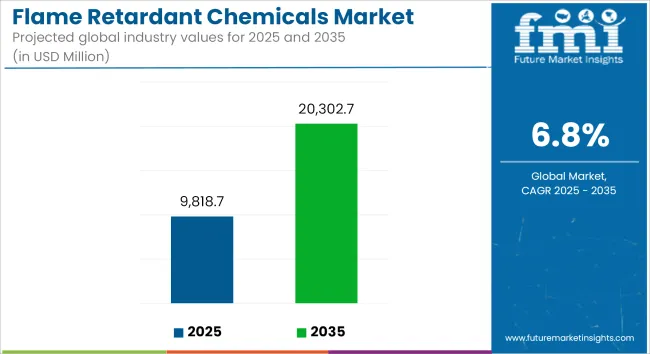

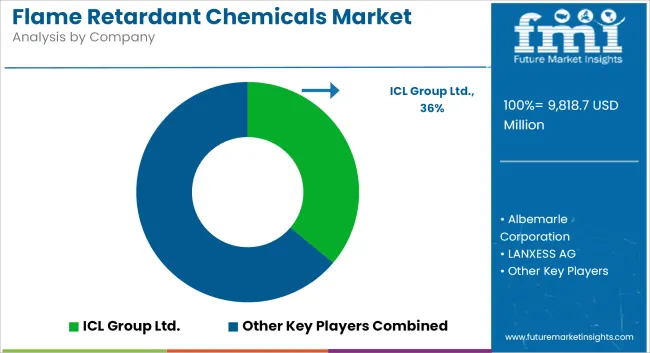

The global flame retardant chemicals market is estimated to grow from USD 9,818.7 million in 2025 to USD 20,302.7 million by 2035, registering a CAGR of 6.8% over the forecast period. Market expansion is being driven by stringent fire safety regulations across construction, transportation, electrical & electronics, and textiles sectors.

| Metric | Value (USD) |

|---|---|

| Industry Size (2025E) | USD 9,818.7 million |

| Industry Value (2035F) | USD 20,302.7 million |

| CAGR (2025 to 2035) | 6.8% |

Rising fire incidences, coupled with increasing awareness of fire prevention in both developed and emerging economies, have prompted manufacturers to adopt flame-retardant solutions across various materials, including plastics, foams, fabrics, and composites.

Demand is further amplified by the growth in construction of high-rise buildings, electric vehicle manufacturing, and the miniaturization of electronic components, all of which demand advanced fire protection. Environmentally-friendly flame retardants, including halogen-free and phosphorus-based compounds, are gaining ground due to increasing scrutiny of brominated flame retardants and regulatory shifts in the USA, EU, and Japan.

Regulatory frameworks such as the European Union's REACH, the USA Environmental Protection Agency’s TSCA, and Japan's Chemical Substances Control Law are encouraging the shift toward low-toxicity, non-halogenated flame retardants. Meanwhile, growing investment in electric mobility and 5G infrastructure is prompting the use of high-performance flame-retardant polymers and additives. Asia-Pacific remains the fastest-growing region, led by China and India, where urbanization, manufacturing growth, and fire safety codes are rapidly evolving.

In the long term, synergy between fire performance, environmental impact, and material compatibility will be the cornerstone of innovation. Hybrid and multifunctional retardants, recyclability considerations, and bio-based alternatives are gaining traction as the industry pivots toward sustainability and compliance. Cross-industry collaborations in R&D and circular product development are also shaping the competitive and regulatory dynamics of this evolving market.

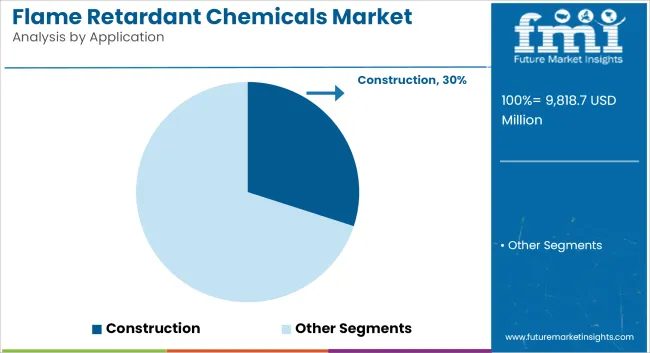

The construction sector is projected to hold the largest application share of approximately 30% in 2025, expanding at a CAGR of 6.1% through 2035. Stringent building codes and fire safety regulations in urban and public infrastructure developments are prompting widespread use of flame-retardant chemicals in insulation, flooring, cables, coatings, sealants, and panels.

