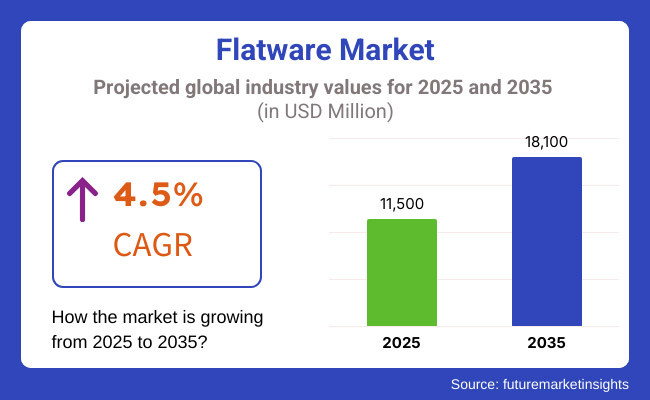

The flatware market is expected to experience steady growth between 2025 and 2035, driven by increasing consumer demand for premium and sustainable dining solutions. The market was valued at USD 11,500 million in 2025 and is projected to reach USD 18,100 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The flatware market is witnessing an increase and it is due to several factors. Various factors such as an increase in disposable income, higher levels of urbanization, and a shift towards more beautifully designed tableware are leading the growth.

Amid growing sustainability concerns and better durability, consumers have started to turn away from plastic and Tupperware towards higher-quality stainless steel, silver-plated, and eco-friendly flatware options. A growing demand from the hospitality and food service industry is also driving the growth in the market, as is demand from hotels, restaurants, and catering services.

Moreover, advancements in manufacturing technology, including 3D metal printing and automated polishing methods, are enabling greater production efficiency and enhanced product quality. Yet there are challenges that remain, in the face of the market’s positive outlook.

Profitability can be affected by volatile raw material costs, especially for stainless steel and silver. In emerging economies, established brands also face risks from low-cost alternatives and counterfeit products. Nevertheless, rising consumer inclination towards branded, premium flatware and increasing demand for personalized and customized designs are projected to offer new growth opportunities.

There is an increasing focus on sustainability, premium appearances, and product trends that will propel the flatware market into the future. The sector is ideal for long term growth in the next decade investing more towards high end dining styles with greater production technologies.

The flatware market in North America is anticipated to dominate the global flatware market with high consumption of premium tableware and growing acceptance of sustainable and eco-friendly products. The market in the United States and Canada is the biggest and importantly driven by changing trends in dining, the increasing hospitality industry, and demand for high-quality stainless steel and coated or silver-plated flatware.

The increasing trend of home dining, especially since the pandemic, has led to a greater demand for aesthetically pleasing and durable flatware. The other factor aiding the growth of the biodegradable and reusable cutlery market is the growing focus towards the environment.

But, there are challenges the volatility of raw material prices and competition from low-cost imports which are a hurdle for manufacturers. To solve these problems, companies are concentrating on inventive designs, material sustainability, and direct-to-consumer sales strategies.

In Germany, France, and Italy fine dining and home aesthetics are very important for consumers, and still, Europe is the main market for flatware. This market is in turn driven by quality, sustainability, and craft. A significant contribution to market growth comes from the hospitality sector (luxury hotels, fine-dining restaurants, etc.).

Meanwhile, European consumers are turning more toward eco-friendly flatware made of bamboo, recycled stainless steel and other sustainable materials. However, these face challenges from high manufacturing costs and strict environmental regulations. To combat these trends, companies are pouring money into innovative manufacturing techniques, personalized flatware options and increased e-commerce distribution channels to meet the growing demand for stylish and environmentally friendly tableware.

Asia-Pacific is known as the flatware market with rapid urbanization, rising disposable income, and increasing spending on home and lifestyle products. During the forecast period, countries like China, India, Japan and South Korea are expected to observe high demand for low-end and high-end flatware as the changing habits of consumers in emerging markets, and the booming hospitality industry are driving the need for flatware.

The growth of the middle-class in the region and the increasing number of online retail platforms has also aided the market. However, challenges such as price sensitivity and competition from counterfeit products remain to be a concern. In addition to addressing these challenges, manufacturers are working on inexpensive ways to manufacture the product, branding, and marketing their designer collections of flatware to broaden the consumer base.

Challenges

Fluctuating Raw Material Costs

The flatware business heavily relies on stainless steel, silver and other metals, and is susceptible to price changes and supply chain disruptions. The increasing costs of raw materials are a challenge for manufacturing companies, as they are highly dependent on both global trade policy and geopolitical factors like inflation. Moreover, sourcing and production processes have impact on supply and is further compounded by the growing demand for sustainable, eco-friendly materials.

Opportunities

Growing Demand for Premium and Sustainable Flatware

Consumers are increasingly seeking aesthetic appeal, durability, and sustainability in their choice of flatware. New market opportunities fuelling luxury dining experiences, eco-friendly kitchenware and reusable alternatives as tastes have evolved, manufacturers are responding in kind, with biodegradable materials, recyclable metals and artisanal designs. However, the hospitality and luxury dining sectors' growth will also contribute to the demand for customized and premium flatware sets.

The global flatware market witnessed robust growth from 2020 to 2024, supported by increasing disposable income levels and rising demand for eco-friendly and premium flatware products. Nevertheless, issues including supply chain disruptions, variable metal prices, and competition from inexpensive alternatives impacted the market's stability.

Those manufacturers that either re-focused on design ingenuity, or made key advancements in stainless steel, or utilized sustainably sourced materials found ways to weather the storm. It will be really interesting to see the future of this industry (2025 to 2035); introduction of smart flatware, antimicrobial coatings and AI-driven customization. The market will face high demand for biodegradable utensils, sustainable luxury designs, and 3D-printed flatware solutions, for both home and commercial dining.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased focus on sustainability regulations |

| Technological Advancements | Rise of premium stainless steel and artisanal designs |

| Industry Adoption | Shift toward durable, aesthetic flatware |

| Supply Chain and Sourcing | Challenges in raw material pricing and availability |

| Market Competition | Dominance of mass-market and luxury brands |

| Market Growth Drivers | Increased consumer spending on home dining |

| Sustainability and Energy Efficiency | Focus on reusable and recyclable materials |

| Consumer Preferences | Demand for durability, affordability, and design |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter eco-friendly material mandates and carbon-neutral production |

| Technological Advancements | Integration of smart sensors, antimicrobial coatings, and self-cleaning materials |

| Industry Adoption | Mass adoption of biodegradable and luxury sustainable flatware |

| Supply Chain and Sourcing | Expansion of local sourcing and ethical material procurement |

| Market Competition | Rise of personalized, AI-designed flatware start-ups |

| Market Growth Drivers | High demand for luxury, custom, and sustainable cutlery |

| Sustainability and Energy Efficiency | Widespread adoption of biodegradable, plant-based flatware |

| Consumer Preferences | Preference for luxury, eco-conscious, and smart dining solutions |

The USA flatware market is witnessing a moderate growth with the increasing interest among consumers of premium and visually appealing dining cutlery. The growing trend of dining at home along with the growing online retail channels are driving the market growth. In addition, stainless steel, silver-plated and eco-friendly flatware innovations are appealing to consumers. Moreover, the hospitality sector (hotels, restaurants, etc.) also fuels the demand for flatware that is both fashionable and long-lasting.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

Growing awareness among consumers regarding sustainable and high-quality tableware is boosting the flatware market across the United Kingdom. The transition to more sustainable and reusable cutlery is a trending momentum, spurred by environmental issues and stockpiling by the government to ban plastic waste. Emerging trends such as growth in e-commerce and premium kitchenware brands are also driving dynamics in the market. The hospitality and catering sectors remain major contributors to demand as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The flatware market in Europe will see steady growth with the changing dining habits boosting progress, as the demand for designer and luxury tableware increases. High-end and customizable flatware is in demand in countries like Germany, France and Italy. Moreover, the trends in sustainability are encouraging customer preferences, with a growing inclination toward biodegradable as well as reusable cutlery. The rising market growth is also being fuelled by the increase in online marketplaces and the growing number of specialty kitchenware retailers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

Japan's flatware market is influenced by a cultural focus on aesthetics and quality craftsmanship. Demand for minimalist as well as ergonomic cutlery is increasing, especially among urban consumers. The market is also driven by the developments in lightweight and enduring materials. This helps to grow the market, as there are global flatware brands available and you can buy online. Besides, the market is being sustained by the demand of high-end restaurants and hotels.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

With increasing disposable incomes and changing dining culture, there is an increasing demand for flatware in South Korea. Growing demand for sophisticated and modern tableware is driving the market. Furthermore, the impact of K-culture on lifestyle trends is leading consumers to demand stylish and functional cutlery. Market growth is also driven by the solid expansion of e-commerce and the demand for imported premium flatware brands.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The growth of the flatware market is attributed to changing consumer preferences, increasing disposable income of the global population, and growing requirement of premium and visually appealing dining essentials. Flatware products in the market range from plastic to stainless steel, silver, and gold, and are used for everyday use as well as luxury dining. The growing prominence of fine dining, the expansion of hospitality services and the rising consumer preference for premium quality, sustainable tableware solutions are also favouring market expansion.

As a result of this new millennium, the Internet has opened an e-commerce system that widens the consistency and availability of the products available together with how the product can be purchased via various online stores and one can buy them for retailing purposes. As material innovation and sustainable alternatives become more relevant and define the competitive landscape, brands are setting their sights on durability, aesthetics, and sustainability.

Stainless steel and silver flatware segments have held a large share of the market owing to their diverse aesthetic, durability, and versatility. The most common, and favoured, type of flatware around households, restaurants, and hotels, is stainless steel. Due to its corrosion resistant, affordable, low maintenance characteristics best for everyday dining as well as on professional food services establishments.

Stainless steel forks, knives, and spoons come in many different grades and finishes for both budget-conscious consumers and the more premium buyer. As hygiene and durable tableware becomes top of mind, demand for stainless steel flatware should remain strong.

Silver flatware accounts for the second most sale due to both mid-premium and luxury market presence. Its elegance and classic appeal makes it a popular choice for special occasions, fine dining, and high-end hospitality establishments.

Silverware is prized for its ornamental beauty and strength, but it does demand periodic polishing and care. Growing disposable income along with increased spending on home décor and interest in formal dining tables fuels steady demand for silver flatware, especially among the affluent consumers and collectors.

Though plastic flatware and similar products can be widely found in casual dining and takeout services, their usage has been declining due to environmental sustainability concerns. However, alternatives to these plastics are beginning to solve these sustainability shortcomings by being biodegradable and/or compostable.

At the same time, gold flatware is becoming more popular among luxury consumers and fine-dining restaurants, where it adds flair to expensive table-service iteration. Stainless steel flatware is gaining popularity as an affordable option with mass adoption, while silverware remains the benchmark for luxury.

By distribution channel, offline sales dominate the market, but online platforms are growing rapidly, reflecting changes in consumer shopping behaviour. Offline distribution channels (supermarkets, hypermarkets, department stores, and specialty home décor retailers) are the greatest sales channels of flatware.

Consumers tend to buy in stores because they get to see the quality of a product, its weight, and finish. Hospitality works, restaurants and catering services buy a lot of items in bulk from local or wholesale supplier’s vendor, with quality assurance and supplier's reliability.

Additionally, many brick-and-mortar stores provide personalized customer service and can allow shoppers to fully test out products before they buy them, creating even more opportunity for offline sales. The e-commerce platforms and penetration of digital shopping habits are driving fast growth for this channel for online retailing.

Here individual consumers along with various commercial buyers purchase the product owing to a wide variety of flatware available along with competitive pricing and home delivery on major e-commerce platforms and brand owned websites.

The accessibility of product comparisons, user reviews, and promotional discounts also increases the propensity for online purchasing. Moreover, the growing usage of social media marketing and influencer partnerships is also significantly contributing to the growth of online sales volume, which homes in the higher-end flatware and luxury ware brands.

Although online shops are far from replacing retail outlets when it comes to bulk items and high-value products, e-commerce platforms will see significant expansion, primarily due to accessibility, variety, and affordability. The growing investment in digital expansion strategies is due to evolution of the consumer shopping landscape.

The growing demand for premium dining experiences, rising disposable income and growing interest in aesthetic tableware are all fuelling significant growth in the flatware market. Consumers desire high quality, strong and attractive flatware that improves the overall dining experience. World-forming innovation in the selection of materials, the ergonomics of the designs, and sustainability initiatives are prominent in the market, which drives companies to deliver green and luxurious-looking cutlery.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Oneida Limited | 18-22% |

| Zwilling J.A. Henckels | 15-19% |

| Lenox Corporation | 12-16% |

| Cambridge Silversmiths | 10-14% |

| Other Companies (Combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Oneida Limited | Specializes in premium stainless steel flatware, offering a mix of classic and contemporary designs. |

| Zwilling J.A. Henckels | Provides luxury flatware sets made with high-carbon stainless steel and advanced forging techniques. |

| Lenox Corporation | Focuses on high-end, designer flatware collections crafted with precision and aesthetic appeal. |

| Cambridge Silversmiths | Offers affordable yet stylish flatware, catering to mass-market and premium segments alike. |

Key Company Insights

Oneida Limited (18-22%)

Another big player in the flatware market is Oneida Limited, famous for long-lasting stainless steel designs and high quality items. Focus on craftsmanship, corrosion resistance and clean styling ensured its place in the marketplace. Its growth is sustained through constant product innovation and expanding distribution channels worldwide.

Zwilling J.A. Henckels (15 to 19% off)

Zwilling J.A. Henckels, This upscale line of high-carbon stainless-steel flatware combines functionality and elegant European designs. The brand's focus on exacting and correct forging, ergonomically driven aesthetics, and best-in-class durability have secured it as one of the best players in the high-end space.

Lenox Corporation (12-16%)

Lenox Corporation is a heritage flatware brand specializing in elegant, designer flatware for fine dining and wedding events. With product designs focusing on craftsmanship, innovation and aesthetics, the company continues to serve premium as well as niche markets.

Cambridge Silversmiths (10-14%)

Cambridge Silversmiths is best known for affordable, fashion-forward flatware for everyday consumers and premium buyers alike. This has built up its worldwide market share, as it strikes the right level between cost and quality, and style trends.

Additional Important Players (35-45% Combined)

The flatware market is consolidated in nature with several emerging companies serving the market with objectives of being able to manufacture sustainable, customized products, and innovations in terms of material. Notable players include:

The overall market size for the flatware market was USD 11,500 million in 2025.

The flatware market is expected to reach USD 18,100 million in 2035.

The demand for flatware is expected to rise due to increasing consumer demand for premium and sustainable dining solutions.

The top five countries driving the development of the flatware market are the USA, Germany, China, Japan, and France.

Stainless steel flatware and silver-plated flatware are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flatware Holders and Organizers Market

Rainbow Flatware Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA