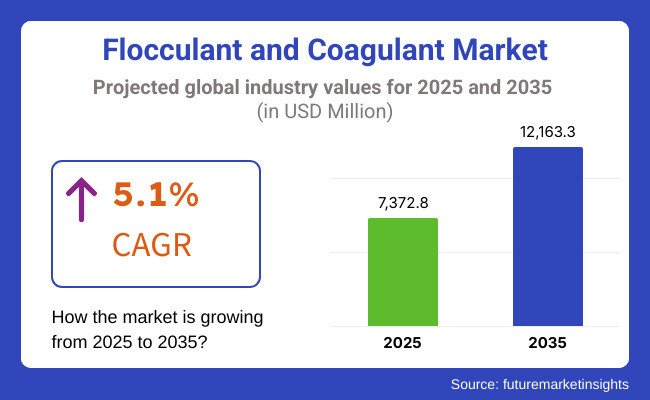

The global flocculant and coagulant market is projected to witness steady growth between 2025 and 2035, driven by rising water treatment needs, rapid industrialization, and stringent environmental regulations. The market is estimated to reach USD 7,372.8 million in 2025 and is expected to grow to USD 12,163.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.1% over the forecast period.

Flocculant and Coagulant are the most important chemical species used in water purification, sewage and industrial waste treatment. Used by municipal water treatment plants; oil & gas refineries; food & beverage processes; mining; chemical manufacturing; and pulp & paper.

The rising population and demand for water treatment has influenced the global industrialization and urbanization and led to the growing consumption of flocculant and coagulant in several water treatment applications to improve the quality of water and meet the government rules. The polymer-based flocculants, environmental coagulation agents, and increasing investments by the government and private sector in various water infrastructure projects are some of the recent developments that stand to influence the market.

With growing International demand for clean drinking water along with stringent release regulations for commercial effluents, collectively these two parameters would form a significant market expansion for the global market during the forecast period. High-performance coagulants and flocculants for industrial and municipal applications requirements are concerned a large rise is anticipated due to this climate change induced water scarcity and governments all over the world are taking initiatives with sustainable water management policies.

The rising demand is mainly driven by the rising demand for clean drinking water, regulatory requirements for wastewater treatment, and the growing industrial activities. The increasing availability of bio-based and high-performing coagulants is anticipated to drive adoption in end-user industries. Ongoing modernization of apt water infrastructure, progressive slinging to circular economy principles and escalating investment in advanced filtration technologies would carve out opportunities for inventive solutions for coagulation-flocculation applications.

Explore FMI!

Book a free demo

North American region is a key market for flocculant and coagulant due to stringent water quality regulations, rising demand for industrial wastewater treatment, and continuous advancements associated with sustainable water purification technologies. Due to authorities like the Environmental Protection Agency (EPA) regulating compliance with wastewater discharge standards, the USA and Canada are starting to see increasing investment levels in municipal water treatment infrastructure.

Increase in oil & gas sector, along with the rise in mining and manufacturing sector is boosting the demand for high-performance coagulants, for the treatment of industrial effluents. Furthermore, the use of polymer-based and bio-based flocculants is growing in popularity as companies seek to pursue sustainable water treatment options.

The increasing need for potable water and projects aimed at treating stormwater is also driving the growth of the market. Artificial intelligence and machine learning Data sets used for training Models of poisoning, cloning, and wind pressure will be used to monitor sediment accumulation in treatment sites, allowing industrial players to optimize mechanical sludge dredging and chemical dosing of sewage in real time, minimize operational costs, and improve treatment efficiency.

The demand for flocculants and coagulants in the European market is growing steadily due to the water reuse initiatives and an increasing focus on industrial waste management, coupled with stringent EU environmental regulations. Countries like Germany, France, and UK have promulgated advanced water treatment programs and encouraged effective coagulation-flocculation processes.

The European chemical and pharmaceutical industry is the leading consumer of flocculants and coagulants as they need highly efficient wastewater solutions. Furthermore, growth in the paper manufacturing, food processing, and energy sectors is driving demand for chemical-based flocculation systems.

The Circular Economy Action Plan (CEAP) of the European Union is also acting as a catalyst for the uptake of the sustainable water treatment chemicals, propelling the demand for biodegradable and non-toxic coagulants. In the long run, government enticements for green chemistry applications and bio-based water treatment solutions are anticipated to drive the market.

Asia-Pacific is the fastest-growing region in the flocculant and coagulant market, driven by rising industrialization, increasing urban population, and growing concerns over water scarcity. The growing focus of municipalities on curbing the amount of contaminated water being dumped or treated in external facilities is now leading to multipliers for coagulants and flocculants, with countries such as China, India and Japan witnessing numerous municipal water treatment projects.

Due to an expansion in the mining sector in Australia and Indonesia, rapid industrialization in China and India and focusing on wastewater treatment regulations. Moreover, significant growth in the pulp & paper industry coupled with the boom in food & beverages sector in the Asia-Pacific region is also driving the uptake of advanced coagulation & flocculation technologies.

An increasing number of governments in the region are investing in water infrastructure, which is expected to make Asia-Pacific a critical growth destination for the market. In addition, increasing investments in seawater desalination projects in the region are further increasing the need for customized solution for improving efficiency for which coagulation technologies including charge neutralization, sweep flocculation, and adsorption are playing a significant role in improving the overall efficiency of effluent treatment.

The Middle East & Africa (MEA) region is witnessing rising demand for water treatment solutions, driven by water scarcity concerns, increasing desalination projects, and industrial expansion. Countries such as Saudi Arabia, UAE, and South Africa are building large-scale water purification factories, which are increasing the popularity of coagulation-flocculation for wastewater treatment and desalination.

Rising oil & gas production across the Middle East is fuelling the demand for advanced water treatment chemicals as industries look to use effective water treatment chemicals to treat produced water and refinery effluents. Furthermore, rise in mining activities across Africa led to increase in demand for Flocculant and Coagulant from mineral processing and sludge dewatering applications.

Expansion in urban population and investments in municipal water supply, will facilitate continued market growth across the region. The growing adoption of mobile and decentralized water treatment plants is another driver of the market owing to the demand for high-performance coagulant treatment formulations in remote areas.

Challenges

Environmental Regulations and Concerns Over Chemical-Based Water Treatment

The flocculant and coagulant market faces growing regulatory scrutiny due to the potential environmental impact of synthetic chemical agents. Some coagulants, such as aluminium and metal salts, can result in sludge production, a change in the acidity of the water, and environmental harm.

Governments across the globe are tightening the regulations on the use of hazardous coagulants in their countries, where industries are looking for sustainable alternatives. Tight regulations such as the Safe Drinking Water Act (SDWA) in the USA and EU Water Framework Directive, along with strict industrial wastewater discharge standards, are enforcing limits on toxic chemical effluent, further fuelling demand for biodegradable and non-toxic alternatives.

Moreover, coagulation sludge generates disposal costs for municipal and industrial clients are not finding easy to overcome as treatment plants will add equipment to handle the sludge and dewater it. Focusing towards the heavy metal content in a coagulant raises questions of long-term contamination potential for both aquatic environments and groundwater stores. This leads to focusing on the research for alternatives in formulations to less sludge generation and more efficient water treatment without harming the environmental safety.

Opportunities

Emergence of Green and Bio-Based Coagulation Technologies

Rise of plant-based polymeric flocculants and natural coagulants to protect the environment globally. Water treatment industries are ever-searching for solutions that are non-toxic, which is eco-friendly alternatives including chitosan-based and starch-derived flocculants are gaining traction. Biodegradable reduces not only chemical waste but also minimizes sludge generation, making it suitable as a green alternative for metal salt-based coagulants.

Moreover, advancements in nanotechnology-based coagulants and bio-engineered polymer flocculants are enhancing product capabilities increasing performance while minimizing chemical consumption. Synthetic biology has been adopted by researchers to modify these natural coagulants, in order to make them more effective, stable, and soluble and work better in various water conditions.

AI-driven dosing systems and real-time monitoring technologies being integrated to optimize bio-based coagulant application, drive down costs, and improve overall water treatment efficiency. Rising in need for circular economy solutions and low-carbon footprint water treatment chemicals drive the major growth of bio-based coagulants and will be the scaling factor for the future market growth.

Between 2020 and 2024, the flocculant and coagulant market saw steady growth, driven by propelled by increasing global water treatment requirements to meet environmental regulations, industry growth, and broader industrial wastewater management initiatives. Municipal and industrial applications of coagulant and flocculant is anticipated to surge in coming years owing to growing demand for clean water and polymeric flocculants have increased efficiency in sedimentation and filtration with polymeric technology.

Market growth was due to growth in industries such as mining, oil & gas, food & beverage, and pulp & paper. Volatility of raw material prices, strict disposal regulations, and environmental concerns about chemical-based coagulants posed challenges.

Looking forward for upcoming period of 2025 to 2035, with AI-driven water treatment process optimization, bio-based coagulants, and circular economy-driven sludge management solutions. An increased reliance on nanotechnology-enhanced flocculants, AI-powered dosage control, and electrocoagulation systems will increase efficiency and sustainability. In addition to this, eco-friendly polices like Zero Liquid Discharge (ZLD), Decentralized waste-water treatment and next-gen Hybrid coagulants shall bring changes in the industry practices.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Water Scarcity & Regulatory Compliance | Governments began to impose stricter limits on dynamic limits and industrial effluent standards. |

| Adoption of Bio-Based & Eco-Friendly Coagulants | Initial adoption of plant-derived and biodegradable coagulants in food & beverage and municipal wastewater treatment. |

| Advancements in Flocculant & Coagulant Efficiency | Heavy duty synthetic polymer flocculates, or use high-charge-density coagulants for quick sedimentation. |

| Mining & Industrial Wastewater Treatment Expansion | High demand for aluminum sulfate, ferric chloride, and polyacrylamides in mining, oil & gas, and power plants. |

| Smart Water Treatment & Automation | Several utilities used automated chemical dosing systems to streamline treatment processes. |

| Market Growth Drivers | Growth in market due to use in urbanization, industrial expansion, and stricter discharge limits for wastewater treatment. |

| Market Shift | 2025 to 2035 |

|---|---|

| Water Scarcity & Regulatory Compliance | Net-zero water regulations, AI-based real-time monitoring of water quality, and circular economy initiatives alter demand for coagulants and flocculants. |

| Adoption of Bio-Based & Eco-Friendly Coagulants | Widespread use of bio-based polymeric flocculants, algae-based coagulants and biodegradable chitosan-based solutions helps reduce chemical footprint. |

| Advancements in Flocculant & Coagulant Efficiency | Nanotechnology-based flocculants, machine learning-optimized coagulation procedures, and coagulant mixtures increase efficiency and decrease sludge amount. |

| Mining & Industrial Wastewater Treatment Expansion | Growth in electrocoagulation, microplastic removal coagulants, and AI-driven predictive dosage control enhances treatment efficiency. |

| Smart Water Treatment & Automation | Real-time optimization with IoT-integrated water quality monitoring, blockchain-based compliance auditing, and AI-governed coagulation systems transforms effectiveness. |

| Market Growth Drivers | Market expansion driven by AI-powered smart water treatment systems, zero-waste chemical recovery, and sustainable flocculant innovation. |

The (North) USA flocculant and coagulant market is witnessing an expansion at a steady rate with the growing demand from municipal water treatment plants is contributing to the market growth in the country. End users are thus following suit with high-performance coagulation & flocculation solutions to meet the environmental regulations set out by the Environmental Protection Agency (EPA)regarding the quality of water discharged, as well as effluent discharged from industries.

The increase of oil & gas operations, particularly in the case of hydraulic fracturing (fracking) methods, is contributing to the growth of demand for produced water treatment. The development of advanced flocculant formulations, specifically designed for solid-liquid separation efficiency, is also boosting the food & beverage and pharmaceuticals and chemical manufacturing sector. In this regard, there is a growing trend towards biodegradable and environmentally friendly coagulants.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

The United Kingdom flocculant and coagulant market is growing at a steady pace, supported by water quality regulations, growing urbanization, and rising demand for sustainable water treatment solutions. The UK Water Industry Research (UKWIR) and the Environment Agency (EA) have enforced strict discharge limits on industrial effluents and sewage treatment plants, driving the need for effective coagulation and flocculation technologies.

Concern over climate change, and rising water scarcity, is fuelling increased adoption of high-performance water treatment chemicals at desalination and water recycling plants. In addition, the growth of the UK's food & beverage and dairy sectors is creating a demand for coagulants applied for process water purification and wastewater treatment. Increasing use of environmental friendly alternative to aluminum-based coagulants, such as organic polymer-based coagulants, is likely to drive segment growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

The European Union flocculant and coagulant market is expanding significantly attributed to stringent water quality standards for various applications, the expansion of the wastewater treatment facilities across various industries, and the investment towards sustainable water management in the EU members. A European Water Framework Directive (WFD) sets severe discharge limits for pollutants, forcing industries to use high performance coagulants and flocculants to meet demand.

Germany, France, and Italy are among the top countries to adopt bio-based coagulants as EU policies back chemical sustainability and lower environmental impact. Moreover, the increasing number of urban wastewater treatment projects is driving the demand for flocculants that improve dewatering efficiency of sludge.

Growing demand for flocculants in sectors like mining, paper production, and textile effluent treatment will provide additional impetus to the market growth. In addition, the development of nanotechnology-based coagulants is enhancing contaminant removal efficiency and minimizing the sludge production.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.1% |

The Japan flocculant and coagulant market is growing at a steady rate driven by high standards of water treatment, rising industrial wastewater treatment needs, and advancements in chemical formulations. Japan has stringent environmental regulations, which mandate zero liquid discharge (ZLD) in numerous industries, and this trend is driving demand for high-performance coagulants.

Japan’s semiconductor and electronics industry growth has also driven demand for ultra-pure water treatment solutions, which require specific flocculants to remove trace contaminants. Japan’s increasing desalination and water recycling projects are also fuelling acceptance of coagulants in brine treatment and industrial wastewater reuse. Hybrid polymeric flocculants with self-tuning coagulation properties are an emerging technology in smart water treatment applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The growth of the South Korea flocculant and coagulant market can also be attributed to increasing industrialization, growing investment in treating municipal wastewater, and stringent government regulations regarding water pollution control. Korean Ministry of Environment (MoE) imposing stricter guidelines on industrial effluent release to wastewater systems, the demand for advanced Flocculant and Coagulant in the manufacturing and chemical sectors has expanded.

The growth of South Korea’s semiconductor and battery manufacturing industries is also increasing demand for ultra-pure water treatment solutions, which need higher-performing coagulants that are low-residue and have high-purity formulations. Market for Polymer & Organics Coagulant are growing with the increasing infrastructure for water recycling or treatment in urban areas. South Korea, as a leader in smart water treatment systems, has developed real-time flocculation monitoring and AI-optimized coagulants dosing technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The flocculant and coagulant market is predominantly driven by the municipal water treatment sector, where urbanization, regulatory drinking water quality standards, and a concern over water scarcity are prominent. Coagulants and flocculants are typically used in municipal water treatment plants to remove suspended solids, organic matter and pathogens from drinking and wastewater. These are essential for the treatment process, helping in the clarification of water, reduction of turbidity, and increment of the filterability, thus ensuring compliance with environmental and public health regulations.

Areas in which Flocculant and Coagulant are most utilized include sedimentation and filtration systems in municipal treatment facilities. Coagulants as aluminum sulfate (alum), ferric chloride, and polyaluminum chloride (PAC) are familiar, whereas relatively new coagulants as polyacrylamides and biopolymer-based flocculants are getting more attention due to their better efficiency and less sludge generation.

The upcoming foams variant versions are eco-friendly coagulants and bio-based flocculants, which contain liquid, air-activated and top-notch coagulant agents available in the waste materials installed under drastic conditions and used as biodegradable flocculants, appealing to sustainable and eco-friendly production through bi-products enabling to meet strict wastewater discharge norms as wheeled in by government regulations.

The industrial water treatment sector is experiencing significant growth, as industries such as chemical processing, oil & gas, food & beverage, and pharmaceuticals seek efficient wastewater treatment solutions to comply with environmental mandates. Both Flocculant and Coagulant are crucial for separating heavy metals, suspended solids, and organics from industrial wastewater streams as they help industries comply with discharge limits and maximize water reuse and recycling.

In industries like power generation and petrochemicals, where substantial quantities of water are needed for cooling and processing activities, higher performance coagulants like ferric sulfate, aluminum chloride, and polymer-based formulations are increasingly being used.

Colour additives are applied to the floc acquired for recovery, and then spore is incorporated into the floc as sensible when all of these are handled in a slurry phase ultimately products are collected in solution phase by precipitation of solution floc dispersed. Market growth is being furthered by the emphasis on zero-liquid discharge (ZLD) systems and water reclamation technologies, which creates demand for coagulation-flocculation solutions that are effective and economically viable.

Flocculants with superior solid-liquid separation capabilities over coagulants and higher growth in industrial water treatment is driving the demand market. These polymers are used to aggregate the fine particles in order to obtain larger flocs, which are much easier to remove by sedimentation, filtration, or flotation. Flocculants are used extensively within industries such as pulp & paper, textiles and mining, where fine particulate removal and process water clarification is critical.

The market is moving towards synthetic polyacrylamide-based flocculants, which offer a huge molecular weight and effective binding strength that enhances overall water treatment efficiency. However, natural flocculants derived from starch, chitosan and polysaccharides from plants are being considered biodegradable substitutes increasingly due to growing environmental concerns. There is an increasing need for environmentally-friendly solutions which leads to the development of flocculants that are low-toxicity and non-residual that meet regulatory specifications.

Coagulants causing a reduction in total suspended solids (TSS) for water quality applications, most commonly in primary clarification and pre-filtration. They destabilize suspended particles, organic matter, and colloidal contaminants in the water, enhancing the ability to separate them in order to easily take them out in the next stages of purification. Coagulants find extensive application in municipal, industrial water treatment and in power plants and mining operations for effective treatment of highly turbid water before reuse/discharge.

Commonly used coagulants include traditional aluminum- and iron-based species (alum, ferric chloride, and ferric sulfate) because of their relatively low cost and good coagulation capacity in practice. But, the demand for organic and polymer-based coagulants has been growing, as industries look for more efficient, non-corrosive, and eco-friendly solutions. They have also coagulant formulations shown of topical and polymeric components are also the trend towards blended coagulant formulations, these show faster sedimentation rate and lower requirements of chemical dosage.

The global Flocculant and Coagulant market is growing at a steady rate on account of the increasing need for solutions for treating water, increasing regulations for industrial wastewater, and the growth of municipal and industrial water purification systems. These products play a critical role in the treatment process, as they improve the elimination of suspended solids, organic matter and contaminants from water sources, resulting in clean, safe water for industrial, municipal and agricultural use.

Technological progression in water treatment, increase in usage of eco-friendly & biodegradable coagulant agents and expansion in sustainable water management infrastructure. Leading manufacturers focus on efficient quiescent settling, quick chemistry, and economical inputs to serve the needs of municipalities, industrial processing plants, and mining companies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SNF Group | 10-12% |

| Kemira Oyj | 9-11% |

| BASF SE | 8-10% |

| Ecolab Inc. (Nalco Water) | 7-9% |

| Solenis LLC | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| SNF Group | High-efficiency coagulants for industrial and municipal water treatment, polyacrylamide-based flocculants global leader. |

| Kemira Oyj | Creates organic and inorganic coagulants for the pulp & paper, oil & gas and mining industries with high-performance water treatment products. |

| BASF SE | Specializes in the design, manufacture, and application of cutting-edge polymer-based flocculants, providing advanced sustainable water treatment solutions through enhanced coagulation performance. |

| Ecolab Inc. (Nalco Water) | Innovatively provides industrial wastewater treatment including eco-friendly coagulants and biodegradable coagulant addition, with a focus on water treatment solutions. |

| Solenis LLC | major global supplier of high-performance coagulants and flocculants for municipal and industrial applications that enhance solid-liquid separation and filtration. |

SNF Group

SNF Group is a world leader in the production of water treatment chemicals, offering polyacrylamide based flocculants and high performance coagulants for municipal, industrial and agricultural applications. The company provides only anionic, cationic, and non-ionic polymer-based flocculants for improved solid-liquid separation. SNF Group has also continued to invest into the development of sustainable polymers, leading to the production of biodegradable sustainable flocculants for water treatment that reduces the unfavourable impacts on the environment.

Kemira Oyj

Kemira offers organic and inorganic coagulants and tailor-made water treatment applications for the pulp & paper, oil & gas and mining industries. The coagulants from the company, which include ferrous and aluminum-based, promote the swift removal of suspended solids and pollutants from wastewater. Kemira has an established and growing sustainable water treatment product portfolio which includes bio-based coagulants and smart dosing technologies to optimize efficiency and cost-effectiveness for most large industrial applications.

BASF SE

BASF is a major provider of polymer-based flocculants, offering customized coagulant formulations for industrial water treatment, food processing, and municipal applications. Innovative solution harmonizes with state-of-the-art chemical engineering and process refinement, making coagulation high-performing with the least consumption of chemicals. BASF's focus is on low-toxicity and biodegradable coagulants, as there is a rising need for sustainable and environmentally friendly water treatment solutions.

Ecolab Inc. (Nalco Water)

Ecolab, specializing in high-performance coagulants and flocculants through its Nalco Water division, deliver optimal performance for safe, cost-effective treatment of industrial wastewater. Manages sludge, filtration The company’s proprietary coagulant formulations help industries minimize sludge generation while optimizing at the same time filtration processes. They are also developing green chemistry solutions while offering plant-based, biodegradable flocculants for sustainable industries and regulatory compliance.

Solenis LLC

Solenis offers advanced coagulant and flocculant solutions across municipal, industrial, and specialty water treatment applications. With applications in power plants, mining operations, and chemical processing facilities, the company’s products help ensure efficient solid-liquid separation and sludge management. Matching the right flocculant base with the right application, Solenis is leveraging formulations to improve the dosage of its biopolymer-based flocculants and intelligent dosing systems to aid treatment efficiency and cost effectiveness.

The global Flocculant and Coagulant market is projected to reach USD 7,372.8 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the forecast period.

By 2035, the Flocculant and Coagulant market is expected to reach USD 12,163.3 million.

The industrial water treatment sector is experiencing significant growth, as industries such as chemical processing, oil & gas, food & beverage, and pharmaceuticals seek efficient wastewater treatment solutions to comply with environmental mandates.

Key players in the Road Marking Paints and Coatings market include Feralco Group, Chemtrade Logistics Inc., IXOM Holdings Pty Ltd., Kurita Water Industries Ltd., Aditya Birla Chemicals, Buckinghams Industries.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.