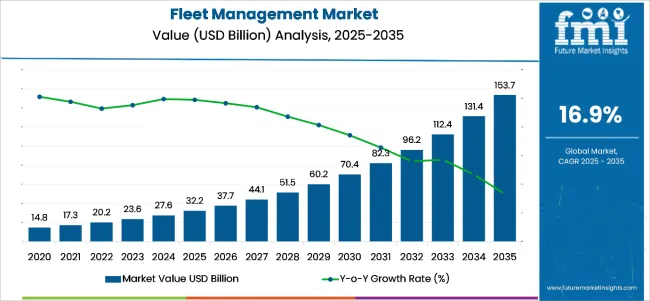

The global fleet management market is valued at USD 32.2 billion in 2025 and is projected to reach USD 153.7 billion by 2035, registering a substantial CAGR of 16.9% during the forecast period.This strong growth reflects the increasing reliance of businesses on advanced fleet monitoring and optimization solutions to improve operational efficiency and reduce costs.

The integration of next-generation technologies such as telematics, artificial intelligence (AI), Internet of Things (IoT), and cloud computing platforms is significantly reshaping fleet management practices across industries worldwide. As companies prioritize better utilization of their vehicle fleets, ensure driver safety, and aim to comply with regulatory mandates on tracking and fuel monitoring, the demand for integrated fleet solutions is rising sharply.

The market expansion is primarily driven by the urgent need for real-time fleet tracking, efficient route planning, and reduction of vehicle idle time to curb operational expenditures. Technological innovations such as predictive maintenance, remote diagnostics, and data analytics are helping fleet operators extend vehicle life, reduce downtime, and optimize fuel usage, contributing directly to profitability.

Additionally, rising awareness of environmental sustainability is pushing firms to invest in eco-friendly fleet management systems that minimize carbon emissions. Government regulations mandating the use of electronic logging devices (ELDs) in regions like North America and Europe are further accelerating market penetration for fleet management technologies, as companies seek to ensure compliance while maintaining competitiveness.

Another crucial factor driving this market's evolution is the growth of industries such as transportation, logistics, construction, and government services that rely heavily on large fleets for daily operations. These sectors are increasingly recognizing the value of data-driven decision-making to enhance fleet productivity, lower accident risks, and improve customer satisfaction through timely deliveries and services.

As connectivity infrastructure improves globally, especially in developing regions, more businesses are expected to adopt fleet management systems. Major market players such as Verizon Connect, Geotab, Samsara, Motive, Teletrac Navman, Omnitracs, Trimble, Fleet Complete, Azuga, and Mix Telematics are heavily investing in research and development to offer AI-powered, scalable, and customizable solutions, further propelling market growth in the years to come.

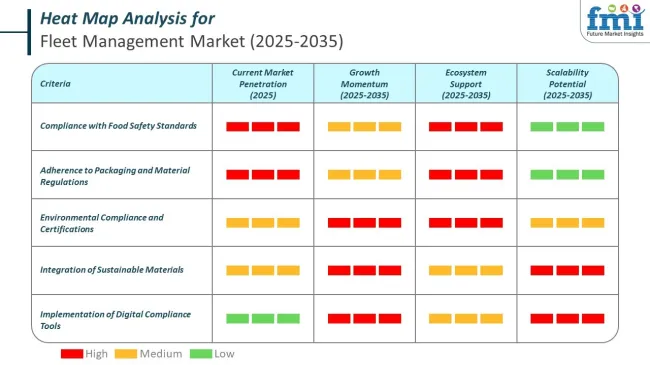

Artificial Intelligence and Machine Learning are revolutionizing fleet management by delivering predictive insights, real-time decision-making, and operational efficiency. These technologies enable businesses to optimize routes, minimize fuel consumption, enhance driver safety, and maintain regulatory compliance.

Leading players in the fleet management industry are actively implementing AI and ML technologies to enhance compliance with operational standards, safety norms, and environmental regulations. These integrations are reshaping logistics efficiency and regulatory adherence across global markets.

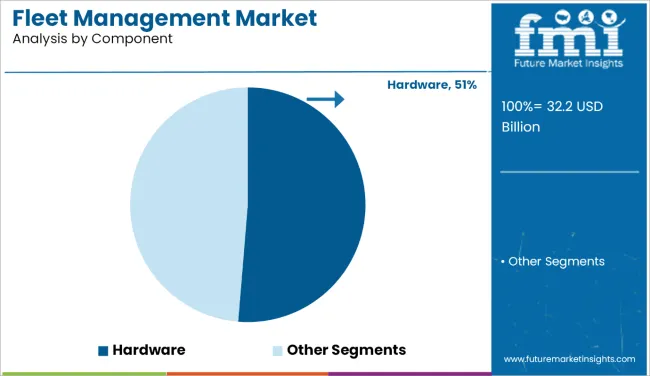

| Component | Share (2025) |

|---|---|

| Hardware | 51% |

The hardware segment has the largest industry share in the industry based on the popularity of GPS tracking devices, telematics devices, onboard diagnostic (OBD) systems, and high-tech sensors. The hardware devices are the foundation for fleet monitoring as they enable real-time tracking of trucks, fuel management, driver behavior analysis, and predictive maintenance.

Increasing demand for IoT-enabled products and AI-driven telematics systems is also resulting in hardware penetration. Furthermore, regulatory requirements calling for vehicle tracking and electronic logging devices (ELDs) boost industry growth in industries such as North America and Europe.

As fleet managers prioritize vehicle safety, fuel consumption, and adherence to regulations, investments in newer telematics hardware keep mounting. As such, the hardware segment stands as the primary revenue contributor to the overall industry for the industry.

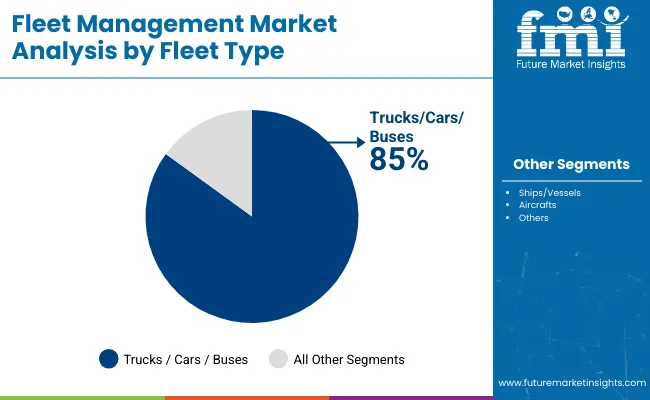

| Fleet Type | CAGR (2025 to 2035) |

|---|---|

| Trucks/Cars/Buses | 85% |

The trucks, cars, and buses segment are witnessing the highest CAGR in the industry due to rapid urbanization, increased logistics demand, and the expansion of public transportation. The surge in e-commerce and growing freight transportation requirements are driving the demand for fleet tracking, route optimization, and predictive maintenance in commercial vehicles.

Likewise, the increased use of ride-hailing, car rental, and corporate fleet leasing services is propelling the use of the industry solutions in the passenger car industry. In public transport, intelligent fleet solutions are optimizing bus routes, lowering fuel usage, and enhancing commuter safety. Government programs for electric and connected vehicles also support this segment's high growth rate, and hence, it is the fastest-growing segment in the industry.

The rapid progress of telematics, IoT, and AI analytics technology is bringing a treasure island of opportunities in the industry space for the fleet performance improvement and operations costs reduction.

The automotive sector has management software to track the health of the vehicle, driver behavior, and regulatory compliance. In the public sector, the government and those in the public sector have a stake in asset utilization and regulatory compliance, whether we are talking about emergency response vehicles or fleets in public transit. The industry is significant for route optimization, risk management, and fuel monitoring of the oil and gas industry to ensure optimal operation performance.

In the e-commerce and retail sectors, cost and last-mile delivery monitoring is significant in ensuring effective supply chain management. Industry growth through higher demand for cloud-based industry, AI-based automation, and electric vehicle fleet monitoring are industry trends driving growth.

| Company/Entity | Contract Value (USD Million) |

|---|---|

| Norwegian Air Shuttle | Approximately USD 50.7 |

| Southwest Airlines | USD 871 |

There will be a lot going on in The industry in 2024 and well into 2025, demonstrating how, strategically, airlines and service providers have operated to maximize activities and, invariably, bottom-line impact. On a short- and long-term basis, Norwegian Air Shuttle's acquisition of 10 excess Boeing 737-800 jets, essentially zero down, would cost the airline money over the years and will cost the airline greater space for planning the future of its fleet.

Similarly, the sale and leaseback of 36 Boeing 737-800 airplanes of carrier Southwest Airlines have bettered the financial position of the carrier by USD 871 million while alleviating the short-term financing burden, thereby helping fleet modernization programs.

Furthermore, Transmetro S.A. S proposed an agency for professional services aimed at enhancing fleet operation management, which has demonstrated its hunger for more efficiency and service delivery. These advancements reflect a wider industry trend towards strategic asset management and operational efficiency in the industry space.

In periods of economic recession, the demand for fleets is decreased consequently, the growth is influenced. With the addition of emission and safety requirements as new regulatory changes, the operating costs have been on the rise. The competitive industry situation has made it hard for companies to balance the prices, thus it impacts pricing which in turn affects the profit margin.

Cybersecurity breaches emerge as a serious threat with the increased dependency of ships on telematics and IoT as well. The small-sized companies are the ones which suffer being putting up with the installment of expensive technologies. Interoperability between the old software and new ones not being supported has a great bearing on how the operation runs.

The interruptions in supply chain, consisting of the shortfall of labor, cause fleet maintenance difficulty. The driver shortage is a factor affecting fleet efficiency and quality of service. Products like gas price changes are some of the expenses Tricky which are added in the budgets therefore affecting the operational costs. In a competitive industry, businesses should pay attention to keeping the workforce, making the supply chain stronger, and managing the fuel costs effectively in order to continue with the normal operations.

Compliance with sustainability laws which is driving the fleet sector towards electric vehicles has meant that the companies now have to bear the additional costs at the beginning. The extreme weather brought about by climate change impacts fleet operations, thus the companies can face delays and maintenance problems.

Deploying artificial intelligence based on the operation and network security ensures efficiency is enhanced. Awareness and adherence to regulatory requirements help avoid penalties. Fuel-efficient fleet acquisition helps save costs and reduce emissions. Risk management tools, in a structured way, help fleet managers identify possible threats and consequently, the business grows sustainably in the transformed industry.

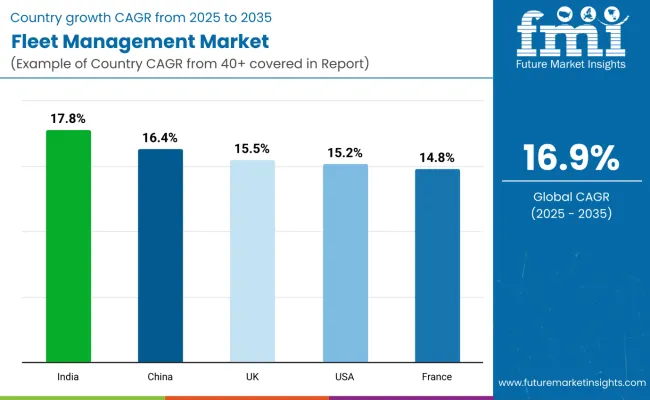

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 15.2% |

| France | 14.8% |

| The UK | 15.5% |

| China | 16.4% |

| India | 17.8% |

The USA boasts the largest industry, fueled by a robust technology ecosystem, regulatory requirements, and a quest for operational efficiency. The Electronic Logging Device (ELD) regulation forces fleet operators to adopt telematics and compliance solutions. Verizon Connect, Geotab, and Samsara lead AI-based analytics, IoT-based vehicle tracking, and predictive maintenance.

The sustainability wave is also fueling fleet electrification and autonomous vehicle adoption. Fleets are embracing cloud-based fleet management software to drive fuel efficiency, lower operating expenditures, and boost driver safety, driving a mature and expanding industry.

FMI is of the opinion that the USA industry is slated to grow at 15.2% CAGR during the study period.

| Key Drivers | Details |

|---|---|

| Regulatory Mandates | Tight emissions regulations and the ELD mandate fuel adoption of telematics and optimization solutions for the fleet. |

| Technology Advancements | IoT, AI, and predictive analytics drive improved fleet efficiency, fuel economy, and safety. |

| Sustainability Drive | The industry is becoming increasingly popular in the form of electric and autonomous vehicles with companies making investments to meet sustainability objectives and reduce their expenses. |

| Online Growth and Logistics | Online retail expansion requires sophisticated fleet solutions for last-mile delivery and supply chain management. |

China's industry is expanding because of urbanization, government-supported smart transportation programs, and strongly growing e-commerce and logistics industries. Government incentives for smart transport systems and vehicle connectivity are evolving with greater AI, telematics, and IoT-based fleet solutions implementation.

Emissions standards and EV incentives push fleet operators to implement smart platforms to enhance fuel efficiency and carbon emission reduction. Unmatched supply chain and manufacturing expansion necessitates goliath-scale fleet operations, propelling industry growth. The emergence of local tech companies, combined with 5G and cloud investments, reaffirms China's leadership in digital fleet transformation.

FMI is of the opinion that the Chinese industry is slated to grow at 16.4% CAGR during the study period.

| Key Drivers | Details |

|---|---|

| Smart Transportation Initiatives | Government policy encourages AI-powered logistics and smart fleet solutions. |

| Rapid Urbanization | Expanding cities require effective transportation and fleet optimization for last-mile delivery. |

| Electrification Policies | Subsidies and stringent emissions policies spur fleet electrification and green logistics. |

| E-commerce and Logistics Boom | Increasing online transactions requires scalable and technology-enabled industry. |

India's industry is growing due to rising transportation needs, state-driven digitalization, and the expansion of e-commerce industries. FASTag for fitting automatic tolling and mandatory vehicle tracking systems is a measure that increases fleet efficiency. Telematics, GPS monitoring, and artificial intelligence-enabled route optimization are required to improve last-mile delivery and ride-hailing operations.

Even though the adoption of the industry is yet to reach levels in the developed world, low-cost cloud technology has made it economical for small and mid-sized fleet operators. As India invests in transport infrastructure, data-thirsty software will see humongous demand.

FMI is of the opinion that the Indian industry is slated to grow at 17.8% CAGR during the study period.

| Key Drivers | Details |

|---|---|

| Government Policies on Digitalization | Drivers of fleet efficiency and cost savings owing to mandates like FASTag and vehicle tracking. |

| Expansion of E-commerce | E-commerce expansion is the reason behind the necessity of effective logistics and fleet solutions. |

| Technology Adoption within Affordability | Mobile-first technologies and cloud technology allow SMEs to embrace the industry. |

| Growth in Transport Infrastructure | Smart transport and road investment enhance the efficiency of fleets. |

French industry is transforming with sustainability objectives, strict carbon emissions management, and IoT-supported fleet tracking. France is progressively adopting electric and hybrid fleets in line with European Union carbon neutrality objectives. With the integration of IoT and AI, real-time fleet monitoring, fuel optimization, and improved driver safety are enabled.

Having leading-edge telematics companies opens the door for growth in the industry. With the fleet owners seeking low-cost solutions, software-based and cloud-based fleet management solutions are on the increase that allow companies to streamline logistics and reduce operational costs.

FMI is of the opinion that the French industry is slated to grow at 14.8% CAGR during the study period.

| Key Drivers | Details |

|---|---|

| Harsh Emission Norms | Fleet electrification and alternative fuels are promoted due to carbon-neutral targets. |

| IoT and AI Solutions | Telematics: Enhanced solutions enable enhanced route optimization and tracking. |

| Cost Optimization Needs | Enterprises make the most out of their operational efficiencies using minimal expense via the industry. |

| Logistics Industry Growth | More supply networks cause higher logistics industry growth demanding wise fleet management. |

A strong logistics economy, supportive government policies for eco-friendly transport, and growing dependency on AI analytics underpin the UK industry. Organizations are embracing telematics and fuel-efficient fleet technology to comply with carbon-reducing policy goals.

A greater focus on real-time monitoring and proactive maintenance raises the level of operational efficiency. A strong logistics economy coupled with rising e-commerce is seeing fleet operators making investments in digital transformation initiatives on route planning optimization, cost optimization, and vehicle utilization.

FMI is of the opinion that the UK industry is slated to grow at 15.5% CAGR during the study period.

| Key Drivers | Details |

|---|---|

| Sustainability Policies | The reduction of carbon emissions spurs fleet electrification and fuel economy. |

| AI and Telematics Adoption | Companies embrace real-time monitoring and anticipatory maintenance to improve operations. |

| E-commerce Growth | Growing last-mile delivery business demand fuels the adoption of the industry. |

| Digital Transformation | Cloud software maximizes data-based decision-making among logistics companies. |

The sector is burgeoning rapidly as companies search for real-time tracking, predictive analytics, and AI-administrated automation systems to better manage fleet operations. Companies are pouring investments into telematics, cloud-based monitoring, and IoT-enabled vehicle diagnostics toward enhancing efficiency, safety, and compliance with regulations.

Key players such as Verizon Connect, Geotab, and Samsara dominate with their advanced solutions responding to telematics, AI-supported analytics, and scalable fleet optimization. The mid-tier establishments, like Motive, Teletrac Navman, and Omnitracs, take compliance management, driver safety, and an operational visibility-focused stance for specialized fleet needs. On the other hand, the emerging firms: Azuga, Fleet Complete, and Mix Telematics offer fuel efficiency tools, driver behavior monitoring, and custom-fit fleet tracking services to distinguish themselves.

Evolutionary aspects of the industry include 5G connectivity, edge computing, and blockchain-based security for fleets, which would grant real-time fleet intelligence and automation. The other driver of technology is related to sustainable fleet solutions, electric vehicle integration, and reduction of carbon footprints.

The strategic aspects of competition are data-driven decision-making, adherence to regulations, and end-to-end integration of fleet operations. Companies with an advantage in AI-driven route optimization, predictive maintenance, and compliance end solutions would ultimately sustain an edge in the digital and automated path of the industry going forward.

By component, the segment is categorized into hardware (GPS tracking devices, dash cameras, Bluetooth tracking tags (BLE beacons), data loggers), software (fleet management software, telematics software), services, professional services (consulting & advisory, integration & implementation, support & maintenance) and managed services.

By fleet type, the segment is classified into trucks/cars/buses, ships/vessels, aircrafts, and railcars.

By application, the segment is categorized into fleet tracking and geofencing, vehicle maintenance and diagnostics, driver behavior monitoring, fuel management, and others.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The industry is anticipated to reach USD 32.2 billion in 2025.

The industry is projected to reach USD 153.7 billion by 2035, growing at a CAGR of 16.9%.

Key players include TomTom N.V., Zebra Technologies Corp., Trimble Inc., Cisco Systems, Inc., GoFleet Corporation, Geotab Inc., Digital Matter, GPS Trackit, Fleetmatics Group PLC, GoGPS, Wireless Links, Embitel, Gurtam, Teletrac Navman, Linxio, Ruptela, Trakm8 Limited, and WebEye Telematics Group.

North America and Europe, driven by increasing adoption of telematics, IoT, and smart transportation solutions.

Cloud-based fleet management solutions dominate due to their scalability, cost-effectiveness, and real-time tracking capabilities.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Fleet Type, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Industry, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 21: Global Market Attractiveness by Component, 2023 to 2033

Figure 22: Global Market Attractiveness by Fleet Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Application , 2023 to 2033

Figure 24: Global Market Attractiveness by Industry, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 46: North America Market Attractiveness by Component, 2023 to 2033

Figure 47: North America Market Attractiveness by Fleet Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Application , 2023 to 2033

Figure 49: North America Market Attractiveness by Industry, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by Industry, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Fleet Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 74: Latin America Market Attractiveness by Industry, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by Industry, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 96: Europe Market Attractiveness by Component, 2023 to 2033

Figure 97: Europe Market Attractiveness by Fleet Type, 2023 to 2033

Figure 98: Europe Market Attractiveness by Application , 2023 to 2033

Figure 99: Europe Market Attractiveness by Industry, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Fleet Type, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Application , 2023 to 2033

Figure 124: South Asia Market Attractiveness by Industry, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by Industry, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Fleet Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Application , 2023 to 2033

Figure 149: East Asia Market Attractiveness by Industry, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Application , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by Industry, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Fleet Type, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Application , 2023 to 2033

Figure 174: Oceania Market Attractiveness by Industry, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Fleet Type, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Application , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by Industry, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Fleet Type, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Fleet Type, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Fleet Type, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by Industry, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by Industry, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by Industry, 2023 to 2033

Figure 196: MEA Market Attractiveness by Component, 2023 to 2033

Figure 197: MEA Market Attractiveness by Fleet Type, 2023 to 2033

Figure 198: MEA Market Attractiveness by Application , 2023 to 2033

Figure 199: MEA Market Attractiveness by Industry, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fleet Management Market Growth – Trends & Forecast 2023-2033

Fleet Management Market Growth – Trends & Forecast 2023-2033

Fleet Management Market Growth – Trends & Forecast 2023-2033

Smart Fleet Management Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fleet Leasing Market Size and Share Forecast Outlook 2025 to 2035

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Pain Management Devices Market Growth - Trends & Forecast 2025 to 2035

Data Management Platforms Market Analysis and Forecast 2025 to 2035, By Type, End User, and Region

Cash Management Services Market – Trends & Forecast 2025 to 2035

CAPA Management (Corrective Action / Preventive Action) Market

Exam Management Software Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA