The flash-based arrays market is projected to experience rapid growth between 2025 and 2035, driven by increasing data storage demands, advancements in enterprise IT infrastructure, and the growing adoption of high-performance storage solutions across industries.

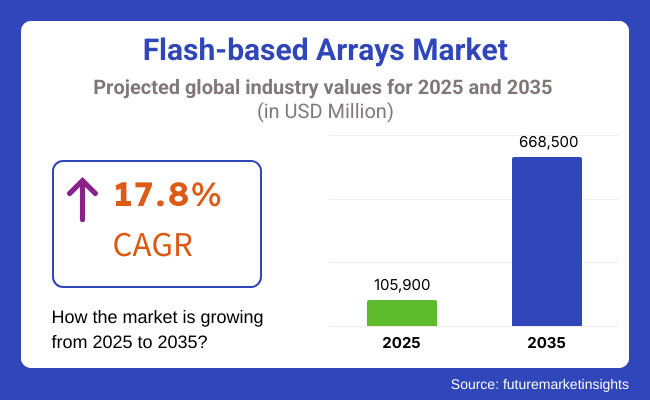

The market was valued at USD 105,900 million in 2025 and is forecasted to reach USD 668,500 million by 2035, reflecting a compound annual growth rate (CAGR) of 17.8% over the forecast period. Many reasons add to the market development of flash-based arrays market.

With the introduction of cloud computing, artificial intelligence (AI), and big data analytics, the amount of data generated is increasing exponentially, and enterprises are increasingly adopting flash-based storage solutions because of their central advantages of efficiency, speed, and reliability.

Moreover, flash-based arrays are being adopted by businesses operating in the healthcare, financial services, and e-commerce industries for their high-speed data transactions with minimal latency. The increasing demand for solid-state storage solutions, combined with technological advancements in NAND flash memory, contributes to the market growth.

Nonetheless, the market is challenged by the high cost of initial deployment of block chain-based IoT solution and issues related to data security, data storage and scalability. Changes in NAND flash memory prices might affect the market as well. On Counter, ongoing advances in storage efficiency, cost savings models, along with next-gen flash storage technologies are likely to reduce these issues thereby paving the way for new avenues in growth for the market players.

Key trends driving the market include the adoption of flash-based storage solutions in the data center, enterprise IT and cloud environments. Demand for flash-based installed storage systems will remain strong as organizations increasingly invest in high-speed, reliable and scalable storage infrastructure.

Moreover, increasing investments in AI-enabled data storage optimization, software-defined storage and energy-efficient flash technologies will drive further growth and one of the most innovative sectors of the market in the years to come.

Flash-based arrays market, by geography North America has a significant market share of the flash-based arrays in North America due to the high density of data centers, cloud computing, and enterprise applications. The USA and Canada dominate the market, which is gaining momentum in IT infrastructure investment, big data analytics, and artificial intelligence.

Here we see growth in the market due to the increasing need for high throughput, low latency storage in industries including finance, healthcare, and e-commerce. So is the pursuit of better storage efficiency, lower power consumption, and stronger data security.

As promising as those prospects may be, however, high start-up costs and integration complexities into existing systems continue to present formidable obstacles. To meet these needs, market players are providing scalable and cost-effective solutions to scale with data management needs.

Given the ongoing digital transformations and growing cloud adoption in Germany, France and UK, Europe is an important market for flash-based arrays. Telecommunication, automotive, research institution, and other industries require high-performance storage demands, which is increasing.

Chain technologies like the GDPR are impacting on the adoption of productive and safe storage technologies. But cost pressures and the need for trained people to operate more complex storage are challenges which the market will have to face. In response, organisations are turning to AI-enabled storage management solutions and hybrid storage approaches to optimise operational efficiency and access to data.

Among regions, Asia-Pacific is projected to grow at the highest CAGR during the forecast period due to rapid digitalization, increasing cloud service providers and the demand for ultra-high-speed data-storage formats in emerging countries, such as China, India, and South Korea. The growing adoption of 5G networks, IoT use cases, and artificial intelligence will assist the market expansion.

The rapid growth of e-commerce, financial services, and IT industries in the region is fueling the demand for scalable and high-performance storage solutions. But, barriers like high deployment cost and data security issues are hindering widespread adoption. We are working on building cost-effective flash storage, larger data center footprint, and forging collaborations with local tech players to address the needs of the market.

Challenges

High Initial Costs and Transition Barriers

Transfer limits allow them to avoid some of the strain caused by thousands of read transactions per second on traditional disk-based arrays; however, despite their faster speeds and other benefits, flash-based arrays have very high upfront costs relative to traditional hard disk drives (HDDs).

Especially for small and mid-size businesses (SMB), enterprises are under budget constraints to allocate in flash storage solution. Moreover, adopting for legacy systems necessitates significant investments in terms of migrating data, compatibility evaluations, and IT infrastructure improvements, rendering the adoption phase intricate and expensive.

Opportunities

Rising Demand for High-Speed, Scalable Storage Solutions

The increasing requirement for high-performance storage is thrusting flash-based arrays into widespread acceptance in AI-driven analytics, cloud computing, and enterprise data centers. Moreover, companies are increasing their investment in NVMe (Non-Volatile Memory Express) and all-flash storage solutions to help accelerate speed and minimize response time, while enabling real-time data processing. Furthermore, increasing focus on 3D NAND development, lower cost per GB for flash storage solutions and software-defined storage (SDS) solutions will fuel the market adoption.

The period between 2020 and 2024 will see rapid expansion of the flash-based arrays market due to cloud adoption, increased enterprise data demands, and enhancements in storage density. Yet cost pressures, supply chain issues, and flash memory endurance concerns provided hurdles. Companies turned to hybrid storage systems that paired solid state drives with high-volume hard drives, artificial intelligence-driven data management, and flash caching to maximize storage efficiency.

By 2025 to 2035, AI-driven storage automation will become mainstream, ultra-dense NAND flash architectures will be leveraged, and quantum-inspired data compression techniques will hit the market. As we go deeper into 2023, the transitional advancements into hyperscale data centers, sustainable storage, and AI-driven predictive analytics will reshape how enterprises and data-oriented organizations will approach storage solutions going forward.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focus on data security and compliance |

| Technological Advancements | Growth of NVMe and 3D NAND storage |

| Industry Adoption | Cloud-driven demand for all-flash arrays |

| Supply Chain and Sourcing | Semiconductor shortages impacting production |

| Market Competition | Dominated by established flash storage brands |

| Market Growth Drivers | Increased need for fast, low-latency storage |

| Sustainability and Energy Efficiency | Efforts toward low-power, high-capacity flash |

| Consumer Preferences | Demand for hybrid flash and cost-efficient SSDs |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-enforced data governance and cyber resilience |

| Technological Advancements | Quantum-enhanced, AI-driven storage architectures |

| Industry Adoption | Hyperscale storage for AI, edge computing, and IoT |

| Supply Chain and Sourcing | Advanced fabrication techniques for high-speed NAND |

| Market Competition | Rise of AI-integrated storage startups and open-source solutions |

| Market Growth Drivers | Exponential data growth in AI, automation, and cloud |

| Sustainability and Energy Efficiency | Carbon-neutral, energy-efficient storage solutions |

| Consumer Preferences | AI-managed, ultra-fast storage ecosystems |

Flash-based arrays have gained popularity in the United States, being one of the largest markets for flash-based storage systems due to the increasing demand for high-performance storage solutions in data centers, cloud computing, and enterprise IT infrastructure. Flash storage is quickly becoming a popular to advantages like fast access, durability, and energy efficiency.

USA-based companies are heavy investors in AI, big data analytics and high-performance computing, all of which are driving the market for flash-based arrays. Moreover, the existence of numerous dominant industry participants and a robust IT infrastructure contributes to continued market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 17.5% |

As the UK continues to see an increase in adoption of all-flash arrays, especially among key industries such as financial services, healthcare and government, the growing trend toward cloud computing and the demand for effective data management solutions are driving the growth of the market.

Companies are focusing on flash storage to boost performance and scalability from systems as more investments are poured into digital, in both transformation and IT modernization. Demand for flash-based arrays is also being spurred by the expansion of local data centers and government-backed initiatives to bolster cybersecurity.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 17.0% |

In the European region, the market for flash-based arrays is fueled by digitalization trends in the telecommunications, automotive, and industrial automation industries. Germany, France, and the Netherlands are the frontrunners in the adoption, as the enterprise has been moving away from relic hard drives to SSD. Regulatory initiatives, for example EU regulations for energy-efficient IT foundation, along with information protection regulations like GDPR are influencing the interest for high-velocity and secure stockpiling answer.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 17.2% |

Japan flash-based arrays market is growing despite the development of smart cities, advanced robotics, and IoT-driven industries. A robust technology sector combined with significant investments in cloud computing and AI are driving demand for efficient and scalable storage solutions in the country. Moreover, the rising requirements of e-commerce and digital banking in Japan, is also fueling the demand for storage infrastructure, thereby supporting the overall market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 17.3% |

Boasting a leading semiconductor industry, high adoption rates of AI, 5G and edge computing, South Korea is a key market for flash-based arrays. This would facilitate outstanding innovation and technological advancements in the sector as you have some of the world's best flash memory manufacturers in the country. Market expansion is being driven by rising investments in data centers and cloud computing services, as well as strong government support for the development of IT infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 17.6% |

Flash-based arrays market is growing at a faster pace with substantial growth rates over the past couple of years and is estimated that the market will further grow during the forecasted period. Flash-based storage arrays offer faster data access and lower latency and greater efficiency than traditional hard disk drive (HDD)-based storage systems.

From IT & telecom, healthcare and banking to government institutions, businesses from every field are migrating to flash storage to enable digital transformation, cloud computing and big data analytics. The emergence of SSD technology, increases in enterprise data volumes and the rapid adoption of artificial intelligence (AI) and machine learning (ML) workloads are also helping to fuel the growth of this sector. As enterprises look for high-performance storage infrastructure that consumes less power and is more durable, Shaw believes the market for flash-based arrays will continue to grow.

All-Flash Arrays (AFAs) enjoys majority share in the market among product type segments owing to the paradigm of performance, speed and energy efficiency offered.

All-Flash Arrays (AFAs) consist of only NAND-based solid-state drives (SSDs), removing all the mechanical components that traditionally caused far heavier data access times. These offer ultra-low latency and high input/output operations per second (IOPS) storing along with data security.

AFAs for real-time analytics, virtualization, and database management are particularly trusted by big companies in areas like financial services, e commerce and cloud computing. Due to the fact that businesses are adopting hybrid and multi-cloud environments as primary, AFAs still remain the application of choice for mission-critical apps that need high toxicity and solid storage of the information.

The hybrid flash arrays (HFAs) have a combination of SSDs with regular HDDs (hard disk drives) for performance at the same time bringing the cost down. HFAs are mostly a necessity in mid-range companies and industries that experience workload spikes, calling for both fast access as well as economically feasible large storage. These solutions also work well for companies that need a transitional path from HDD-based storage to all-flash environments.

As data-intensive applications are rapidly climbing up the ladder, All-Flash Arrays (AFAs) will continue to dominate the storage scene, while Hybrid Flash Arrays (HFAs) will specifically be catering to enterprises with budget restrictions in place that require scalable storage solutions.

Large enterprises dominate the organization size segment for storage in the hyper-converged system market because of their high volume of data processing needs and extensive investments in advanced storage infrastructure.

Large enterprises from all segments, including BFSI, health care, media & entertainment, and manufacturing, need high-speed, high-capacity storage systems to process large amounts of data. High levels of availability, disaster recovery capabilities, and cloud integration are among the top reasons these businesses are adopting AFAs and HFAs.

Furthermore, excellent low latency that is necessary in a variety of applications consequently raises the use of such array usages, driving growth in the flash storage segment. The increasing need for high performance computing (HPC) and data analytics based on AI, has led large organizations to further leverage towards flash-based array systems for optimal data storage and management, and processing efficient data.

Increased cloud adoption is also motivating SMEs to reflect the cost benefits offered by flash-based storage. Cost restrictions have historically made it impossible for SMES to justify investment in enterprise class storage systems, but the emergence of scalable and cost-effective HFAs are doubling demand growth in this segment.

Flash-based heterogeneous/array integration to improve operation with minimum downtime and better cyber-security is being observed among small and medium enterprises (SMEs) in the sectors as retail, professional services, and logistics. With the ongoing IT transformation; large enterprises will still dominate flash-based arrays, but SMEs will also invest in hybrid & cost-efficient flash-based solutions for their IT infrastructure investment.

The flash-based arrays market is driven by the growing need for reduced latency and high-speed performance for increased throughput in cloud computing, mobile computing like smart devices and enterprise applications in this interactive world.

Flash-based arrays provide faster performance, lower latency, and improved energy efficiency, contributing to their popularity in modern data centers and enterprise IT infrastructure. In this market, organizations strive to stay competitive by innovating in areas such as technology, high-capacity storage solutions, and securing data.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dell Technologies | 20-25% |

| NetApp | 15-20% |

| Hewlett Packard Enterprise (HPE) | 12-16% |

| Pure Storage | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dell Technologies | Offers high-performance flash storage solutions, focusing on enterprise-grade reliability and scalability. |

| NetApp | Specializes in hybrid cloud storage and AI-driven data management with a strong emphasis on data protection. |

| Hewlett Packard Enterprise (HPE) | Provides intelligent flash storage systems with machine learning integration for optimized performance. |

| Pure Storage | Focuses on all-flash storage solutions with high-speed, energy-efficient architectures. |

Key Company Insights

Dell Technologies (20-25%)

Once again Dell Technologies leads the flash-based arrays market flexible high performing multi-cloud-enabled storage solution for next generation data center, cloud applications and AI-based workloads. Its focus on enterprise data management, improved security, and smooth hybrid IT integration supports its world leadership in the industry.

NetApp (15-20%)

NetApp one of the top innovators in hybrid cloud storage focused on data protection, AI-based analytics, and efficient flash storage. Its emphasis on hybrid cloud integration and seamless performance optimization fortifies the company's competitive edge in the space.

Hewlett Packard Enterprise (HPE) (12-16%)

HPE is known for its intelligent flash storage solution built on machine learning and predictive analytics to increase storage efficiency and scale. Market growth continues for the company with a focus on automation and AI-driven storage management.

Pure Storage (10-14%)

Pure Storage is the leader in all-flash storage solutions that deliver ultra-fast performance, energy efficiency and next-generation data storage architectures. Its focus on effortless deployment, cloud-centricity, and sustainable practices placed it among the strongest competitors in the category.”

Some Other Major Players (30-40% Combined)

The flash-based arrays market is highly competitive owing to the large number of emerging players concentrating on NVMe technology, AI-optimized storage, and data security innovations. Key players include:

Table 1: Global Market Value (US$ billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 7: Global Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 9: North America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 15: North America Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 17: Latin America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 23: Latin America Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 31: Western Europe Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 49: East Asia Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 55: East Asia Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ billion) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ billion) Forecast by Organization Size, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Organization Size, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ billion) Forecast by End-Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 3: Global Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 4: Global Market Value (US$ billion) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ billion) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 17: Global Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Organization Size, 2023 to 2033

Figure 23: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 27: North America Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 28: North America Market Value (US$ billion) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 41: North America Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Organization Size, 2023 to 2033

Figure 47: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 51: Latin America Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ billion) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 65: Latin America Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Organization Size, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 75: Western Europe Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 89: Western Europe Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ billion) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Organization Size, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ billion) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Organization Size, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 147: East Asia Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ billion) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 161: East Asia Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Organization Size, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ billion) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ billion) by Organization Size, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ billion) by End-Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ billion) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ billion) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ billion) Analysis by Organization Size, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Organization Size, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Organization Size, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Organization Size, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ billion) Analysis by End-Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Organization Size, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

The overall market size for the flash-based arrays market was 105,900 million in 2025.

The flash-based arrays market is expected to reach USD 668,500 million in 2035.

The demand for flash-based arrays is expected to rise due to increasing data storage demands, advancements in enterprise IT infrastructure, and the growing adoption of high-performance storage solutions across industries.

The top five countries driving the development of the flash-based arrays market are the USA, Germany, China, Japan, and South Korea.

All-flash arrays (AFAs) and hybrid flash arrays (HFAs) are expected to command a significant share over the assessment period.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA