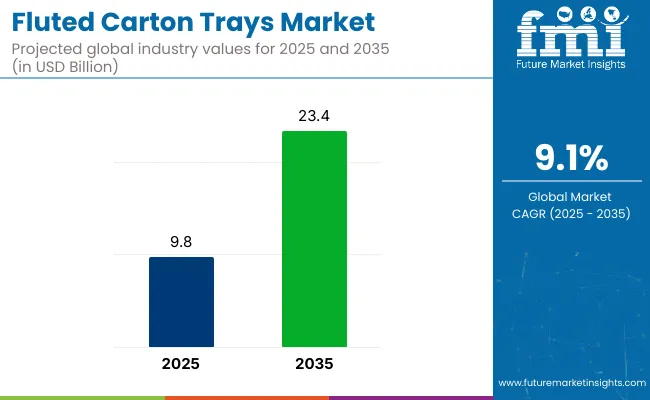

The fluted carton trays market is projected to grow from USD 9.8 billion in 2025 to USD 23.4 billion by 2035, registering a CAGR of 9.1% during the forecast period. Sales in 2024 reached USD 8.9 billion. Growth has been driven by increasing adoption across retail-ready packaging formats, sustainable foodservice containers, and e-commerce transit solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.8 billion |

| Industry Value (2035F) | USD 23.4 billion |

| CAGR (2025 to 2035) | 9.1% |

Surge in demand for biodegradable alternatives, coupled with expanding retail infrastructure in developing economies, has contributed to widespread uptake of fluted trays. Enhanced structural integrity and customizability are being preferred for convenience and shelf appeal in global food and consumer goods sectors.

In June 2025, Amcor, a global leader in developing and producing responsible packaging solutions, announced it has designed and produced a bespoke three-compartment ready meal tray for a new range of single-serve ambient microwaveable ready meals from specialist French manufacturer Cofigeo.

“This was a challenging project, especially given its shape, to make the tray as thin as possible, but thanks to the technical support of Amcor, we have managed to achieve the same wall thickness as our standard single compartment version,” said Jean-Michel Perquin, Cofigeo Group Packaging R&D Manager. “Equally important, despite the number of different ingredients across the five meals, all are filled efficiently on the line.”

Circular economy principles have been driving innovation in the fluted carton trays market, with significant focus on material optimization, recyclability, and low-carbon manufacturing. Advances in corrugation techniques and fiber strength enhancement are being integrated to increase load-bearing capacity and moisture resistance.

Retailers have adopted mono-material tray formats that ease sorting and enhance end-of-life recyclability. To meet sustainability goals, many suppliers have aligned their trays with FSC-certified board standards and water-based adhesives. Innovations in die-cutting and folding allow customizable branding while maintaining eco-compliance across various applications.

By 2035, additional market opportunity is expected to be unlocked through the rise of direct-to-consumer channels, retail-ready packaging, and plant-based food packaging needs. Suppliers investing in automation and AI-enabled production lines are likely to gain cost efficiencies and shorten lead times.

Moreover, compliance with extended producer responsibility (EPR) norms across Europe and parts of Asia will influence design innovation. Manufacturers offering high-strength, formable, and easily recyclable trays are expected to hold competitive advantage. Strategic collaborations between packaging converters and large FMCG companies are anticipated to shape the next wave of product standardization and market penetration.

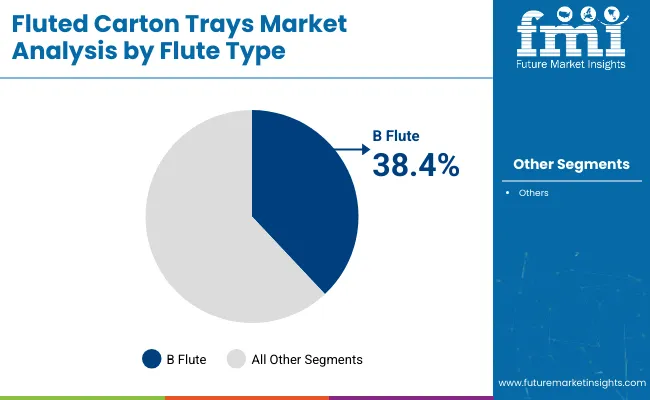

The market is segmented based on flute type, tray style, end-use industry, and region. By flute type, the segmentation includes A, B, C, E, and F flutes, along with double-wall combinations such as BC and EB; B and C flutes are most commonly adopted for balancing stacking strength and cushioning for transit packaging.

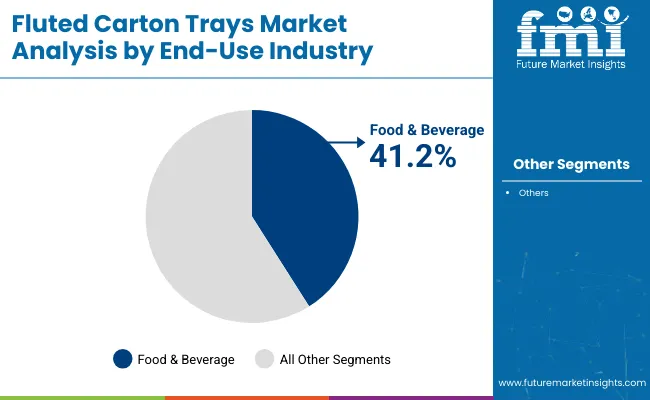

Tray styles include die-cut, foldable, partitioned, slotted, and display trays, with die-cut trays dominating due to their customizability and precise fit for automation and branding. End-use industries comprise food & beverage, fresh produce & agriculture, bakery & confectionery, consumer goods, pharmaceuticals, industrial components, and retail & e-commerce food-related segments dominate due to the rising demand for hygienic, lightweight, and eco-friendly packaging. Regionally, the market covers North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

B flute has been projected to account for 38.4% of the corrugated box flute type market by 2025, due to their excellent crush resistance and compact profile. These trays have been preferred for applications where stacking strength and rigidity are vital without compromising space efficiency. Their ability to absorb shocks and resist deformation has made them ideal for shipping and retail displays.

Furthermore, compatibility with automated packing lines has improved adoption in high-throughput packaging environments. B flute trays have been widely used in the packaging of fragile and semi-rigid goods across sectors.

The fine flute structure has enabled superior printability, which enhances brand visibility and shelf appeal. Their recyclability and use in FSC-certified corrugated board solutions have aligned with retailer sustainability mandates. Increased demand for robust, eco-friendly secondary packaging has been instrumental in driving B flute tray sales across regional supply chains.

Manufacturers have integrated B flute trays into customized die-cut formats for varying load requirements. Their performance in moisture-prone environments has been enhanced with food-safe coatings. Lightweight yet durable characteristics have ensured efficient logistics and reduced carbon footprint.

Moreover, rapid growth in e-commerce and food delivery services has fueled demand for corrugated trays with precise product fit and reliable protective properties. As supply chains continue to prioritize material efficiency and consumer appeal, B flute trays are expected to maintain dominance.

Enhanced adaptability across manual and automated systems has further supported widespread industry preference. Suppliers have focused on innovations in board composition and digital printing to meet evolving customer needs. With cost-effectiveness, rigidity, and design versatility, B flute trays remain a market mainstay.

The food & beverage industry has been estimated to dominate end-use consumption in the flute-based corrugated packaging market with a 2025 share of 41.2%. Fluted trays have been extensively used to package bottled drinks, frozen meals, snacks, and dairy products. Their stackable design has supported efficient retail display and in-store shelf replenishment.

Food-grade coatings and laminated liners have been adopted to meet safety and moisture resistance standards. Tray formats have allowed customization for product-specific containment, branding, and point-of-sale presentation. Corrugated trays have proven ideal for produce, meal kits, and ready-to-eat offerings in both cold and ambient conditions.

Compliance with food safety standards such as BRC and FDA has influenced procurement preferences. Recyclable and compostable materials have also been introduced to align with retailer and consumer sustainability expectations.

The rapid rise in takeout, foodservice, and meal delivery has boosted the use of lightweight, disposable fluted trays. Cost savings, thermal insulation, and easy handling have increased their utility in fast-moving consumer goods (FMCG). Retailers have adopted corrugated trays with die-cut features for promotional displays and seasonal packaging formats.

Standardization of tray dimensions has allowed smoother palletization and warehouse integration. With demand driven by freshness, visual merchandising, and eco-conscious consumption, food & beverage brands are expected to remain key buyers of fluted trays. Packaging vendors have responded by offering modular, automation-compatible designs. Enhanced print graphics, structural resilience, and environmental compliance have made fluted carton trays indispensable in modern food packaging logistics.

Raw Material Price Volatility and Plastic Alternative Competition

Fluctuating raw material costs, especially in virgin and recycled paperboard supply chains is one of the key challenges faced for the growth of fluted carton trays market. Another factor grazing on our market share is the competition from plastic-based alternatives that provide durability and moisture resistance but at a significantly lower cost.

Overcoming these challenges will necessarily involve investments in low-cost, fibre-based coatings, supply chain optimization, and hybrid packaging solutions that balance performance and sustainability.

Expansion of Customizable and Smart Packaging Solutions

There is a high opportunity for growth in the market, as demand for customizable and smart packaging solutions increases. Digital printing, QR-coded traceability and moisture resistant carton coatings are all in sync with brand marketing and consumer engagement trends.

Meanwhile, new levels of compost ability and biodegradability in carton tray materials are offering packaging integrity while achieving sustainability goals. With increasing regulatory pressure and a growing preference among consumers for environment-friendly solutions, the fluted carton trays market is likely to witness significant growth over the next ten years.

Fluted cartons in the United States are a major market continuing to grow with increasing adoption of sustainable and eco-friendly packaging solutions in food industries, rising regulatory pressures on reducing plastic waste, and the growing adoption of biodegradable packaging in the food and beverage industries.

The growing penetration of e-commerce and ready-to-eat meal services is driving demand for durable and lightweight fluted carton trays. Industry growth is further fuelled by rising adoption of recyclable materials and closed-loop packaging systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.4% |

The UK fluted carton trays market is anticipated to grow over the forecast period in the region due to strict government regulations with respect to single-use plastics, rising consumer preference for compostable and recyclable packaging and growing demand for premium food packaging solutions in the region. Growing food delivery and takeaway industry is leading to innovations in lightweight and durable tray designs.

More labour is thought to be being offered to drinks having less wasteful packaging, whilst deposit-return systems for food holders are also having effects on the availability of space. Water-based inks and chemical-free coatings adopted for greater sustainability are also adding to product attractiveness.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.7% |

Germany, France, and Italy have emerged as market leaders for fluted carton trays in the European Union, thanks to solid circular economy policies, growing investments in sustainable material for packaging, and surge in demand for eco-friendly substitutes to plastic trays. As such, EU’s strict directives on packaging waste and extended producer responsibility (EPR) initiatives are driving innovation in recyclable & biodegradable carton trays.

Moreover, the rising popularity of plant-based food items and the growing need for premium bakery and confectionery packaging are further propelling the growth of the market. Automation trends in packaging production and developments in digital printing technologies, are accumulating to improve industry competitiveness.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.0% |

The growth of Japan fluted carton trays market is attributed to, increasing high-quality & aesthetic food packaging demand, government support for sustainable materials, and growing consumer preference towards recyclable packaging product. And operations at carton trays that are lightweight and space-saving are describing innovation with the country’s emphasis on compact and efficient packaging designs.

The surging number of convenience stores and the soaring demand for home meal replacement (HMR) are also driving the demand for durable and microwavable carton trays. Packaging types with advanced features like QR codes that assist in product traceability are also influencing market dynamics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.6% |

In South Korea, the growing government initiatives to reduce plastic waste, increased adoption of sustainable food packaging solutions, and a healthy expansion of e-commerce are driving the market for fluted carton trays. Growing demand from fast-food chains and food delivery services is driving the sales of durable and sustainable carton trays.

Innovations in water-resistant and oil-repellent coatings for food trays further boost product usability. Moreover, the growing use of digital printing technologies in custom packaging solutions, as well as the incorporation of AI-driven waste management strategies, contribute to the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.3% |

Growing demand for sustainable packaging solutions, increasing adoption of eco-friendly food packaging, and technological advancements in corrugated material are the major driving forces for the growth of the fluted carton trays market.

It is a steadily growing market with the increasing demand of e-commerce, fresh produce packaging, and takeaway food services. Key trends underlying the global market's growth are lightweight and recyclable carton trays, biopolymer-based coating innovations, and customization for branding and product differentiation.

The overall market size for the fluted carton trays market was USD 9.8 billion in 2025.

The fluted carton trays market is expected to reach USD 23.4 billion in 2035.

The top 5 countries driving the development of the fluted carton trays market are the USA, China, Germany, France, and India.

The Single Wall Board Fluted Carton Trays segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Carton Sealer Machine Market Size and Share Forecast Outlook 2025 to 2035

Carton Liners Market Size and Share Forecast Outlook 2025 to 2035

Carton Bottle Market Size and Share Forecast Outlook 2025 to 2035

Carton Display Market Size and Share Forecast Outlook 2025 to 2035

Carton Folding And Gluing Machine Market Size and Share Forecast Outlook 2025 to 2035

Carton Serialization Machine Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Market Share Breakdown of Carton Display Industry

Industry Share & Competitive Positioning in Carton Bottle Market

Carton Sealing Tape Market

Carton Sealer Market

Carton Form Fill Seal Machine Market

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Egg Carton Manufacturers

Milk Carton Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Brick Carton Packaging Industry

Brick Carton Packaging Market by Packaging Type from 2024 to 2034

Pizza Cartons Market

Dairy Carton Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA