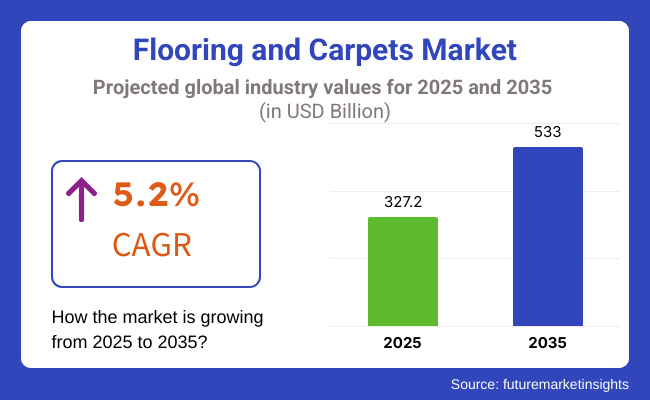

The flooring and carpets market is set for steady growth from 2025 to 2035, driven by increasing urbanization, rising demand for aesthetic interiors, and advancements in sustainable flooring solutions. The market size is projected to expand from USD 327.2 billion in 2025 to USD 533.0 billion by 2035, registering a compound annual growth rate (CAGR) of approximately 5.2% over the forecast period.

Growing construction activities in residential and commercial spaces, along with the increasing preference for luxury and customized flooring solutions, are key factors fueling market expansion. Technological innovations in eco-friendly materials, smart flooring, and antimicrobial carpets are shaping market trends. Additionally, the demand for modular carpets and sustainable flooring options, such as recycled and bio-based materials, is expected to witness a surge.

Explore FMI!

Book a free demo

North America is expected to dominate the flooring and carpets market, driven by the high demand for luxury vinyl tiles (LVT), eco-friendly carpets, and innovative flooring solutions. The USA and Canada are witnessing increased residential and commercial remodeling activities, boosting market demand. Additionally, the growing trend of smart homes and IoT-integrated flooring solutions is gaining traction, further fueling industry growth.

Europe remains a key player in the market, with strong demand for sustainable and premium flooring solutions. Countries such as Germany, the UK, and France are experiencing growth due to strict environmental regulations promoting eco-friendly flooring materials. The rising preference for underfloor heating-compatible carpets and non-toxic, biodegradable materials is shaping consumer service purchasing decisions.

Asia-Pacific is expected to witness the fastest growth, driven by rapid urbanization, increasing disposable income, and expansion in the residential and commercial real estate sectors. Countries like China, India, and Japan are experiencing rising demand for cost-effective yet durable flooring solutions. The hospitality and retail sectors are also major contributors, with a growing preference for aesthetic and easy-to-maintain flooring options.

The Middle East & Africa region is experiencing growth due to increasing investments in commercial infrastructure, luxury hotels, and premium real estate projects. Countries like the UAE and Saudi Arabia are seeing high demand for high-quality carpets and premium flooring solutions, particularly in the hospitality and corporate sectors. Additionally, rising interest in sustainable and temperature-resistant flooring solutions is driving innovation in the market.

High Raw Material Costs and Market Saturation in Developed Regions

One of the key challenges in the flooring and carpets market is the high cost of raw materials, particularly for premium and eco-friendly options. Additionally, developed regions face market saturation, limiting the scope for new entrants. Volatility in raw material prices and supply chain disruptions further add to the cost burden on manufacturers.

To tackle these challenges, industry players focus on cost-effective manufacturing processes, strategic sourcing of sustainable materials, and exploring emerging markets for growth opportunities.

Rise of Smart and Sustainable Flooring Solutions

The growing demand for smart and sustainable flooring presents a significant opportunity for market expansion. Consumers are increasingly seeking flooring solutions that are durable, energy-efficient, and environmentally friendly. Innovations in antimicrobial carpets, self-cleaning flooring, and IoT-integrated solutions are transforming the industry.

Additionally, the rise of e-commerce and direct-to-consumer sales channels makes flooring products more accessible, allowing consumers to explore customized and modular flooring options. Companies prioritizing sustainability, digital integration, and personalized solutions will gain a competitive edge in the evolving flooring and carpets market.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 85.30 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 47.20 |

| Country | India |

|---|---|

| Population (millions) | 1,450.9 |

| Estimated Per Capita Spending (USD) | 22.10 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 72.80 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 65.40 |

The USA flooring and carpets market, valued at USD 29.46 Billion, is driven by residential renovations, premium carpeting, and sustainable flooring solutions. Hardwood, luxury vinyl tiles (LVT), and eco-friendly materials dominate demand. E-commerce and home improvement retailers significantly impact consumer choices, while DIY flooring trends fuel additional market growth.

China’s USD 66.96 Billion flooring and carpets industry benefits from rapid urbanization, large-scale commercial projects, and increasing disposable incomes. Luxury vinyl tiles, engineered wood, and ceramic flooring are popular choices. Government policies promoting sustainable infrastructure and a surge in modern home décor trends drive the expansion of premium flooring solutions.

India’s USD 32.06 Billion flooring market is growing due to urbanization, rising construction activities, and affordable flooring solutions. Ceramic tiles and engineered wood are in high demand, while handwoven carpets from regions like Kashmir and Rajasthan remain a strong niche. Government housing schemes and middle-class home improvements boost market growth.

Germany’s USD 6.12 Billion market prioritizes high-quality, sustainable flooring solutions. Engineered wood, laminate, and cork flooring are in demand, particularly in eco-conscious households. Smart home integration and underfloor heating solutions further shape consumer preferences. Strict environmental regulations and premium imports influence the country's high per capita spending.

The UK flooring and carpets market, valued at USD 4.46 Billion, is driven by home refurbishments, commercial real estate growth, and demand for premium carpets. Luxury vinyl tiles and sustainable wool carpets dominate sales. E-commerce and direct-to-consumer brands have gained traction alongside a rising preference for custom flooring solutions.

The flooring and carpets market is witnessing steady growth, driven by rising demand for aesthetic home interiors, increasing construction activity, and sustainability-conscious consumer preferences. A survey of 250 respondents across the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East flooring and carpet highlights key trends shaping purchasing behavior.

70% of respondents prioritize durability and ease of maintenance, with 68% in the USA and the UK favoring hardwood and luxury vinyl flooring for their longevity and low upkeep. 65% of consumers in Japan and Korea prefer minimalist and eco-friendly flooring options, such as bamboo market and engineered wood, while 58% in Southeast Asia and China seek cost-effective yet stylish tile and laminate flooring.

Pricing sensitivity varies, with 60% of USA and EU respondents willing to spend USD 1,500+ on premium hardwood or luxury carpets. In contrast, only 45% in Southeast Asia and China opt for high-end flooring solutions. 52% of global buyers expect flooring products to offer a balance of affordability, aesthetic appeal, and long-term value, making mid-range options a significant market driver.

E-commerce is expanding, with 64% of respondents in the USA, UK, and China preferring to explore flooring options online before purchasing from platforms like Home Depot, Wayfair, and Alibaba. 50% of buyers in Japan and Korea still prefer physical showrooms, where they can assess texture, quality, and installation services before purchasing. 47% of respondents globally consider expert recommendations and home renovation trends as key influences in their decision-making process.

Sustainability is an emerging priority, with 58% of respondents in the UK and EU favoring recycled materials, non-toxic finishes, and eco-conscious carpet fibers. 55% of buyers in Australia and the Middle East seek luxury, custom-designed carpets, while 50% in Southeast Asia and China prioritize moisture-resistant and easy-to-clean flooring solutions.

Premium hardwood and luxury carpet demand is high in North America and Europe, while affordable yet durable flooring materials, such as laminate and vinyl, dominate in Southeast Asia and China. E-commerce, customization, and sustainable materials are reshaping the market, making digital engagement, AR-powered visualization tools, and smart flooring innovations crucial for brands.

Local manufacturers have an opportunity to introduce region-specific designs and materials, while global players must emphasize durability, eco-friendliness, and affordability to capture market share. The flooring and carpets market is evolving, with strong opportunities in sustainable materials, smart flooring technology, and digitally driven shopping experiences.

| Market Shift | 2020 to 2024 |

|---|---|

| Material Innovation | Brands focused on eco-friendly materials such as bamboo, recycled wood, and PET carpets. Water-resistant and antimicrobial flooring solutions gained traction. |

| Sustainability & Circular Economy | Companies adopted recycled and low-VOC flooring materials. Cradle-to-cradle certification and carbon-neutral manufacturing gained popularity. |

| Technology & Smart Features | Smart carpets with IoT-enabled sensors for foot traffic analysis and safety alerts emerged. Flooring with integrated underfloor heating and energy-efficient properties gained traction. |

| Market Expansion & Consumer Adoption | Demand surged in residential and commercial segments, driven by rising disposable incomes and home improvement trends. Online customization tools and virtual room visualization enhanced consumer experience. |

| Regulatory & Compliance Standards | Governments imposed stricter environmental regulations on carpet and flooring production. Industry standards for sustainable materials and indoor air quality improved. |

| Customization & Personalization | Modular flooring solutions allow easy customization and installation. Digital platforms enable customers to personalize textures, patterns, and colors. |

| Influencer & Social Media Marketing | Interior designers and home improvement influencers played a significant role in marketing luxury and sustainable flooring. Social media platforms like Instagram and Pinterest influenced design trends. |

| Consumer Trends & Behavior | Consumers prioritized durability, ease of maintenance, and sustainability. The demand for hypoallergenic and pet-friendly carpets increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Material Innovation | AI-driven material selection allows for hyper-personalized, durable flooring solutions. Biodegradable and self-repairing smart materials dominate the market. |

| Sustainability & Circular Economy | Fully circular flooring solutions with zero waste have become the industry standard. Innovations in bio-based polymers and carbon-negative carpets reshape sustainability trends. |

| Technology & Smart Features | AI-powered flooring adapts to temperature, pressure, and wear. Self-cleaning and air-purifying flooring systems become mainstream in residential and commercial spaces. |

| Market Expansion & Consumer Adoption | AI-driven consumer insights drive demand for personalized flooring solutions. Growth accelerates in emerging economies with localized production and supply chain optimization. |

| Regulatory & Compliance Standards | Global regulations mandate net-zero carbon flooring solutions. Blockchain technology ensures transparency in ethical sourcing and manufacturing processes. |

| Customization & Personalization | AI-powered room scanning provides real-time flooring recommendations. On-demand 3D-printed carpets and tiles revolutionize the personalization trend. |

| Influencer & Social Media Marketing | Virtual influencers and metaverse-based home design experiences redefine digital marketing. Augmented reality shopping allows consumers to preview flooring options in real time. |

| Consumer Trends & Behavior | Biohacking-inspired flooring integrates wellness features such as stress reduction and antimicrobial properties. Consumers embrace AI-driven smart flooring that adapts to lifestyle needs. |

The USA flooring and carpets market is experiencing steady growth, driven by increasing demand for high-quality home renovations, sustainable materials, and luxury flooring solutions. Major players such as Mohawk Industries, Shaw Industries, and Interface dominate the market.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The UK flooring and carpets market is expanding due to rising urbanization, increased demand for high-quality interiors, and growing emphasis on sustainable flooring materials. Key retailers include Victoria PLC, Amtico, and Brintons.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

Germany’s flooring and carpets market is growing, with a strong demand for high-performance, durable flooring solutions. Key manufacturers such as Tarkett, Forbo, and Gerflor play a dominant role.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.5% |

India’s flooring and carpets market is witnessing significant growth, driven by rising urbanization, infrastructure development, and increasing consumer preference for modern interiors. Companies like Welspun Flooring, Greenlam, and Responsive Industries dominate the sector.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

China’s flooring and carpets market is experiencing rapid growth, fueled by increasing urban development, technological innovations, and the expansion of the e-commerce sector through platforms like Alibaba and JD.com.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

Consumers increasingly prefer high-end flooring materials such as hardwood, marble, and luxury vinyl tiles (LVT) for aesthetic appeal and durability. Sustainability trends drive demand for eco-friendly flooring options, including bamboo, reclaimed wood, and recycled carpets, with brands emphasizing low-VOC and non-toxic materials.

The shift towards modular and customizable carpet solutions allows consumers to create unique interior spaces. Carpet tiles, area rugs, and patterned wall-to-wall carpets gain traction in residential and commercial spaces. Leading brands offer stain-resistant, hypoallergenic, and easy-to-maintain options, catering to modern lifestyle needs.

The hospitality, office, and retail sectors increasingly adopt premium flooring and carpets to enhance ambiance and functionality. In residential spaces, home renovation trends boost demand for stylish and durable flooring solutions. Smart carpets with integrated temperature control and noise-reduction properties gain popularity.

Online retail platforms provide extensive flooring and carpet selections, with virtual room visualizers and AI-driven recommendations simplifying customer choices. Smart flooring technologies, including self-cleaning surfaces and IoT-enabled heating systems, gain consumer interest. Digital marketing and influencer collaborations further boost brand visibility and sales.

The global flooring and carpets market is experiencing significant growth, driven by rapid urbanization, increasing construction activities, and a rising preference for aesthetically pleasing and durable flooring solutions. The market encompasses a variety of products, including carpets, vinyl flooring, laminate, and hardwood, catering to both residential and commercial applications.

Companies are focusing on product innovation, sustainable materials, and strategic acquisitions to strengthen their market positions. The industry is characterized by both established players and emerging firms striving to capture market share through diverse product offerings and targeted marketing strategies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Mohawk Industries, Inc. | 12-15% |

| Shaw Industries Group, Inc. | 10-13% |

| Tarkett S.A. | 8-11% |

| Beaulieu International Group | 6-9% |

| Interface, Inc. | 5-8% |

| Other Companies (combined) | 44-59% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mohawk Industries, Inc. | Offers a comprehensive range of flooring products, including carpets, hardwood, laminate, and vinyl. Focuses on sustainability initiatives, such as using recycled materials and reducing environmental impact. |

| Shaw Industries Group, Inc. | Provides a diverse portfolio of flooring solutions, emphasizing innovation and design. Invests in technology to enhance product durability and aesthetics, catering to both residential and commercial markets. |

| Tarkett S.A. | Specializes in resilient and non-resilient flooring products, including vinyl, laminate, and carpet tiles. Prioritizes eco-friendly products and has implemented circular economy principles in its operations. |

| Beaulieu International Group | Offers a wide array of flooring solutions, including carpets, vinyl, and laminate. Focuses on design innovation and has a strong presence in both residential and commercial sectors. |

| Interface, Inc. | Known for modular carpet tiles and resilient flooring, emphasizing sustainability and carbon-neutral products. Pioneers in environmental initiatives within the flooring industry. |

Strategic Outlook of Key Companies

Mohawk Industries, Inc. (12-15%)

Mohawk leads the flooring and carpets market with a broad product portfolio that caters to various consumer preferences. The company emphasizes sustainability by incorporating recycled materials into its products and implementing eco-friendly manufacturing processes. Mohawk continues to expand its market presence through strategic acquisitions and investments in innovative technologies.

Shaw Industries Group, Inc. (10-13%)

Shaw Industries focuses on delivering innovative and high-quality flooring solutions. The company invests in advanced technologies to enhance product durability and design, appealing to both residential and commercial customers. Shaw's commitment to sustainability is evident through its various environmental initiatives and sustainable product offerings.

Tarkett S.A. (8-11%)

Tarkett specializes in a wide range of flooring products, with a strong emphasis on sustainability. The company has implemented circular economy principles, focusing on recycling and reducing waste. Tarkett's eco-friendly products and commitment to environmental responsibility resonate with environmentally conscious consumers.

Beaulieu International Group (6-9%)

Beaulieu offers a diverse range of flooring solutions, focusing on design innovation and quality. The company has a significant presence in both residential and commercial markets, providing products that meet various aesthetic and functional requirements. Beaulieu continues to invest in new technologies and design trends to stay competitive.

Interface, Inc. (5-8%)

Interface is renowned for its modular carpet tiles and commitment to sustainability. The company has been a pioneer in environmental initiatives within the flooring industry, offering carbon-neutral products and focusing on reducing its ecological footprint. Interface's innovative designs and eco-friendly approach appeal to a growing segment of environmentally conscious consumers.

Other Key Players (44-59% Combined)

Several other companies contribute to the growth of the flooring and carpets market by focusing on niche segments, innovative designs, and sustainable practices. Notable brands include:

These companies leverage their unique strengths and market insights to offer products that cater to specific consumer preferences. They employ strategies such as product diversification, strategic partnerships, and investments in sustainable technologies to enhance their market positions.

The flooring and carpets market is projected to expand at a CAGR of 5.0% between 2023 and 2033.

The flooring and carpets market is anticipated to surpass USD 485,371.5 million by 2033.

The global worth of flooring and carpets market is USD 297,976 million in 2023.

Some leading companies in the market are Mohawk Industries Inc., Interface Inc., Beaulieu International Group N.V.

Carpets hold a significant market share of 33.90% in 2023, driven by the resurgence of comfort and style.

The United States, with a substantial market share of 27.8% in 2023, leads the market due to design-driven demand.

One of the key challenges in the market is the fluctuation in raw material prices, which can impact profit margins.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.