The seasoned salt and specialty seasoning mix business involves flavors and infused salt used for cooking, artisan foods and specialty seasoning mixes. These are flavored with herbs, spices, smoked, truffle, citrus, and other natural flavors, meeting the increasing interest in high quality, gourmet, and healthful alternatives to basic seasoning.

On the one hand, the growing consumer interest in gourmet cooking coupled with the rising demand for clean-label and natural seasonings, and the trend of households globally adopting various cuisines drive the market. Moreover, increasing growth of low-sodium variants of organic salts and flavored salts are also contributing to the growth of market.

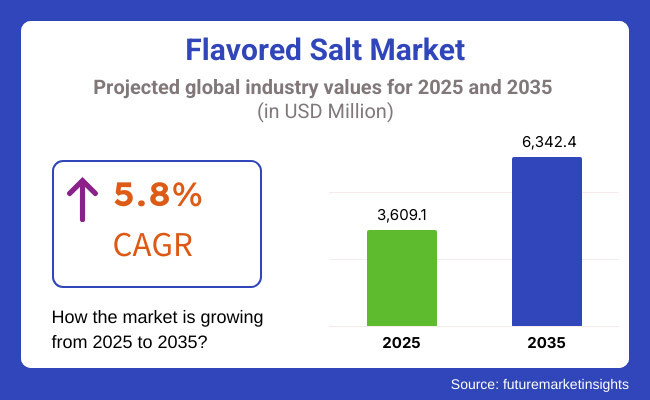

In 2025, the global flavored salt market is projected to reach approximately USD 3,609.1 million, with expectations to grow to around USD 6,342.4 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period.

The anticipated CAGR highlights the rising demand for premium and organic seasoning products, increasing adoption of flavored salts in home cooking and foodservice, and the expansion of global e-commerce and gourmet food markets. Additionally, innovations in exotic and functional salt blends (e.g., Himalayan pink salt, black truffle salt, smoked sea salt, and infused mineral salts) are expected to drive market diversification.

The salted-roasted nuts market in North America owns a significant market share, owing to demand from consumers for gourmet and specialty foods, a rise in health-conscious consumption, and globalization leading to increasing trends in home cooking. The premium salts retail & online presence are growing organically and artisanal salt consumption in the United States and Canada. The continuing development of plant-based and clean-label seasoning products are likewise driving the expansion of the market.

The demand for gourmet salt is primarily in Europe, with France, Italy, and Germany being the largest producer and consumer in this region. These elements are ever present and are pushing the market forward, including strong regional culinary traditions, demand for quality natural flavourings, and growth in high-end foodservice businesses. Additionally, EU regulations promoting organic and sustainable food are pushing the use of natural flavor salts without processing.

The Asia-Pacific region is also expected to record the fastest growth in the flavored salt market, fueled by growing disposable incomes, rising interest in international cuisines, and increasing urbanization in India, China, Japan and Australia. Rising demand for umami seasonings, increasing awareness about gourmet and functional salts, a large food and beverages industry, and growing e-commerce channels and gourmet food stores in the region are some factors expected to drive the regional market.

Challenges

High Production Costs and Increasing Health Concerns

With quality sourcing and processing, it takes quality of sourcing and processing to endow salts with herbs, spices, and specialty flavors and thus, the tuned cost of production becomes a challenge for the Flavored Salt Market.

Additionally, growing consumer concern for sodium content in diet and state regulations on salt intake could hinder market growth. Competition is also fueled by the availability of low-sodium and alternative seasonings (e.g., salt-free spice blends and potassium-based salt substitutes).

Opportunities

Growth in Gourmet, Organic, and Functional Seasoning Trends

Growing gourmet cooking trends, premium seasoning blends and clean-label attitudes continue to drive flavored salt demand. For better flavor, health benefits, and culinary innovation, consumers are increasingly seeking organic, artisanal, and infused salts.

Market opportunities are opening with recent advances in smoked salts, truffle salts, and premium mineral-rich salts. Also on the rise, with health-minded consumers, are functional flavored salts, which come with added minerals, adaptogens and umami-boosting nutrients.

