The flow meter devices market is anticipated to be valued at USD 11.87 billion in 2025. It is expected to grow at a CAGR of 8.5% during the forecast period and reach a value of USD 26.84 billion in 2035.

In 2024, the flow meter devices market experienced steady expansion, driven by the increasing adoption of IoT-enabled smart meters and advancements in wireless monitoring systems. These industries like oil and gas, water management, and pharmaceuticals, spent a lot of money in measuring precision flow technologies to produce constructing efficiency as a measurement. And the government's imposition of laws for water conservation and emission monitoring further caused increases in the use of new ultrasonic and Coriolis measures for flow.

There is much more advancement trending these days in AI-powered analytics feeding in monitoring systems for better collection of real-time data and predictive maintenance optimization. As the digital transformation picks up across industries, the outlook for 2025 and beyond is even brighter for the sector. Cloud-connected flow meters will see greater adoption for remote diagnostics and automated calibration.

Demand will also be driven by expanding infrastructure projects in emerging economies, especially in the water treatment and energy sectors. Also, there will be evolutions in battery-powered and energy-efficient solutions of flow meters to meet sustainability targets. By honing in on industrial automation and the adoption of "Industry 4.0", there is marked progress on a path that engenders long-run expansion-and the industry should continue to garner its share of 8.5% CAGR growth for years to come.

Key Metrics

| Metric | Value |

|---|---|

| Estimated Industry Size in 2025 | USD 11.87 Billion |

| Projected Industry Size in 2035 | USD 26.84 Billion |

| CAGR (2025 to 2035) | 8.5% |

Explore FMI!

Book a free demo

Surveyed Q4 2024, n=500 stakeholder participants across manufacturers, distributors, and industrial end-users in North America, Europe, and Asia-Pacific

The survey revealed that 79% of stakeholders identified IoT integration and wireless monitoring as the primary drivers of flow meter adoption. The push for higher accuracy and operational efficiency was a top concern for the oil & gas (82%) and water management (74%) industries. Regulatory compliance also ranked high, with 67% of respondents citing environmental mandates on water conservation and emissions monitoring as key influences on purchase decisions.

Regional Variances

The survey found a clear shift towards digitalization, with 65% of respondents incorporating cloud-based monitoring into operations. Smart meters with AI-powered flow analysis were in use across high-precision sectors, with pharmaceuticals (58%) and chemical processing (52%) leading adoption.

Regional Variances

Stakeholders exhibited clear preferences for specific flow meter technologies based on industry demands. Ultrasonic flow meters led in water management (62%), while Coriolis meters dominated in oil & gas (57%). The survey also indicated that stainless steel (69%) remains the preferred material due to its durability and corrosion resistance.

Regional Variances

A major concern across regions was cost efficiency, with 84% of stakeholders citing rising material and energy costs as a challenge. Automation costs were also debated, with North American (63%) and European (55%) respondents willing to pay a 15-20% premium for advanced features, while Asia-Pacific (72%) preferred lower-cost models (< USD 7,000).

Investment Priorities

Stakeholders highlighted multiple challenges in supply chain reliability, skilled labor shortages, and regulatory compliance. 53% of manufacturers faced delays in semiconductor components for smart meters, while 49% of distributors struggled with rising tariffs on electronic imports.

Regional Variances

The survey findings indicate a strong global demand for smart, efficient, and sustainable flow meter solutions. However, regional priorities vary, requiring industry players to tailor their strategies. North America and Europe will see higher automation investments, while Asia-Pacific remains cost-sensitive but rapidly expanding. Companies must focus on affordable innovations, enhanced connectivity, and regulatory compliance to maximize growth opportunities.

| Country/Region | Regulations & Mandatory Certifications |

|---|---|

| United States | EPA Clean Water Act (CWA): Requires precise flow measurement for wastewater discharge compliance. National Institute of Standards and Technology (NIST) Certification: Ensures accuracy standards for custody transfer applications in oil & gas. American Water Works Association (AWWA) Standards: Mandatory for municipal water flow meters. Federal Energy Regulatory Commission (FERC) Guidelines: Governs metering in energy and utility sectors. |

| Canada | Measurement Canada Approval: Mandatory certification for flow meters used in trade applications. Canadian Environmental Protection Act (CEPA): Requires accurate metering for emission control in industrial operations. National Research Council Canada (NRC) Guidelines: Enforceable for precision metering in chemical and pharmaceutical industries. |

| European Union | MID (Measuring Instruments Directive) 2014/32/EU: Mandatory for flow meters used in billing applications (water, gas, and energy). EU Industrial Emissions Directive (IED): Enforces strict flow monitoring for pollution control. ATEX Certification: Required for flow meters used in explosive or hazardous environments. CE Marking: Mandatory for all flow meters sold within the EU, ensuring compliance with safety, health, and environmental standards. |

| United Kingdom | UKCA (UK Conformity Assessed) Marking: Post-Brexit equivalent of the CE Mark for flow meters sold in the UK. Environment Agency Regulations: Require precise metering in water abstraction and industrial discharge monitoring. OFGEM (Office of Gas and Electricity Industries) Standards: Enforceable for metering accuracy in the energy sector. |

| China | China Metrology Accreditation (CMA): Certification for accuracy and reliability of flow meters used in trade. National Institute of Metrology (NIM) Guidelines: Set calibration and performance standards. Ministry of Ecology and Environment (MEE) Regulations: Mandate real-time flow monitoring for industrial emissions. |

| India | Bureau of Indian Standards (BIS) Certification: Required for flow meters in water and energy applications. Central Pollution Control Board (CPCB) Regulations: Mandate accurate flow measurement for wastewater and industrial emissions compliance. Petroleum and Explosives Safety Organization (PESO) Approval: Required for flow meters in hazardous environments like oil & gas. |

| Japan | Japan Industrial Standards (JIS) Certification: Necessary for flow meters in industrial applications. Ministry of Economy, Trade, and Industry (METI) Regulations: Enforce metering accuracy in manufacturing and energy sectors. Waterworks Law Compliance: Requires certified flow meters for municipal water management. |

| South Korea | Korea Testing Certification (KTC): Ensures compliance with national metrology standards. Ministry of Environment Regulations: Enforce strict flow monitoring in industrial wastewater discharge-Korea Gas Safety Corporation (KGS) Certification: Required for flow meters used in natural gas applications. |

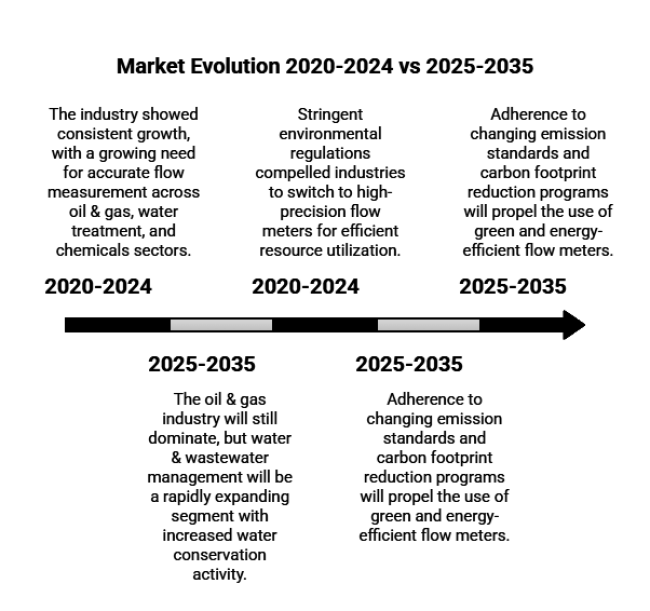

| 2020 to 2024 (Historical Performance) | 2025 to 2035 (Future Projections) |

|---|---|

| The industry showed consistent growth, with a growing need for accurate flow measurement across oil & gas, water treatment, and chemicals sectors. | The industry is poised to grow substantially, fueled by fast-paced industrialization, sustainability efforts, and the growth of IoT-enabled smart meters. |

| Advances in technology brought ultrasonic, Coriolis, and electromagnetic flow meters, enhancing accuracy and efficiency. | Real-time monitoring, predictive analytics, and remote diagnostics-enabled smart meters will become ubiquitous, ensuring efficient operation. |

| COVID-19-related disruptions affected supply chains and reduced industrial processes, influencing short-term demand. | Post-pandemic recovery and infrastructure development will fuel demand, with automation and digitalization transforming the industry. |

| Stringent environmental regulations compelled industries to switch to high-precision flow meters for efficient resource utilization. | Adherence to changing emission standards and carbon footprint reduction programs will propel the use of green and energy-efficient flow meters. |

| Major players emphasized competitive pricing and product differentiation to maintain industry presence. | Competition will intensify, with R&D spends on AI-driven flow measurement and wireless connectivity dictating the sector dynamics. |

| Growth was dominant in power generation, oil & gas, and chemicals industries owing to efficiency needs in operations. | The oil & gas industry will still dominate, but water & wastewater management will be a rapidly expanding segment with increased water conservation activity. |

Flow meters are projected to grow at a CAGR of 8.2% from 2025 to 2035, driven by precision, regulatory compliance, and advanced technologies like ultrasonic and Coriolis meters. Their demand spans industries such as oil and gas, water treatment, and power generation. IoT-enabled smart meters with real-time monitoring are gaining traction as automation rises.

Energy-efficient, low-maintenance solutions are in focus, aligning with sustainability goals. Manufacturers are enhancing accuracy, response time, and fluid compatibility, ensuring flow meters remain the leading category amid growing efficiency and compliance needs. The increasing shift toward digital monitoring and predictive maintenance further boosts adoption, reinforcing their role in industrial process optimization.

The oil and gas sector is forecasted to expand at a CAGR of 8.0% from 2025 to 2035, maintaining its dominance as the leading end-user segment. Growth is driven by increasing reliance on flow meters for precise measurement in pipeline monitoring, custody transfer, and drilling operations. Advanced flow meters, including ultrasonic and Coriolis types, are gaining traction due to their accuracy and reliability.

Rising energy demand and expanding pipeline infrastructure further accelerate adoption. Stricter environmental regulations push companies toward smart meters with real-time monitoring. The shift to digital oilfields and automation reinforces demand, ensuring flow meters remain essential for efficiency, compliance, and cost optimization in oil and gas operations.

The USA flow meter devices market is forecasted to expand at a CAGR of 7.8% from 2025 to 2035, driven by stringent environmental regulations, the adoption of smart metering solutions, and advancements in industrial automation. The USA Environmental Protection Agency (EPA) mandates precise flow measurement across industries such as oil & gas, water treatment, and chemical processing, propelling the demand for high-precision flow meters.

The shale gas boom and increasing pipeline infrastructure investments are accelerating the demand for custody transfer flow measurement solutions in the energy sector. The USA Department of Energy's initiatives promoting efficiency in water and power management encourage utility providers to integrate advanced metering infrastructure (AMI). Additionally, rising wastewater recycling efforts and stricter Clean Water Act regulations are expanding opportunities for flow meters in municipal applications.

However, challenges such as supply chain disruptions and fluctuating raw material prices persist. Leading manufacturers are prioritizing domestic production, automation, and IoT-enabled solutions to enhance efficiency and accuracy.

The UK is set to expand at a CAGR of 7.2% from 2025 to 2035, driven by sustainability initiatives, regulatory compliance, and smart infrastructure advancements. The UK government’s net-zero carbon emissions target by 2050 is accelerating the adoption of energy-efficient and digital flow metering solutions across industries such as water management, oil & gas, and renewable energy.

Post-Brexit regulatory changes have led to the introduction of UKCA (UK Conformity Assessed) certification, impacting manufacturers and distributors in the sector. The UK Environment Agency is enforcing stricter regulations on water abstraction and discharge monitoring, leading to higher demand for ultrasonic and electromagnetic flow meters in municipal and industrial applications. Additionally, significant investments in hydrogen and biofuel production are driving the need for precision flow measurement solutions.

The oil & gas sector continues to show stable demand for flow meters, particularly for pipeline monitoring and custody transfer applications. However, the high initial cost of smart metering systems remains a challenge for small and medium enterprises (SMEs). To address this, manufacturers are leveraging AI-powered analytics and smart manufacturing techniques to improve efficiency and reduce costs, ensuring sustained industry growth in the UK.

France is forecasted to expand at a CAGR of 7.5% from 2025 to 2035, driven by strong renewable energy investments, industrial digitalization, and strict environmental policies under the European Green Deal. The government’s push for decarbonization and water conservation is fueling demand for high-precision flow meters in energy, wastewater management, and manufacturing sectors.

Modernization in the water sector has led to increased investments in smart metering solutions to enhance resource efficiency. The oil & gas industry in France, though smaller than in neighboring countries, continues to generate stable demand for custody transfer flow meters due to stringent EU compliance requirements. The rapid shift towards hydrogen energy and biofuels is further boosting the adoption of advanced flow measurement solutions.

France’s industrial sector is embracing digitalization, integrating IoT-enabled solutions for real-time monitoring and operational efficiency. However, high implementation costs for smart technologies remain a challenge for some end-users. Government incentives and industry collaborations are helping to mitigate these concerns. As sustainability regulations tighten and digital transformation accelerates, France is emerging as a key industry for advanced industrial monitoring systems.

Germany is forecasted to expand at a CAGR of 7.6% from 2025 to 2035, propelled by Industry 4.0 adoption, stringent environmental regulations, and growing investments in process automation. The country’s robust manufacturing sector, particularly in chemicals, automotive, and pharmaceuticals, is a major driver for precision flow metering solutions.

Germany's Federal Water Act mandates accurate flow measurement in water-intensive industries, increasing the demand for electromagnetic and ultrasonic flow meters. Additionally, the German Renewable Energy Act (EEG) is accelerating investments in green hydrogen and biofuel projects, driving the need for specialized metering solutions. The country’s push for carbon neutrality is also encouraging industries to integrate smart, energy-efficient flow meters to optimize resource consumption.

With Germany being a global leader in automation and process control, industrial facilities are adopting IoT-enabled and AI-driven metering technologies for enhanced efficiency and predictive maintenance. However, challenges such as high equipment costs and complex regulatory frameworks pose barriers to industry growth. Despite this, the presence of key industry players and government-backed sustainability initiatives ensure a strong trajectory for the flow meter sector in Germany.

Italy is forecasted to expand at a CAGR of 7.3% from 2025 to 2035, fueled by investments in water infrastructure, industrial expansion, and the adoption of smart metering solutions. The Italian government’s efforts to improve water distribution networks and reduce wastage are driving the demand for advanced flow meters, particularly electromagnetic and ultrasonic variants.

The country’s manufacturing and chemical industries are also witnessing a rise in demand for precision flow meters due to increasing process automation and regulatory compliance under EU directives. Italy’s National Energy and Climate Plan (NECP) aims to enhance energy efficiency across sectors, encouraging the deployment of digital flow metering solutions for optimized resource management.

Despite strong growth prospects, challenges such as aging infrastructure and financial constraints in small enterprises hinder the adoption of high-end metering technologies. However, government grants and private-sector investments are bridging this gap, ensuring steady industry expansion. With sustainability and industrial automation at the forefront, Italy is poised to be a key player in the European flow meter devices market.

South Korea is forecasted to expand at a CAGR of 6.9% from 2025 to 2035, driven by rapid industrial automation, technological advancements, and rising investments in smart manufacturing. The government’s push for digital transformation under the "K-Smart Manufacturing Strategy" is fostering increased adoption of IoT-enabled flow meters in industries such as semiconductors, chemicals, and water treatment.

South Korea’s strict environmental regulations, particularly in wastewater management and air pollution control, have led to widespread demand for precision flow metering solutions. The country is also investing in hydrogen and renewable energy projects, creating new opportunities for specialized flow meters in the energy sector.

Despite the growing demand, high equipment costs and a fragmented supply chain remain challenges for industry players. However, government incentives and collaborations with technology providers are mitigating these hurdles, ensuring sustained growth. As South Korea continues to strengthen its smart manufacturing ecosystem, the adoption of advanced flow metering technologies is expected to rise significantly.

Japan is forecasted to expand at a CAGR of 6.5% from 2025 to 2035, supported by its strong focus on precision engineering, energy efficiency regulations, and advancements in industrial automation. The country's manufacturing sector, particularly in the electronics, chemicals, and automotive industries, relies heavily on accurate flow measurement, driving demand for high-precision metering solutions.

Government policies aimed at energy conservation and wastewater treatment are further bolstering adoption. The Japanese Ministry of Economy, Trade, and Industry (METI) has introduced stringent energy efficiency regulations, encouraging industries to adopt smart metering solutions for optimal resource management. Additionally, the rise of hydrogen energy and carbon-neutral initiatives is driving demand for advanced flow measurement solutions.

Despite its technological leadership, Japan faces high costs and slow adoption of new technologies among smaller industries. However, government subsidies and increasing collaborations with digital technology firms are driving penetration. As industrial efficiency and sustainability gain prominence, Japan is expected to maintain a steady demand for advanced flow metering solutions.

China is forecasted to expand at a CAGR of 8.1% from 2025 to 2035, fueled by strict environmental regulations, rapid industrialization, and advancements in process automation. The Chinese government’s aggressive policies on reducing industrial emissions and improving water conservation are driving demand for high-precision flow meters across industries.

The country’s large-scale investments in smart water management, oil & gas infrastructure, and chemical processing are creating strong growth opportunities for both domestic and international flow meter manufacturers. Additionally, China’s focus on renewable energy, particularly hydrogen and wind power, is increasing the demand for specialized flow metering solutions.

However, price sensitivity and intense competition from low-cost local manufacturers pose challenges for premium brands. To counter this, leading companies are focusing on technological differentiation, such as AI-driven flow monitoring and wireless IoT connectivity. With continued government support for industrial digitalization, China remains one of the most lucrative destinations for advanced monitoring solutions.

As of 2024, the flow meter devices market has experienced significant growth, driven by increasing demand for accurate flow measurement solutions across sectors such as oil and gas, water and wastewater, chemicals, and pharmaceuticals. Leading companies such as Emerson Electric Co., Siemens AG, Honeywell International Inc., ABB Ltd., and Endress+Hauser Group have been actively enhancing their product portfolios and expanding their geographic presence to capitalize on emerging opportunities.

Emerson Electric Co. holds an estimated 22% share of the industry, maintaining its leadership position through continuous innovation and strategic investments. In 2024, Emerson launched a new series of ultrasonic flow meters with enhanced accuracy and durability, targeting the oil and gas sector.

The company also announced a partnership with American Water, a major water utility provider, to deploy advanced flow meters for real-time water monitoring and leak detection. According to a press release on Emerson’s official website, this collaboration aims to improve water conservation and operational efficiency in urban water systems.

Siemens AG, with a 20% industry share, has focused on integrating advanced technologies into its flow meter offerings. In 2024, Siemens introduced a new line of IoT-enabled flow meters designed for smart manufacturing applications. These devices feature predictive maintenance capabilities, enabling real-time monitoring and reducing downtime in industrial processes. Siemens also acquired Cascade Technologies, a smaller firm specializing in wireless communication protocols, as reported by Automation World.

This acquisition has strengthened Siemens’ ability to deliver seamless connectivity and interoperability in industrial IoT applications. The company also expanded its distribution network in Europe and North America to enhance customer accessibility.

Honeywell International Inc., holding approximately 18% of the industry share, has prioritized innovation and sustainability in 2024. The company launched a new series of energy-efficient magnetic flow meters, targeting the water and wastewater management sector. Honeywell also announced a collaboration with Sidewalk Labs, a leading smart city developer, to deploy flow meters for urban infrastructure monitoring. According to Smart Cities World, this partnership aims to enhance resource management and sustainability in smart cities.

The company holds roughly 15% of the industry share and is directing its efforts towards further penetration of the chemical and pharmaceutical sectors. In 2024, ABB would introducethe Coriolis flow meter series with either enhanced precision and chemical durability or resistant to the harshest industrial environment. Also, said Water Technology Online, the company entered into partnership with Xylem Inc., a global water technology firm, so as to provide integrated solutions from water treatment plants.

Endress+Hauser Group, holding around 12% of the industry share, at the same time emphasizes technology development and strategic collaboration in 2024. The company introduced ultra-low-power-consumption thermal mass flow meters meant for remote and off-grid applications. An agreement with NextEra Energy-another top undisputed leader in renewable energy-was announced by Endress+Hauser to install flowmeters on sites in the biogas and solar energy industry, Renewable Energy World confirmed.

Increasing industrial automation, regulatory requirements, and the need for precise fluid measurement across industries drive demand.

Oil and gas, water treatment, chemicals, power generation, food and beverage, and pharmaceuticals are the main industries using these solutions.

Innovations like ultrasonic and Coriolis meters, IoT integration, and AI-driven analytics enhance accuracy, efficiency, and automation.

Manufacturers face rising raw material costs, regulatory compliance issues, and the need for continuous innovation amid competitive pressures.

Strict accuracy and environmental standards shape design, calibration, and certification, ensuring reliability in critical applications.

By type, the industry is segmented into flow meters, flow controllers, and flow sensors.

In terms of the end-user industry, the sector is segmented into oil and gas, chemicals and pharmaceuticals, water and wastewater, food and beverage, power generation, and others.

The industry is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.