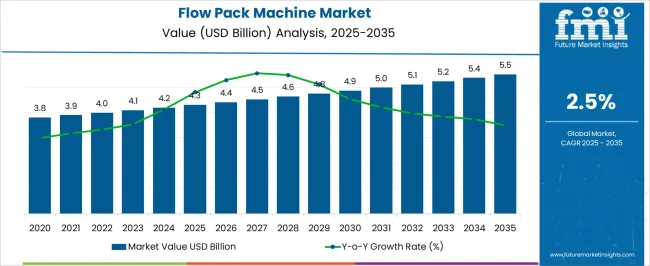

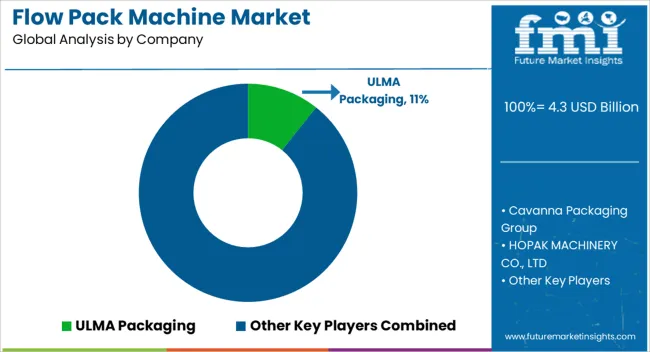

The Flow Pack Machine Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 5.5 billion by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period.

| Metric | Value |

|---|---|

| Flow Pack Machine Market Estimated Value in (2025 E) | USD 4.3 billion |

| Flow Pack Machine Market Forecast Value in (2035 F) | USD 5.5 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

The flow pack machine market is advancing steadily, supported by rising demand for flexible packaging solutions in food, pharmaceutical, and consumer goods sectors. Growth is fueled by increasing consumer preference for hygienic, tamper-proof, and shelf-ready packaging formats.

Automation has become a critical driver, reducing labor costs and enhancing production efficiency in high-volume packaging operations. Horizontal and vertical flow wrapping technologies are being adopted to accommodate diverse product formats, while customization trends are leading to innovations in sealing and cutting mechanisms.

The current market outlook is strengthened by demand from food and beverage industries, where product safety and extended shelf life are critical. Looking ahead, technological integration such as IoT-enabled monitoring and smart packaging solutions is expected to further enhance efficiency and market competitiveness.

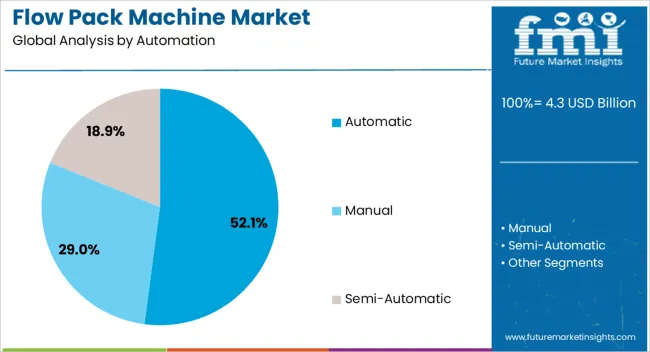

The automatic segment holds approximately 52.1% share in the automation category, reflecting its dominance in high-output packaging operations. Automated flow pack machines enable consistent sealing quality, reduced product wastage, and increased throughput, making them highly preferred in large-scale production environments.

The segment’s adoption has been supported by labor shortages and rising production costs, prompting manufacturers to invest in automation for long-term efficiency gains. Integration with smart sensors and programmable logic controllers has further improved operational reliability.

With sustained demand for cost-effective and hygienic packaging solutions, the automatic segment is expected to retain its leadership, especially in industries with continuous packaging requirements.

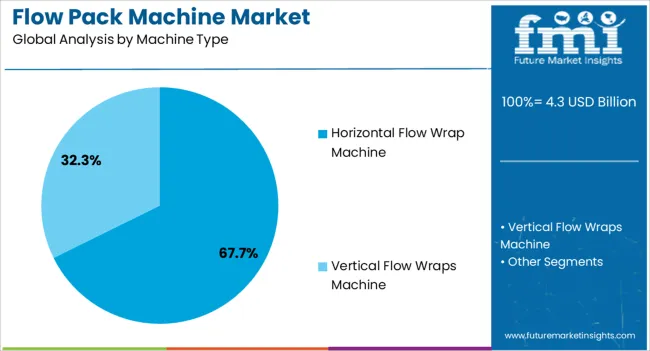

The horizontal flow wrap machine segment dominates the machine type category with approximately 67.7% share, driven by its versatility in handling a wide range of solid products, including confectionery, bakery goods, and packaged snacks. These machines provide secure wrapping, high-speed performance, and adaptability to different product dimensions, supporting widespread industry adoption.

Their ability to ensure product integrity and enhance presentation has strengthened their role in competitive food and consumer goods markets. Continuous technological improvements in servo-driven control systems and user-friendly interfaces have further boosted efficiency.

With food safety and convenience remaining top priorities, the horizontal flow wrap machine segment is projected to sustain its leadership position.

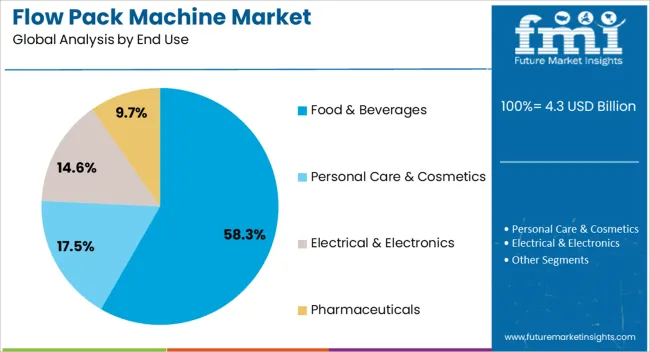

The food and beverages segment accounts for approximately 58.3% share of the end-use category in the flow pack machine market. This dominance is driven by the sector’s need for high-speed, hygienic, and cost-effective packaging solutions.

Flow pack machines are widely utilized for bakery items, confectionery, ready-to-eat meals, and dairy products, ensuring extended shelf life and compliance with stringent safety standards. The segment benefits from rising demand for packaged and convenience foods across both developed and emerging economies.

Increasing investment in retail-ready and single-serve packaging formats has reinforced demand. With continuous growth in global food consumption and heightened focus on product safety, the food and beverages segment is expected to remain the leading end-use category.

Automation Leads the Way

Automation demand in sectors like food, beverage, consumer goods, and pharmaceuticals is rising. These industries demand automated flow packaging machines to reduce manual labor and increase their outputs. Convenient and eco-friendly options are being preferred by consumers.

Emphasis on reducing material waste is high in almost every sector. Regulatory requirements for product safety, labeling, and traceability are getting stricter in various industries. Businesses are, therefore, ordering these machines to minimize compliance risks and uphold their reputations. SMEs are also ordering more of these machines due to better affordability and accessibility.

Manufacturers Cater to the Demand for Portable and Cost-effective Machine

Flow pack machine manufacturers are noticing an emerging demand from small businesses for packaging machines that are small, cheap, and easy to use. This is, therefore, leading to opportunities to make special machines for these businesses, like mini flow pack machines. This can help them reach more customers in the small business sector.

They can also offer extra services like helping with packaging designs and training. This can make clients happier and bring in more revenue. Using tech like cloud, AI, and smart machines can lead to the launch of better machines. Also, opportunities can arise when looking at making machines for various sectors, like for packaging medical products or cosmetics.

Global flow pack machine sales increased at a CAGR of 1.8% from 2020 to 2025. Countries in the Asia Pacific region are urbanizing and industrializing. China and India are at the top of the list. This hints at more growth in these regions. So, automatic flow pack machines are in demand to package products.

Companies in these regions are buying these machines to make more products and compete with others worldwide. This helps the flow pack machine industry grow because more people in growing countries are buying them, and it gives companies a chance to sell in new places and industries.

In light of the shifting focus towards eco-friendly packaging materials across the entire packaging industry, many players are adopting flow pack packaging methods. Therefore, the adoption of efficient sealing methods for flow packs is crucial for those embracing sustainable packaging materials to reinforce their market positioning and meet growing demands for enhanced product protection.

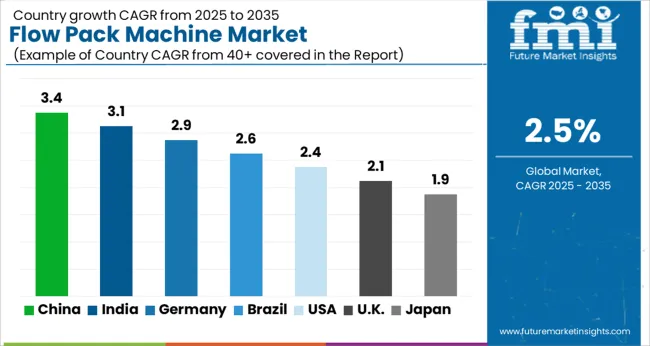

This section analyzes the demand for flow pack machines in key countries as given in the table below. The industry is led by sales of flow pack machines in India. China and Thailand are close behind. This indicates that Asia Pacific is emerging as a key hotspot for growth. In this section, a detailed analysis is offered to understand Asia Pacific’s lead in the industry.

| Countries | CAGR 2025 to 2035 |

|---|---|

| China | 4.2% |

| India | 5.1% |

| Thailand | 3.8% |

The flow pack machine market demand analysis points to a 4.2% CAGR for China till 2035. In China, there's a big increase in convenience stores and grab-and-go shops. This translates to a high need for packaging machines that can quickly pack single-serve snacks and meals. Also, they are using artificial intelligence and robots in packaging and manufacturing.

With so many people shopping online, they need packaging that's secure and easy to open, so manufacturers are making machines that can do this. And because food safety is a big concern, investments in machines that can make sure food packaging is clean and safe are rising. These factors are cumulatively raising the demand in China.

The demand for flow pack machines in India will rise at a 5.1% CAGR until 2035. In India, small businesses are growing, and the government is supporting food processing. Also, online shopping is booming, and people want safe packaging. Indian companies are making machines that are affordable for small businesses and make sure food is packed safely.

These machines follow the rules to keep food safe. Other than food processing, applications in cosmetics and pharmaceuticals sectors are rising. The rise of direct-to-consumer brands also catalyzes sales in India.

The demand for flow pack machines in Thailand will escalate at a 3.8% CAGR till 2035. The country is a leading Halal food producer. This creates a need for machines that can package food according to the rules specific for Halal food. Therefore, Thai companies are investing in machines that use eco-friendly materials and can label food with nutrition information.

Plus, Thailand exports various food products to other countries, so there is a need for machines that can package food for export. This ultimately helps Thailand's food export industry and makes sure the food meets international standards.

In this section, the key segments of the flow pack machine market are analyzed by the data from the research. The market has gained profits from horizontal machine type due to the automated process of running the machine. On the other hand, flow pack machines are mainly used for packing non-food items and a detailed analysis has been provided to understand the demand.

| Segment | Horizontal (Machine Type) |

|---|---|

| Value Share (2025) | 67.7% |

The horizontal machine type segment holds the leading flow pack machine market shares in 2025. Horizontal flow pack machines are popular because they can package lots of different things like food, household items, medicine, and electronics. They're fast, so they help companies make a lot of products quickly without needing too many workers.

These machines seal packages well, keeping products fresh and safe from things like water and dust. They can also work with other machines to make a whole production line run automatically, which saves time and money.

Compared to other packaging methods, they're also pretty cheap to buy and run. Because companies want to save money and make things faster and better, the demand for these machines keeps going up.

| Segment | Non-food (End Use) |

|---|---|

| Value Share (2025) | 56.5% |

The non-food end-use segment captured the top flow pack machine market shares in 2025. These machines are really useful for packing things that aren't food. These things can be anything from medicine and household items to electronics and gadgets. These machines are good at making packaging that can handle the bumps and knocks of delivery.

They are used by pharmaceutical businesses to package things like medicines safely. And for fragile stuff like phones and tablets, these machines can make packaging that protects them from getting damaged. As more companies care for the environment, using sustainable materials, like recyclable plastics can be opportunistic.

The flow pack machine industry is fiercely competitive. Top competitors such as Bosch Packaging Technology, ULMA Packaging, and the IMA Group dominate via innovation and worldwide reach. Smaller regional producers compete by concentrating in certain niches of the industry.

Strategic alliances promote collaboration and access to complementary technology. The competitive landscape is shaped by regulatory compliance and technical breakthroughs like AI and robots, which reward organizations that value innovation and customer service.

Industry Updates

The industry bifurcates into Horizontal and Vertical.

The sector trifurcates into Automatic Machines, Semi-automatic Machines, and Manual Machine.

The industry fragments into Less than 150, 151 to 350 PPM, 351 to 600 PPM, 601 to 1,000 PPM, and More than 1,000 PPM.

The industry is segmented into Food (Chocolate & Bars, Cookies & Crackers (Biscuit), Bakery, Frozen, Fresh Produce, Dairy, Meat, and Other Foods) and Non-Food (Healthcare, Personal Care & Cosmetics, Homecare, and Cleaning & Hygiene).

Analysis of the market has been conducted in the countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa (MEA).

The global flow pack machine market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the flow pack machine market is projected to reach USD 5.5 billion by 2035.

The flow pack machine market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in flow pack machine market are automatic, manual and semi-automatic.

In terms of machine type, horizontal flow wrap machine segment to command 67.7% share in the flow pack machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Meter Devices Market Size, Share, and Forecast 2025 to 2035

Flow Cytometry Market - Trends & Growth Forecast 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Flower Box Market Demand & Floral Packaging Innovations 2024 to 2034

Flow Diverter Market Analysis – Size, Trends & Forecast 2024-2034

Flow Wrap Market from 2024 to 2034

Flowback Tank Market Growth – Trends & Forecast 2024-2034

Flow Cytometer Market

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Flowpack Paper Packaging Market

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Inflow Pressure Screen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Inflow Control Devices Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA