (Apr 2024) It pulled back bardoxolone methyl, an FSGS asset, due to inconsistent results and turned to other prospects in nephrology.

Pfizer Pursues FSGS Biomarker Partnership with Biotech (May 2024) Pfizer entered into an agreement with a diagnostic company to identify FSGS biomarkers for precision medicine applications.

Aurinia reports out on voclosporin for FSGS (June 2024). Aurinia began a proof-of-concept trial of voclosporin in FSGS, although it is unclear how significant a Industry effectthis would be.

The industry is bifurcated into primary FSGS and secondary FSGS.

It is fragmented into corticosteroids, immunosuppressive drugs, plasmapheresis, ACE inhibitors and ARBs & diuretics.

It is segmented as drug therapy, dialysis and kidney transplant.

The industry is studied across North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa.

Increased prevalence, rising diagnosis rates, and advances in biologics and immunosuppressive therapies are driving sales.

Consistent growth is projected as a result of more R&D in new treatments, increasing demand for targeted therapies, and increased diagnostic capabilities.

The leading manufacturers in the industry include B. Braun Melsungen AG, Beckman Coulter Inc., Baxter International Inc., ChemoCentryx Inc., Dimerix Ltd, Medtronic PLC, Pfizer Inc., Mylan N.V., Amgen Inc., AstraZeneca plc, Novartis AG, Roche Holding AG, Vertex Pharmaceuticals Incorporated, Travere Therapeutics, Inc.

Immunosuppressive medication, especially monoclonal antibodies, is likely to take the lead because they are more effective in treating drug-resistant cases.

FMI projects that the Industry will reach USD 5.39 billion by 2035, driven by innovative treatment methods and an expanding patient pool.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Disease Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Treatment , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 17: Global Market Attractiveness by Disease Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 19: Global Market Attractiveness by Treatment , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 37: North America Market Attractiveness by Disease Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 39: North America Market Attractiveness by Treatment , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Disease Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Treatment , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 77: Europe Market Attractiveness by Disease Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 79: Europe Market Attractiveness by Treatment , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Disease Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Treatment , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Disease Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Treatment , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Disease Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Treatment , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Disease Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Treatment , 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Disease Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Disease Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Disease Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Treatment , 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Treatment , 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Treatment , 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Disease Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Drug Class, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Treatment , 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Progressive Multifocal Leukoencephalopathy Treatment Market Size and Share Forecast Outlook 2025 to 2035

High-precision Confocal Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Fucosidosis Therapeutics Market - Growth & Innovations 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA