Increasing demand from automotive, aerospace, construction, electronics, healthcare, and chemical processing sectors has been estimated to contribute to the steady growth of the fluoropolymer market from the forecast period 2025 to 2035 Because of this unique high-temperature stability, absolute safety, and low fringe, These are more reliable than any polymers in tough industrial environments and sensitive applications.

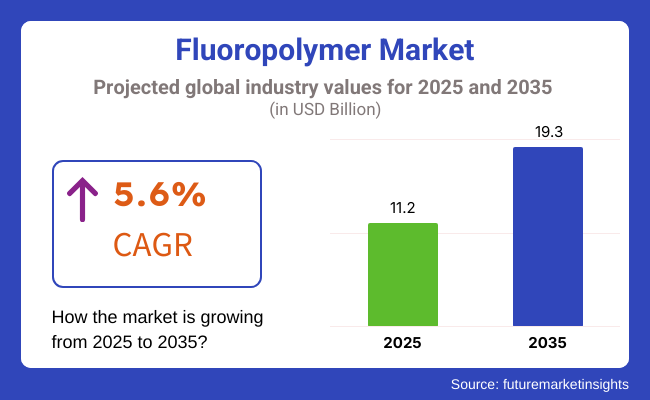

It is expected that the global market will rise from USD 11.2 Billion at 2025 to USD 19.3 Billion by 2035, and the 2023 to 2035 CAGR will be around 5.6%. Fluoropolymers' versatility and importance are illustrated by their growing use in electric vehicle batteries, semiconductors and renewable energy systems. Rising use of these materials in medical devices and pharmaceutical packaging; due to non-reactive and biocompatible characteristics.

Fluoropolymers have been utilized in protective coatings, architectural membranes, and high-performance seals to improve durability and service life. Because of its low signal loss, high dielectric strength, and high thermal stability, electrical insulation and wire insulation are built on fluoropolymer materials for use in electronics as a wire insulation.

Fluoropolymers also continue to remain a key material of choice owing to their durability, life span, and low-maintenance properties with the ever-increasing demand for sustainable and energy-efficient solutions from a variety of industries.

With these trends, and an expanding universe of end-use applications, fluoropolymers are poised for robust growth, enabling modern industries to meet changing demands while preserving the fluoropolymer legacy of reliability and performance.

Explore FMI!

Book a free demo

North America significantly contributes to the demand for fluoropolymers due to its strong demand across various sectors, including automotive, electronics, and healthcare. The consumption in high-end applications represents North America-led where advanced fluoropolymers are utilized in diverse applications such as semiconductor fabrication, fuel cell membranes, and medical device components.

Their chemical inertness, thermal stability, and superb dielectric characteristics, fluoropolymers are also important to the area’s semiconductor industry, which uses them in many chip fabrication processes.

As semiconductors and next-generation electronics require rising investments and domestic costs, manufacturers will want better kinds of fluoropolymer, of which high-purity, high-performance varieties will be in great demand.

The shift to electric vehicles (EVs) in the auto sector is also fuelling the demand for fluoropolymer coatings, seals, and battery components. The regional market's growth is driven by the use of such materials in EV manufacturing to improve battery safety, thermal management, and efficiency.

As the North American fluoropolymer market has gradually established its position, it is expected to be increasingly bolstered with every investment in both a century industrial base and advanced and high technologies.

European market is driven largely by fluoropolymers in automotive and aerospace. Countries such as Germany, France, Italy, and the United Kingdom are thereby leading the market with respect to the adoption of fluoropolymers owing to the chemical resistance, low friction & thermal stability.

The automotive sector, and Europe specifically, plays an important role in adopting a new generation of fluoropolymer components. Fluoropolymers are widely used in fuel cell membranes, EV battery components and high-performance seals, all critical to improving energy efficiency and reducing emissions.

Fluoropolymers are also used in the European aerospace industry, primarily for coatings and insulation materials. Fluoropolymers have become a blanket foundation for the aerospace industry due to their resistance against severe environments.

Moreover, due to strict environmental policies in Europe, there is a growing demand for fluoropolymers with long-lasting and low-maintenance properties that reduce the need for frequent replacements, resulting in a lower environmental impact. Mass additions of wind and solar farms, the use of fluoropolymers is also increasing in all sorts of applications such as cable insulation and protective coatings and in photovoltaic device components.

Asia-Pacific is the largest and fastest-growing market for fluoropolymers, driven by fast-paced industrialization, urbanization, and rising investments in high-tech industries. The electronics and semiconductor sector is a key driver of fluoropolymer.

South Korea’s plans to become a key player in the global semiconductor market have driven huge investments in domestic production facilities, which employ fluoropolymers for etching, cleaning, and insulating.

South Korea and Japan are also big players in advanced electronic devices, batteries, and EV components, which heavily depend on fluoropolymers for high-performance coatings, separators, and chemical-resistant components. Adopting hybrid and electric vehicles will drive demand for lightweight and durable materials that improve efficiency and safety across the region's automotive market.

The demand for fluoropolymer applications in pipes, fittings, and industrial coatings is opening new fluoropolymer opportunities for the fluoropolymer market in India owing to a large number of infrastructure development and water treatment projects.

The region’s growing pharmaceutical and healthcare industries are also increasing demand for medical-grade fluoropolymers for packaging, drug delivery devices, and surgical instruments.

With strong industrial growth and government support to encourage advanced manufacturing and sustainability, the Asia-Pacific region is set to remain a global powerhouse in the fluoropolymer market.

High Production Costs and Regulatory Compliance

The Fluoropolymer Market is also confronting challenges such as high production costs, strict environmental regulations, and complex manufacturing processes. Fluoropolymers are costlier, owing to the use of special raw materials like Fluorspar and complex processing methods.

Additionally, per- and polyfluoroalkyl substances (PFAS) with many fluoropolymer agents have led to tougher regulations on the production and use of fluoropolymers due to their potential environmental impact. On top of that, companies responsible for sustainability must keep products up to quality with all the regulations.

How does a manufacturer stay ahead of the curve? By finding methods of production that prioritize reducing costs, exploring other feedstock options, and adopting fluoropolymer formulations to meet regulatory demands that will continue to change with time.

Expanding Applications in High-Performance Industries

Increasing demand for fluoropolymers in highly vital sectors like aerospace, automotive, electronics, and healthcare, immense growth opportunities lie ahead. Fluoropolymers have great chemical resistance and thermal stability and are non-stick, making them a good choice for many high-performance applications.

Rising electric vehicles (EVs) sales, combined with the demand for advanced semiconductor manufacturing, are driving fluoropolymer coating, insulation material, and specialty film demand. Also, the growing adoption of medical-grade fluoropolymers in implantable equipment, surgical instruments, and drug delivery systems is creating opportunities for market growth.

The Fluoropolymer Market has had stable growth primarily due to increasing industrial applications, wide usage of nonstick fluoropolymer coatings, and advancements in polymer processing. The demand for Fluoropolymers was driven by a mounting trend towards lightweight, high-performance materials in the aerospace and automotive industries.

Stakeholders became much more production of potencies-centric than this ever had been, few tried to leverage their years behind, whilst supply-lining things from supply chain issues and raw materials priced volatility was not remaining, and enterprise contracts have been set within the very long run with most medium-sized companies in the raw materials market.

As anticipated, from 2025 to 2035, there will be rapid adoption of sustainable & next-generation fluoropolymers. PFAS-free fluoropolymers will drive the research and development of more sustainable alternatives with similar performance characteristics. AI and automation offer improved quality control, increased efficiency, and decreased waste in polymer manufacturing.

In addition, the increase in focus on high-temperature, chemically resistant materials in the semiconductor, renewable energy, and medical industries will drive demand. Companies leveraging circular economy principles to enhance fluoropolymer recycling technologies, creating bio-based alternatives, etc., will expand market.

Market Shifts: A Comparative Analysis

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased scrutiny on PFAS-related fluoropolymers |

| Technological Advancements | Improved polymer processing techniques for high-performance applications |

| Industry Adoption | Growth in automotive, aerospace, and cookware applications |

| Supply Chain and Infrastructure | Fluctuating raw material prices impacting production costs |

| Market Competition | Presence of established players and niche product innovators |

| Market Growth Drivers | Demand for lightweight, heat-resistant, and chemical-resistant materials |

| Environmental Sustainability | Development of low-emission fluoropolymer alternatives |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental policies promoting PFAS-free and sustainable alternatives. |

| Technological Advancements | AI-driven automation in fluoropolymer production and development of bio-based alternatives. |

| Industry Adoption | Expansion into EVs, renewable energy, and medical-grade fluoropolymers. |

| Supply Chain and Infrastructure | Development of regional supply chains and improved fluoropolymer recycling technologies. |

| Market Competition | Rise of sustainable polymer start-ups and increased competition from emerging economies. |

| Market Growth Drivers | Stronger emphasis on sustainability, circular economy integration, and performance-driven innovation. |

| Environmental Sustainability | Advancements in fluoropolymer recycling, biodegradable formulations, and green manufacturing processes. |

The market for Fluoropolymers in the United States is expected to move steadily due to the growing demand from various applications including aerospace, semiconductor manufacturing and medical. The USA semiconductor industry, whose crown jewels include companies such as Intel, Texas Instruments, and Global Foundries, is a large consumer of fluoropolymer coatings and films used in high-performance electronics.

The automotive sector, however, in particular, is driving demand for wire insulation, gaskets and fuel system coatings based on fluoropolymers, with the expanding electric vehicle market also strongly linked to fluoropolymers. Moreover, biocompatible fluoropolymers are used in the medical industry for drug-delivery devices, catheters, and implants.

The United States fluoropolymer market is expected to grow steadily, given the stringent regulations from the FDA regarding medical materials and the increasing investment in fluoropolymer-based solutions for 5G and advanced electronics.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

The growing penetration of the fluoropolymer in aerospace, healthcare & industrial applications is expected to drive the United Kingdom fluoropolymer market. The aerospace sector in the UK - whose big players include BAE Systems and Rolls-Royce - heavily relies on fluoropolymer coatings and composites, which are employed in everything from wiring to fuel lines and structural parts.

The medical device industry is another growth area where fluoropolymers are used for surgical instruments, tubing, and biopharmaceutical manufacturing. So, too, are the corrosion-resistant linings and insulation materials made from fluoropolymers revolutionizing the industrial coatings and chemical processing sectors. The steady pace of growth in the UK fluoropolymer market is driven by mounting regulatory pressure for sustainability and improvements in high-performance materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

The fluoropolymer market in the European Union is poised to show steady growth driven by growing demand in the automotive, electronics, and chemical industries. The EU, with Germany, France, and Italy as the three leading automotive producers, are major constituencies for fluoropolymer-based coatings, seals, and gaskets for EVs and fuel-efficient combustion engines.

To improve chip-making and high-performance electronics, fluoropolymer films and coatings are used more in the semiconductor and electronics industry, primarily in Germany and the Netherlands.

The EU’s stringent environmental laws on perfluorinated chemicals (PFCs) pave the way for innovation in sustainable fluoropolymers, with manufacturers experimenting with low-impact alternatives for coatings and insulation material.

The need for innovative solutions, sustainable fluoropolymer technology, and its increasing adoption in automotive and semiconductor applications in the coming years is expected to drive growth in the EU fluoropolymer market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

The Japanese fluoropolymer market seems to witness demand from the high-tech industry, semiconductors and electronics & automotive applications, which, in turn, is expected to drive the market in the country. Japan is one of the world leaders in batched semiconductor manufacturers, with companies like Tokyo Electron and Renesas Electronics raising the requirement for fluoropolymer-based combings and movies.

The automotive industry, especially in hybrid and electric vehicles, is also increasing the usage of fluoropolymer-based gaskets, wire insulation, and battery components. Demand for biocompatible fluoropolymers in medical implants and drug delivery systems is also driven by Japan’s progress in medical technology.

The Japanese fluoropolymer market has a steady growth outlook owing to the strategic investments in research and development in high-performance materials and their booming usage in electronics and healthcare industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The South Korean fluoropolymer market is expanding, with surging demand from the semiconductor, electronics, and EV battery sectors. Major semiconductor manufacturers such as Samsung and SK Hynix are based in South Korea, employing fluoropolymer-based coatings and films to improve chip production efficiency.

The growing use of fluoropolymers in lithium-ion batteries, wire insulation, and lightweight composite materials for electric vehicles (EVs) is a boon for players, such as HC and LG Energy Solution, in the EV industry that is on a growth trajectory.

Moreover, South Korea's innovative chemical processing sector is integrating fluoropolymer-based corrosion-resistant materials in both petrochemical plants and industrial applications.

The South Korean fluoropolymer market is anticipated to grow steadily as an active investment environment in semiconductor technology, EV batteries, and industrial coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

High durability, chemical resistance, and long-term reliability upon exposure to extreme conditions of PTFE and PVDF segments capture a major share of the fluoropolymer market.

These high-end fluoropolymers are critical to the delivery of enhanced thermal stability along with very low friction and extreme electrical insulation properties, which makes them a necessary part of the automotive, healthcare, industrial processing, and electronics sectors.

Fluoropolymers can be of many types, but the most common fluoropolymer is polytetrafluoroethylene (PTFE) due to its chemical inertness, high dielectric properties, and high heat resistance.

With the rising demand for PTFE for industrial applications such as corrosion-resistant materials in chemical manufacturing, food processing, and mechanical engineering, PTFE-based components applications have increased across industries, focusing on material longevity and operational safety.

Stringent regulations and increased diversity of PTFE applications in medical and healthcare devices with enhanced biocompatible coatings for surgical implants, catheters, and laboratory equipment have further fuelled the market demand, which will ensure a greater adoption measure in precision healthcare technologies.

The use of PTFE in automotive engineering with low-friction seals, gaskets, and hoses for high-performance engines has increased adoption, ensuring better fuel efficiency, amplified durability, and lesser component wear.

Market growth has been accelerated through the development of new generations of PTFE composites that exhibit reinforced PTFE using ceramics or carbon as fillers to increase mechanical strength and thermal conductivity for a wide range of stress-intensive engineering applications.

Emerging advanced coatings based on polytetrafluoroethylene (PTFE), non-stick, heat-resistant, and water-repelling compositions have bolstered the market growth by offering excellent utility in cookery, textiles, and building construction.

The advantages of PTFE, such as chemical stability, high-temperature resistance, and non-reactivity, are counterbalanced by challenges, including production cost, environmental issues related to perfluorooctanoic acid (PFOA) emissions, and diminished mechanical strength, which makes them not ideal for structural use.

PTFE is still a significant form in the family of fluoropolymers, and novel synthetic processes, as well as AI-supported polymer formulation tools and hybrid PTFE composites, will further resolve the cost, environmental, and mechanical limitations of PTFE, broadening the scope of fluoropolymers in the market.

Polyvinylidene fluoride market adoption has surged across industries, primarily in chemical processing, electronics, and renewable energy, as manufacturers further deploy PVDF-based solutions to improve the structural integrity of their products, enhance flame resistance, and provide long-lasting environmental stability. PVDF offers better mechanical strength, excellent UV resistance, and superb chemical resistance than conventional thermoplastics, thus its key role in aggressive industrial environments.

PVDF coatings are being increasingly used in construction and architectural applications, including multi-component weather-resistant, anti-corrosive, and high-gloss coatings for metal facades and structural components, leading to wider adoption of PVDF-based fluoropolymers among construction firms owing to high-performance, aesthetic, and low-maintenance advantages offered by fluoropolymers.

Thus, it is shown that PVDF coatings also increase the durability of metal structures and structures by more than 30%, reducing maintenance costs and complexity and increasing the reliability of buildings.

Ultra High Molecular Weight (UHMW) PVDF to Provide Superior Filtration Efficiency and Fouling Resistance, Has Strongly Reinforced Market Demand as a Result of High Segment Adoption in Desalination Plants, Pharmaceutical Processing, and Wastewater Treatment Systems.

PVDF, with high dielectric strength, flame-barrier ability, and excellent electrochemical stability, which are integrated into lithium-ion battery separators, also contribute to the increased adoption, enhancing the safety, energy efficiency, and durability of the battery system, such as EVs and energy storage systems.

The evolution of graphene-infused PVDF composites with improved thermal conductivity and mechanical strength has accelerated market expansion, increasing utilization in lightweight coatings, flexible devices, and aerospace applications.

The introduction of PVDF-based photovoltaic back sheets, with high UV resistance, excellent weather ability, and excellent electrical insulation properties, has encouraged market expansion and ensures better performance of its application in solar energy systems and renewable power.

However, PVDF has to overcome challenges such as high prices of raw materials, processing problems, and environmental issues regarding fluoropolymer waste disposal. But through new inventions in bio-derived PVDF synthesis, AI-enhanced process optimization, and closed-loop PVDF recycling systems, sustainability, cost efficiency and market competitiveness are improving, leading to continued growth for PVDF-based fluoropolymers.

Some of the key market frontrunners of the two segments are automotive & electrical & electronics. Industries are increasingly using fluoropolymer-based materials for improved durability, enhanced thermal stability, and superior reliability under extreme operating conditions across various end-user industries.

Fluoropolymer-based materials have been one of the fastest-growing segments for automotive applications for the last four decades as the automotive vehicle manufacturers focus on fuel economy and emissions, yet can offer long-term durability, PTFE, PVDF and FEP. Fluoropolymers exhibit higher heat, chemicals, and mechanical stress resistance than ordinary polymeric materials, making them indispensable for high-performance automotive engineering.

High-performance fluoropolymers are witnessing widespread adoption in applications such as vehicle engine components such as low-friction PTFE coatings for piston rings, cylinder liners, and bearings as the automotive OEMs continue to move towards energy efficiency improvement and engine wear reduction.

The introduction of fluoropolymer-based fuel system components offering PVDF fuel lines, FEP-coated fuel tanks, and corrosion-resistant gaskets has bolstered the market demand, therefore promoting greater penetration in hybrid and fuel-efficient vehicle platforms.

While offering benefits like improved component life, reduced fuel consumption, and enhanced thermal management, integrating fluoropolymers into automotive applications is hampered by high material costs, a lack of recycling infrastructure, and processing complexity.

Recent advancements with AI-powered polymer design, hybridization of fluoropolymer-metal composites, and closed-loop recycling programs for fluoropolymers enhance sustainability, cost-effectiveness, and market scalability, keeping the prospects for automotive fluoropolymer applications on a growth trend.

Electrical & electronics applications will dominate the market, with strong growth in semiconductors, high-voltage insulation, and flexible electronics, as techcos increasingly turn to fluoropolymers to increase circuit reliability, improve thermal stability, and guarantee high-performance insulation.

In contrast to conventional insulating materials, fluoropolymer dielectric materials exhibit low dielectric loss, high breakdown voltage, and excellent dielectric properties, making them ideal for next-generation components and applications.

Although its benefits include high insulation resistance, high resistance to electric arcs, good circuit protection, and electronic miniaturization, fluoropolymers have constraints in their use in the electronics area, specifically processing challenges, environmental concerns, and production costs. However, new advances in AI-assisted material design, nanocomposite fluoropolymers, and sustainable polymer processing are enhancing efficiency, sustainability, and market viability and will maintain market growth rates for fluoropolymer-based electronic applications.

The fluoropolymer global market is expanding at a great pace because of growth in the demand for high-performance polymers & plastics in automotive, aerospace, electronics, chemical processing, healthcare, etc. Companies are working on low-friction coatings, high-heat-resistant fluoropolymers, and sustainable processing techniques to improve durability, chemical resistance, and energy efficiency.

Fluoropolymer formulation players include global chemical manufacturers and specialized fluoropolymer developers, who drive technological advancements in PTFE, PVDF, FEP and other formulations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Chemours Company | 15-20% |

| Daikin Industries Ltd. | 12-16% |

| 3M Company (Dyneon Fluoropolymers) | 10-14% |

| AGC Inc. (Asahi Glass Co.) | 8-12% |

| Solvay S.A. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Chemours Company | Develops Teflon™ PTFE, PFA, and FEP fluoropolymers for coatings, semiconductors, and chemical processing. |

| Daikin Industries Ltd. | Specializes in high-performance fluoropolymers (PVDF, ETFE) for electronics, automotive, and industrial applications. |

| 3M Company (Dyneon Fluoropolymers) | Manufactures low-friction, high-durability fluoropolymers for medical, aerospace, and industrial sectors. |

| AGC Inc. (Asahi Glass Co.) | Provides PTFE, FEP, and ECTFE-based fluoropolymer coatings and resins for chemical resistance applications. |

| Solvay S.A. | Offers fluorinated polymers such as PVDF and Hyflon® for automotive, coatings, and battery applications. |

Key Company Insights

Chemours Company (15-20%)

Chemours is the leading fluoropolymer manufacturer, creating Teflon™ and other advanced, versatile fluoropolymers and providing AI-assisted polymer formulation to create high-performance coatings and applications in commercial and industrial settings.

Daikin Industries Ltd. (12-16%)

Daikin is known for PVDF and ETFE fluoropolymers with high-temperature resistance, electrical insulation, and chemical durability across numerous industries

3M Company (Dyneon Fluoropolymers) (10-14%)

3M supply specialty fluoropolymers for aerospace, medical devices, and industrial coating applications, designed for low friction and high wear resistance.

AGC Inc. (Asahi Glass Co.) (8-12%)

AGC manufactures fluoropolymer coatings and resins, which are engineered for chemical resistance and heat stability in both semiconductor and automotive applications.

Solvay S.A. (5-9%)

High-performance PVDF and Hyflon® fluoropolymers at Solvay with a commitment to sustainability-based production processes for energy storage and coatings for these products equally.

Next-gen fluoropolymer solutions, AI server based performance analytics on materials, and green polymer processing are some of the offerings brought to you by several manufacturers in the chemical segment. These include

The overall market size for Fluoropolymer Market USD 11.2 Billion In 2025.

The Fluoropolymer Market expected to reach USD 19.3 billion in 2035.

The demand for the fluoropolymer market will grow due to increasing applications in automotive, electronics, and healthcare industries, rising demand for high-performance materials with chemical resistance, advancements in manufacturing technologies, and growing adoption in renewable energy and aerospace sectors.

The top 5 countries which drives the development of Fluoropolymer Market are USA, UK, Europe Union, Japan and South Korea.

Polytetrafluoroethylene (PTFE) and Polyvinylidene Fluoride (PVDF) Drive Market to command significant share over the assessment period.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.