Growing high-strength, moisture-resistant and very easily releasable solutions used for tape packaging, taping and masking activities is definitely beneficial for a sector flatback tape which is being increasingly adopted by automotive, building and industrial manufacturers in developing their formulations. Tape manufacturers are improving their formulation with additional features such as reinforced paper backs and pressure-sensitive adhesives to eco-friendly substitutes in their developments. The heavy-duty tapes being developed stand for adhesion during their usage while allowing clean removal for shortcuts in well-defined applications.

Further, manufacturers adopt features such as AI quality control, automated lines and biodegradable resins to attain enhanced sustainability and efficiencies. Current industry trends survey moving towards producing more lightweight high-tensile flat back tapes that offer excellent holding power with lesser environmental foot print.

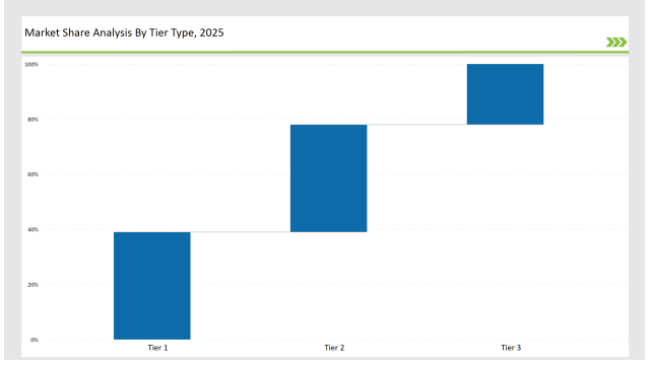

Tier 1- 3M players like Intertape Polymer Group, Berry Global- and they share about 39% of the market for being the leaders in high-performance adhesive solutions, long-lasting designs, and extensive networks for distributing products.

Tier 2 companies such as Tesa SE, Scapa Group and Shurtape Technologies cover the remaining 39% of the market through affordable, custom-made and versatile flat-back tapes for various industrial processes.

Tier 3 include players that are niche or regional, specializing in tamper-evident, recyclable, and industrial-grade flatback tapes, commanding 22% of the market. These manufacturers take every inch of their production locally, specialize in niche applications, and focus on eco-friendly packaging solutions.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Intertape Polymer Group, Berry Global) | 20% |

| Rest of Top 5 (Tesa SE, Scapa Group) | 12% |

| Next 5 of Top 10 (Shurtape Technologies, Nitto Denko, IPG, Saint-Gobain, Sekisui Chemical) | 7% |

The flatback tape industry serves multiple sectors where strong adhesion, clean removal, and durability are essential. Companies are developing high-performance tapes to support industrial and commercial needs. They are optimizing adhesive formulations to improve bonding on challenging surfaces. Additionally, manufacturers are integrating UV-resistant coatings to enhance durability in outdoor applications. Businesses are also developing ultra-thin, high-strength flatback tapes to reduce material usage while maintaining superior performance.

Manufacturers are optimizing flatback tapes with high-performance adhesives, reinforced backings, and sustainable materials. They are enhancing tear resistance by integrating advanced fiber reinforcements. Additionally, companies are developing ultra-thin adhesive layers to improve flexibility without compromising strength. Businesses are also incorporating pressure-sensitive adhesives to enhance usability across various industrial applications.

Innovations and sustainability have become the pillars for the advancement of the flatback tape industry. Companies have begun incorporating artificial intelligent-based defect detect systems as well as solvent-free adhesive technologies in building better performance with enhanced reinforcement structures. They are also providing fiber-based reinforcement alternatives to synthetic materials. Manufacturers have developed products that tamper-proof and water-resistant type of tapes for maximum reliability. Moreover, they are advancing in the integration of tracking capabilities into packaging tapes to provide for the real-time monitoring of the supply chain.

Technology suppliers should focus on automation, digital tracking, and sustainable adhesive advancements to support the evolving flatback tape market. Partnering with packaging, automotive, and construction industries will accelerate innovation and adoption.

|

Tier Type |

Example of Key Players |

|---|---|

|

Tier 1 |

3M, Intertape Polymer Group, Berry Global |

|

Tier 2 |

Tesa SE, Scapa Group, Shurtape Technologies |

|

Tier 3 |

Nitto Denko, IPG, Saint-Gobain, Sekisui Chemical |

Leading manufacturers are advancing flatback tape technology with AI-powered quality control, sustainable adhesives, and high-performance reinforcements. They are integrating fiber-reinforced backings to enhance durability and resistance to tearing. Additionally, companies are adopting water-based adhesive formulations to reduce environmental impact. Manufacturers are also developing ultra-thin, high-tensile flatback tapes that maintain strength while minimizing material use.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched clean-release, industrial-grade flatback tapes in March 2024. |

| Intertape Polymer | Expanded eco-friendly flatback tape portfolio in April 2024. |

| Berry Global | Developed high-tensile, tear-resistant packaging tapes in May 2024. |

| Tesa SE | Released writable and customizable flatback tapes in June 2024. |

| Scapa Group | Strengthened UV-resistant and waterproof tape offerings in July 2024. |

| Shurtape Technologies | Introduced tamper-evident flatback tapes in August 2024. |

| Nitto Denko | Pioneered heat-resistant flatback tapes in September 2024. |

The flatback tape market is evolving as companies invest in sustainable adhesives, AI-driven defect detection, and advanced reinforcement technologies. They are enhancing tensile strength by integrating new fiber compositions that improve flexibility and durability. Additionally, manufacturers are optimizing adhesive bonding to ensure superior performance on rough and low-energy surfaces. Businesses are also incorporating high-temperature resistance features to expand applications in extreme industrial conditions.

Manufacturers are integrating AI-driven quality control, biodegradable adhesives, and advanced fiber reinforcements. Companies will refine lightweight, high-strength designs in order to reduce waste material. Product security with digital authentication features will become a more common practice among businesses. Automated production lines will allow growth and cost-effectiveness. Smart tracking with RFID-enabled tapes would enhance the security logistics. Moreover, AI-based analytics are expected to streamline the manufacturing process, thereby reducing costs and optimizing adhesive formulations.

Leading players include 3M, Intertape Polymer Group, Berry Global, Tesa SE, Scapa Group, Shurtape Technologies, and Nitto Denko.

The top 3 players collectively control 20% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include sustainability, high-tensile strength, automation, and digital tracking.

Explore Packaging Consumables and Supplies Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.