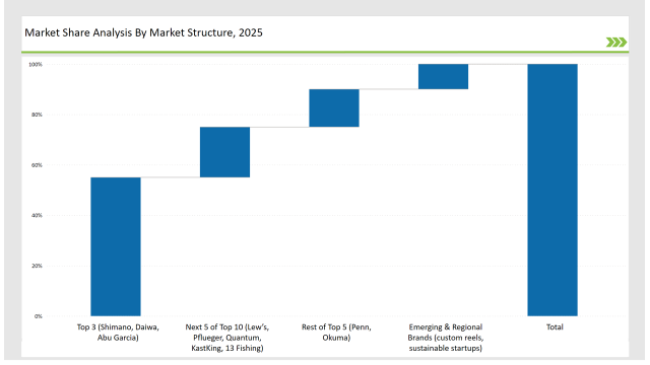

The global fishing reels market is growing as more people take up outdoor activities and anglers seek better, high-performance reels for a variety of fishing techniques. With advancements in reel materials, drag systems, and smart fishing technology, the brands are targeting precision, durability, and lightness in design. Top three market leaders: Shimano, Daiwa, and Abu Garcia, occupy 55% market share through high-end engineering, heritage brands, and extensive product lines. The regional players and mid-tier brands that focus on affordability and niche fishing styles hold 30% of the market share. The remaining 15% consists of emerging eco-friendly and smart reel start-ups.

Explore FMI!

Book a free demo

| Market Segment | Industry Share (%) |

|---|---|

| Top 3 (Shimano, Daiwa, Abu Garcia) | 55% |

| Rest of Top 5 (Penn, Okuma) | 15% |

| Next 5 of Top 10 (Lew’s, Pflueger, Quantum, KastKing, 13 Fishing) | 20% |

| Emerging & Regional Brands (custom reels, sustainable startups) | 10% |

The fishing reels market in 2025 is moderately fragmented, with several international and regional manufacturers competing. Key players like Shimano, Daiwa, and Abu Garcia hold strong positions, but a large number of niche and regional brands contribute to a diverse product range. The market benefits from technological advancements, catering to both recreational and professional anglers.

There are various sales channels for the fishing reels market: the sales take place through specialty outdoor and sporting goods stores, who allocate 50% since anglers want to check products in person. E-commerce leads for 35%, with direct-to-consumer brands like catalogue orders online exclusives, and it allows the easy review of products. Regional distributors and independent tackle shops account for 10% catering towards niche fishing styles and local expertise. Direct manufacturer websites and fishing expos appeal to 5% of the remaining high-end buyers and brand enthusiasts.

The fishing reels market is segmented into spinning reels, baitcasting reels, fly reels, and trolling reels. Spinning reels dominate with 50% of the market, valued for their versatility and ease of use. Baitcasting reels account for 25%, preferred by experienced anglers for precision and power. Fly reels contribute 15%, appealing to fly fishing enthusiasts seeking lightweight, performance-driven reels. Trolling reels hold 10%, targeting offshore and deep-sea fishing applications.

Building on the base of material improvement, sustainability effort, and a rise in digitization, fishing reels have actually witnessed a sea change in 2024. Some of these monumental changes happened at the hands of the following players:

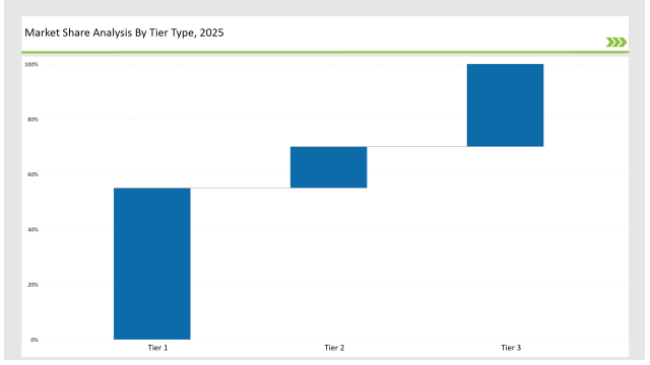

| Tier Type | Tier 1 |

|---|---|

| Example of Key Players | Shimano, Daiwa, Abu Garcia |

| Market Share% | 55% |

| Tier Type | Tier 2 |

|---|---|

| Example of Key Players | Penn, Okuma |

| Market Share% | 15% |

| Tier Type | Tier 3 |

|---|---|

| Example of Key Players | Regional brands, sustainable startups |

| Market Share% | 30% |

| Brand | Key Focus Areas |

|---|---|

| Shimano | Lightweight carbon fiber reels with advanced drag systems |

| Daiwa | Smart reels with digital braking and connectivity features |

| Abu Garcia | Saltwater-resistant reels with corrosion protection |

| Penn | High-speed retrieval and tournament-grade durability |

| Okuma | Affordable hybrid reels with premium features |

| Emerging Brands | Eco-friendly materials and custom reel designs |

The trend in the fish reels market will largely increase compared to the previous years over a period through innovations in lightweight materials, digital tracking technology, and sustainability. The smart-enabled and AI-driven designs for reel efficiency and ergonomic forms, which make an angler a successful angler, are set to go. The near-future market trends will introduce casting analysis systems through AI. Manufacturers will integrate 3D-printed parts with reel bodies for customization and energy-efficient processes with sustainable packaging, biodegradable lubricants, and many other aspects based on environmental requirements. The future of the sector is going to focus on the precision engineered, digitally convenient, and eco-friendly fishing gears for both amateur anglers and sport fishing professionals.

Leading brands such as Shimano, Penn, and Daiwa collectively hold around 55% of the market.

Regional manufacturers catering to specialized fishing needs hold approximately 30% of the market.

Startups focusing on smart and eco-friendly fishing reels hold about 10% of the market.

Private labels from outdoor retailers and sporting goods stores hold around 5% of the market.

High for companies controlling 55%+, medium for 40-55%, and low for those under 30%.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.