Flavoured water packaging is a market segment focused on enhanced, fruit-flavoured and functional water, which helps to refresh and rehydrate the body while also providing flavor, vitamins, minerals and electrolytes. The growth of the market is attributed to an increase in consumer inclination toward consuming healthier drinks as alternatives to sugary soft drinks, growing awareness about the advantages of hydration, and the ongoing trend for functional drinks.

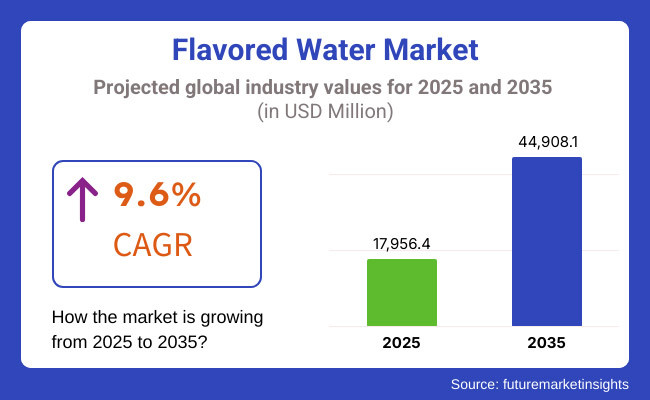

In 2025, the global flavoured water market is projected to reach approximately USD 17,956.4 million, with expectations to grow to around USD 44,908.1 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 9.6% during the forecast period.

The anticipated CAGR underscores the rising adoption of flavoured water among health-conscious consumers, growing product innovation in infused and functional water categories, and the expansion of premium and organic beverage offerings. Additionally, increased investment in sustainable packaging and eco-friendly bottled water solutions is expected to enhance market adoption.

North America holds a significant proportion in the flavoured water market due to high consumer preference for health-centric guns, increasing demand for functional beverages, and established brands of bottled water.

Low-calorie, vitamin-fortified, and naturally flavoured waters dominate the United States and Canada owing to increasing distribution channels via retail and e-commerce platforms. Heightened awareness regarding obesity and initiatives for reducing sugar consumption have also propelled the growth of the market.

Europe experienced a share holding a major part of the market, being Germany, France, and the United Kingdom as the major contributors to the premium bottled water consumption, sustainable packaging innovation, and organic drink trends.

Strict regulations enforced by European Union regarding sugar reduction and the usage of artificial ingredients has also driven demand for clean label and natural flavoured water products. The increasing in demand for mineral-infused and electrolyte-enhanced water is also driving market growth.

China, India, Japan, and Australia will lead market expansion for flavoured water in this region, driven by increasing urbanization, disposable incomes, and health-conscious hydration awareness. The increased middle-class population and changing consumer demands to healthier drinks have been supporting the demand of flavoured and functional water in the region. Further, investments by international beverage actors in locally inspired tastes and eco-conscious packaging have also contributed to regional market expansion.

Challenges

Competition from Functional Beverages and High Production Costs

Competition from functional beverages such as sports drinks, vitamin waters, herbal teas, and plant-based hydration products is an emerging threat to global Flavoured Water Market. In addition, how the product is produced (natural flavouring, organic, eco-package) also affects the price and profitability. Growing worries over artificial sweeteners and preservatives are also pressuring brands to transition to clean-label products, which come with a higher price tag.

Opportunities

Growth in Health-Conscious and Functional Hydration Trends

The flavoured water market is driven by the increasing demand for low-calorie, naturally flavoured and functional drinks. Emerging categories of premium products like electrolyte-fortified, adapt genic and CBD-infused flavoured waters. Additionally, sustainable packaging solutions, AI-driven personalized hydration and plant-based flavour innovations are expected to appeal to environmentally and health-conscious consumers.

Between 2020 and 2024, there was a boom of flavoured water market as a healthier alternative to carbonated soft drinks. The companies used low-calorie, naturally sweetened and organic flavourings to target health-conscious consumers. Production cost inflation, supply chain disruptions and competition from functional beverages limited profit margins.

Market by 2025 to 2035 will shift toward personalized, functional, and AI-optimized hydration solutions. With the emergence of AI-driven hydration monitoring, bioactive compounds derived from plants, and intelligent-packaging technologies, flavoured waters will reach new heights. Additionally, sustainable packaging, carbon-neutral manufacturing, and biodegradable bottle substitutes will become in line with sustainability-led consumer demand.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, EFSA, and WHO guidelines on artificial sweeteners and additives |

| Technology Innovations | Use of natural fruit Flavors, stevia-based sweeteners, and vitamin-enriched blends |

| Market Adoption | Growth in low-calorie, sparkling, and organic flavoured waters |

| Sustainability Trends | Shift toward BPA-free plastic bottles and limited-edition eco-friendly packaging |

| Market Competition | Dominated by major beverage brands (PepsiCo’s LIFEWTR, Nestlé Pure Life, The Coca-Cola Company’s Smart water, Hint, LaCroix, Spindrift) |

| Consumer Trends | Demand for zero-calorie, vitamin-infused, and sparkling flavoured waters |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on clean-label claims, functional ingredients, and carbon-neutral production |

| Technology Innovations | Advancements in AI-driven hydration tracking, smart bottle technology, and personalized nutrient-infused water |

| Market Adoption | Expansion into CBD-infused, adapt genic, and probiotic-enhanced hydration solutions |

| Sustainability Trends | Large-scale adoption of biodegradable bottles, refillable water pods, and plant-based packaging |

| Market Competition | Rise of AI-driven beverage startups, functional water brands, and sustainability-focused hydration solutions |

| Consumer Trends | Growth in personalized hydration kits, gut-health-enhancing flavoured waters, and carbon-neutral beverage brands |

The United States flavoured water market in the United States. Instead consumers are increasingly eschewing carbonated soft drinks in favour of functional and natural flavoured water products, driving potential growth in the market.

Market growth is also being further encouraged by the availability of the top drink manufacturers, and new flavor launches which incorporate functional ingredients such as vitamins, electrolytes, and probiotics. In addition, rising popularity of convenient ready-to-drink hydration beverages among sporty consumers is increasing sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.9% |

The UK flavoured water market is expanding due to growing awareness of sugar-free and low-calorie beverage options. The rising adoption of functional beverages infused with natural Flavors, antioxidants, and minerals is supporting market demand.

Government initiatives promoting healthier drink choices and taxation on sugary drinks are further accelerating the shift toward flavoured water consumption. Additionally, the increasing demand for sustainable packaging and eco-friendly beverage brands is influencing purchasing decisions in the UK market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 9.4% |

Emerging health-conscious customers demand and stringent control on artificial sweeteners in beverages are driving the European Union (EU) Flavoured Water market to rapid growth. Competition in the naturally flavoured, fruit extract-infused mineral and spring water market is fostering rising demand for it across the region.

Flavoured water that is organic and clean-label is particularly strong in Germany, France and Italy, all major markets. Premium flavoured and sparkling flavoured water segments also help in promoting the growth of the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 9.2% |

Japan’s flavoured water market is expanding due to increasing demand for functional beverages and innovative hydration solutions. The country’s focus on health and wellness is fueling the adoption of flavoured water products enriched with collagen, vitamins, and minerals.

High potential in the Japanese beverage formulation technology coupled with rising demand for personalized hydration are anticipated to drive the growth of the market. In addition, the growth of vending machine sales and availability in convenience stores is increasing consumer access to flavoured water products.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.6% |

The demand for flavoured water is growing in South Korea, as consumers are seeking low-calorie, naturally flavoured, and functional drinks. The South Korean dynamic soft drink market is thriving with vibrant innovation in drinks formulation of flavoured waters; probiotic-fortified water; herbal-based flavoured water.

