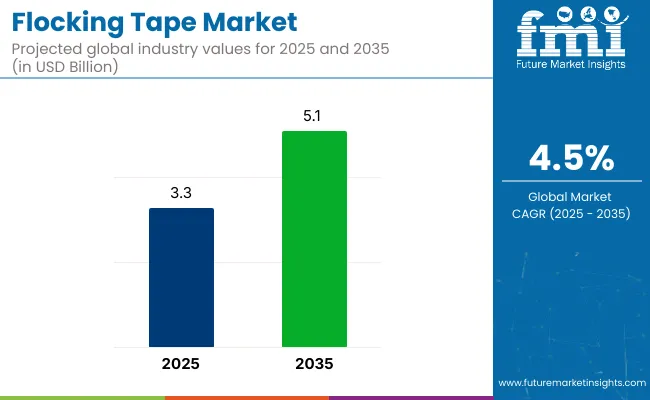

The flocking tape market is projected to grow from USD 3.3 billion in 2025 to USD 5.1 billion by 2035, registering a CAGR of 4.5% during the forecast period. Sales in 2024 reached USD 2.6 billion, reflecting steady growth driven by increasing demand for high-performance, sustainable, and multifunctional adhesive solutions.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3.3 Billion |

| Projected Market Size in 2035 | USD 5.1 Billion |

| CAGR (2025 to 2035) | 4.5% |

This growth is attributed to the rising adoption of electric vehicles (EVs), lightweight automobile components, and advancements in Nano coatings technology to increase durability. The market's expansion is further supported by innovations in flocking tape designs and materials, enhancing their functionality and appeal to various industries.

In January 2025, FrogTape® introduced the latest innovation in its portfolio - FrogTape Advanced™, the most elite painter’s tape on the market. “In 2010, FrogTape® forever changed how we paint. Consumers and professionals alike could forget about the common challenge of paint bleed and instead experience super sharp paint lines every time, thanks to the tape’s PaintBlock® Technology.

This feature seals the tape edges, blocking paint bleed to deliver clean lines and a beautiful result,” says Mary Kate Hearns, Senior Product Manager for FrogTape®. “Now, we’re introducing the most technologically advanced tape we’ve ever made. FrogTape Advanced™ takes PaintBlock® Technology and combines it with new innovations to provide an even more premium product, giving DIYers and pros alike the confidence to take on any project.”

Growing environmental awareness is reshaping the flocking tape market, prompting producers to develop tapes that are biodegradable, non-toxic, and recyclable. Recent advancements feature the use of nano-coating technologies for enhanced durability, the introduction of smart adhesives that respond to temperature changes, and the adoption of more eco-friendly flocking fibers.

These advancements align with global sustainability goals and regulatory requirements, making flocking tapes an attractive option for environmentally conscious consumers. Additionally, the adoption of computerized equipment in industrial production lines is expected to improve efficiency and cost savings.

The flocking tape market will witness growth over the next decade, driven by increasing demand in automotive, aerospace, construction, and consumer goods industries for high-performance and sustainable adhesive solutions. Companies investing in innovative, eco-friendly technologies are expected to gain a competitive edge.

The market's expansion is further supported by the growing emphasis on noise reduction, surface protection, and aesthetic enhancement in various applications. With continuous advancements in materials and manufacturing processes, the flocking tape market is set to offer lucrative opportunities for stakeholders over the forecast period.

The market has been segmented based on type, material, end-use industry, and region. Types such as single-sided flocking tape, double-sided flocking tape, self-adhesive flocking tape, and non-adhesive flocking tape (used with external adhesives) have been incorporated to support bonding precision, application flexibility, and noise reduction.

Materials including polyester, nylon, rayon, cotton, and eco-friendly or biodegradable alternatives have been selected to offer texture, durability, and environmental compatibility. End-use industries such as automotive manufacturing, electronics manufacturing, textile & fashion, packaging, furniture manufacturing, and DIY & craft sectors have been included where flocking tapes are utilized for insulation, decorative, and functional performance.

Regional segmentation has been structured across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa to reflect demand trends, industrial base, and regulatory shifts.

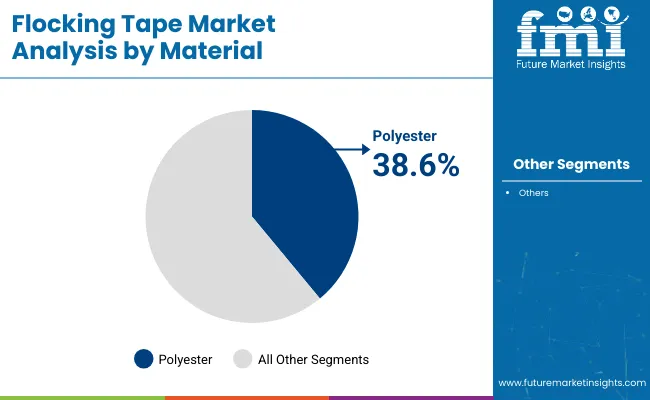

Polyester flocking tape is expected to hold the largest share of 38.6% in the flocking tape market in 2025, as its application has been driven by high durability, surface conformity, and anti-squeak performance. These tapes have been extensively applied in sealing systems, sliding components, and interior trim sections.

Consistent adhesion and flock retention have been ensured through controlled electrostatic coating processes. Resistance to abrasion, stretching, and edge fray has supported use in both visible and concealed vehicle parts.

Production flexibility has enabled polyester tapes to be tailored to a range of widths, thicknesses, and fiber densities. Compatibility with automated lamination and die-cutting equipment has improved throughput in high-volume production environments. Dimensional stability and elongation control have been achieved for accurate fit in curved or grooved assemblies. Market share has been maintained due to proven mechanical performance across industrial and transport applications.

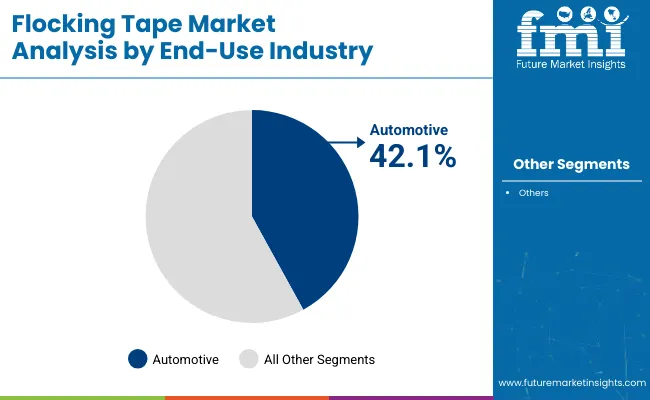

The automotive segment is projected to account for 42.1% of the flocking tape market in 2025, as its dominance has been driven by requirements for NVH (noise, vibration, and harshness) reduction and precise part alignment.

Flocking tapes have been integrated into door panels, window channels, and dashboard assemblies to reduce frictional noise and provide smooth tactile surfaces. Resistance to wear and sliding fatigue has been prioritized in areas subjected to repeated motion. Seamless fitment and thermal stability have supported use in both ICE and electric vehicle platforms.

OEM specifications and interior styling standards have guided product configurations and installation techniques. Flocking tapes have been paired with plastic, metal, and composite substrates for diverse trim assemblies. Increased vehicle customization and part modularity have reinforced the need for adjustable and high-tolerance tape formats. Continued vehicle production and global platform expansions have preserved the segment’s leading role.

High Production Costs and Limited Awareness in Emerging Markets

The flocking tape market is the high manufacturing cost, particularly for high-durability as well as for weather-resistant applications. Unlike standard adhesive tapes, the scenery of electrostatic flocking is more complex and costly, making NTN less competitive. Moreover, the market growth is also hindered due to developing regions not being aware of and adopting this market. Specifically in automotive, construction and industrial.

Growth in Automotive, Electronics, and Noise-Reduction Applications

Car interior applications, electronic insulation, and soundproofing are driving increasing demand for flocking tapes, driven by greater emphasis on noise reduction, toughness, and aesthetics. Innovations in sustainable adhesives, self-repairing flocking products, and conductive flock tapes for electronic shielding are expanding market possibilities.

Additionally, increase in adoption of electric vehicles (EVs) and lightweight automobile components are driving the demand for flocking tapes for wire harness protection and anti-squeak applications.

The USA flocking tape market is growing steadily with increasing demand from automotive, electronics, and constructions industries. The adoption of flocking tape in vehicles for noise reduction, surface protection, and aesthetic enhancement is driving the market growth.

Moreover, the growth in demand for high-performance adhesive products across the textile and packaging sectors is expected to drive the market growth. Innovative green and heat defiant flocking tappings are also shaping the market, as they comply with acute environmental guidelines.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The UK flocking tape market is expanding due to increased use in the automotive and aerospace segments where noise and vibrations reductions are the key drivers for the segment. Increasing application of flocking tape in decorative and protection application in furniture and textile industries are other factors expected to drive the market growth.

In addition, adhesive flocking tapes development is being influenced by the demand for low-emission and sustainable adhesives to comply with UK environmental laws.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

Flocking tape market in Europe will be driven by stringent regulations on noise reduction and energy efficiency of appliances and vehicles. Rising adoption of flocking tape in automotive dashboards, window channels, and door seals is anticipated to drive the market.

Germany, France and Italy as major markets, with strong demand from the automotive, textile and packaging industries. The flocking tape market is being impacted by increasing focus on sustainable & biodegradable adhesive solutions due to environmental regulations in the E.U.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.2% |

Japan's flocking tape market is growing due to its high demand in precision engineering, automotive and consumer electronics sectors. Flocking Tape market is anticipated to witness market growth, owing to the dynamic technological advancement in advanced materials and high-performance adhesive solutions, in the country of Japan.

Use of flocking tape for noise absorbing applications in vehicles and household appliances is gradually growing. In addition, favorable manufacturing practices in Japan and regulations that promote low-VOC containing adhesives will boost the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The South Korea flocking tape market is prospering on account of its flourishing automotive and electronics sectors. Increasing applications of flocking tape in soundproofing, scratch-resistant coatings, and decorative applications in the interiors of automotive such as carpets and mats as well as neats and cushions are driving the demand.

In addition, the packaging and consumer goods industries in South Korea’s growth is fueling demand for high quality adhesive solutions. Market growth is also being driven by the development of lightweight and heat resistant flocking tape.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The flocking tape market is witnessing growth due to the increasing requirement for noise reduction, surface protection, and aesthetic appearance in sectors such as automotive, electronics, construction, and packaging.

Soft, velvet-like surfaces and high abrasion resistance make flocking tapes suitable for extensive use in sealing, anti-squeak applications, and decorative finishes. Growth of the market is supported by innovations in adhesive technology, rising usage of lightweight materials in automobile production, and rising consumer goods applications.

The overall market size for flocking tape market was USD 3.3 Billion in 2025.

The flocking tape market is expected to reach USD 5.1 Billion in 2035.

Increasing applications in automotive interiors, rising demand for noise reduction and surface protection, and growing adoption in packaging and textile industries will drive market growth.

The top 5 countries which drives the development of flocking tape market are USA, European Union, Japan, South Korea and UK.

Cotton flocking tapes growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape Unwinder Market Trends & Growth Outlook 2024-2034

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA