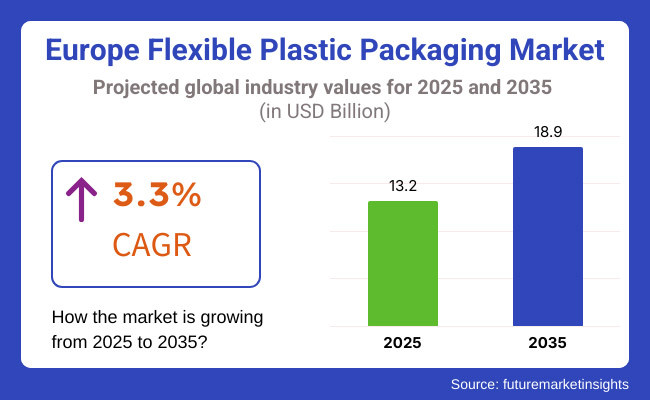

The Europe flexible plastic packaging market is anticipated to be valued at USD 13.2 billion in 2025. It is expected to grow at a CAGR of 3.3% during the forecast period and reach a value of USD 18.9 billion in 2035.

Flexible plastic packaging is a light, tough, and economical form of packaging that includes pouches, bags, and films in food, beverage, pharmaceuticals, and personal care applications, which are rapidly growing in popularity due to factors such as rising e-commerce, growing convenience, sustainability trends, and advances in biodegradable materials, mainly driven by cost savings and extended shelf life.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Moderate expansion as a result of high demand for food, drinks, and medicines. | Higher growth driven by advancements in sustainable and biodegradable materials. |

| Shift towards recyclable materials and lightweight packaging. | Widespread adoption of compostable, bio-based, and circular economy solutions. |

| Stricter EU regulations pushing brands toward sustainability. | Even more stringent laws banning single-use plastics and enforcing closed-loop recycling. |

| Consumers prefer convenience and portability but are increasingly eco-conscious. | Demand for fully sustainable, non-toxic, and reusable packaging increases significantly. |

| Smart packaging begins to emerge, with limited use of digital printing and tracking. | Digitalization, AI-driven packaging, and blockchain-backed traceability become mainstream. |

| Use of virgin plastics still prevalent, with a slow shift to recycled content. | Bio-based and recycled plastic domination, with little or no virgin plastic use. |

| Development of high-barrier films for food safety and extended shelf life. | Intelligent and active packaging innovations, self-sealing films, and interactive labels. |

| Increased demand for flexible packaging in online shopping. | Expansion gains pace with light, strong, and sustainable packaging leading the industry. |

| Initial steps towards circular economy practices. | Completely closed-loop recycling and waste management systems combined with closed-loop manufacturing. |

Sustainability & Circular Economy Initiatives

The market for environmentally friendly and recyclable flexible plastic packaging is growing fast in Europe. Tightening EU regulations like the European Green Deal and Single-Use Plastics Directive encourage brands to transition to sustainable packaging.

For the further recyclability of packaging, brands have been moving toward mono-material packing such as all-polyethylene or all-polypropylene. With the rising consumer demand for eco-friendly packaging, biodegradable and compostable films from bio-based polymers like PLA and PHA are also gaining traction.

Growth in E-Commerce & Convenience Packaging

As per FMI estimation, the urban boom in e-commerce and change in lifestyles affect the requirement of lightweight, tough, and protective flexible plastic packaging materials. The online retail boom has increased the demand for flexible, affordable, tamper-free packaging ensuring the ultimate protection of products during transit.

Busy urban consumers, however, prefer convenience packaging including resealable pouches and portion-sized packs, which, in addition to providing extended shelf life, add to their usage convenience. With so many brands vying for visibility online, attractive and functional flexible packaging acts as the differentiator.

| Attributes | Details |

|---|---|

| Top Product Type | Pouches |

| Market Share in 2025 | 3.5% |

The pouches segment is expected to see steady growth, with its market share in the Europe flexible plastic packaging market rising to 3.5% by 2025. This growth is driven by increasing demand for lightweight, resealable, and easy-to-transport packaging solutions.

Pouches have gained popularity in sectors such as food & beverages, pharmaceuticals, and personal care, where convenience and extended shelf life are key factors. The rise in e-commerce and direct-to-consumer brands has also contributed to the increasing adoption of flexible pouches due to their cost-effectiveness and lower transportation costs compared to rigid packaging.

Sustainability concerns are further shaping the demand for eco-friendly pouches, with many manufacturers shifting toward biodegradable, compostable, and recyclable materials. Companies are investing in advanced barrier technology and high-performance films to enhance product protection while meeting regulatory standards.

Additionally, the shift toward customized and smart packaging solutions, such as stand-up pouches with resealable zippers and spouts, is expected to drive innovation in the segment. As sustainability regulations tighten across Europe, the adoption of recyclable mono-material pouches will continue to gain traction.

| Attributes | Details |

|---|---|

| Top End Use | Industrial Packaging |

| Market Share in 2025 | 4.6% |

The industrial packaging segment is projected to expand, reaching a market share of 4.6% by 2025. The increasing adoption of flexible plastic packaging solutions in industrial applications is driven by the need for cost-efficient, durable, and lightweight alternatives to traditional rigid packaging.

Industries such as automotive, chemicals, agriculture, and construction are shifting toward flexible plastic packaging due to its versatility, resistance to harsh environmental conditions, and ease of handling. The demand for bulk packaging solutions, such as heavy-duty flexible pouches and liners for industrial goods, is expected to contribute to the growth of this segment.

The push for sustainable industrial packaging is also influencing market trends, with many manufacturers transitioning to recyclable and reusable flexible plastic materials. The incorporation of high-performance films, advanced polymer blends, and eco-friendly resins is improving the durability and sustainability of flexible industrial packaging solutions.

Additionally, advancements in barrier properties, tamper-proof sealing, and smart tracking technologies are making flexible plastics a preferred choice for industries seeking enhanced protection and supply chain efficiency. The integration of automation and digital printing solutions is further streamlining production, making flexible plastic packaging more adaptable to various industrial needs.

The European flexible plastic packaging industry itself is highly concentrated, with the presence of key global players such as Amcor Plc, Berry Global Inc., Huhtamaki Oyj, Mondi Plc, as well as Constantia Flexibles Group GmbH accounting for a sizeable share of the industry.

With respect to business conduct, these industry leaders have exercised further control through merger and acquisition activity. For example, with Amcor's purchase of Berry Global Group in an USD 8.4 billion merger, it has claimed its status as the largest plastic packaging company in the world. The further strengthening of the industry against this merger will be International Paper Co.'s USD 7.16 billion purchase of DS Smith, which has now been sanctioned by the European Union.

Such a presence of major players indicates the competitive situation of the industry wherein its existing state is shaped by strategic expansions and consolidations. Knowledge, experience, modern technology, and strong consumer bases of these companies help to entrench their top positions in the European flexible plastic packaging industry.

As the industry continues to evolve, the Tier 1 companies are expected to keep those influential rolls, driving innovation and setting standards compliant with regulatory and sustainability objectives. The strategic exploits and international exposure place them on top of the flexible plastic packaging industry in Europe.

In conclusion, the concentration of a few leading global companies in the European flexible plastic packaging industry, as a result of strategic mergers and acquisitions, has fortified their current positions and shaped the competitive landscape of the plastic packaging industry.

European flexible plastic packaging is more than an interesting and dynamic market; it is an extremely competitive market that is rapidly becoming highly promising because of the increase in demand for lightweight durable, and cost-effective packaging solutions in various industry segments, including the food and beverages sector, pharmaceuticals, and consumer goods. Evidently, that brings altogether a number of key players, constantly improv

Amcor Plc has the headquarters based in Switzerland among the topmost companies that dominate the European flexible plastic packaging scenario. In November 2024, Amcor announced the news that they would acquire a USA-based company, Berry Global Group, through an all-stock transaction price of USD 8.43 billion. Clearly, the intent of such a merger is to create a giant packaging powerhouse generated from revenues totaling USD 24 billion, strengthening Amcor's market reach and capabilities.

The combined entity will operate under the Amcor Plc name post-acquisition with current Amcor CEO Peter Konieczny at the helm. This mega-deal is expected to realize USD 650 million in synergies by the third year following closure, slated for mid-2025.

A significant name in Europe's flexible plastic packaging market is ALPLA Group, an Austria-based multinational plastics manufacturer specializing in the manufacture of blow-molded bottles, caps, injection-molded parts, preforms, and tubes.

With a presence in 46 countries and annual sales of €4.9 billion in 2024, ALPLA is a major player in the flexible plastic packaging market for Europe. The company is actively investing to boost its activities in recycling by planning an average investment of €50 million annually until 2025 to scale up its recycling capabilities. These overall efforts are consistent with trend demands for greener packaging solutions in Europe.

Other significant players in the area competition are Klöckner Pentaplast (kp), a Luxemburg company with major operations in Germany and the UK. kp is engaged in plastic packaging products, and 31 plants are established in 18 different countries, employing almost 5,700 around the globe.

The company realizes annual revenue of around €2 billion. kp serves a wide range of market sectors, from food packaging to pharmaceuticals and consumer goods. Its strategic focus includes the development of recycled-content products and of high-barrier protective packaging in adherence to growing consumer and regulatory demand to much greener packaging solutions.

The competitive landscape is further intensified by other renowned companies like Huhtamaki Oyj, Constantia Flexibles, and Sealed Air Corporation, in the race to gain more market share through various means of innovation, merges, and acquisitions. Such consolidation activities, highlighted by the Amcor acquisition of Berry Global, hint toward the trend of forming "bigger" companies that provide all-in-one packaging solutions and realize operational synergies.

Today's economies increasingly invest into a sustainable future for the future generations in every country. ALPLA also invests significantly into recycling infrastructure for sustainability with exemplary investments shown this way so far; putting AU USD 50 million on average investments for taking recycling capabilities through 2025 as well as developing recyclability and biodegradability in its materials. This proactive approach by ALPLA is of meeting some of the consumer expectations as well as regulatory requirements.

On the other hand, technological modernization is another primary consideration on maintenance of competitive viability within the market. Companies are investigating the potential use of new materials, barrier enhanced, alongside improved functionality of flexible plastic packaging targeting the varying needs of different industries.

The trend also appears to be embraced among the leading players in the market with integration of smart packaging solutions that come with advantages like extended shelf life and improved safety of the products.

Indeed, the European flexible plastic packaging market will have strategic alliances in the form of mergers and acquisitions; it will include all aspects of sustainability; and it would step further to adopt and create more innovative technological advancements on a continuous basis. As companies grapple with environmental regulations and changing consumer patterns, those that are able to marry innovation with sustainability will rank highly above others in the competition in this fast evolving market.

The Europe flexible plastic packaging market is expected to be valued at USD 13.2 billion in 2025 and grow to USD 18.9 billion by 2035 at a CAGR of 3.3%.

The future prospects for flexible plastic packaging sales in Europe are strong, driven by sustainability trends, e-commerce growth, and advancements in biodegradable and recyclable materials.

Key manufacturers in the Europe flexible plastic packaging market include Amcor Plc, Berry Global Inc., Huhtamaki Oyj, Mondi Plc, and Constantia Flexibles Group GmbH.

The pouches segment is expected to lead the industry, with a market share of 3.5% in 2025 due to increasing demand for lightweight, resealable, and cost-effective packaging solutions.

The market is segmented by material into oil-based polymers and bioplastics.

Based on the product type, the market is segmented into pouches, bags & sacks, tubes, sleeve labels, and films & wraps.

Based on end use, the market is segmented into consumer packaging and industrial packaging.

The market are categories based on packaging type, including vacuum skin packaging (VSP), modified atmospheric packaging (MAP), and general barrier.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Ventilated FIBC Market Growth - Demand & Forecast 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.