Non-halogenated flame retardants such as aluminum hydroxide, magnesium hydroxide, and phosphorus-based compounds are gaining momentum in residential and commercial construction due to their low smoke generation and reduced environmental impact. High-rise buildings, modular construction, and retrofitting projects are key growth areas, particularly in North America, Western Europe, and the Middle East.

Increased use of fire-rated drywall, treated plywood, and protective coatings is aligning with green building certification programs such as LEED and BREEAM. Urban fire incidents and rising insurance premiums are also incentivizing developers to integrate flame retardant materials into architectural design from the outset.

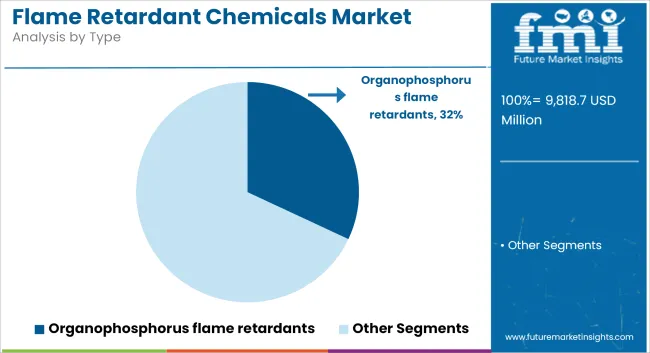

Organophosphorus flame retardants are anticipated to lead the market by type, accounting for approximately 32% of global consumption in 2025, and are forecast to grow at a CAGR of 6.4% through 2035. These phosphorus-based chemicals are extensively used in polyurethane foams, engineering plastics, and epoxy resins, offering flame inhibition through a condensed-phase mechanism that forms a protective char layer.

Their halogen-free nature aligns with stringent environmental and health safety regulations across North America and Europe, which increasingly restrict brominated and chlorinated alternatives. As a result, demand is surging in electrical & electronics, automotive, and building insulation sectors. Organophosphorus compounds like DOPO derivatives and ammonium polyphosphate are valued for their high thermal stability, low smoke emission, and compatibility with various polymer matrices.

Ongoing innovation in reactive and additive-grade formulations is further enhancing their appeal across lightweight plastic composites used in electric vehicles and consumer electronics. With strong regulatory backing and broad application potential, organophosphorus flame retardants are poised to remain the preferred choice among end-use industries.

Environmental Scrutiny, Health Concerns, and Cost Pressure

Industry is under growing scrutiny about the toxicity and persistence of halogenated flame retardants, which have been banned or restricted in some countries. There is also a need for safer alternatives for the impact of brominated compounds on health and environment. At the same time, non-halogenated and specialty compounds frequently lead to increased expenses and complicated assimilation into existing manufacturing systems.

Green Chemistry, Circularity, and Regulatory-Driven Innovation

Bio-based, recyclable and low-smoke formulations comply with LEED, BREEAM and other green standards. The growth of smart devices, electric vehicles (EVs), battery enclosures and building-integrated electronics has opened up new demand for lightweight, high-performance flame-retardants. Novel approaches involving nanotechnology, synergistic formulations, and coating-form flame-resistant systems are anticipated to empower next-gen fire mitigation solutions without sacrificing material performance.

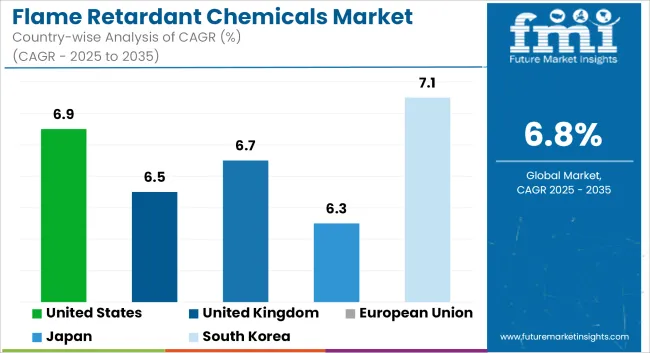

Fire safety regulations legislated by government to ensure fire safety in construction, electronics, transportation and textiles is the key driver of the USA flame retardant chemicals market, which has been growing for quite some time. There is an increase for including non-halogenated flame retardant substances, such as aluminum hydroxide, organophosphates, and nitrogen-based, due to environmental and health concerns.

The construction industry is one of the key end users because commercial and residential infrastructure must comply with strict fireproofing standards. The USA market is segmenting towards sustainable flame retardant formulations including polymer wire coatings and eco-friendly insulation materials, which offer distinctive attributes when blended into marketable products like recycled plastics shipping products.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.9% |

The UK flame retardant chemicals market is growing due to new fire safety codes being introduced, especially in areas such as housing, public infrastructure, and consumer electronics. Increases in regulatory review and enforcement of flame retardant standards, in particular for cladding and insulation applications, has expedited as a result of the Grenfell Tower tragedy.

There is increasing demand for halogen-free and low-smoke formulations throughout furniture, textiles, and automotive interiors. Research institutes and manufacturers in the UK are investing in bio-based and recyclable fire retardant additives.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

Germany is leading in the flame retardant chemicals market, due to stringent product safety regulations and the compliance of materials in accordance with REACH. Since there is a huge demand for environment-friendly flame retardants in electronics, cables, and construction panels. In the context of sustainability goals, EU manufacturers are substituting brominated compounds for phosphorous-based and mineral flame retardants.

Glass-fibre composites (GFRPs), for example, have been used for a long time, but circular economy initiatives are pushing the development of flame-retardant flame retardants that are compatible with recycled polymers and bio-composites.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.7% |

Japan flame retardant chemicals market is growing steadily driven by the country’s emphasis on disaster resistant construction and strict fire safety regulations within public and industrial facilities. Non-halogenated flame retardants are being formulated and widely utilized in automotive, electronics, and building applications where smoke suppression and thermal stability are of utmost importance.

Japan has introduced innovative phosphorus-nitrogen mixtures and polymeric flame retardants that satisfy fire performance and environmental safety requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

South Korea flame retardant chemicals market is anticipated to witness robust growth during the forecast period owing to the growing construction sector, high volume of electronics production in the country, and increasing fire safety regulations in the country. The domestic output of halogen-free flame retardants is increasing, which can be used in semiconductors, household appliance, and electric vehicle component.

There is also increasing investment into intumescent coatings and additive technologies that make energy-efficient building products more fire-resilient. The environmental policies of South Korea however can promote flame retardants with low toxicity and recyclability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

The flame retardant chemicals market is marked by high regulatory pressure, shifting consumer preferences, and the need for sustainable innovation. Industry leaders are proactively reformulating product lines to reduce halogen content and toxicity while maintaining high fire resistance and mechanical performance. Environmental stewardship and health compliance are becoming primary drivers of competitive strategy.

R&D investment is focused on multifunctional additives that can impart flame retardancy along with thermal stability, electrical insulation, and mechanical reinforcement. Synergistic combinations (e.g., aluminum trihydrate with phosphate esters) are being deployed to meet the evolving needs of construction, automotive, and electronics sectors.

The overall market size for the flame retardant chemicals market was USD 9,818.7 million in 2025.

The flame retardant chemicals market is expected to reach USD 20,302.7 million in 2035.

The demand for flame retardant chemicals will be driven by stringent fire safety regulations across construction, electronics, and transportation sectors, growing use of flame-retardant plastics and textiles, increasing demand for lightweight fire-resistant materials, and advancements in halogen-free and environmentally sustainable formulations.

The top 5 countries driving the development of the flame retardant chemicals market are the USA, China, Germany, Japan, and South Korea.

The organophosphorus flame retardants segment is expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flame Detector Market Size and Share Forecast Outlook 2025 to 2035

Flameproof Equipment Market Size and Share Forecast Outlook 2025 to 2035

Flame Barrier Market Size and Share Forecast Outlook 2025 to 2035

Flame Resistant Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Flame Photometer Market Size and Share Forecast Outlook 2025 to 2035

Flame Ionization Detectors Market Size and Share Forecast Outlook 2025 to 2035

Flame Proof Lighting Market Growth 2025 to 2035

Flame Arrester Market

Flame Retardant Masterbatch Market Size and Share Forecast Outlook 2025 to 2035

Flame Retardant Film Market Analysis & Forecast 2024-2034

Flame Retardant Market Growth – Trends & Forecast 2024-2034

Bromine Flame Retardant Market Growth – Trends & Forecast 2024-2034

Inorganic Flame Retardants Market

North America Flame Retardant Thermoplastics Market Size and Share Forecast Outlook 2025 to 2035

Non-Halogenated Flame Retardants Market- Growth & Demand 2025 to 2035

Fire Retardant Coatings Market Size and Share Forecast Outlook 2025 to 2035

Fire Retardant Fabrics Market - Growth & Demand 2025 to 2035

Breaking Down Market Share in the Fire Retardant Plastics Industry

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Biochemicals Control Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA