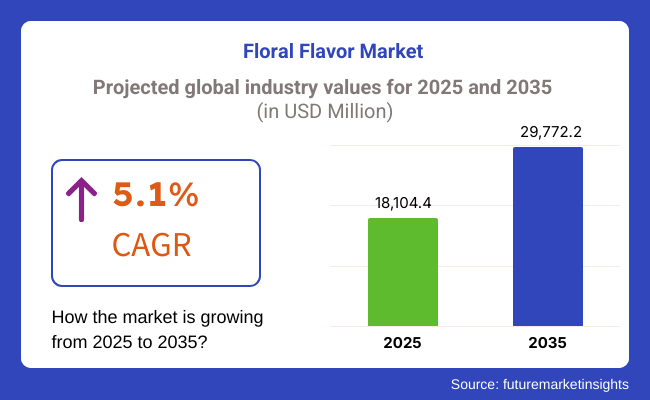

The global floral flavor market is projected to grow from USD 18,104.4 million in 2025 to USD 29,772.2 million by 2035, reflecting a CAGR of 5.1% during the forecast period.

The growing shift toward clean-label and natural flavoring is one of the key factors propelling expansion. Consumers are also seeking alternatives to synthetic additives, favoring natural floral flavors like rose, lavender, hibiscus, and elderflower. This trend is seen in categories such as wine, ready-to-drink drinks, functional food, dairy, and confectionery, in which the floral flavors provide sensory uniqueness and wellness attributes.

Brands are tapping into the trend by introducing new products, including floral sparkling waters, botanical cocktails, and herbal teas, to consumers concerned about health and wellness-a reason attributed to increasing consumer inclination toward natural and botanical ingredients. Spurred by evolving palettes, brands have been introducing floral-infused flavors across a range of food and beverage applications.

As a result, the industry is on a strong growth trajectory. However, some industry leaders are increasing their production capacity to meet the growing demand. As an example, major flavor houses and ingredient suppliers are developing sustainable sourcing practices with flower cultivators to ensure consistent flavor profiles while also being environmentally conscious.

The industry is also being shaped by what is known as premiumization, with consumers paying a premium price for exotic, rare floral tastes. Premium vehicle-high category line expansion with floral notes is taking root in gourmet segments (finest chocolates, niche drinks, and top fine dining). In response, companies have begun experimenting with more unique floral pairings, combining flavors like jasmine and citrus or rose and vanilla to produce signature profiles.

There are also plenty of limited-edition and seasonal launches taking advantage of that impulse-purchase potential as brands focus on exclusivity. Floral flavors appeal to more than taste, and brands complement them by employing botanical images and stories to connect with the consumer emotionally. Moreover, the increasing trend towards Eastern and Mediterranean cuisines that have long seen floral flavors play a key role in accelerating their entry into markets.

As competition intensifies, companies are emphasizing R&D investments to formulate innovative, heat-stable, and long-lasting floral flavors suitable for diverse applications. The growing use of floral flavors in plant-based and functional foods also presents lucrative opportunities, as brands cater to the growing segment of consumers prioritizing health and sustainability. With evolving consumer tastes and increasing product diversification, the floral flavor industry is poised for sustained growth in the coming years.

The floral flavour industry is dynamical full in the way it grows as a result of customers recently showing a definitive preference to flavors that are more natural, aromatic, and health-busting in their usage in various sectors.

Particularly in the food & drink sector floral flavors such as lavender, rose, hibiscus, and elderflower are used more in thrilling manners and are not limited to only drinks, but are also used in candy, and high-end products because of their sensory appeal.

Floral notes are prized in the fragrance and perfume industry as a source of exotic and soothing scents, which additionally spurs a selling of essential oils and natural extracts. The pharmaceutical domain is bringing in flower scents such as in herbal medicines, food, and therapeutic formulations that are disclosed to carry antioxidant and anti-inflammatory benefits.

Cosmetics & personal care business is utilizing a lot of floral extracts in creams and hair care basically making a lot of demands for organic and chemicals-free alternatives. The sustainability and clean labels trends are proliferating so the industry also witnesses a growing preference for eco-friendly, elaborate and traditional-flower infused products.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.5% |

| H2 (2024 to 2034) | 5.1% |

| H1 (2025 to 2035) | 4.6% |

| H2 (2025 to 2035) | 5.2% |

The following table shows a comparative analysis of the change in CAGR over a six-month period for the base year (2024) and the current year (2025) of the global floral flavor industry. The insights collated in this assessment outline drastic changes in pricing and sales patterns that have shaped a better understanding of market's future across segments. H1 is the first half of the year (January - June) and H2 is the second half (July - December).

The industry is projected to grow at a CAGR of 4.5% in the first half (H1) of the decade from 2025 until 2035 and a marginally higher growth rate of 5.1% in H2 of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 4.6% in the first half and maintain steady momentum at 5.2% in the second half. In the first half (H1), the industry recorded an increase of 10 BPS, while in the second half (H2), a minor increase of 10 BPS was observed.

During 2020 to 2024, the floral flavor industry experienced explosive growth as natural and botanical ingredients demand boomed in the food, beverage, and cosmetics industries. AI-based industry intelligence and big data helped firms to discover novel consumer preferences for floral flavors and opened doors to lavender, hibiscus, and rose flavors.

Clean-labeling trends and growing popularity of plant-based and functional beverages also drove demand for floral flavors. Artificial intelligence-based analysis became more convenient to create flavor, better optimize ingredient procurement, and improve product personalization. Disruption in the supply chain and labeling issue issues with natural ingredients were, however, challenging to overcome.

Future up to 2025 to 2035, biotech, blockchain, and AI technologies will transform the floral flavor industry. Predictive analytics powered by AI will find new floral blends and aid hyper-individualized product development. Supply chains using blockchain will provide assurance and quality of natural ingredients and green, bioengineered floral extracts minimize the impact.

Decentralized AI will provide response to shifting consumer patterns in real-time and optimize production efficiency. Healthy functionality by flower flavorings such as stress reduction and immune system boost will give way to product development.

AI-based sensory evaluation will create advanced taste profiles, fuelling product diversification. Flower flavor business will turn towards environmentally friendly production, AI-engineered products, and penetration into the industry through intelligent, dynamic strategies.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing need for natural, botanical flavors in food, beverages, and personal care | Hyper-personalized, AI-based flavor profiles with functional health benefits |

| AI-fueled insights for flavor innovation and market timeliness | AI-optimized real-time sensory analysis and new flavor formulation |

| Supply chain ruptures and natural ingredient supply chain issues | Blockchain-integrated, transparent supply chains with automated compliance |

| Clean-label, sustainable production emphasis | AI-fueled, carbon-neutral flavor production employing bioengineered extracts |

| Regulation of natural ingredient labeling and food safety | Conformance to AI-based, automated rules and real-time regulation monitoring |

| AI-driven market intelligence and production optimization | Decentralized AI and blockchain for real-time market adaptation security |

| Growing demand for floral flavors for relaxation and wellness | Functional health benefits (stress relief, immunity) driving market innovation |

The floral flavour market is susceptible to various risks, especially supply chain instability. For body and mind, raw substances such as lavender, hibiscus, and rose which are used for floral flavouring are gathered and cultivated in a seasonal manner and as a result require certain climatic conditions. Supply disruption arising to crop diseases, droughts, and extreme weather can drive prices up and down.

Regulatory compliance is another principal risk. Almost all regions have their exclusive food safety standards and labelling requirements particularly that for the natural extracts and essential oils that are included in food and beverage products. The organic certification, allergen-related info, the limitation on the use of unnatural additives rule incurs a lot of expenses making compliance with such directives a daunting task.

The challenge of changing customer preferences is also seen here. Blossoms as a cultivable food source have made their way into drinks, sweets, and cosmetics, but this trend may not endure or can occupy only a small market share. Saturation of the market and competition from fruit-based flavours or functional ingredients like adaptogens can diminish the potential of growth.

Furthermore, the high cost of extraction processing, and storage is a deterring factor for the profitability aspect. Floral extracts need to be carefully handled as they are fragile and require special storage facilities. Therefore, it raises the logistics cost that any raw materials price surge or supply chain instability can directly affect the market growth and profit margins.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 4.8% |

| China | 5.5% |

| Germany | 4.2% |

| Japan | 4.0% |

| India | 6.0% |

The USA will lead the floral flavor market in 2025, with a projected volume of USD 3,525 million and a projected CAGR of 4.8% through 2035. Natural and clean-label product growth is driven by growing consumer demand. The beverage segment, i.e., specialty tea and craft cocktails, increasingly incorporate floral flavors like lavender and elderflower.

The confectionery and dairy sectors also toy with flower infusions to create distinctive flavor profiles. Companies stress sustainable sourcing and transparent labeling to maintain pace with consumer interest. For instance, major beverage companies have introduced fizzy water with floral infusions to attract health-conscious consumers, further fueling the trend.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Growing demand for natural ingredients | Natural ingredients are used in lieu of synthetic ones, driving the market for floral flavors. |

| Emergence in specialty beverages and craft beverages | Floral infusions in craft cocktails and premium teas are in vogue. |

| Emergence in dairy and confectionery markets | Floral infusions in ice creams, yogurts, and chocolates fulfil evolving consumer patterns. |

| Sustainable sourcing | Companies target floral ingredients that are sustainably produced to meet regulatory and consumer pressures. |

The market in China is likely to increase to USD 2,845 million by 2025, with a robust CAGR of 5.5%. Its historical use of flower ingredients in food and beverage, coupled with rising awareness of health and wellness, is fueling the growth. Floral flavors like jasmine and chrysanthemum remain staples in traditional tea and increasingly make their way into emerging food and beverage items.

Increased middle class and rising disposable income propel demand for innovative and premium products. Domestic businesses invest in research and development to create new flavors that incorporate local flavors and new flavors to maintain their share.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Cultural flavor preference for flowers | Traditional ingredients like jasmine and chrysanthemum are still popular. |

| Rising disposable income | More people seek good-quality premium flower products. |

| Food and drink innovation | Companies introduce new combinations of flowers to appeal to young consumers. |

| Wellness consumption patterns | Flower flavors pair well with healthy food and drink consumption. |

FMI is of the opinion that the floral flavor industry in Germany is forecasted to increase to USD 2,254 million by 2025, with a CAGR of 4.2% from 2035. Healthy consumer demand motivates natural and organic products. Floral flavors take center stage for craft beers, artisanal chocolate, and baked goods.

The sector is also witnessing strong demand for botanically flavored soft drinks from health-conscious consumers. Companies place great stress on using locally sourced floral ingredients and ensuring high-quality standards. Combining chefs and food scientists leads to a gigantic leap in the development of new floral flavor profiles, which are adopted by massive numbers of consumers.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Natural product consumption is very high | Customers consume clean-label and organic floral flavors. |

| Growth of craft and artisan food | Floral flavors are utilized in chocolates, baked goods, and specialty drinks. |

| Growth of non-alcoholic botanical drinks | The Alcohol-free flower-infused beverage industry is growing. |

| Focus on local ingredients | Companies utilize quality controls through localization. |

The Japanese floral flavor industry will grow to USD 1,850 million by 2025 at a CAGR of 4.0%. The strong tea culture and food and beverage innovation result in the expanding industry. Sakura (cherry blossoms) and yuzu flavor foods are in great demand and are discovered to be placed at the top of desserts, tea, and a course meal.

Floral and seasonal floral flavors are popular among Japanese consumers, which has led companies to introduce new types. The functional beverage industry also grows with floral flavors being added to health-oriented beverages, including energy drinks and relaxation teas. Japanese companies emphasize precision in flavor creation, with floral elements adding to the final product without overpowering it.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Robust tea culture | Floral teas like cherry blossom and yuzu-flavored ones continue to be popular. |

| Seasonal and limited-edition preference | Consumers crave special, time-restricted floral products. |

| Functional beverage growth | Floral foods are included in relaxation and energizing beverages. |

| Innovations in old and new cuisine | Japanese food industries use floral taste in sweet as well as salty foods. |

FMI is of the opinion that the India's floral flavor industry is expected to be the most rapidly growing with a CAGR of 6.0% and a value of USD 1,965 million by 2025. The age-old practice in the nation of utilizing floral ingredients in food and drinks, for example, rose and saffron in sweets and beverages, is the foundation of the growth.

Urbanization and health consciousness drive demand for flower-infused herbal teas and functional drinks. Conventional sweets and milkshakes also employ floral fragrances to meet evolving consumer tastes. The wellness trend has led companies to launch floral-derived health supplements and Ayurveda-derived drinks, driving the industry forward.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Indian culture of floral flavors | Indian sweets and drinks employ rose and saffron. |

| Growing demand for herbal and functional beverages | Floral ingredient trend in wellness-focused products. |

| Urbanization and rise in disposable income | Buyers expect premium and specialty floral-infused products. |

| Ayurveda-formulated product growth | The industry witnesses a surge in floral-infused health beverages and supplements. |

| Segment | Value Share (2025) |

|---|---|

| Hibiscus (By Raw Material) | 23.4% |

Based on type, the raw material segment is expected to bubble to the top with a share of 23.4% of the overall flower flavor industry by 2025, driven particularly by the popularity of hibiscus. An extremely citric and tart profile, along with a significant portion of antioxidants, has densely populated its demand in beverages, dairy products, and confectionery.

Hibiscus is an active ingredient utilized in herbal teas, functional beverages, functionally-alcoholic drinks, such as botanical cocktails, and plant-based yogurts, driven by its potential efficacy in blood pressure modulation and CV health.

Research suggests that hibiscus tea can reduce systolic blood pressure by as much as 7.58 mmHg. This only further entrenches its hold in the marketplace, with mega brands such as RUNA, Honest Tea, and Republic of Tea expanding their lines of hibiscus-infused beverages.

Lavender is emerging as a luxury floral flavor, beloved for its gentle aroma and stress-reducing properties. It’s making its way into artisanal chocolates, baked goods, high-end tea blends, and craft beverages. Lavender-infused lattes, botanical cocktails, and wellness-minded drinks are surging as well amid growing demand for that natural feel-good ingredient.

Studies show that lavender helps reduce feelings of anxiety and increase sleep quality, which is why it appears in so many functional and relaxation-oriented products.While hibiscus rules mass-market applications, lavender is winning high-end wellness and premium food products. Both ingredients are not only riding the trend for increased use of botanical and floral flavors but are becoming key parts of the increasingly global flavors space.

| Segment | Value Share (2025) |

|---|---|

| Organic Floral Flavors (By Product Type) | 61.7% |

The organic floral flavours segment will account for the biggest share of value, 61.7% of the overall value in 2025. This growth is being fuelled by consumer demand for natural, chemical-free, sustainably sourced ingredients, particularly in more premium teas and functional beverages, confectionery, and plant-based dairy alternatives.

Notably, strong clean-label trends, along with budding consumer desire for USDA Organic and EU Organic-certified offerings have led brands including Pukka Herbs, Yogi Tea, and Numi Organic Tea to expand their portfolios featuring floral (infusions). For purity without compromising those delicate floral notes, producers are employing cold pressing and steam distillation.

While natural floral tastes are the fairest of the flower heads, synthetic floral aspects also play a part in the terrain, as they are inexpensive, stable, and uniform in mass-market production. It is commonly applied in carbonated drinks, candy, dairy products, and processed food, where optimum shelf life and gradual flavour intensity are essential. For example, synthetic rose, jasmine, and violet flavours are also essential in perfumed beverages and floral candies, letting brands maintain flavour consistency across huge batches.

Consumer awareness about clean-label ingredients therefore is leading the way towards organic floral flavors in the industry. Synthetic substitutes, on the other hand, will still find purpose in economically sensitive and high-volume operations, thus becoming accessible to a larger consumer pool.

The floral flavor market is progressing at a healthy pace, owing to enhanced consumer spend on natural, botanical, and exotic taste profiles in the food, beverage, and personal care industries. Growth towards clean label, plant-based, as well as wellness products is fostering innovation across the sectors.

Leading players in the industry include Givaudan, Symrise, Firmenich, International Flavors & Fragrances (IFF), and Sensient Technologies. All these leading companies have established varied portfolios, proprietary extraction techniques, and strong collaborations with F&B brands.

These companies are mainly focusing on sourcing natural and organic floral extracts, sustainable sourcing, and further product innovation to drive a competitive advantage. Start-ups and niche service providers focus on artisanal, regional, or functional floral infusions to meet the needs of premium consumers and health-conscious individuals.

Advancements in cold press extraction, supercritical CO2 extraction, and AI-generated flavor creation will transform the industry. In addition, floral flavors will extend into different categories beyond tea and confections, such as dairy, alcoholic beverages, and functional wellness drinks.

Sustainability, authenticity, and sensory appeal form the key strategic pillars, with the companies referencing their organic certifications, traceability of sourcing, and the unique floral varieties of regions. As more restrictions on artificial ingredients tighten and stricter demands for transparency grow, brands that use natural extraction methods, least processing, and creative floral combinations are expected to keep their competitive edge in this dynamic landscape.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Givaudan | 18-22% |

| Symrise AG | 15-18% |

| Firmenich SA | 12-16% |

| International Flavors & Fragrances (IFF) | 10-14% |

| Sensient Technologies Corporation | 8-12% |

| Other Players | 30-40% |

| Company Name | Key Offerings & Focus |

|---|---|

| Givaudan | Leading in florally inspired beverage and confectionery solutions using AI-driven flavor development as well as sustainable sourcing. |

| Symrise AG | Based on natural floral extracts focusing R&D onto botanical flavor innovation as well as functional ingredient applications. |

| Firmenich SA | World-class pioneer in high-purity floral flavors for premium beverages, dairy, and fragrances with strong biotechnology and fermentation-based extraction expertise. |

| International Flavors & Fragrances (IFF) | Offers excellent floral flavors for plant-based and health-conscious products, investing in high-technology extraction processes. |

| Sensient Technologies Corporation | A specialist in coloration and flavor fusion with natural floral essences for beverage, confectionery, and cosmetics purposes. |

Key Company Insights

Givaudan (18-22%)

World leader in floral flavor creativity with a focus on sustainable ingredient sourcing and AI-driven flavor solutions.

Symrise AG (15-18%)

Investing in botanical R&D, with significant volumes in floral infusions for premium drinks and functional foods.

Firmenich SA (12-16%)

Firmly positioned among the luxury and high-intensity floral flavors and can extract these from biotechnology for better aromas.

International Flavors and Fragrances (10-14%)

Floral application growth in plant-based foods, wellness beverages, and specialty confectioneries.

Sensient Technologies Corporation (8-12%)

Blends natural flavor with color creativity, aiming for clean-label and aesthetically pleasing foodstuffs.

Other Key Players (30-40% Combined)

The industry is segmented into Hibiscus, Lavender, Orange Flower, Rose, Jasmine, Cherry Blossom, Chamomile, Violette, and Others.

The industry is divided into Organic and Synthetic categories.

The industry encompasses Beverages, Confectionery, Dairy Products, Bakery Products, and Savory Products.

The industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 22: Western Europe Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Western Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 28: Eastern Europe Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 30: Eastern Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Raw Material, 2018 to 2033

Table 46: Middle East and Africa Market Volume (MT) Forecast by Raw Material, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Raw Material, 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Raw Material, 2023 to 2033

Figure 35: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Raw Material, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 63: Western Europe Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 67: Western Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 81: Eastern Europe Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 85: Eastern Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Raw Material, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Raw Material, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 117: East Asia Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 121: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Raw Material, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Raw Material, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Raw Material, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Raw Material, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Raw Material, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Raw Material, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Raw Material, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The global floral flavor industry is expected to grow at a CAGR of 5.1% during the forecast period from 2025 to 2035.

The industry is projected to reach a value of approximately USD 29,772.2 million by 2035 end.

The natural flavor segment is expected to witness the fastest growth, driven by increasing consumer demand for clean-label and health-conscious products.

The industry growth is primarily driven by rising health consciousness, a preference for natural and exotic flavors, and the expanding use of floral flavors in beverages and food products.

Prominent companies in the industry include BASF SE, Firmenich SA, Carbery Group (Synergy Flavours), Sensient Technologies Corporation, and International Flavors and Fragrances Inc.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA