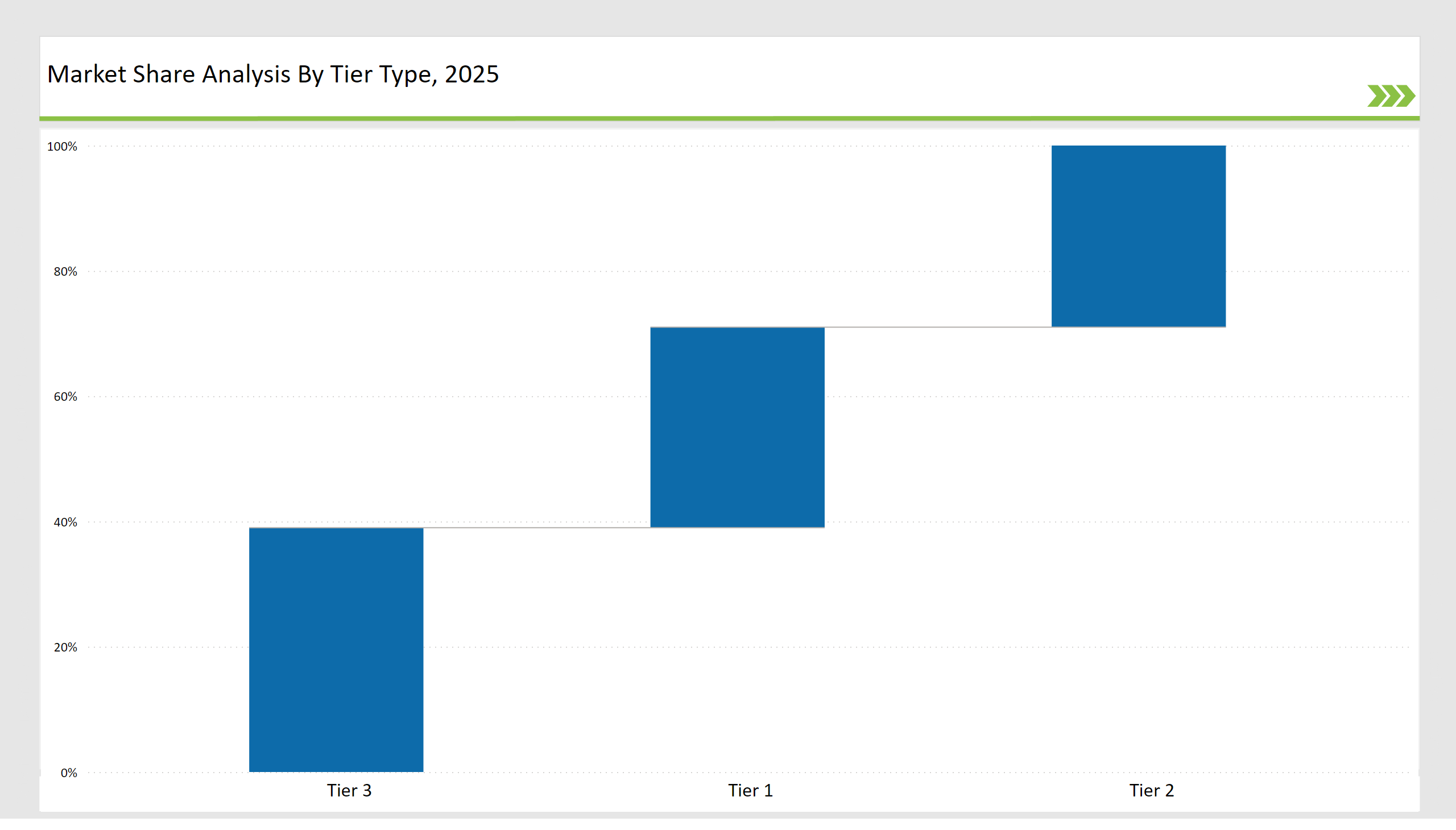

The fluting paper market is classified into three levels based on the market presence and competitive strategy. Tier 1 companies are comprised of Smurfit Kappa, Mondi Group, and DS Smith, holding 32% market share.

Economies of scale, cutting-edge R&D, and all-inclusive global distribution networks support their market positions. High-strength fluting paper, sustainable packaging materials, and lightweight designs will enable these companies to remain on top in markets for corrugated packaging, e-commerce, and food & beverage. Innovation in the production of recycled and virgin fluting papers is an added strength in the market position.

Tier 2 players, including International Paper, Stora Enso, and WestRock, represent around 29% of the market. These companies offer affordable, flexible fluting paper products to mid-sized companies and regional brands. They focus on operational efficiency, sustainable forestry practices, and environmental compliance that would allow them to expand into new markets.

The remaining market share is held by Tier 3 players, who account for 39%. These are regional manufacturers and niche start-ups. Regional manufacturers target the localized demand with innovative, cost-effective, and sustainable fluting paper solutions. The flexibility helps them respond rapidly to changes in consumer preferences and to new regulatory requirements for eco-friendly packaging solutions.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (Smurfit Kappa, Mondi Group, DS Smith) | 13% |

| Rest of Top 5 (International Paper, Stora Enso) | 14% |

| Next 5 of Top 10 (WestRock, Nine Dragons Paper, Pratt Industries, Lee & Man, Rengo Co.) | 5% |

Targeted End-user Key Industries

Vendor-Focused Product Categories

The major players shaping the Fluting Paper Market are Smurfit Kappa, Mondi Group, DS Smith, International Paper, and Stora Enso. In their efforts to enhance sustainability, these companies have launched high-quality recycled fluting paper, optimized their processes, and broadened their product offerings. The growing demand for FSC-certified fluting paper indicates a shift towards responsible sourcing and waste reduction. cycled fluting paper, improved efficiency, and expanded their product lines.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Smurfit Kappa, Mondi Group, DS Smith |

| Tier 2 | International Paper, Stora Enso, WestRock |

| Tier 3 | Nine Dragons Paper, Pratt Industries, Lee & Man, Rengo Co. |

| Manufacturer | Latest Developments |

|---|---|

| Smurfit Kappa | Launched lightweight, high-strength fluting paper (May 2024) |

| Mondi Group | Developed fully recyclable fluting paper for e-commerce (April 2024) |

| DS Smith | Introduced FSC-certified recycled fluting paper (March 2024) |

| International Paper | Expanded sustainable forestry sourcing for fluting paper (June 2024) |

| Stora Enso | Increased production of food-safe, moisture-resistant fluting paper (July 2024) |

The top five producers have an absolute market share of 27 percent, whereas top ten holds around 32%.

Medium, as the top players hold between 30% and 60% of the industry share.

? They contribute 39% of the market by offering specialized and regional solutions.

Sustainability, strength-to-weight optimization, and smart packaging solutions.

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Takeaway Containers Market Report - Key Trends & Forecast 2025 to 2035

PVC Packing Straps Market Report – Key Trends & Forecast 2025 to 2035

Reusable Packing Market Analysis – Size, Share & Forecast 2025 to 2035

Printed Boxes Market Analysis – Trends, Demand & Forecast 2025 to 2035

Poultry Packaging Market Insights - Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.