Market growth of flavored salt catering to consumer interest in premium and artisanal varieties drifted in line with home cooking culture 2020 to 2024, driven by social media influenced culinary culture and premiumization of seasoning offerings. Yet constraints from priceensitivity, sodium-limited regulations, and competition from other seasonings were headwinds.

2025 to 2035, the market will move towards organic, functional, and AI-personalized seasoning solutions. Low-sodium, bio fortified, and adaptogenic flavoured salts will cater to the health-focused and specialty-diet markets. AI-based flavour profiling and personalized seasoning kits will also lead to customization and consumer interaction in the gourmet salt category.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA, WHO, and regional sodium intake guidelines |

| Technology Innovations | Use of smoked, herb-infused, and flavored sea salts |

| Market Adoption | Growth in premium home cooking, restaurant-grade flavored salts, and gourmet seasoning kits |

| Sustainability Trends | Shift towards organic and ethically sourced sea salts |

| Market Competition | Dominated by gourmet food brands and salt manufacturers (Maldon, Jacobsen Salt Co., SaltWorks, McCormick, Morton Salt) |

| Consumer Trends | Demand for culinary-grade flavored salts for gourmet cooking and BBQ rubs |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on sodium reduction, clean-label claims, and functional ingredient labelling |

| Technology Innovations | Advancements in AI-driven flavor customization, bio fortified salts, and adaptogenic seasoning blends |

| Market Adoption | Expansion into low-sodium, functional salts with added minerals and specialty dietary salts (e.g., keto, paleo, vegan-friendly) |

| Sustainability Trends | Large-scale adoption of sustainable harvesting, eco-friendly packaging, and regenerative salt farming |

| Market Competition | Rise of customized seasoning startups, AI-powered food-tech companies, and functional salt innovators |

| Consumer Trends | Growth in AI-personalized seasoning subscriptions, health-enhancing salt blends, and experiential flavor innovations |

The flavored salt market in the USA is growing, attributed to increasing consumer appetite for premium and small-batch seasonings. Increased home cooking, taste for premium food experiences and ethnic cuisine are fuelling demand for flavoured salts, such as smoked, truffle and herb infusions.

Consumer consciousness also drives faster growth in the market, as includes consumer-conscious demand for low sodium content and higher mineral content in flavored salts. And with the growth of e-commerce and specialty food retail stores, consumers are finding high-end flavored salts more accessible than ever.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

A flavored salt is a seasoning that consists of a mixture of salt with other abundant elements such as spices, herbs, or dehydrated vegetables; its properties are used to improve the taste of dishes for the United Kingdom floured salt. The growing focus of natural and organic seasonings is driving demand for flavored salts comprising herbs, spices and sea minerals.

Booming trends in home cooking - fueled by cooking shows and social media - are generating demand for artisanal and international flavored salts. The necessity for low-sodium variants and functional seasonings are also shaping product development in the UK market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

EU flavored salt market to Witness Growing Demand for Mediterranean-style Cuisine, High-end Seasonings, and Organic Food. By region Gourmet salts (read: Himalayan pink salt, black lava salt, smoked sea salt) continue to gain traction.

Germany, France, and Italy are strong markets since there is a lot of demand for high-quality seasonings both at-home and in restaurants. EU regulations promoting natural and additive-free foods are also boosting demand for clean-label flavored salts.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 5.5% |

The requirement for top class food components and umami-flavored spices have led to the growth of Japan Flavored Salt market. Killing the salt game, high quality seasonings are the base of Japanese food, thus, available specialty flavored salts like yuzu yze, matcha or miso flavoring salts increase.

The growth of japan market is also fuelled by Fusion cuisine and Global food trends. Moreover, the growing demand for health-friendly seasoning products, including mineral-based and low-sodium salt, is also driving the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The flavored salt market in South Korea is growing as the demand for gourmet food products and global cuisine increases. The proliferation of premium grocery stores and gourmet seasoning packages is driving the requirement for specialized and renowned flavored salts.

Growing market growth is leaded by K-food trends and a boost on international culinary influences through home cooking and foos experimentation. Another key growth factor driving the South Korean market is the demand for added value with functional seasonings; South Korean consumers are looking for products that offer health benefits beyond basic flavor and nutrition and are open to trying new seasonings that are more functional.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Mined salt, pulled from ancient underground sources, is appreciated for its extra minerals, flavor, and crystalline structure. Common examples of this category are Himalayan pink salt, rock salt, and black salt, which are popularly used for gourmet cooking, health consciousness, and artisanal seasoning blends.

Mined salt fetches demand due to its little processing and naturalness is among the foremost factors influencing its market. Here, these pocket seas are preserved in the salt, which unlike those of refined table salt - which are separated during processing for refined grains - contain important minerals such as potassium, magnesium and calcium, making it a healthier option that brings forth more complexity of flavors.

Mined salt also boasts several important minerals, including potassium, magnesium and calcium, making it a healthier option that brings forth more complexity of flavors. From the moisturized, iron-rich Himalayan salt to the mineral-salt black salt, consumers often think these two salt types are better than conventional salt because of their different color, texture and various health claims associated with them.

The coarse-textured mined salts specifically can be helpful for seasonings and spices adhering to them, and even for infused flavored salts suitable for grilling or adding to seasoning rubs. “Flavored salts give dishes more magnitude,” Peters explains, noting that salt helps proteins, other flavor compounds, and nutrients assimilate more effectively.

But the collection and treatment of harvested salt are labour- and energy-intensive processes, making them more expensive than refined products. To rectify this, manufacturers are adopting sustainable mining practices and utilizing eco-friendly packaging, which guarantees that their products are produced in an environmentally responsible manner, attracting the ethically aware consumer.

Sea salt obtained through evaporated seawater processes is highly prized for its natural character, flaky texture, and versatility in gourmet applications. Most chefs and food lovers love the taste of sea salt since the properties of sea salt can accentuate food, without overloading the natural essential flavors.

Sea salt has a few key advantages, one of which is pure, briny flavor that complements infused flavors such as herbs, citrus and smoky notes. Unlike the highly refined version of table salt, sea salt holds on to some trace minerals responsible for subtle flavor differences, and is often sought after for making flavored salt blends.

Flaky sea salts like Maldon salt and fleur de sel, on the other hand, are often used as finishing salts to give crunchy texture and a burst of flavor to gourmet dishes. Application of edible sea salt-based flavored salts in snacks seasonings, bread topping and marinades among many food manufacturers further facilitates its widespread application in the food industry.

While this has advantages, sea salt harvesting is subject to climate factors, resulting in seasonal variations of production. A number of producers have been investing in sustainable evaporation techniques, solar drying methods, and controlled production environments, assuring that global markets receive consistent supply and quality.

The herb-flavored salts are one of the key benefits they have, because they add complexity and depth to simple ingredients. Basil, oregano, parsley and chive-infused salts are widely used by chefs and home cooks to season grilled meats, roasted vegetables, pasta dishes and toppings for artisanal bread.

Moreover, the growing interest in organic and preservative free herb salts led the creation of artisanal and small-produces flavored salt varieties. Manufacturers are also trying out herb blends and smoked infusions, developing personalized flavor profiles for gourmet applications.

But the drying of fresh herbs into salt blends is not without its difficulties. In response, producers are using freeze-drying and slow-infusion methods, allowing for maximum flavor retention and shelf stability without synthetic additives.

Fennel salt has emerged as a gourmet darling, imparting a sweet quality and gentle anise-like flavor to Mediterranean, Indian and fusion fare. This variety is a delightful pairing with seafood, poultry and roasted vegetables, and offers chefs and foodies alike a vibrant seasoning option.

One factor driving fennel salt’s increasing use is its balancing capacity against intense flavors while providing aromatic complexity. Food brands are mixing fennel-infused salts into pre-prepared spice blends and artisanal seasonings, making the ingredient easy to reach for in the kitchen.

While its demand is growing, fennel salt is still considered a niche product, not found in most local grocery stores except for specialty gourmet stores and online systems. Manufacturers are distributing the product in more supermarket chains and health-focused retailers across the country, making it more available for the consumer.

The flavored salt market is showing steady growth owing to the increasing demand for gourmet, organic, and specialty seasoning products in household cooking, foodservice, and packaged food industries. Other factors driving the market growth include rising trend towards ethnic and artisanal flavors, clean-label seasoning blends, and premium gourmet flours. Moreover, increasing preference for low-sodium variants, infused salts, and personalized taste profiles continue to enhance consumer interest.

Market Share Analysis by Key Players & Banquet Cabinet Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| McCormick & Company, Inc. | 18-22% |

| SaltWorks, Inc. | 14-18% |

| Morton Salt, Inc. | 12-16% |

| San Francisco Salt Company | 10-14% |

| Jacobsen Salt Co. | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| McCormick & Company, Inc. | Produces herb-infused, smoked, and gourmet flavored salts for household and foodservice applications. |

| SaltWorks, Inc. | Specializes in all-natural and handcrafted sea salts with various infusions and mineral-rich blends. |

| Morton Salt, Inc. | Offers flavored and specialty salts tailored for snacking, culinary seasoning, and food processing. |

| San Francisco Salt Company | Provides premium flavored sea salts with a focus on organic, natural, and exotic flavors. |

| Jacobsen Salt Co. | Develops hand-harvested artisan salts with unique regional flavors and specialty smoked varieties. |

Key Market Insights

McCormick & Company, Inc. (18-22%)

McCormick salted 'em with its wide ranging selection of gourmet and infused salts from garlic, truffle, sriracha and herb blends. Its premium and commercial-grade seasoning blends are designed for households, chefs, and food processors.

SaltWorks, Inc. (14-18%)

SaltWorks focuses solely on all-natural, unrefined sea salt, providing smoked, Himalayan and infused varieties that cater to health-conscious and gourmet customers.

Morton Salt, Inc. (12-16%)

For home cooking, snack seasoning and food manufacturing Morton Salt provides flavored salts, which are balanced blends for a great flavor profile.

San Francisco Salt Company (10-14%)

San Francisco Salt Company specializes in premium-grade flavored salts, including Hawaiian, Himalayan and Mediterranean varieties, and aims to reach organic and artisanal food lovers.

Jacobsen Salt Co. (8-12%)

Jacobsen Salt Co. - hand-harvested, small-batch specialty salts, including natural sea salt with local- and smoked-flavored infusion.

Other Key Players (26-32% Combined)

Several emerging and regional players are expanding the market with niche and innovative flavored salt offerings, including:

The overall market size for flavored salt market was USD 3,609.1 million in 2025.

The flavored salt market is expected to reach USD 6,342.4 million in 2035.

Rising consumer preference for gourmet and artisanal seasonings, increasing demand for premium food products, and growing interest in exotic and healthier flavor alternatives will fuel market growth.

The top 5 countries which drives the development of flavored salt market are USA, European Union, Japan, South Korea and UK.

Herb-flavored salts growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavored Water Market Trends - Hydration & Wellness Demand 2025 to 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Milk Market Analysis by Type, Distribution Channel, and Region through 2035

Global Flavored Empty Capsule Market Analysis – Size, Share & Forecast 2024-2034

Liquor Flavored Ice Cream Market Size and Share Forecast Outlook 2025 to 2035

Liquor Flavored Cigars Market

Salt Content Reduction Ingredients Market Size & Trends 2035

Salt Meter Market

Salt Hydrate Market

Basalt Rock Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fiber Reinforced Polymer BFRP Market Size and Share Forecast Outlook 2025 to 2035

Basalt Fibre Market Size & Forecast 2024-2034

Sea Salt Market Analysis – Size, Share & Forecast 2024 to 2034

Soap Salts Market Size and Share Forecast Outlook 2025 to 2035

Bath Salts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solar Salt Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA