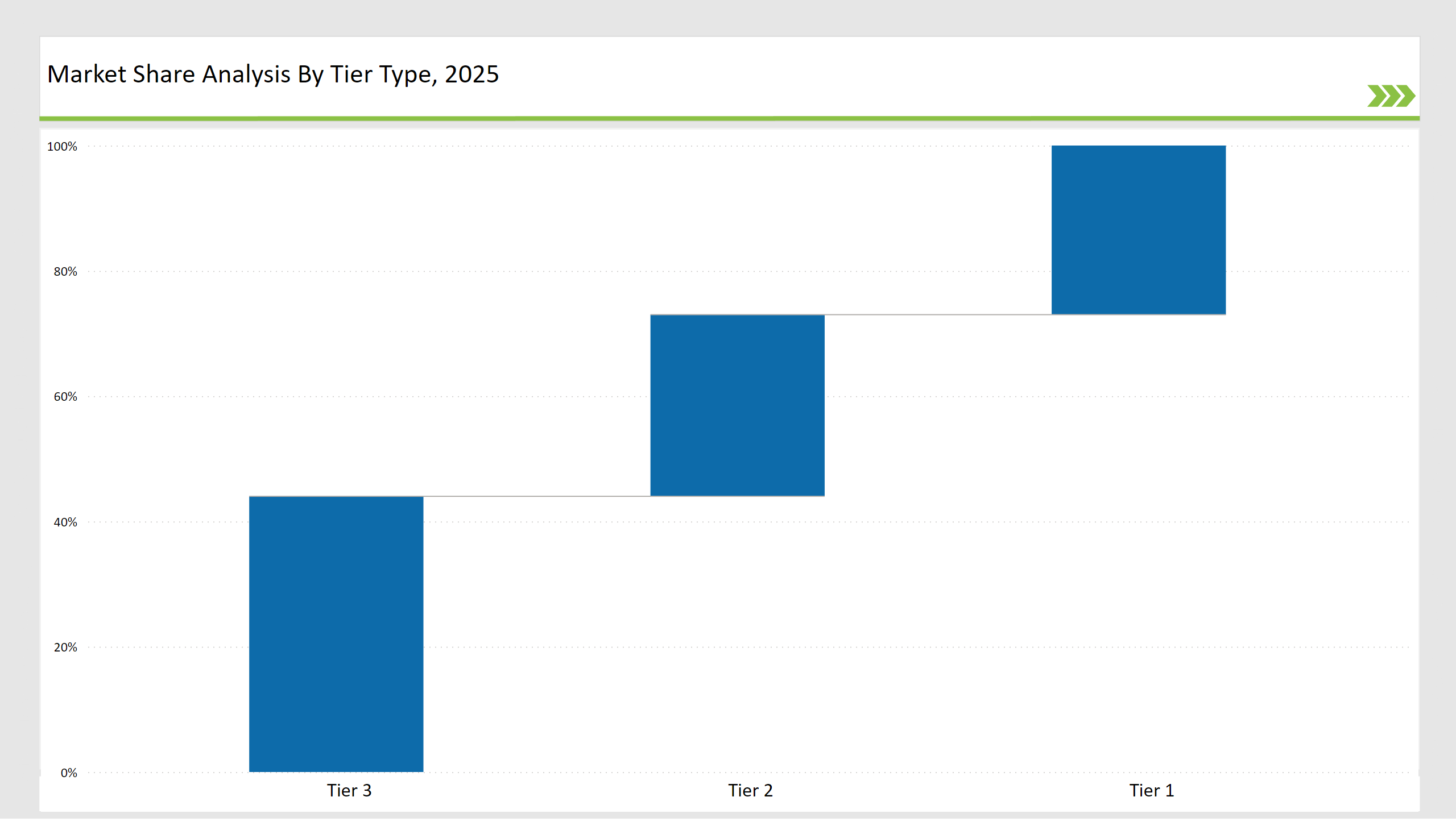

The foamer bottle market is segmented into three tiers according to market presence and competitive strategy. Tier 1 companies include Silgan Dispensing, Raepak, and Albea, with a market share of 27%. The Tier 1 companies use the advantage of economies of scale, advanced R&D, and solid global distribution networks.

They commit to sustainable packaging, high-quality dispensing solutions, and customization options to maintain their strong hold in markets like personal care, pharmaceuticals, and household cleaning. Innovations in recyclable foamer bottles and airless dispensing technology further strengthen their competitive positioning.

Tier 2 participants like Frapak Packaging, Kaufman Container, and Zhejiang JM Industry command about 29 percent of the market share. Companies such as these provide low-priced, customizable foam bottle solutions for mid-sized enterprise customers and local brands.

In fact, because of their operations efficiency, materials innovation, and attention to all new regulations pertaining to sustainability, these companies can enter the emergent markets easily.

Tier 3 players comprise regional manufacturers and niche start-ups and represent the remaining 44% of the market. Localized demands are addressed by these companies, serving innovative, sustainability-oriented, and cost-effective foamer bottles. These players can respond more rapidly than the former two tiers of players to shifts in consumer preference and regulatory pressures in eco-friendly packaging solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Silgan Dispensing, Raepak, Albea) | 14% |

| Rest of Top 5 (Frapak Packaging, Kaufman Container) | 8% |

| Next 5 of Top 10 (Zhejiang JM Industry, Epopack, Yonwoo, Ampac, Rieke Packaging) | 5% |

Targeted End-user Key Industries

Vendor-Focused Product Categories

Silgan Dispensing, Raepak, Albea, Frapak Packaging, and Kaufman Container are some of the leaders that have majorly contributed to the Foamer Bottle Market. The respective companies developed eco-friendly, recyclable foamer bottles, enhanced manufacturing productivity, and increased their product offerings following the imposition of environmental compliances.

The widespread incorporation of post-consumer recycled (PCR) plastic as well as airless foamer technology signifies the industry is shifting towards sustainability and product durability.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Silgan Dispensing, Raepak, Albea |

| Tier 2 | Frapak Packaging, Kaufman Container, Zhejiang JM Industry |

| Tier 3 | Epopack, Yonwoo, Ampac, Rieke Packaging |

| Manufacturer | Latest Developments |

|---|---|

| Silgan Dispensing | Launched fully recyclable foamer bottles (May 2024) |

| Raepak | Introduced refillable, sustainable foamer bottle solutions (April 2024) |

| Albea | Developed high-barrier, lightweight foamer bottles (March 2024) |

| Frapak Packaging | Expanded production of 100% PCR foamer bottles (June 2024) |

| Kaufman Container | Launched customizable, airless dispensing bottles (July 2024) |

Silgan Dispensing, Raepak, Albea, Frapak Packaging, and Kaufman Container.

The top five manufacturers collectively control 22% of the market, while the top ten account for 27%.

Medium, as the top players hold between 30% and 60% of the industry share.

They contribute 5% of the market by offering specialized and regional solutions.

Sustainability, foam dispensing advancements, and refillable packaging solutions.

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Reusable Packing Market Analysis – Size, Share & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Polystyrene Packaging Market Analysis - Size & Growth Forecast 2025 to 2035

Paper Bubble Wrap Market Trends - Demand, Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.