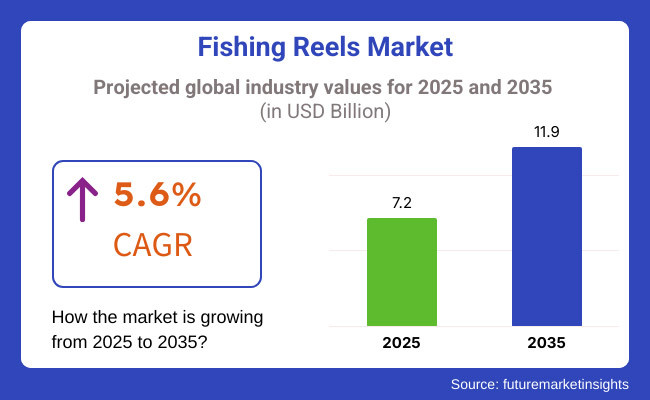

The fishing reels market is expected to experience steady growth between 2025 and 2035, driven by increasing recreational fishing activities, rising disposable incomes, and the growing popularity of sport fishing. The market is projected to expand from USD 7.2 billion in 2025 to USD 11.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The market expansion is fuelled by technological advancements in fishing rolls, including quill light accessories, perfection gearing, and digital advancements. The adding influence of social media and out-of-door adventure trends is farther boosting consumer interest in high- performance fishing gear. Also, sustainability trends are egging manufacturers to borrow Eco-friendly accoutrements and product styles to feed to environmentally conscious gillers.

Explore FMI!

Book a free demo

North America remains the largest request for fishing rolls due to a well- established inclination culture, strong consumer spending on out-of-door conditioning, and the presence of leading fishing outfit brands.

The adding relinquishment of high- tech fishing gear, including smart rolls with digital shadowing capabilities, is anticipated to drive request growth. Also, conservation enterprise promoting catch- and- release fishing will contribute to sustainable product development.

Europe is witnessing steady demand for fishing rolls, driven by a strong tradition of sport fishing in countries like the UK, Germany, and France. Growth in Eco-tourism and recreational fishing is boosting request expansion, while regulations aimed at sustainable fishing practices are encouraging the relinquishment of biodegradable fishing gear. The demand for decoration, high- performance rolls is growing, particularly among professional grillers and fishing event actors.

Asia- Pacific is anticipated to be the swift- growing region for fishing rolls, with rising participation in recreational fishing across countries similar as Japan, China, and Australia. Adding urbanization, rising disposable income, and government enterprise to promote fishing tourism are crucial factors driving the request. The expansion of-commerce platforms and digital marketing strategies is enhancing product availability, farther supporting market growth

Challenges

One of the significant challenges in the fishing rolls request is the proliferation of fake products. Numerous low- quality clones of decoration fishing rolls are available at lower prices, which not only impacts the profit of licit brands but also affects consumer trust in the assiduity. Companies must strengthen therians-counterfeiting measures, similar as incorporating unique periodical canons and authentication technology, to combat this issue.

Environmental enterprises regarding fishing gear pollution also pose a challenge. Lost or discarded fishing rolls and lines contribute to marine debris, harming submarine ecosystems. As sustainability becomes a precedence, manufacturers must invest in biodegradable accoutrements and recyclable factors. Compliance with strict environmental regulations, especially in regions with strict conservation laws, adds to the complexity of product and distribution.

Opportunities

The adding mindfulness of sustainable fishing practices presents a substantial occasion for request players. Consumers are laboriously seeking Eco-friendly rolls made from recycled or biodegradable accoutrements. Companies that prioritize sustainable product, ethical sourcing, and an eco-conscious packaging will gain a competitive edge in the request.

Also, the integration of smart technology in fishing rolls offers a economic growth avenue. Features similar as digital displays, GPS shadowing, and automated drag systems are revolutionizing the fishing experience, attracting tech- expertise grillers.

With the rise of smart out-of-door gear, companies that introduce in this space can tap into a new member of fishing suckers looking for advanced, data- driven fishing results. Likewise, expanding online retail channels and direct- to- consumer deals models can enhance brand visibility and availability, enabling manufacturers to reach a broader followership encyclopaedically.

| Country | Population (millions) |

|---|---|

| United States | 345.4 |

| China | 1,419.3 |

| Japan | 123.3 |

| Australia | 26.4 |

| Canada | 40.3 |

| Country | Estimated Per Capita Spending (USD) |

|---|---|

| United States | 27.40 |

| China | 18.90 |

| Japan | 32.60 |

| Australia | 40.20 |

| Canada | 30.10 |

The USA fishing rolls request thrives due to recreational and competitive fishing culture. With abundant lakes, gutters, and places, the demand for high- quality rolls is strong. Brands like Shimano, Daiwa, and Penn dominate the request, offering advanced rolls for freshwater and saltwater fishing. The rise of e-commerce has further boosted availability and product variety.

China, with its vast consumer base, gests stable demand for fishing rolls, driven by both recreational and marketable fishing. Domestic brands give affordable options, while ultra-expensive transnational brands feed to suckers. Online retail platforms like JD.com and Alibaba play a crucial part in request expansion.

Japan has a mature fishing rolls request, known for its high- end, technologically advanced rolls. Domestic manufacturers like Shimano and Daiwa lead invention with perfection engineering. Fishing is a popular recreational exertion, and demand for feather light, durable rolls remains strong.

Australia’s fishing rolls request benefits from a strong fishing culture, supported by abundant marine and brackish fishing locales. High per capita spending reflects consumer preference for decoration- quality rolls. Saltwater fishing is particularly popular, driving demand for erosion- resistant models.

Canada’s request is driven by its expansive brackish fishing openings. Ice fishing rolls, bait casting rolls, and spinning rolls see strong demand. Sustainability-conscious buyers prefer durable, long- lasting rolls, boosting decoration member growth

The sport fishing reel market is growing steadily with growing sport fishing activity, higher demand for high-quality reels, and innovations in the technology of fishing gear. Trends and industry influences identified by 250 sport anglers, professional anglers, and owners of outdoor stores trend towards significant key areas.

Reeling reels are still the best option, and 63% of the interviewees picked them because they are convenient and universal, especially for beginners and leisure anglers. On the other hand, 41% of professional fishermen use bait casting reels because they are precise and responsive, especially for catching large fish species.

Material innovation also matters as 58% of the customers seek light yet robust reels made from aluminium or carbon fibre to be more performing and strong. Furthermore, 39% of the customers seek coatings that are saltwater-resistant, reflecting greater demand by beach and deep-sea anglers for corrosion-resistance reels.

Smart reels and digitalization are also not behind, with 29% of the survey participants willing to possess digital braking reels with Bluetooth capabilities and adjustable drag in real-time for better fishing. The vintage reel is still the winner, however, as 54% of the anglers prefer mechanical simplicity to technology.

Price and brand awareness are the two that call the shots on the purchasing decision, with 47% paying top dollar for the best brands such as Shimano, Daiwa, and Penn, 35% getting the middle option on price without compromising on quality, and 18% of the buyers using the starter reels for occasional fishing.

Specialty shops and the internet are prime selling points, with 66% of fishers purchasing fishing reels in the store or online to access more options and discounted prices, and 34% purchasing in the store to try equipment prior to purchase. Subscription plans for equipment and individual reel assembly are new among avid anglers.

With increased popularity for sport fishing, manufacturers and retailers are able to capitalize on demand by providing modern, high-performance reels with increased strength, intelligent features, and ergonomics for different fishing applications.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced lightweight, corrosion-resistant materials such as carbon fibre and titanium. Digital line counters and braking systems improved casting accuracy. |

| Sustainability & Circular Economy | Companies adopted recyclable materials, biodegradable fishing lines, and eco-friendly coatings. Repairable and modular reel designs encouraged longevity. |

| Connectivity & Smart Features | IoT-enabled fishing reels integrated with mobile apps for real-time catch tracking and weather updates. Bluetooth connectivity enhanced angler performance insights. |

| Market Expansion & Consumer Adoption | Increased interest in outdoor activities and recreational fishing drove demand for high-performance reels. Direct-to-consumer (DTC) sales and e-commerce platforms expanded accessibility. |

| Regulatory & Compliance Standards | Stricter environmental regulations encouraged sustainable fishing gear production. Certifications for lead-free, eco-friendly materials gained prominence. |

| Customization & Personalization | Brands introduced interchangeable spool sizes, ergonomic handles, and adjustable drag systems for personalized angling experiences. AI-assisted reel selection tools improved consumer engagement. |

| Influencer & Social Media Marketing | Fishing influencers, YouTubers, and competitive anglers promoted advanced reels and fishing techniques. TikTok and Instagram fueled trends in high-performance gear. |

| Consumer Trends & Behavior | Consumers prioritized lightweight, durable, and high-precision reels. Demand surged for saltwater-resistant, low-maintenance, and high-speed retrieval reels. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered smart reels adjust drag, tension, and retrieval speed in real time. Self-lubricating and self-repairing materials extend reel longevity and performance. |

| Sustainability & Circular Economy | Zero-waste reel manufacturing becomes the standard, utilizing AI-optimized material sourcing. Block chain ensures ethical and sustainable production tracking. |

| Connectivity & Smart Features | AI-powered reels sync with smart wearables and sonar systems for precision fishing. Block chain-backed traceability ensures sustainable fishing practices. |

| Market Expansion & Consumer Adoption | Emerging markets drive demand for cost-effective, AI-integrated fishing solutions. AI-driven analytics refine product recommendations based on water conditions, fish species, and angler preferences. |

| Regulatory & Compliance Standards | Governments mandate carbon-neutral manufacturing for fishing equipment. Block chain enhances compliance tracking and ethical sourcing verification. |

| Customization & Personalization | AI-driven customization tailors reel performance to an angler’s fishing style, technique, and target species. 3D-printed, on-demand reel components enhance durability and personalization. |

| Influencer & Social Media Marketing | Virtual fishing influencers and met averse-based fishing tournaments redefine digital marketing. AR-powered reel demonstrations allow consumers to experience reel mechanics before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired angling integrates AI-driven fish tracking and fatigue-reducing reel designs. Consumers embrace smart, sustainable fishing reels for optimized performance and eco-conscious fishing. |

The USA fishing rolls request is witnessing steady growth, driven by adding recreational fishing participation, rising demand for technologically advanced rolls, and expanding e-commerce deals. Major players include Shimano, Penn, and Daiwa.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

The UK fumbling rolls request is expanding due to the rising trend of freshwater and saltwater fishing, adding investments in decoration fishing outfit, and strong consumer preference for eco-friendly gear. Leading brands include Hardy, Okuma, and Abu Garcia.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

Germany’s fishing reels market is growing, with consumers prioritizing durability, versatility, and eco-friendly manufacturing. Key players include DAM, WFT, and Zebco Europe.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.7% |

India’s fishing rolls request is witnessing rapid-fire growth, fueled by adding interest in recreational fishing, expanding littoral tourism, and the affordability of locally manufactured fishing gear. Major brands include Rapala, Shimano, and SureCatch

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.2% |

China’s fishing rolls request is expanding significantly, driven by rising disposable inflows, adding fishing culture, and rapid-fire advancements in roll technology. crucial players include Haibo, RYOBI China, and KastKing.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.5% |

The fumbling rolls request is passing strong growth, driven by adding participation in recreational fishing and competitive inclination events. Gillers seek advanced roll designs that enhance casting delicacy, reclamation speed, and continuity. Spinning rolls, bait casting rolls, and fly rolls are among the most popular choices for freshwater and saltwater fishing suckers. Growing interest in sustainable fishing and eco-friendly inclination practices is also shaping request demand, with manufacturers fastening on recyclable accoutrements and biodegradable fishing gear.

Advancements in fishing roll technology are driving request expansion, with manufacturers incorporating feather light accoutrements like carbon fibre, magnesium, and aluminium blends to ameliorate performance and continuity. High- speed gear rates, digital retardation systems, and enhanced drag mechanisms are getting standard features in decoration fishing rolls. Smart fishing rolls equipped with digital shadowing, Bluetooth connectivity, and mobile app integration are gaining traction among tech- expertise grillers looking for data- driven fishing gests.

Online retail platforms are playing a pivotal part in the fishing rolls request, offering gillers access to a wide range of products from global brands. The rise of direct- to- consumer (DTC) deals through manufacturer websites and social media commerce enables fishing gear companies to engage directly with guests and give individualized recommendations.

Subscription- grounded fishing attack boxes and influencer- driven marketing juggernauts are farther enhancing product visibility and driving deals.

As sustainability becomes a crucial concern in out-of-door sports and recreational conditioning, fishing roll manufacturers are investing in environmentally friendly accoutrements and product styles. The demand for lead-free factors, biodegradable fishing lines, and recycled roll bodies is adding among Eco-conscious consumers.

Brands are also promoting responsible fishing practices, catch- and- release enterprise, and hook-ups with conservation associations to support marine life preservation and niche restoration.

Market for fishing reels is expanding with increasing recreational fishing, customer demand for angling as a sport, and innovation in reel design. Brand loyalists among makers focus on lightweight but tough materials and precise engineering to offer better user experience.

Players focus on brand name, product innovation, and sponsorship of professional tournament fishing to gain stronger market presence. Increased popularity of e-commerce and direct-to-consumer business also drives market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Shimano | 20-25% |

| Daiwa | 15-20% |

| Abu Garcia | 10-14% |

| Penn Fishing | 8-12% |

| Okuma Fishing | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Shimano | Leads in high-performance spinning and bait casting reels. Focuses on lightweight carbon-fiber technology and digital control braking systems. Expands e-commerce sales and global reach. |

| Daiwa | Specializes in precision-engineered reels for both freshwater and saltwater fishing. Innovates with Marshalled technology for enhanced durability. Strengthens distribution partnerships. |

| Abu Garcia | Known for its premium bait casting reels and affordability. Expands its product line with digitally controlled braking systems and ergonomic designs. |

| Penn Fishing | Dominates the saltwater fishing reel segment. Innovates with corrosion-resistant and high-torque reel systems for deep-sea fishing. Expands online sales channels. |

| Okuma Fishing | Focuses on affordability and performance. Enhances its reel technology with smooth drag systems and lightweight construction. Targets growing demand for inshore and offshore fishing reels. |

Strategic Outlook of Key Companies

Shimano (20-25%)

Shimano dominates the fishing reels industry with high-end and long-lasting designs. It invests in innovative braking systems and wear-resistant materials. Growth in emerging markets and online sales enhances its international market share.

Daiwa (15 to 20%)

Daiwa invests in technological innovation, especially with its Magsealed bearings and light-weight reel designs. The company strengthens its distribution network, both targeting professional anglers and recreational anglers.

Abu Garcia (10-14%)

Abu Garcia pushes deeper into the baitcasting reel category with emphasis on precision engineering and streamlined construction. Abu Garcia spends on advancing digital brake control technology and intensifying relationships with pro anglers.

Penn Fishing (8-12%)

Penn Fishing has a hold on the saltwater fishing reel category, building on the image of the brand as strong and long-lasting. Penn Fishing spends on corrosion-resistance technologies and building product lines for deep-sea anglers

Okuma Fishing (6-10%)

Okuma gains traction in the budget-friendly and mid-range fishing roll request. The brand focuses on invention in drag systems and feather light construction to feed to both casual and professional grillers.

Other Key Players (30-40% Combined)

Several smaller and emerging brands contribute to market diversity, emphasizing specialized fishing reels, affordability, and sustainability. Notable brands include:

The Fishing Reels industry is projected to witness a CAGR of 5.6% between 2025 and 2035.

The Fishing Reels industry stood at USD 6.3 billion in 2024.

The Fishing Reels industry is anticipated to reach USD 11.9 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 6.2% in the assessment period.

The key players operating in the Fishing Reels industry include Shimano Inc., Daiwa Corporation, Pure Fishing Inc., Okuma Fishing Tackle Co. Ltd., Abu Garcia, and Penn Fishing.

Spinning Reels, Bait casting Reels, Spin cast Reels, Fly Reels, Trolling Reels, and Others.

Aluminium, Graphite, Stainless Steel, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Sporting Goods Stores, and Others.

Recreational Fishing, Professional Fishing, and Commercial Fishing.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Tiffin Market by Product, Material, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.