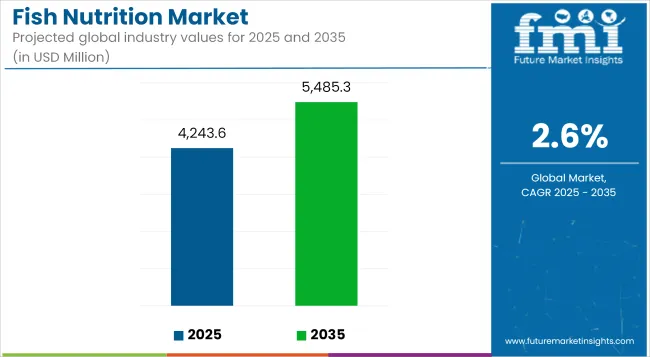

As of 2025, the global fish nutrition industry is valued at approximately USD 4,243.6 million and is likely to register a CAGR of 2.6% to surpass USD 5,485.3 million by the end of 2035. The market is anchored in the rising need for optimal aquatic health and performance, particularly within commercial aquaculture systems.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 4,243.6 Million |

| Market Value (2035F) | USD 5,485.3 Million |

| CAGR (2025 to 2035) | 2.6% |

Specialized nutrition solutions for improving feed conversion ratios, disease resistance, and reproductive efficiency are gaining heightened relevance among fish farmers. The industry has also witnessed a sustained transition from traditional feed components to scientifically-formulated additives that meet evolving regulatory and sustainability benchmarks.

Current market dynamics reflect an increased preference for protein-dense and micronutrient-fortified ingredients tailored for diverse fish species such as salmon, tilapia, and catfish. Factors such as intensified aquaculture output, higher susceptibility to aquatic diseases, and the need for faster growth cycles have shaped nutritional innovation.

However, growth has been partially restrained by fluctuating raw material costs, limitations in digestibility of plant-based proteins, and challenges in balancing feed efficiency with environmental impact. The market is also shaped by ongoing R&D efforts targeting improved palatability and nutrient absorption. Industry participants are strategically focused on region-specific formulation adjustments, investment in feed enzymes, and transition toward sustainable marine and microbial ingredients.

By 2035, the fish nutrition market is expected to consolidate its presence across industrial aquaculture hubs, with a focus on Asia-Pacific and Latin America. Functional additives such as prebiotics, enzymes, and immunostimulants are projected to gain traction, especially in disease-prone regions. Precision nutrition strategies tailored by lifecycle stage and species type are likely to redefine feed customization frameworks.

Digital feed optimization technologies and traceability tools may further enhance the performance monitoring of nutrition regimens. The next decade will likely see partnerships between biotechnology firms and feed formulators aimed at scalable, low-footprint nutritional innovations capable of supporting both growth and sustainability targets in aquaculture.

Customized formulations for lifecycle-specific fish diets account for nearly 14.6% of the total market share in 2025. These offerings are increasingly deployed in hatcheries and grow-out farms to enhance early-stage survival rates and late-stage feed conversion ratios. Unlike standard formulations, tailored nutrition optimizes the amino acid profile, energy density, and micronutrient composition aligned with each species' physiological needs.

For example, larval feeds for seabass or salmon require a distinct ratio of DHA, nucleotides, and digestible peptides to support organogenesis and immunity. European Food Safety Authority (EFSA) guidance supports such targeted nutrient intervention to improve aquaculture output sustainably. Companies such as Sparos (Portugal) and Zeigler Bros. (USA) have made significant inroads with modular feed platforms designed to adapt across lifecycle phases and environmental conditions.

Adoption of these customized regimens is expanding in high-intensity aquaculture regions across East Asia and the Mediterranean, particularly among salmonids, seabream, and shrimp operations. However, cost constraints and complex logistics limit broader uptake in lower-income aquaculture economies.