Demand for hydration products with additional skin and health benefits are sweeping the shelves, thanks to the influence of K-beauty and wellness trends. In addition, the evolution of convenience store and online channels is allowing them to be reachable, which is fueling growth across the board.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.5% |

Even flavoured water has become a hit across the beverage industry by giving customers a light flavoured not-carbonated water option. Hydration-minded consumers, those obsessed with faint taste and silky mouthfeel, prefer still flavoured water to carbonation.

Increasing demand for functional hydration is one of the key drivers fueling still flavoured water adoption in the global market. And many beverage companies are insulating their still flavoured water with electrolytes, vitamins and plant extracts to offer hydration-purpose additional health benefits.

Further, athletes and fitness enthusiasts favour still flavoured water infused with electrolytes, amino acids, and antioxidants to help recover after exercising and endurance while exercising. Many companies are producing natural, fruit-flavoured still waters - imbued with botanical extracts, such as aloe vera, hibiscus and ginger - to respond to the increased demand for wellness beverages.

Better for maintains competition, however, from sparkling water and functional beverage segments. In order to stand out amidst this wave of competition, companies are touting unusual ingredient combinations, eco-friendly packaging, and transparency about where and how they source their ingredients, all three of which help keep consumers trusting their brand and loyal to remaining customers.

Sparkling flavoured water has taken off, particularly among consumers who want something fizzy, but not sugary or artificially sweetened. The growing demand for healthier carbonated beverages as alternatives to sodas and soft drinks has propelled the popularity of sparkling flavoured water, most brands now offering zero-calorie, naturally flavoured and probiotic-laden varieties.

It is associated with indulgence and premium refreshment, making it one of the key drivers for growth in sparkling flavoured water consumption. The crisp texture and refreshing mouthfeel of sparkling water have led to it being a preferred beverage in social settings, bars and restaurants. Sparkling water Flavors inspired by cocktails (and mock tails) - lime-mint mojito, elderflower tonic, citrus spritz - have also gained popularity in the market, attracting consumers interested in more upscale, non-alcoholic beverages.

Again, natural fruit extracts, botanical infusions, and functional ingredients have also contributed to the increasing appeal of sparkling flavoured water for health-minded consumers. Many beverage companies are now on board with a caffeine-infused sparkling water, nootropic blend or adapt genic option, as it has broader market outreach among millennials and Gen Z consumers.

Despite a growing popularity in the recent months, concerns with regards to bloating and acidity of carbonated drinks may limit the uptake of sparkling flavoured water among some consumer segments. In reaction to this, brands are releasing light-carbonated and pH-adjusted products that can provide digestive comfort without the downside of less fizz.

Flavoured organic water is a fast-growing market right now as consumers prefer natural, non-GMO and pesticide-free ingredients in their drinks. As the world is moving toward clean food and clean label organic flavoured water companies are focusing on certified organic fruit extracts, holistically-harvested plant infusions and pollution-free processing.

In addition, the growing consumer demand for premium hydration products has led to the creation of organic flavoured water infused with superfoods, probiotics, and herbal adaptogens. As consumers increasingly seek out drinks that deliver more than just hydration, organic flavoured water is uniquely positioned to serve the beverage needs of consumers looking for immune health, gut health and stress management.

On the other hand, the organic flavoured water market faces several challenges, such as high production costs, limited ingredient availability, and price sensitivity. Brands are also collaborating with local farmers, investing in sustainable supply chains, and reducing the size of their organic products with smaller, affordable packaging, which widens consumer reach without sacrificing quality.

Traditional flavoured waters command the largest part of the market as they are inexpensive, widely available, and offer a wide spectrum of Flavors. Unlike organic options, commercial flavoured water is produced according to standard farming and processing practices, which reduces costs for both producers and consumers.

Mass marketability and accessibility are the biggest drivers of the success of traditional flavoured water. Many of the major beverage companies have a number of regular flavoured-water varieties in multiple price ranges, including diverse flavor options. Meanwhile, traditional flavoured waters have also found themselves in the same mention, thanks to multipack and bulk packaging, making them a convenient choice for families, office retreats and travel-based hydration.

Even traditional flavoured water companies have introduced sugar-free, low-calorie, and naturally sweetened alternatives targeting health-conscious consumers at not-premium prices of organic products. Most companies turn to stevia, monk fruit, or erythritol as a sweetener substitute, attempting to tread a fine line between flavor and health.

And while it has a cost advantage, concerns over artificial additives, artificial flavor agents and health risks have led some to opt for organic or purely-natural alternatives. To that end, companies are adopting clean-label concepts, reducing usage of artificial colors and artificial preservatives, which means more consumer trust and transparency.

Flavoured water market continue to grow at a faster velocity due to increasing demand for a healthier alternative beverage, reduction of sugar and functional hydration. Heightened concentration on health is steering customers away from artificially flavoured carbonated soft drinks and juices benefiting zero-calorie, vitamin- fortified and naturally flavoured water. The market is also bolstered by clean-label, organic and functional water innovations including electrolyte-infused, collagen-enhanced and CBD waters.

Market Share Analysis by Key Players & Banquet Cabinet Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| PepsiCo, Inc. (Aquafina, LIFEWTR, Bubly) | 18-22% |

| The Coca-Cola Company (Dasani, Vitaminwater, Smart water) | 14-18% |

| Nestlé S.A. (Perrier, S.Pellegrino, Nestlé Pure Life) | 12-16% |

| Hint, Inc. | 10-14% |

| Talking Rain Beverage Company (Sparkling Ice) | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| PepsiCo, Inc. | Offers Aquafina FlavorSplash, LIFEWTR, and Bubly, catering to natural, functional, and sparkling flavoured water segments. |

| The Coca-Cola Company | Provides Vitaminwater, Smart water, and Dasani flavoured waters, focusing on hydration, vitamins, and functional ingredients. |

| Nestlé S.A. | Specializes in premium and natural mineral-infused flavoured waters under brands like Perrier, S.Pellegrino, and Nestlé Pure Life. |

| Hint, Inc. | Develops naturally flavoured, sugar-free still and sparkling waters, targeting clean-label and health-conscious consumers. |

| Talking Rain Beverage Company | Produces Sparkling Ice, a zero-sugar, vitamin-enhanced flavoured sparkling water with a variety of Flavors. |

Key Market Insights

PepsiCo, Inc. (18-22%)

PepsiCo leads the flavoured water market with Bubly (sparkling), LIFEWTR (functional), and Aquafina FlavorSplash (flavoured hydration), offering a diverse range of natural and zero-calorie options.

The Coca-Cola Company (14-18%)

Coca-Cola’s portfolio includes Vitaminwater (enhanced hydration), Smart water (electrolyte-infused), and Dasani flavoured waters, catering to fitness and health-conscious consumers.

Nestlé S.A. (12-16%)

Nestlé’s Perrier and S.Pellegrino dominate the premium mineral-flavoured water segment, while Nestlé Pure Life targets everyday hydration with light fruit Flavors.

Hint, Inc. (10-14%)

Hint focuses on naturally flavoured, sugar-free water, appealing to organic and clean-label consumers looking for plant-based, artificial-sweetener-free hydration.

Talking Rain Beverage Company (8-12%)

Talking Rain’s Sparkling Ice is a leading zero-sugar flavoured sparkling water, enriched with antioxidants and vitamins, catering to calorie-conscious and active lifestyle consumers.

Other Key Players (26-32% Combined)

Several emerging and niche players are innovating in functional and premium flavoured water categories, including:

The overall market size for flavoured water market was USD 17,956.4 million in 2025.

The flavoured water market is expected to reach USD 44,908.1 million in 2035.

Increasing consumer shift toward healthier beverage alternatives, rising demand for low-calorie and functional drinks, and growing innovations in natural flavouring will drive market growth.

The top 5 countries which drives the development of flavoured water market are USA., European Union, Japan, South Korea and UK.

Conventional flavoured water higher growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by Flavor, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 10: Global Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: Global Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 13: Global Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 14: Global Market Volume (Litre) Forecast by End Use Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: North America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 20: North America Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 22: North America Market Volume (Litre) Forecast by Flavor, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 24: North America Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 25: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 26: North America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 27: North America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 28: North America Market Volume (Litre) Forecast by End Use Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: Latin America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: Latin America Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 36: Latin America Market Volume (Litre) Forecast by Flavor, 2018 to 2033

Table 37: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 38: Latin America Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 39: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Latin America Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 41: Latin America Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 42: Latin America Market Volume (Litre) Forecast by End Use Application, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Europe Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 48: Europe Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 49: Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 50: Europe Market Volume (Litre) Forecast by Flavor, 2018 to 2033

Table 51: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 52: Europe Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 53: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 54: Europe Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 55: Europe Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 56: Europe Market Volume (Litre) Forecast by End Use Application, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Asia Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Asia Pacific Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 61: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 62: Asia Pacific Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 63: Asia Pacific Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 64: Asia Pacific Market Volume (Litre) Forecast by Flavor, 2018 to 2033

Table 65: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 66: Asia Pacific Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 67: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 68: Asia Pacific Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 69: Asia Pacific Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 70: Asia Pacific Market Volume (Litre) Forecast by End Use Application, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: MEA Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 73: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: MEA Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 75: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 76: MEA Market Volume (Litre) Forecast by Nature, 2018 to 2033

Table 77: MEA Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 78: MEA Market Volume (Litre) Forecast by Flavor, 2018 to 2033

Table 79: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 80: MEA Market Volume (Litre) Forecast by Packaging, 2018 to 2033

Table 81: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 82: MEA Market Volume (Litre) Forecast by Distribution Channel, 2018 to 2033

Table 83: MEA Market Value (US$ Million) Forecast by End Use Application, 2018 to 2033

Table 84: MEA Market Volume (Litre) Forecast by End Use Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 17: Global Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 21: Global Market Volume (Litre) Analysis by Flavor, 2018 to 2033

Figure 22: Global Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 23: Global Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 24: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 25: Global Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 26: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 27: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 28: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 29: Global Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 30: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 31: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 32: Global Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 33: Global Market Volume (Litre) Analysis by End Use Application, 2018 to 2033

Figure 34: Global Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 35: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 36: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 37: Global Market Attractiveness by Nature, 2023 to 2033

Figure 38: Global Market Attractiveness by Flavor, 2023 to 2033

Figure 39: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 40: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 41: Global Market Attractiveness by End Use Application, 2023 to 2033

Figure 42: Global Market Attractiveness by Region, 2023 to 2033

Figure 43: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 45: North America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 46: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 47: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 48: North America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 49: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 50: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 51: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 52: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 53: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 54: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 55: North America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 59: North America Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 60: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 61: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 62: North America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 63: North America Market Volume (Litre) Analysis by Flavor, 2018 to 2033

Figure 64: North America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 65: North America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 66: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 67: North America Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 68: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 69: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 70: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 71: North America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 72: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 73: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 74: North America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 75: North America Market Volume (Litre) Analysis by End Use Application, 2018 to 2033

Figure 76: North America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 77: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 78: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 79: North America Market Attractiveness by Nature, 2023 to 2033

Figure 80: North America Market Attractiveness by Flavor, 2023 to 2033

Figure 81: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 82: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 83: North America Market Attractiveness by End Use Application, 2023 to 2033

Figure 84: North America Market Attractiveness by Country, 2023 to 2033

Figure 85: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 86: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 88: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 89: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 92: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 93: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 97: Latin America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 98: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Latin America Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 102: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Latin America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 105: Latin America Market Volume (Litre) Analysis by Flavor, 2018 to 2033

Figure 106: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 107: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 108: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 109: Latin America Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 110: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 111: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 112: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Latin America Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Latin America Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 117: Latin America Market Volume (Litre) Analysis by End Use Application, 2018 to 2033

Figure 118: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 119: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 120: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 121: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 122: Latin America Market Attractiveness by Flavor, 2023 to 2033

Figure 123: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 124: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 125: Latin America Market Attractiveness by End Use Application, 2023 to 2033

Figure 126: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 129: Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 130: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 132: Europe Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 133: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 134: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 135: Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 136: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 137: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 138: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: Europe Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 140: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 143: Europe Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 144: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 145: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 146: Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 147: Europe Market Volume (Litre) Analysis by Flavor, 2018 to 2033

Figure 148: Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 149: Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 150: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 151: Europe Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 152: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 153: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 154: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 155: Europe Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 156: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 157: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 158: Europe Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 159: Europe Market Volume (Litre) Analysis by End Use Application, 2018 to 2033

Figure 160: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 161: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 162: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 163: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 164: Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 165: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 166: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 167: Europe Market Attractiveness by End Use Application, 2023 to 2033

Figure 168: Europe Market Attractiveness by Country, 2023 to 2033

Figure 169: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 172: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 173: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 174: Asia Pacific Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 175: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 176: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 177: Asia Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 178: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 179: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 180: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 181: Asia Pacific Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 182: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 183: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 184: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 185: Asia Pacific Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 186: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 187: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 188: Asia Pacific Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 189: Asia Pacific Market Volume (Litre) Analysis by Flavor, 2018 to 2033

Figure 190: Asia Pacific Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 191: Asia Pacific Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 192: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 193: Asia Pacific Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 194: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 195: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 196: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 197: Asia Pacific Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 198: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 199: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 200: Asia Pacific Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 201: Asia Pacific Market Volume (Litre) Analysis by End Use Application, 2018 to 2033

Figure 202: Asia Pacific Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 203: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 204: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 205: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 206: Asia Pacific Market Attractiveness by Flavor, 2023 to 2033

Figure 207: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 208: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 209: Asia Pacific Market Attractiveness by End Use Application, 2023 to 2033

Figure 210: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by End Use Application, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: MEA Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 220: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 221: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 222: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 223: MEA Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 227: MEA Market Volume (Litre) Analysis by Nature, 2018 to 2033

Figure 228: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 229: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 230: MEA Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 231: MEA Market Volume (Litre) Analysis by Flavor, 2018 to 2033

Figure 232: MEA Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 233: MEA Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 234: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 235: MEA Market Volume (Litre) Analysis by Packaging, 2018 to 2033

Figure 236: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 237: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 238: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 239: MEA Market Volume (Litre) Analysis by Distribution Channel, 2018 to 2033

Figure 240: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 241: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 242: MEA Market Value (US$ Million) Analysis by End Use Application, 2018 to 2033

Figure 243: MEA Market Volume (Litre) Analysis by End Use Application, 2018 to 2033

Figure 244: MEA Market Value Share (%) and BPS Analysis by End Use Application, 2023 to 2033

Figure 245: MEA Market Y-o-Y Growth (%) Projections by End Use Application, 2023 to 2033

Figure 246: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 247: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 248: MEA Market Attractiveness by Flavor, 2023 to 2033

Figure 249: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 250: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 251: MEA Market Attractiveness by End Use Application, 2023 to 2033

Figure 252: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Flavored Milk Market Analysis by Type, Distribution Channel, and Region through 2035

Global Flavored Empty Capsule Market Analysis – Size, Share & Forecast 2024-2034

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Liquor Flavored Cigars Market

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA