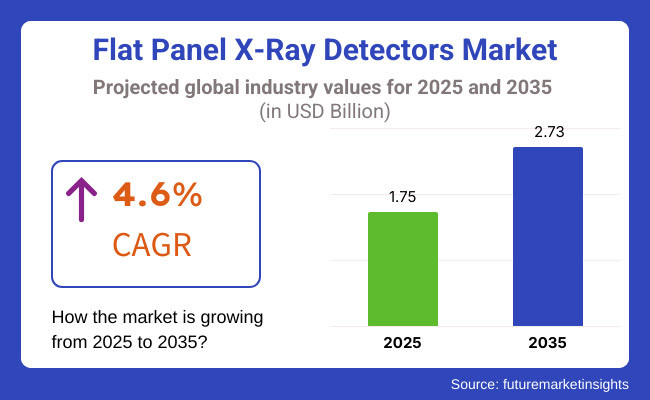

The flat panel X-ray detectors market is anticipated to be valued at USD 1.75 billion in 2025. It is expected to grow at a CAGR of 4.6% during the forecast period and reach a value of USD 2.73 billion in 2035.

Flat Panel X-ray detectors are digital imaging devices that convert X-rays to electronic signals in medical and industrial applications demanding high-resolution imaging. It has widespread applications in medical diagnoses (including radiology, dentistry, and orthopedics), security screening, and non-destructive testing in industries where it provides better image quality with reduced processing time while minimizing radiation exposure.

The Flat Panel X-ray Detectors Market includes digital devices for high-resolution X-ray imaging in medical, security, and industrial applications. Market growth is driven by advancements in digital radiography, increasing demand for early disease diagnosis, increasing healthcare investments, as well as growing adoption in non-destructive testing, enhancing imaging efficiency and accuracy.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth due to increased demand in medical imaging, dental diagnostics, and industrial applications. | Expansion at a rapid pace propelled by the integration of AI, improving the resolution of imaging, and the adoption of consumer electronics in emerging markets. |

| Transition from analog to digital X-ray with improvements in image processing and sensitivity. | AI-powered imaging, enhanced real-time diagnostics, and ultra-high-resolution detectors revolutionizing medical imaging. |

| An increasing utilization in hospitals and diagnostic centers, for example orthopedics, cardiovascular, and dental imaging. | Near-universal adoption in healthcare settings with AI-driven diagnostic support, reducing dependency on radiologists. |

| Increased use in non-destructive testing (NDT) and security screening, but limited to high-end applications. | Expanded applications in aerospace, manufacturing, and AI-powered security screening for automated threat detection. |

| There is some movement set in place that is towards lightweight and portable detectors, so that hospitals and fields are always on the move. | Development of ultra-thin, flexible, and even wearable X-ray detectors enabling new medical and industrial use cases. |

| Early-stage AI integration with some automated image analysis tools. | Fully AI-associated X-ray diagnostic-taking has the advantage of automatically spotting abnormalities, generally decreasing the time required for analysis. |

| High costs limiting adoption in some regions, particularly in developing markets. | Widespread affordability as production scales and costs decline, increasing accessibility in low-income regions. |

| Strengthened regulations for radiation safety and standardization of digital X-ray systems. | Global standardization of AI-assisted X-ray diagnostics with stricter quality control and safety measures. |

| Improvements in energy-efficient X-ray detectors but still reliant on traditional manufacturing. | Widespread adoption of low-power, sustainable materials, and eco-friendly manufacturing processes. |

| Focus on improving image resolution, reducing radiation exposure, and enhancing durability. | The thrust on artificial intelligence-aligned automation, real-time remote diagnostics, and quantum imaging is new-fangled and unmatched when it comes to clarity. |

AI-Enhanced Imaging and Real-Time Diagnostics

AI-enhanced flat-panel detectors for X-ray imaging are now a permanent fixture on the market and offer speedy and accurate image results. Companies have adopted the use of machine learning algorithms to improve image clarity, instantaneous detection of anomalies, and automated diagnostics. Such telemedicine innovations would allow faster decision making by radiologists and doctors, hence improving patient outcomes.

Indeed, rising levels of demand for high-efficiency medical imaging generally bring about expectations that newer forms of X-ray systems be able to provide real-time analyses and AI-based recommendations for better and early detection of diseases.

Portable and Wireless X-Ray Solutions

The demand for X-ray technology that facilitates portability, facilitates flexibility in application, and is compatible with digital healthcare records continues to escalate. The direction now is towards wireless and lightweight flat-panel X-ray detectors that are convenient and mobile. Hospitals or emergency response teams are choosing battery-powered, portable detectors that can provide instant images in any kind of area, from remote clinics to ambulances. Such solutions minimize the need for permanent X-ray machines that allow doctors to do diagnostics in real-time, even in tough circumstances.

Flat panel X-ray detectors find application in the manufacturing domain, where they are used for non-destructive testing (NDT) and quality control purposes. These detectors help in the identification of structural defects, cracks, etc., in industrial components, thus assuring reliability and safety of products produced by industries. Such industries are automotive, aerospace, electronics, and others, usually demanding precise imaging results for upholding manufacturing standards.

The growing recognition of automation and sophisticated inspection strategies has really caused an increase in demand in many areas, for example, in manufacturing activities in digital X-ray imaging. Flat panel detectors provide much faster processing time relative to the other digital detectors with a relatively higher resolution and low radiation exposure. With artificial intelligence-enabled analytics and real-time defect detection systems becoming popular across industries, it is expected that digital X-ray solutions will be adopted even more in manufacturing.

The flat panel X-ray detectors made from Amorphous Silicon (a-Si) are quite popular for their affordability and sensitivity. They produce clear and high-resolution images, ideal for medical imaging, security screening, and industrial applications. The low power requirement to operate them also makes them suitable for portable and fixed systems.

The a-Si detectors’ stability and wide availability make them a preferred choice for hospitals and diagnostic centers. They offer consistent performance and durability, ensuring long-term reliability in X-ray imaging systems. As the demand for faster and more efficient diagnostic tools grows, a-Si flat panel detectors continue to play a crucial role in advancing imaging technology.

| Countries | CAGR |

|---|---|

| USA | 4.8% |

| China | 4.7% |

Advancements in Medical Imaging Drive Growth in the USA

The USA is anticipated to grow at a 4.8% CAGR from 2025 to 2035. The rising demand for advanced imaging solutions in healthcare facilities is a key driver of market growth. In addition, the trend from conventional X-ray systems to digital flat panel detector systems is improving diagnostic accuracy while minimizing patients' exposure to radiation and improving workflow efficiency. Moreover, the raise of chronic diseases is putting much pressure on the health systems as it increases the urge for an early detection of diseases further linking to the best possible use of enhanced imaging techniques.

Support from the governments for the technological advancements to foster the introduction of AI in radiology is expected to ramp up the future scope of the market. The increasing investments into the healthcare infrastructure combined with the diagnosis imaging centers opened are responsible for steady demand. The need for high-end flat-panel X-ray detectors will remain strong in the USA as hospitals and clinics upgrade their radiology departments.

Technological Innovations and Expanding Healthcare Infrastructure Fuel China’s Market

China would witness a growth of 4.7% CAGR between 2025 and 2035 owing to swift technological innovation and a robust healthcare industry in the country. In the country, medical imaging has modernized and upgraded to enhanced patient care, resulting in high adoption of digital X-ray systems. Government-backed initiatives aimed at promoting digitization in health care and expansion of hospitals further fuels the growth of the market. Additionally, the increasing need for portable and wireless X-ray detectors is supporting fast and effective diagnosis.

As per FMI analysis, this has led to increased local production of affordable, high-quality detectors from China - a country that has both strong manufacturing capabilities as well as a lot of research investment in the development of medical imaging technology. The migration to flat panel detectors is also gaining more popularity as medical practitioners seek to improve the precision in diagnosis while minimizing radiation exposure on patients. The population aging in China, and increasing healthcare expenditure, will also maintain the sophisticated imaging solutions being embraced, thereby driving growth within the market over the next decade.

Rising Adoption of Digital Imaging Fuels Growth in the UK Flat Panel X-Ray Detectors Market

The UK is rising gradually, characterized, owing to the increasing demand for progressive medical imaging technologies. There has been a transition from conventional X-ray systems to digital flat panel detectors, which enhances the accuracy of diagnosis and reduces scan times and radiation besides providing information on burdening chronic diseases such as musculoskeletal disorders and respiratory conditions; therefore, healthcare providers are boosting investment in high-quality imaging solutions for early and precise diagnosis.

And with the government initiatives focusing on digital transformation of the healthcare sector and the introduction of artificial intelligence into radiology, increased market uptake is inevitable. The increase of private diagnostic imaging centers and investments in hospital establishments is leading to an increase in accessibility of advanced imaging solutions. In fact, the upgrading of radiology departments in medical facilities will keep the high demand for efficient, high-performance flat panel X-ray detectors extending throughout the United Kingdom.

Advancements in Healthcare Infrastructure Drive Growth in India’s Market

Rapid transformation is taking place within the development of India through modernization in health infrastructure, alongside an increased awareness of and exposure to advanced diagnostic imaging technology. From traditional analog system of medical imaging to digital X-ray technology, helps to increase the accuracy of diagnosis and thus more operational efficiency in hospitals and diagnostic centers. The increasing incidence of orthopedic, heart, and lung diseases is another major factor fuelling the uptake of advanced imaging devices.

The Indian government’s push for healthcare digitization, coupled with rising investments in medical technology, is accelerating market growth. The increasing affordability of digital imaging solutions and the expansion of radiology services in rural and semi-urban areas are making advanced diagnostics more accessible. At a time where healthcare providers are striving to improve the quality of care while minimizing costs, strong growth in demand for flat panel X-ray Detectors is likely to continue over the next few years.

Technological Innovation and Strong Medical Infrastructure Propel Germany’s Market

Steady growth is currently being enjoyed in Germany, which is blessed with a long-standing traditional healthcare system and good investment in medical imaging technology. The country’s focus on precision diagnostics and patient safety is driving the shift toward advanced flat panel detectors, which offer high-resolution imaging and reduced radiation exposure. The increasing incidence of chronic diseases and the need for early disease detection are further boosting the demand for modern X-ray systems.

Germany’s emphasis on research and innovation in medical imaging is fostering the development of cutting-edge flat panel detector technology. Government support for digital healthcare transformation, along with the presence of key market players investing in R&D, is shaping market trends. As hospitals and diagnostic centers continue to upgrade their imaging centers, the demand for efficient, AI-based flat panel X-ray detectors is going to remain strong across the nation.

The flat panel X-ray detectors industry has been consolidated by a few major companies that dominate technology, distribution, and regulatory compliance. They use advanced sensor technology, rigid supply chains, and exclusive partnership agreements with healthcare providers to leverage the major medical imaging companies. The introduction of AI diagnostics and improved picture quality guarantees that the overwhelming majority of hospitals, diagnosis centers, and research facilities will use their products, thus serving to reinforce their dominance in the industry.

They have also invested significantly in the improvement of the detectors' sensitivity, lowering the radiation dose, and rendering them portable. Their patented technologies and regulatory approvals further enhance their competitive supremacy. Such long-term agreements keep suppliers to a minimum and ensure greater control over all procurement and standardization of products in the market.

These giants have the economies of scale as well as proprietary manufacturing processes needed to set prices and establish norms in the sector. Their competence in digital imaging, even more so when combined with connections to cloud-based radiology solutions, clearly demonstrates their prowess. Small outfits have very little room to operate; they are floundering under high development costs and complicated compliance requirements.

However, the competitive environment remains concentrated with the leaders extending to the new healthcare markets and developing next-generation detectors. With flexible designs, AI-enabled image processing, and sustainable materials, these firms are manipulating advancements in the industry. Their grip on high-end medical imaging and industrial inspection makes it very difficult for market New Entrants.

The flat panel X-ray detectors market is growing rapidly with the development in the field of digital imaging technology and increasing demand for high-quality diagnostics. Varex Imaging Corporation, Canon Inc., and Koninklijke Philips N.V. are among the key players which lead innovation by developing advanced detectors with better resolution, faster speeds of processing, and improved durability for medical as well as industrial applications.

The companies are highly investing in research and development to enhance the accuracy of imaging and reduce radiational exposure. Strategic mergers and acquisitions, such as Philips' recent ventures into the medical imaging field, only increase market competition. Partnerships among imaging technology providers and healthcare providers have also raised product innovations to or had the potential to raise it broader along the way of digital X-ray solutions.

Conversion areas mention aspiring market avenues, highlighted in their own right for development despite the challenge of high initial investment, with their orientation toward complex regulatory approvals and a workforce capable of operating such advanced imaging systems. On the contrary, the promising projections for increased market expansion are given by the increased government initiatives to modernize the healthcare infrastructure and the growing adoption-favored AI-powered imaging technologies.

Emerging countries, particularly in the Asia-Pacific region, offer excellent market opportunities to key business players. Demand for portable and wireless flat panel detectors has risen as healthcare requires increasing flexibility and efficiency for imaging solution facilities. Thus, with developments still accruing, the market is certain to thrive in the long run, both in medical applications and non-medical needs.

Recent Developments

In November 2024, Detection Technology, a worldwide leader in X-ray detectors, announces the availability around the world of the extended X-ray flat panel detector portfolio, which now includes over 60 products. These offerings include advanced detectors based on a-Si (amorphous silicon), IGZO (indium gallium zinc oxide), and CMOS (complementary metal-oxide semiconductor) technologies, designed for a wide range of industrial, medical, and security X-ray imaging applications.

The flat panel X-ray detectors market is projected to reach USD 2.73 billion by 2035, growing at a CAGR of 4.6% from 2025.

Flat panel X-ray detectors are facing strong sales opportunities due to innovation in digital radiography, AI-imaging, and rising demand in industrial and medical applications.

Key manufacturers of flat panel X-ray detectors include Varex Imaging Corporation, Canon Inc., Koninklijke Philips N.V., FUJIFILM Holdings, and Teledyne Digital Imaging Inc.

Marketers are presented with high-value business opportunities in the Asia-Pacific region, especially China and India, where the healthcare infrastructure is expanding and digital imaging solutions are increasingly being adopted.

The market is segmented by application into manufacturing, security, construction, semiconductors, bomb disposal, and others.

Based on the product, the market is segmented into amorphous silicon (a-Si), amorphous selenium (a-Se), and complementary metal oxide semiconductor (CMOS).

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Large Synchronous Motor Market Analysis - Size & Industry Trends 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.