Still, the rising prevalence of data-driven feed formulation software and portable feed blending units is helping close the accessibility gap. Lifecycle-tuned nutrition is projected to gain additional traction, especially in operations targeting high-value export species with stringent quality metrics.

Microbial and algal protein concentrates represent an emerging segment, capturing 6.8% of the fish nutrition market in 2025. These ingredients are fast becoming viable alternatives to fishmeal, driven by volatile marine raw material prices and sustainability mandates.

Feed producers are increasingly using biomass derived from Corynebacterium, Methylococcus, Schizochytrium, and Nannochloropsis due to their consistent amino acid profiles and superior digestibility. Notably, Calysta’s FeedKind® and Corbion’s AlgaPrime® DHA have gained adoption in salmon and trout diets. These proteins are aligned with EU Novel Food and USA GRAS guidelines, offering regulatory clarity and traceability.

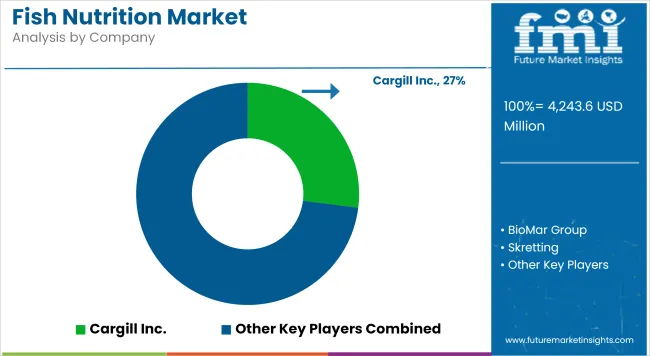

The segment has seen strong support from feed integrators such as BioMar and Skretting, who have incorporated microbial and algal inputs into commercial formulations. Their low environmental footprint and closed-loop production models align with sustainability certifications such as ASC and GlobalG.A.P. However, commercial scalability and cost parity with conventional ingredients remain bottlenecks.

As pilot-scale fermentation infrastructure expands in Europe and North America, downstream partnerships with aquafeed blenders are accelerating. The next wave of innovation will focus on hybrid blends, combining microbial biomass with enzyme-treated plant proteins for enhanced palatability and amino acid bioavailability in carnivorous fish diets.

High Cost of Nutritious Feeds and Sustainability Issues

In the fish nutrition market, a huge challenge is its high cost of key materials hydrolyzed fish meal or fish oil, and specialized additives like discs or vibrating drops. Moreover, raw material cost fluctuations and sourcing of fish meal as regards sustainability.

In addition, variations in feed quality, the lack of standardization in transitional markets and environmental problems stemming from aquafeed production waste all affect the market.

Alternative Protein Sources, AI-Based Feed Optimization, and Functional Feeds

In spite of the challenges, there is still real hope for growth in the fish nutrition market. These new protein sources, including insect meal, algae protein and single cell protein development, in effect address long-term sustainability concerns and reduce reliance on fish meal.

AI-driven precise fish nutrition, based on machine learning algorithms that match the feed ingredients to fish species, development stage and environmental factors, is increasing feed conversion rates and cutting wastes in production while extending this benefit directly to farmers. At the product level, rising demand for functional/health-enhancing feeds containing omega-3, probiotics, vitamins and other immunity agents is bringing fresh profits to nutritional feed providers.

The move into more complete fish feed formulas with added nutrients for faster growth more resistance to disease and better fillet quality is driving innovation in this area.

High demand for superior farmed fish, higher money invested in sustainable fish farming, and improved feed are major reasons why the fish food industry continues to expand in the USA The FDA and NOAA establish regulations on fish food to make fish grow and remain healthy.

There is a movement towards feeding fish protein-rich diets, omega-3, and probiotics. Also, relying on new options such as insect or one-cell organism fishmeal makes fish feed more environmentally friendly.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.8% |

The fish nutrition market in the UK is growing. This is due to more people using eco-friendly fish farming. There is also a higher need for enriched fish diets. The government is working to lessen the use of fishmeal from wild fish. The UK Food Standards Agency (FSA) and Marine Management Organisation (MMO) check the nutrition and safety of fish feed.

The rise of special fish food with helpful bacteria and other health boosters is helping the market grow. Also, using plant-based and low-carbon feed is aiding sustainability in the field.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.4% |

The EU fish nutrition market grows steadily because of strict rules on fish feed safety, more study on healthy fish diets, and higher need for quality farmed fish. EFSA and CFP promote better feed ingredients and nutrition.

Germany, France, and the Netherlands lead in using algae omega-3, bioactive supplements, and low-impact fish feed. Money goes into smart fish feed to resist disease and boost growth, shaping the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.6% |

The fish nutrition market in Japan is getting bigger. This is because people want more expensive seafood, and there is more money going into precise fish farming. There are also new ways to help fish stay healthy. The Japan Ministry of Agriculture, Forestry, and Fisheries supports studying how to make better fish food for types like tuna, yellowtail, and eel.

Japanese companies are making special feeds. These feeds have the right mix of amino acids and some probiotics to make fish healthier. They also use smart computers to feed fish in better ways. Moreover, new kinds of marine proteins and eco-friendly feeds are shaping how the market grows.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.7% |

The fish food market in South Korea is growing steadily. This is due to more fish farms, a rise in need for strong fish diets, and government plans for better fish food. The Ministry of Oceans and Fisheries and the National Institute of Fisheries Science make rules for fish food and push for studies on new protein sources.

Better omega-3 fish food and special diets for different fish types are boosting fish growth. Money is also going into proteins from microalgae and probiotics in fish food to improve fish health and nutrition.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.9% |

The fish nutrition market is growing because more people want better food for fish to make them healthy and grow faster. The need for good seafood is rising around the world. New ways to make fish food are helping this market, along with rules that support green and good-for-the-earth fish food.

Companies aim to make fish food rich in protein, omega-3s, and stuff that helps the fish stay healthy and fight off diseases. Big players in the market are fish food makers, biotech firms, and developers of new types of protein. They all work to bring new ideas like food from tiny algae, bugs, and probiotics to help fish do better.

The overall market size for the fish nutrition market was USD 4,243.6 Million in 2025.

The fish nutrition market is expected to reach USD 5,485.3 Million in 2035.

Growing aquaculture production, increasing focus on high-quality protein sources, and advancements in sustainable and fortified fish feed formulations will drive market growth.

China, India, Indonesia, Norway, and the USA are key contributors.

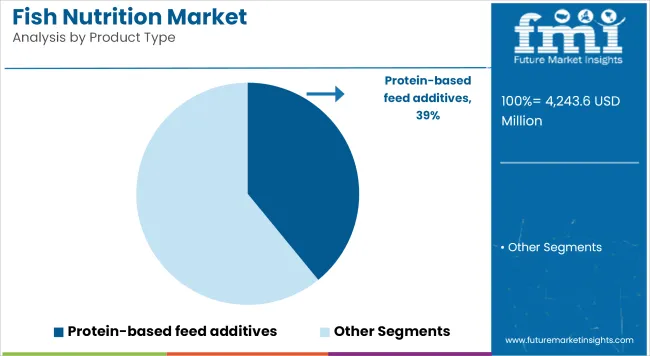

Protein-based fish nutrition products are expected to dominate due to their essential role in fish growth, immunity, and overall health.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Pond Circulating Water Pump Filter Market Size and Share Forecast Outlook 2025 to 2035

Fish Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Isolates Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Oil Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Concentrate Market Size and Share Forecast Outlook 2025 to 2035

Fish Feed Pellet Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Fermentation Market Size and Share Forecast Outlook 2025 to 2035

Fishing Reels Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Filleting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Feed Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Peptones Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA