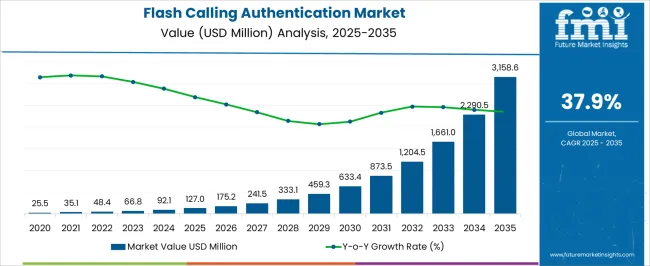

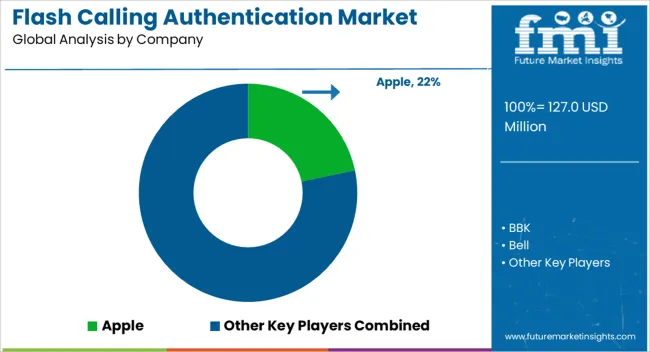

The Flash Calling Authentication Market is estimated to be valued at USD 127.0 million in 2025 and is projected to reach USD 3158.6 million by 2035, registering a compound annual growth rate (CAGR) of 37.9% over the forecast period.

| Metric | Value |

|---|---|

| Flash Calling Authentication Market Estimated Value in (2025 E) | USD 127.0 million |

| Flash Calling Authentication Market Forecast Value in (2035 F) | USD 3158.6 million |

| Forecast CAGR (2025 to 2035) | 37.9% |

The flash calling authentication market is expanding rapidly due to the growing need for secure, frictionless, and cost effective authentication methods across digital ecosystems. The rise of mobile based transactions, digital banking, and e commerce platforms has accelerated adoption, as flash calling offers a seamless user experience without additional passwords or codes.

Telecom operators and service providers are increasingly integrating this method owing to its ability to reduce SMS costs and prevent fraud through number based verification. Advancements in telecom infrastructure, increasing smartphone penetration, and regulatory emphasis on secure digital identification are further shaping adoption trends.

The market outlook is favorable as organizations prioritize both security and convenience, positioning flash calling authentication as a viable alternative to traditional SMS based one time passwords in safeguarding digital interactions.

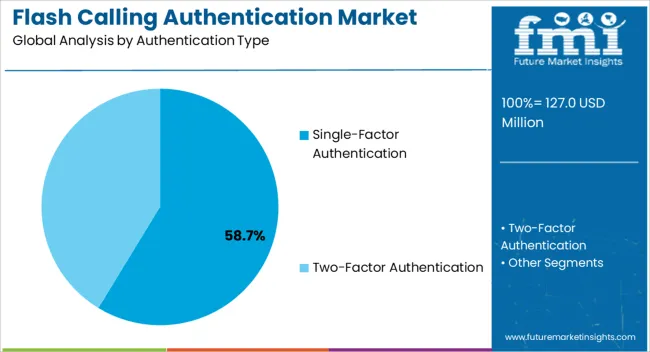

The single factor authentication type segment is projected to account for 58.70% of total revenue by 2025, positioning it as the dominant authentication category. This growth is supported by its ability to provide a cost efficient, fast, and user friendly authentication process without the need for additional applications or complex steps.

Single factor methods in flash calling have gained traction as they simplify customer onboarding and verification processes while maintaining adequate levels of security for low to medium risk transactions. Enterprises have increasingly adopted this approach to enhance user satisfaction, reduce abandonment rates, and streamline digital service access.

The combination of simplicity, affordability, and widespread applicability has reinforced the leadership of single factor authentication within the flash calling authentication market.

The flash calling authentication market witnessed a growth rate of 35.4% from 2020 to 2025.

Historically, the demand for flash calling authentication solutions has been driven by the need for enhanced call security and the rising threat of fraudulent activities, such as identity theft and phone scams. Organizations and individuals have recognized the importance of verifying caller identities to prevent unauthorized access and protect sensitive information.

The flash calling authentication market size is projected to be worth USD 66,792.7 million in 2025. The market is likely to surpass USD 1, 6454,800.0 million by 2035 at a CAGR of 37.9% during the forecast period.

With the proliferation of smartphones and the increasing reliance on mobile devices for communication, the need for secure mobile calling solutions is growing. The evolving regulatory landscape, including regulations related to data protection and privacy, is significantly contributing to the increased demand for flash calling Authentication.

Various industries, such as finance, healthcare, and e-commerce, have specific security requirements and face high risks of fraudulent activities. These industries are expected to drive the demand for flash calling authentication as they seek robust authentication solutions to protect sensitive customer information and maintain trust.

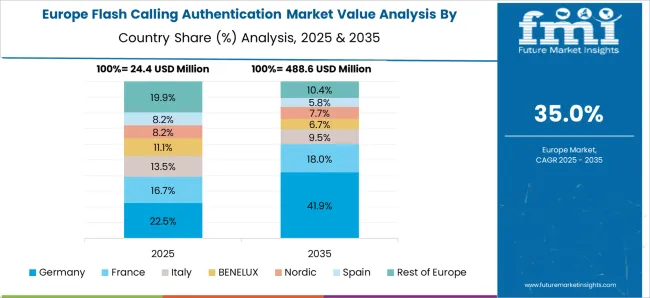

Europe captured a sizeable share of 24.3% in 2025. The region's businesses, government organizations, and individuals prioritize secure communication to protect against fraudulent activities and ensure privacy.

People in Europe have a strong focus on privacy and security concerns. Flash calling authentication, with its ability to verify caller identities and protect against fraudulent activities, aligns well with the privacy and security expectations of consumers in Europe and organizations. This drives the adoption of flash calling authentication solutions across various sectors in Europe.

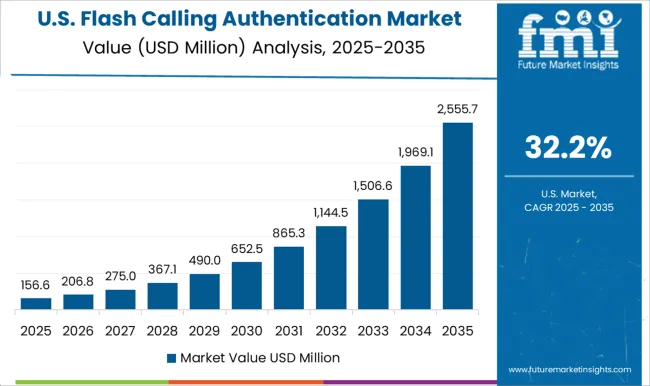

The United States market holds a commanding share of 18.7%, highly influencing North American region. The United States is renowned for its technological innovations, and the flash calling authentication market is no exception.

Companies and research institutions in America are at the forefront of developing cutting-edge technologies and solutions to combat identity theft, spoofing, and other forms of fraudulent activities in phone calls. These advancements contribute to the growth and competitiveness of the United States market.

With the increasing prevalence of phone scams and fraudulent calls, consumer protection has become a significant concern in the United States market. Flash calling authentication addresses this concern by providing reliable methods to verify caller identities and protect individuals from falling victim to scams.

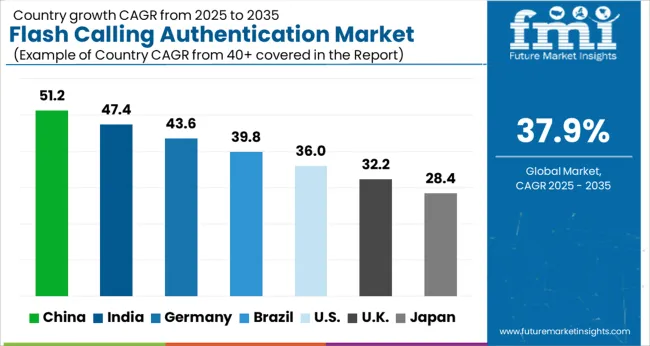

The United Kingdom market in flash calling authentication is anticipated to record a progressive CAGR of 36.5% from 2025 to 2035. The United Kingdom has established regulatory frameworks to address privacy, data protection, and consumer rights in the telecommunications sector. Regulatory bodies such as Ofcom (Office of Communications) and the Information Commissioner's Office (ICO) play a vital role in promoting secure communication practices. Compliance with regulations and guidelines related to consumer privacy and call security drives the adoption of Flash calling authentication solutions in the United Kingdom market.

China is showing all the signs to be one of the notable markets globally, witnessing an astonishing CAGR of 37.4% between 2025 and 2035. China is a mobile-first market, with a significant number of smartphone users and a high reliance on mobile communication. Flash calling authentication solutions cater to the mobile-centric nature of the market, providing secure and convenient authentication methods for phone calls.

Government support, policies, and regulations drive the adoption of flash calling authentication solutions in the market. Additionally, regulatory measures are in place to ensure compliance and promote secure communication practices.

The single factor authentication (SFA) holds a significant share of the flash calling authentication market. SFA refers to the use of a single method or factor, such as a password or a PIN to authenticate the identity of a caller during a phone call.

SFA remains prevalent in certain scenarios while the market is witnessing advancements in multi-factor authentication (MFA) and strong security measures. It is particularly utilized in situations where a basic level of identity verification is sufficient or where convenience and ease of use are prioritized over heightened security.

The multi factor authentication segment is likely to hold 39.3% of the market share. As the importance of securing phone communications increases, organizations and users are recognizing the limitations of relying solely on a single authentication factor like a password or PIN.

MFA combines multiple factors, including something the caller knows (e.g., password or PIN), has (e.g., mobile device or token), or is (e.g., biometric data like fingerprint or voice recognition), to establish a robust and reliable identity verification process.

Manufacturers can improve output and match consumer demand through strategic alliances, improving both revenues and market share. End-users profit from new technologies as new items and technologies are introduced. One of the potential benefits of strategic cooperation is increased manufacturing capacity.

Recent Developments:

The global flash calling authentication market is estimated to be valued at USD 127.0 million in 2025.

The market size for the flash calling authentication market is projected to reach USD 3,158.6 million by 2035.

The flash calling authentication market is expected to grow at a 37.9% CAGR between 2025 and 2035.

The key product types in flash calling authentication market are single-factor authentication and two-factor authentication.

In terms of , segment to command 0.0% share in the flash calling authentication market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flash LED Driver ICs Market Size and Share Forecast Outlook 2025 to 2035

Flash Point Tester Market Size and Share Forecast Outlook 2025 to 2035

Flash-based Arrays Market Insights - Trends & Growth Forecast 2025 to 2035

Flashpoint Analyzer Market

Flash Point Apparatus Market

Arc Flash Risk Assessment Market Size and Share Forecast Outlook 2025 to 2035

All Flash Array Market Size and Share Forecast Outlook 2025 to 2035

Zoned Flash Market Analysis by Component, Drive Interface, End User, and Region Through 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

Universal Flash Storage Market Report - Growth & Forecast 2025 to 2035

Enterprise Flash Storage Market

Chemical Deflasher Market

Authentication and Brand Protection Market Size and Share Forecast Outlook 2025 to 2035

Authentication Solution Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Authentication Solutions Manufacturers

FIDO Authentication Market Analysis - Size, Share, and Forecast 2025 to 2035

Cloud Authentication Market Size and Share Forecast Outlook 2025 to 2035

Crypto Authentication ICs Market Growth – Trends & Forecast through 2034

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Risk-based Authentication (RBA) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA