The global fish meal industry is structured in three general segments: Multinational Producers (55%), Regional Players (30%), and Specialty/Niche Manufacturers (15%). Large multinational companies such as Omega Protein Corporation, Nutreco N.V., and Austevoll Seafood ASA dominate with vertically integrated supply chains, large-scale production plants, and extensive worldwide distribution networks.

These companies sell primarily aquaculture and animal feed markets with high outputs and product homogeneity. Local manufacturers like Pesquera Diamante S.A. and DHA (Danish Fishmeal and Oil) hold 30% market share, using domestic fish procurement, environmental friendliness, and strategic buying contracts to compete in their respective locations.

Most such organizations specialize in wild-caught and farmed sources of fishmeal. The other 15% is owned by specialty and niche fish meal manufacturers like Hawkins Watts Limited and Skretting, who produce high-value, protein-rich fish meal for premium pet food, nutraceuticals, and sustainable aquaculture products.

Explore FMI!

Book a free demo

| Market Structure | Top Multinational Producers |

|---|---|

| Industry Share (%) | 55% |

| Key Companies | Omega Protein Corporation, Nutreco N.V., Austevoll Seafood ASA, Cargill, Inc., Marubeni Corporation |

| Market Structure | Regional and Mid-Sized Players |

|---|---|

| Industry Share (%) | 30% |

| Key Companies | DHA (Danish Fishmeal and Oil), Pesquera Diamante S.A., Hawkins Watts Limited, Südzucker AG |

| Market Structure | Specialty & Niche Manufacturers |

|---|---|

| Industry Share (%) | 10% |

| Key Companies | Skretting, premium fish meal suppliers for nutraceuticals, pet food, and organic farming |

| Market Structure | Private Labels & Small-Scale Producers |

|---|---|

| Industry Share (%) | 5% |

| Key Companies | Independent fish meal suppliers, small fisheries focusing on local markets |

The industry is moderately consolidated with the multinational giants at the forefront but regional and niche players innovating in sustainability and high-value fish meal uses.

Fish Meal Powder (40%) is the highest value segment because of its protein-rich nature, easy digestibility, and wide usage in aquaculture and animal nutrition. Omega Protein Corporation and Nutreco N.V. lead the market in this segment with high-quality protein meal for fish and livestock feed.

Fish Meal Pellets (35%) are extensively utilized in aquaculture and poultry feed because of their stability, easy transportation, and controlled release of nutrients. Austevoll Seafood ASA and Cargill possess good production capacities for commercial fish meal pellets to serve large-scale fish farming operations.

Fish Oil (20%) finds major applications in nutraceuticals, aquaculture, and functional pet food formulations based on its omega-3 fatty acid content.

Aquaculture (50%) is the largest user of fish meal, spurred by the increasing global demand for farmed fish and seafood. Large firms like Nutreco and Skretting are creating high-performance fish meal blends to aid in sustainable aquaculture expansion.

Animal Feed (30%) is the key segment with fish meal serving as a protein-fortified ingredient to swine, poultry, and livestock feed. This market is ruled by Cargill and Omega Protein Corporation using specially designed fish meal to enhance animal growth and feed efficiency.

Pet Food (10%) is also becoming more of a specialty product as upscale pet nutrition labels use fish meal and fish oil for digestibility, coat quality, and protein delivery. Hawkins Watts Limited is among them, has expertise in functional pet food ingredients.

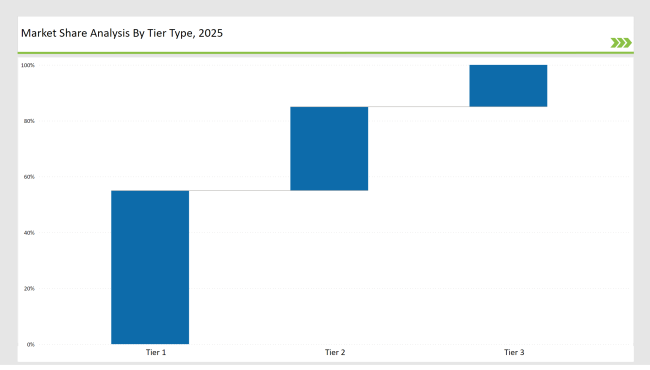

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | Omega Protein Corporation, Nutreco N.V., Austevoll Seafood ASA, Cargill, Inc., Marubeni Corporation |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | DHA (Danish Fishmeal and Oil), Pesquera Diamante S.A., Hawkins Watts Limited, Südzucker AG |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Example of Key Players | Skretting, premium fish meal suppliers for nutraceuticals, pet food, and organic fertilizers |

| Company Name | Key Focus or Initiative |

|---|---|

| Omega Protein Corporation | Expanded sustainable fishery certification programs , ensuring responsible wild fish harvesting and supply chain transparency. |

| Nutreco N.V. | Developed alternative protein-rich fish meal blends , integrating insect and algae-based proteins to reduce dependency on wild fish stocks. |

| Austevoll Seafood ASA | Increased fish meal production capacity , improving global supply for aquaculture and animal feed industries . |

| DHA (Danish Fishmeal and Oil) | Enhanced fish oil extraction methods , achieving higher DHA and EPA purity levels for nutraceutical applications . |

| Pesquera Diamante S.A. | Launched an upcycling initiative , repurposing seafood processing byproducts into high-protein fish meal. |

| Südzucker AG | Entered the organic fish meal-based fertilizer market , targeting sustainable and regenerative agriculture . |

| Cargill, Inc. | Developed high-performance fish meal formulations , improving feed efficiency and nutrient absorption in aquaculture. |

| Marubeni Corporation | Expanded fish meal trade networks in Asia-Pacific , strengthening supply chains in China, Vietnam, and Thailand . |

| Skretting | Introduced closed-loop fish meal production , utilizing farmed fish byproducts to support sustainable aquaculture . |

| Hawkins Watts Limited | Launched premium fish meal for high-protein pet nutrition , catering to functional pet food brands . |

Call for alternative and sustainable protein will gain pace as the industry shifts away from dependence on wild-caught fish. Leaders such as Skretting and Nutreco already lead the way with the incorporation of insect proteins, algae-sourced omega-3s, and proteins through fermentation in fish meal manufacturing. The trend will conserve global fish stocks while keeping feed production at high quality.

The growth of high-performance aquaculture feed will propel the increased innovation in fish meal formulae designed for nutritional optimization. Cargill and Marubeni Corporation are investing in precision nutrition models, applying AI and data-driven feed optimization to improve fish growth rates and feed efficiency. Future fish meal production will be formulated on tailored formulations for various aquaculture species.

Implementation of circular economy techniques will become the rule to produce fish meal. Organizations will turn by-products of seafood, trim, and bycatch into valuable fish meal and fish oil products. Pesquera Diamante S.A. has already gained success in the practice of sustainability in processes involving waste utilization, and others will follow suit.

Pet food and nutraceutical industries will be huge growth markets for fish meal and fish oil. As leading pet nutrition companies continue to emphasize high-protein and omega-3 values, Hawkins Watts Limited and other companies are investing in high-digestibility fish meal products for pet nutrition.

At the same time, DHA (Danish Fishmeal and Oil) is entering high-purity omega-3 supplements, keeping up with increasing consumer demands for functional food ingredients.

The growth of farmed seafood production is the biggest driver, as fish meal remains a critical protein source for improving fish growth, digestion, and feed efficiency.

Omega Protein Corporation, Nutreco, Austevoll Seafood ASA, Cargill, and Marubeni Corporation lead due to large-scale fish meal production, strong supply chains, and global distribution networks.

Companies are shifting toward certified sustainable fisheries (MSC, ASC) and alternative protein sources like insect-based and algae-derived proteins to reduce reliance on wild-caught fish stocks.

High-quality fish meal and fish oil are widely used in premium pet food, providing high protein digestibility, omega-3s for coat health, and functional benefits.

Companies like Nutreco and Skretting are investing in blended protein formulations, integrating insect meal, algae-based proteins, and plant-derived amino acids.

Dairy Protein Crisps Market Flavor, Packaging, Application and Distribution Channel Through 2025 to 2035

Bouillon Cube Market Analysis by Type and Distribution Channel Through 2035

Food Fortification Market Analysis by Type, Process and Application Through 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Dead Sea Mineral Market Analysis by Source, End-use and Distribution Channel Through 2025 to 2035

Benzyl Alcohol Market Analysis by Grade, End Use and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.