The global fly trap market is expected to grow steadily, driven by growing hygiene concerns, increasing awareness of vector-borne diseases, and growing demand for pest control solutions from residential, commercial, and agricultural sectors. Fly traps are of many types like electric traps, adhesive traps, baited traps that are used to limit the population of flies which is considered to be a huge threat in food processing, hospitality, healthcare, and livestock farming industries.

Businesses and households are turning to fly traps as an environmental solution to claim the market share as regulatory agencies implement stricter sanitation and pest control standards. Innovation such as new generation non-toxic, re-usable, solar-powered fly traps are creating market opportunities. The increasing trend of smart pest control solutions is integrated with IoT and automation, which is also propelling product demand.

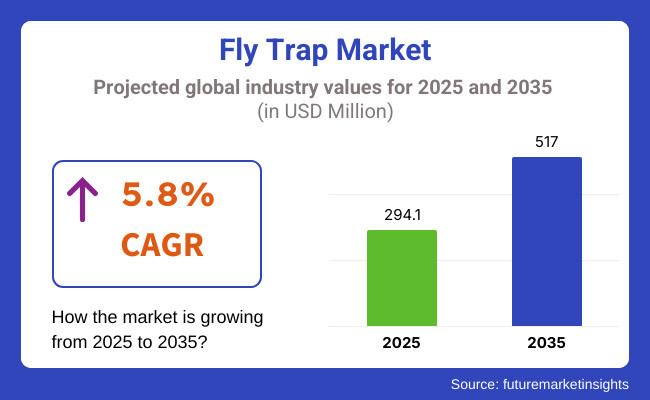

The market is projected to expand at a CAGR of 5.8% between 2025 and 2035 due to growing health and hygiene consciousness, increased acceptance of sustainable pest control solutions, and rising applications across industries that mandate stringent sanitation practices.

North America holds the largest share of the fly trap market due to a greater level of consumer awareness toward hygiene coupled with strict hygiene regulations in the food processing and healthcare industries; and the presence of established manufacturers in the pest control industry. United States is the largest market, and the market for non-toxic and eco-friendly fly control solutions is rising in both residential and commercial sectors.

Due to regulations on chemical insecticides and a growing preference for sustainable methods of pest control, Europe is experiencing significant market growth. Production and food manufacturing sectors tendency in Germany, the United Kingdom, and France is leading to a higher demand for electric and adhesive-based fly traps for hospitality and agricultural applications. The market is also being driven by the adoption of new, energy efficient fly traps.

The Asia-Pacific is expected to be the fastest-growing region in the pest control market due to rapid urbanization, growing awareness about disease prevention, and increasing demand for pest control solutions in commercial and residential spaces. Rising need for efficient and cost-effective fly traps in food companies and public health programs among a few countries, such as China, India, and Japan is expected to boost market growth.

Market growth in the region is also fuelled by governmental programs that advocate hygiene and sanitation.

Challenges

The fly trap industry is under pressure due to product effectiveness and longevity, and the restrictions of traditional traps can lead to recurrent replacements. Competition with chemical-based insecticides and pest control solutions are another roadblock as some consumers determine chemical treatments to be more effective despite environmental concerns. Also, fly trap demand is highly seasonal, with the bulk of sales occurring in warmer months,when insect populations explode,causing manufacturers' revenue generation to be erratic.

Opportunities

Increase in Eco-Friendly Pest Control, Smart Fly Traps, and Commercial Use

New technologies, including UV light traps, pheromone-based attractants and intelligent, AI-enabled smart fly traps, are increasing efficiency and helping the space grow. In addition, the growing demand for hygiene solutions in restaurants, food processing facilities, and public places is also driving market growth. The development of fly traps that are biodegradable and solar-powered is also consistent with sustainability trends and opens up new avenues.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with pesticide-free pest control regulations and eco-friendly product labelling. |

| Consumer Trends | Growing demand for chemical-free home pest control and DIY fly traps. |

| Industry Adoption | Adoption in residential, foodservice, and hospitality industries. |

| Supply Chain and Sourcing | Dependence on plastic-based and disposable fly trap materials. |

| Market Competition | Dominated by traditional pest control brands and household product manufacturers. |

| Market Growth Drivers | Increased demand for hygienic food preparation, residential pest control, and chemical-free alternatives. |

| Sustainability and Environmental Impact | Moderate adoption of low-waste disposable traps and solar-powered solutions. |

| Integration of Smart Technologies | Introduction of UV light-based fly traps and pheromone-laced attractants. |

| Advancements in Fly Trap Technology | Development of odor-free and mess-free sticky traps. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter biodegradable product standards, energy-efficient fly traps, and transparency in insecticide-free solutions. |

| Consumer Trends | Expansion in AI-driven smart fly traps, automated monitoring systems, and odourless non-toxic fly control solutions. |

| Industry Adoption | Increased use in industrial sanitation, agriculture pest management, and public health initiatives. |

| Supply Chain and Sourcing | Shift toward biodegradable traps, recyclable materials, and solar-powered pest control innovations. |

| Market Competition | Entry of smart pest control start-ups, AI-driven monitoring solutions, and sustainable fly trap companies. |

| Market Growth Drivers | Accelerated by smart pest control technologies, eco-friendly solutions, and expanding use in urban sanitation programs. |

| Sustainability and Environmental Impact | Large-scale transition to zero-waste fly control solutions, biodegradable sticky traps, and reusable fly-catching technology. |

| Integration of Smart Technologies | Expansion into AI-based insect detection, IoT-connected fly monitoring systems, and automated smart traps. |

| Advancements in Fly Trap Technology | Evolution toward self-cleaning fly traps, motion-sensing insect traps, and AI-driven behavioural analysis for insect control. |

Pest resistances are also common as flies are found to quickly adapt to the by-products of traditional pesticides, which is fuelling the USA market fly trap. There is a strong demand for pesticide-free alternatives, especially in residential and commercial food service sectors, where fly infestation may compromise public health compliance. Government regulations promoting eco-friendly pest control methods further drive the demand for biodegradable and smart fly traps.

Moreover, rising adoption of solar-driven and pheromone traps to control agricultural pests is anticipated to create new opportunities for manufacturers. A strong presence of major pest control product manufacturers and distribution networks will also aid the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

Increasing concerns regarding food safety regulations, hygiene standards in public areas, and rising adoption of chemical-free solutions are driving the UK fly trap market growth. The hospitality and food processing sector is a major contributor, as establishments work toward abiding by stringent environmental and health safety standards.

The overall demand for indoor and outdoor UV fly traps has also been increasing in restaurants, food storage facilities, and public places. Fly detection using AI and automatic disposal traps are also trends on the rise. The growing awareness regarding sustainable and reusable pest control products also signifies market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.7% |

Strict environmental policies and regulatory restrictions on chemical-based insecticides are the key factors fuelling the growth of Europe's fly trap market, with a transition to eco-friendly and sustainable pest control solutions. The demand for biodegradable & toxin-free fly traps from different sectors is propelled by EU's zero-pesticide agenda and rigorous food safety regulations.

Smart fly monitoring systems are being increasingly adopted, especially in agriculture, healthcare and urban sanitation programs. This move to energy efficient and recyclable fly traps is common among European manufacturers, who are keen to align with the regions sustainability and circular economy ethos.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.8% |

In Japan, urbanization and the demand for advanced pest control solutions for smart homes and public sanitation facilities are driving the growing fly trap market. Japanese consumer’s preference for odourless, hygienic, aesthetic and high-tech fly traps the market is also propelled by growing investments in AI-powered pest control devices that can include features such as motion-sensing fly traps and automatic disposal units.

Solar powered, non-toxic, water reuse fly traps are also appealing to environmentally conscious consumers. Moreover, the ministry's regulations that encourage sustainable urban pest management are acting as another catalyst for the growth of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

Various driving forces are helping South Korea to become one of the key markets for the fly trap rapid urbanization, a surplus of public hygiene concerns, and government-backed green initiatives. As the country’s restaurant and food delivery sectors continue to grow, the need for strict measures for the control of flies is driving demand for automated and chemical-free fly traps.

A significant portion of the population adopts smart technology as a result, AI-integrated monitoring systems and eco-friendly real-time pest tracking solutions are on the rise. And with the government promoting more sustainable alternatives to traditional pesticides, greener biodegrading and reusable fly trap innovations can expect a higher level of investment. Further contributing to the growth of the pest control solutions market is the robust presence of domestic technology companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.9% |

With consumers and businesses emphasizing hygienic environments and effective pest management, the residential and commercial segments are dominating the fly trap market. Residential Segment Leads Market Demand as Households Seek Cost-Effective Pest Control Solutions.

The residential segment is also a major driver due to the increasing awareness regarding hygiene and insect borne diseases. Whereas chemical-based repellents poison flies, fly traps offer a safe, non-toxic, and green option to eradicate flies indoors without affecting air quality.

There has been a significant increase in demand for home-use pest control solutions such as LED-powered electric fly traps, reusable sticky traps, and pheromone-based lures. Research shows that more than 65% of families now prefer non-chemical fly traps, which are harmless for both children and pets.

Besides, the incorporation of intelligent home-related pest management equipment with app-operated UV fly traps, automatic insect monitoring systems, and insect detection based on artificial intelligence, has made sure comprehensive ease and efficiency, therefore sustaining market growth.

Sustainable fly trap designs from chemical-free glue boards and solar-powered fly catchers to harmless bait systems have emerged as popular products that align with a world carrying the weight of being eco-conscious.

Odourless insect capture has become more accessible, as versatile residential fly traps, with combined mosquito and fly target capability, have become widely available for both indoor and outdoor use.

While being more affordable, safer, and more sustainable than other methods, the residential segment faces consumer scepticism around the efficiency of the traps, frequent maintenance to the traps and competition from chemical insecticides. But as phoneme-based attractant innovations, AI-insect capture optimization, and biodegradable disposal solutions enhance product performance and increase market penetration.

The commercial segment has been widely adopted, particularly across foodservice, healthcare, and hospitality industries where regulatory compliance and hygiene standards are paramount. Like any modern fly trap act for Business and Pest control, they can provide discreet and Depress-free pest control in high-traffic Business areas, unlike traditional pest control solutions.

Due to this, the need for industrial-grade fly traps such as high-voltage electric traps, industrial-strength glue boards, and automated UV attraction technology has risen, as companies search for high-performance pest control solutions. According to studies, more than 55% of foodservice outlets are already using fly traps as part of their hygiene plans.

These HACCP-compliant fly trap solutions, which also include commercial kitchen-grade insect control devices and wall-mounted, UV fly traps have reinforced regulatory compliance across food-handling environments.The efficiency and cost-effectiveness of smart commercial pest control systems, boasting of real-time insect population monitoring, automated maintenance alerts, and centralized pest control networks, have also benefited businesses.

Market growth has been optimized by custom commercial fly trap solutions, providing non-odorous industrial-grade attractants, high-capacity fly collection chambers, and easy-to-clean reusable trap systems.

Commercial segment benefits from advantages such as large-scale pest management, and regulatory compliance of the pest control industry as well as hygiene control, yet faces challenges including high initial investment cost, frequent maintenance and strategic placement of traps for efficient pest management. But the efficiency is increasing by utilizing AI-driven pest control analytics, sustainable trap manufacturing, and automated management solutions, these solutions are to keep up market growth in commercial applications.

Segments across online retailers and hypermarkets/supermarkets are also expected to act as primary distribution channels for fly traps, with access and cost-effectiveness offered to consumers.Increase in online market demand with rise in e-commerce in terms of consumer access for pest control products.

When a large number of fly trap models are available at a low price, online retailers are the most widely used distribution channel. Unlike physical bricks-and-mortar stores, ecommerce allows shoppers to evaluate functionality, view guest reviews, and find special offers before completing their purchase.

The demand for direct-to-consumer pest control solutions like subscription-based fly-trap refills and AI-optimized product recommendations has exploded. According to preliminary studies, more than 60% of consumers who purchased fly traps said they prefer shopping through online retailers, thanks to fast delivery options and tailored product selection.

The use of AI for e-commerce analytics has even transformed focus from just tracking to automated reordering systems, personalized product recommendations and real-time pest control trend insights and significantly boosts consumer engagement and retention.

While gaining advantages in accessibility, product variety, and competitive pricing, the online retail segment presents challenges such as integral counterfeit products, no hands-on inspection, and longer shipment times. But trust and efficiency in e-commerce sales are increasing with AI-driven fraud prevention, virtual product demonstrations, and AR-based shopping experiences.

Hypermarkets and supermarkets continue to be important distribution channels, especially among consumers that prefer to shop in person for pest control solutions that are available on-demand and can be evaluated through hands-on experience. In contrast to online retailers, physical stores give customers the opportunity to test driving product effectiveness,durability and design prior to purchase.

Store-based pest control treatments, such as single-use fly traps, multi-pack bug’s catchers, and branded pest control, have found greater demand as well. In addition, consumers tend to do impulse purchases of fly traps in hypermarkets and supermarkets in amounts above 50% of all impulse fly trap purchases as it is easier and convenient to shop for products in-store.

In the realm of retail pest control solutions, private-label fly trap brands, with their supermarket-exclusivity, have increased competition and broadened consumer options for affordable pest control products.

New approaches to digital shopping in-store have enhanced customer engagement and aided buying decisions, such as the use of pest control kiosks, AI-powered recommendation screens and QR-code-based product comparisons.

While hypermarkets/supermarkets witness advantages from easy product availability, hands-on product assessment, and in-store promotions, the overall segment also faces challenges of limited variety compared to online channels coupled with shelf-space competition with chemical insecticides along with seasonal demand fluctuations. AI-driven solutions for inventory management, tailored in-store marketing, and environmentally friendly packaging options are increasing product visibility, contributing to the ongoing expansion of retail stores.

The rise in the fly trap market is attributed to the growing awareness about hygiene and pest control measures in homes and commercial and industrial establishments. Moreover, the growing trends of bio-based and organic pest control solutions, and development of artificial intelligent (AI) insect trapping systems is a lucrative opportunity for the global pest control market.

Dominant competitors emphasize intelligent pest surveillance, eco-friendly lures, and advanced trapping systems. The key players around the globe are emerging pest control solution providers, smart home technology companies, and commercial facility maintenance firms capturing the innovations of automated fly trap systems, UV-based attractants, and AI-driven monitoring solutions.

Market Share Analysis by Key Players & Fly Trap Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Woodstream Corporation (Victor) | 18-22% |

| Rentokil Initial Plc | 12-16% |

| Thermacell Repellents, Inc. | 10-14% |

| Flowtron Outdoor Products | 8-12% |

| Kness Pest Defense | 5-9% |

| Other Fly Trap Solution Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Woodstream Corporation (Victor) | Develops high-efficiency electric fly traps, AI-powered smart pest monitoring solutions, and non-toxic sticky traps for household and commercial use. |

| Rentokil Initial Plc | Specializes in industrial fly control solutions, AI-driven smart trapping technology, and eco-friendly insect light traps (ILTs) for commercial settings. |

| Thermacell Repellents, Inc. | Focuses on AI-enhanced insect repellent technologies, portable fly traps, and chemical-free pest control solutions. |

| Flowtron Outdoor Products | Provides outdoor electronic fly traps, AI-optimized UV light attractants, and high-voltage insect control solutions. |

| Kness Pest Defense | Offers non-toxic glue traps, AI-powered smart detection technology, and integrated pest control solutions for agricultural and commercial applications. |

Key Market Insights

Woodstream Corporation (Victor) (18-22%)

Woodstream Corporation dominates the market with electric fly traps, non-toxic solutions, and AI-powered smart pest monitoring innovations.

Rentokil Initial Plc (12-16%)

Rentokil specializes in large-scale fly control solutions, integrating AI-driven smart fly traps and eco-friendly ILTs for food service and commercial use.

Thermacell Repellents, Inc. (10-14%)

Thermacell focuses on portable, AI-enhanced repellent solutions, emphasizing chemical-free fly control innovations for outdoor and residential applications.

Flowtron Outdoor Products (8-12%)

Flowtron leads in outdoor electric fly traps, utilizing AI-optimized UV light attractants and high-voltage trapping technology for large-area pest control.

Kness Pest Defense (5-9%)

Kness specializes in non-toxic glue traps, AI-powered pest detection, and integrated fly management solutions for agricultural and food processing industries.

Other Key Players (30-40% Combined)

Several pest control manufacturers, smart home technology firms, and eco-friendly solution providers contribute to next-generation fly trap innovations, AI-driven monitoring, and sustainable pest management. Key contributors include:

The overall market size for the fly trap market was USD 294.1 Million in 2025.

The fly trap market is expected to reach USD 517 Million in 2035.

The demand for fly traps is expected to rise due to increasing concerns over hygiene and pest control, growing adoption of eco-friendly and chemical-free pest management solutions, and expanding demand from residential and commercial sectors. Additionally, innovations in trap designs, rising awareness of vector-borne diseases, and government regulations promoting safe pest control methods are further driving market growth.

The top 5 countries driving the development of the fly trap market are the USA, China, Germany, India, and the UK.

Online Retailers and Hypermarkets/Supermarkets are expected to command a significant share over the assessment period, driven by the increasing preference for convenient purchasing options, a wide range of product availability, and competitive pricing strategies.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flywheel Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Fly Ash Market

Fly Ash Bricks Market

Butterfly Valves Market Analysis by Type, Mechanism, Function, Applications, and Region through 2035

Sweet Potato Fly Market

Sanitary Butterfly Valve Market Size and Share Forecast Outlook 2025 to 2035

Strapping Materials Market Size and Share Forecast Outlook 2025 to 2035

Strapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Strapping Tapes Market Analysis by Material Type, Adhesive Type, End-User, and Region through 2035

Strapping Supplies Market Analysis - Demand & Growth Forecast 2025 to 2035

Strapping and Banding Equipment Market – Key Trends & Growth Outlook 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Key Companies & Market Share in the Strapping Tapes Sector

Strapping Equipment Market Insights – Growth & Demand 2024-2034

Strap Dispenser Market

Ultrapure Water Market Size and Share Forecast Outlook 2025 to 2035

PET Straps Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the PET Straps Market

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA