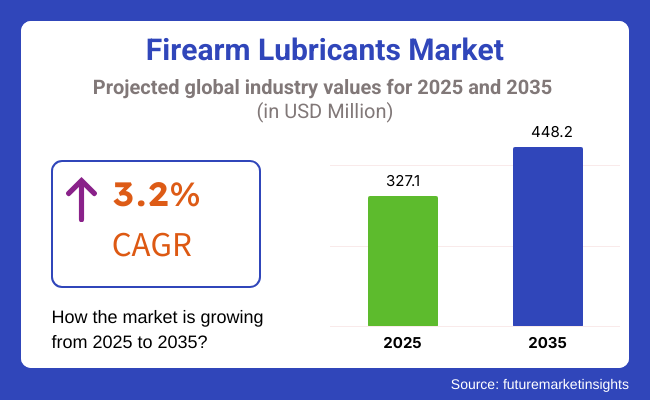

The global firearm lubricants market is projected to experience steady growth between 2025 and 2035, driven by rising demand for firearm maintenance, increasing military and law enforcement procurement, and advancements in high-performance lubrication technologies. The market is estimated to reach USD 327.1 million in 2025 and is expected to expand to USD 448.2 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.2% over the forecast period.

Today, firearm lubricants are an important component of ensuring proper weapon usage to minimize the wear and tear of the weapon and prevent corrosion in environments where contaminants may be present. Growing application of firearms in military, private protection, hunting, and sporting activities is anticipated to increase demand in the market. In addition, synthetic and bio-based lubricants have begun to revolutionize the market with longer-lasting, temperature-resistant, and environmentally friendly solutions

Moreover, the demand for superior quality firearm lubricants is increasing owing to the strict regulation of firearm maintenance and the rise in the number of police agencies across the globe. Increasing defense budgets across significant surging economies and positive civilian firearm ownership rates coupled with a growing cognizance regarding firearm maintenance are factors expected to propel continuous growth in this market.

Factors augmenting market growth include increasing military-grade lubricants production, firearm industry expansion, and growing emphasis on firearm longevity and operational efficiency. Furthermore, trends in the industry are also expected to be influenced by the development of nanotechnology-based lubricants, high-value synthetic blends, as well as non-toxic firearm maintenance products.

Manufacturers are also specially addressing the need for improving lubricant formulations to increase reliability, accuracy, and firearm longevity due to growing concerns around firearm safety and changing regulatory landscape around firearm ownership, and increased demand for lubricants designed to withstand harsh environmental conditions.

Explore FMI!

Book a free demo

North America dominates the firearm lubricants market, driven by high civilian firearm ownership, robust defense spending, and extensive use of firearms by law enforcement agencies. The largest market for firearm lubricants is in the United States, which accounts for a sizable base of gun owners, military forces, and law enforcement agencies.

Large manufacturers of firearms and a rich tradition of shooting sports in these countries create a demand for high-performance firearm cleaning and maintenance products. With the National Rifle Association (NRA) and other gun advocacy groups doing their part to spread awareness on gun maintenance, the need for premium-quality lubricants has become more important than ever before.

Also, the increasing investments in the military modernization programs and increasing participation in shooting sports are the primary reasons that are alarming for the growth of market for specialized, long-lasting firearm lubricants.

Military procurement programs, growing security concerns, and a well-established hunting community are all fuel the growth. Countries with strong defense budgets such as Germany, France, Italy, the UK already have expanding law enforcement divisions and these drives the adoption of advanced firearm maintenance products.

Moreover, strict rules regarding the maintenance of firearms and their operational effectiveness are driving firearms and military personnel to adopt high-quality biodegradable grease compatible with EU safety standards.

Due to the growing concern over terrorism, cross-border security issues and increasing participation in recreational shooting sports, the European market is expected to experience continued demand for firearm lubricants across military, law enforcement and civilian applications.

Asia-Pacific region is becoming an area of high potential for the growth of firearm lubricants market owing to rising military spending, border security threats, and increasing personal firearms ownership in a few countries.

It is being widely adopted by various countries to meet military and law enforcement firearm procurement to deter international trade to mutual inhibit, such as India, China, Japan, South Korea, etc., especially in terms of extreme environmental conditions advocate for advanced firearm lubrication to put forward strong demand. Moreover, an increase in private security companies, along with collaborations in defense also contribute to the growth of the market.

With urban crime and shooting sports growing in popularity, civilian firearm purchases are seeing a steady uptick in the likes of countries such as Thailand, the Philippines, and Australia, further driving the demand for firearm cleaning & maintenance products. In addition, growing demand for synthetic lubricants based on all-weather and heavy-duty fire arms use is projected to fuel the market growth.

The Middle East & Africa region is witnessing growing demand for firearm lubricants due to rising military activities, law enforcement expansion, and increasing firearm ownership for security purposes. A matter of national priority and defence modernisation, countries like Saudi Arabia, the UAE and Israel are allocating huge budgets for the procurement of advanced firearms and maintenance equipment.

Moreover, the growing law enforcement requisites in Africa, especially in Nigeria, South Africa and Kenya also influence the demand for durable and high-performance firearm lubricants capable of performing in high-temperature and arid environments. The growth of the firearm lubricants market is driven by the emergence of private security companies, increasing geopolitical tensions, and the formation of defense budgets in this region.

Challenges

Stringent Regulations on Firearm Usage and Maintenance

Civilian firearm possession is strictly regulated in many countries, which dampers demand for firearm lubricants. Civilian access, storage, and use of firearms are regulated in ways that indirectly affect the sales of all firearm maintenance products such as lubricants.

Also, the push toward green alternatives have resulted in tightening restrictions on petroleum-based lubricants due to toxicity and disposal hazards. Manufacturers must adhere to new applicable standards and invest in bio-based, biodegradable lubricant formulations, possibly increasing production costs.

It places a strong pressure on companies to create compliant, eco-friendly lubricants that are compatible with changing global firearm maintenance norms while profiting firearm performance at its peak.

Growing Competition from Alternative Lubrication Solutions

Market growth is being impacted by the growing availability of multi-purpose industrial lubricants, which boast the same performance as specialized firearm lubricants. In order to cut the costs, some users selection general-purpose oils, synthetic greases and lubricants for automotive applications instead of dedicated products for firearm maintenance.

However, there exists a continuing evolution in substrates and new technologies around lubricants like: dry film coatings, ceramic-based lubricants, and some graphene infused firearm coatings. To compete, manufacturers must provide best-in-class durability, lengthy protection and use-case-specific advantages over existing products.

Opportunities

Advancements in Synthetic and Nanotechnology-Based Lubricants

Silicon Polymer, Nanotechnology Premium Coatings and high-temperature gun care products are changing the market. Modern firearm lubricants are engineered to lower friction, minimize residue accumulation, and enhance the lifespan of a firearm. Nanotechnology based lubricants are self-repairing, so they will ensure your gun is protected in the most extreme of operating conditions.

These technologies are being adopted broadly in military, law enforcement, and high-performance shooting applications, creating new avenues for manufacturers to generate revenue. Finally, the market will witness increased R&D expenditures for advanced lubrication technology with global players investing in the development of faster and long lasting solutions in the coming years.

Expansion of the Civilian Firearm Market and Shooting Sports Industry

Increasing popularity of shooting sports and self-defense firearm ownership along with private security services is expected to boost demand for firearm maintenance products globally. Policy changes across numerous states are loosening gun ownership regulations for self defense, which are resulting in a wave of civilian gun sales.

Firearm lubricants market in North America, Europe and Asia-Pacific, there is a rising interest in shooting sports, including competitive shooting, hunting, and tactical training, which are becoming increasingly popular in North America, Europe, and Asia-Pacific, leading to the growing demand for firearm lubricants.

The market is expected to continue to grow, with manufacturers who focus on producing user-friendly, biodegradable, and high-performance lubrication products that are tailored to civilian and/or sporting and military end users.

Between 2020 and 2024, the firearm lubricant market saw steady growth, driven by increasing civilian firearm ownership, rising defense spending, and demand for high-performance lubricants in military and law enforcement applications. Manufacturers acquired synthetic, bio-based, and corrosion-resistant lubricants, contributing to extended firearm life and performance.

The growing popularity of competitive shooting sports, hunting and self-defense trends also drove demand for specialized gun oils, greases and cleaning solutions. However, challenges such as disruptions in the supply chain, stringent firearm regulation, and growing environmental concerns related to petroleum products acted as hurdles to the growth of the market.

Looking ahead to 2025 to 2035, the firearm lubricant market is set to evolve with growth expected due to demand driven by AI performance monitoring, bio-based lubricants, and self-lubricating firearm coatings. Trends toward non-toxic, bio-degradable-based gun oils and the development of newer nano-coating technologies will further influence market dynamics.

Smart firearm integration, military-grade extreme condition lubricants, and new demands for low-friction, high-temperature formulations will further re-architect the next evolution in firearm maintenance solutions.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Defense & Law Enforcement Firearm Maintenance | Growing uptake of synthetic lubricants and extreme-weather formulations for firearms used by military and law enforcement. |

| Environmental Conservation Concerns | Increasing need for low smell, biodegradable gun oils and less toxic firearms cleaner. |

| Clean Energy Generation Preferences & Sustainability | Manufacturers are adding long-service-interval, low-evaporation, corrosion-resistant lubricants. |

| Adoption of Advanced Diagnosis Technologies | Many of the firearm lubricants included anti-friction additives and nano particle based coatings for improved performance. |

| Rise in Civilian & Competitive Shooting Sports | Sport shooting and self-defense markets grew, which increased demand for long-lasting, quick-drying lubricants. |

| Technological Advancements in Lubrication Efficiency | Innovating ceramic-based lubricants, high-temperature greases and low-residue oils for long-life firearm operation. |

| Market Growth Drivers | Expansion driven by an increase in firearm ownership, military modernization programs and participation in shooting sports. |

| Market Shift | 2025 to 2035 |

|---|---|

| Defense & Law Enforcement Firearm Maintenance | Adoption of self-lubricant firearm coatings, AI-based lubricant application and smart sensor-based wear detection in the future. |

| Environmental Conservation Concerns | Bio-based, plant-derived lubricants and non-toxic, eco-friendly firearm maintenance products gaining widespread adoption. |

| Clean Energy Generation Preferences & Sustainability | Carbon neutral, synthetic, and hydrogen lubrication systems for high usage of firearm applications. |

| Adoption of Advanced Diagnosis Technologies | AI-powered lubricant diagnostics with real-time wear analysis on firearm components and block chain-enabled trail of maintenance history. |

| Rise in Civilian & Competitive Shooting Sports | Custom-formulated lubricants for competition-grade firearms, smart lubrication dispensers, and sensor-based cleaning alerts. |

| Technological Advancements in Lubrication Efficiency | Lubricants that last longer than a month (such as nano-coating). Integrated self-lubricating components for firearms. |

| Market Growth Drivers | Market expansion driven by AI-integrated firearm maintenance, ultra-durable nanotech lubricants, and next-generation military weaponry. |

The United States is estimated to account for a considerable share of the firearm lubricants market, owing to the high ownership of firearms among civilians in the country, increased procurement by law enforcement agencies, and military modernization programs. Another Veteran-focused solution aiming to ensure guns are combat ready when needed the USA has a mature firearms industry and a consistent demand for high-performance lubricants for maintenance, corrosion resistance, and improved weapon longevity.

More gun sales and shooting sports participation the past few years, gunsmiths and gun people are buying up synthetic gun oils that do not evaporate at higher temps and carbon not caking up. There may also be advances in bio-based and non-toxic firearm lubricants, as this technology is coming under scrutiny due to environmental regulations and safety issues.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.3% |

The growing need of law enforcement, military firearm maintenance programs, and sporting firearm usage in the United Kingdom firearm lubricants market is creating moderate growth opportunities. The civilian firearms market is regulated, but demand for lubricants exists in the military, police, and shooting sports sectors.

Attention to detail with precision shooting and competitive sports has led to an increased demand for low-friction and residue-free lubricants that enhance firearm performance. In a separate effort to reduce lead and carbon-based residue emissions, the UK government is promoting the adoption of cleaner, low-odor firearm lubricants.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.0% |

The European Union firearm lubricants market is growing at a steady rate, because of military modernization programs law enforcement procurement and growing search for hunting and sporting firearms. Military-grade weapons and training drills require defense industry arms such as Germany, France, and Italy, which have a powerful defense industry.

The trend towards low-VOC, biodegradable firearm lubricants is growing, largely due to tightening EU-wide environmental regulations. The creation and expansion of private security firms and increased civilian firearms ownership in Eastern Europe are also increasing the demand for longer-lasting and temperature-resistant lubricants.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.2% |

Japan's market for firearm lubricants is comparatively small but growing, primarily due to law enforcement requirements, military applications, and demand for high-tech firearm maintenance solutions. Civilian ownership of firearms, however, is tightly controlled, so demand comes mainly from Japan’s Self-Defense Forces (JSDF), law enforcement agencies, and firearm collectors.

Japan’s emphasis on technological precision and longevity of firearms makes nano-lubricants and self-cleaning firearm coatings in higher demand. And the country’s tough environmental laws are forcing innovation in zero-emission and solvent-free gun lubricants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.9% |

Major factors driving the growth of the South Korea firearm lubricants market include expansion in the defense sector, increased investments in firearm R&D and rising exports of firearms and ammunition. South Korea, home to one of the most advanced military forces in Asia, is in need of state-of-the art lubricants for military firearms, artillery and training weapons.

Korean defense organizations are adopting low-friction coatings and heat-resistant oils used in advanced polymer-based lubricants into firearm maintenance practices. The government will also invest in environmentally compatible military-grade lubricants to meet international emission and toxic chemical standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

Liquid firearm lubricants are the most commonly used due to their versatility, ease of application, and their ability to penetrate difficult or small parts of a firearm. These extremely lubricants eliminate friction, prevent carbon build up and improve overall performance of your firearm which makes them the first choice for military, law enforcement and the recreational firearm user.

Companies create liquid lubricants for application to every component of their guns, including barrels, bolts, slides and trigger systems. Liquid formulations spread much better than grease and dry lubricants to provide distributed coating on the surface of the metals and helping to repel moisture and contaminants.

From military-grade firearms to competition pistols, the demand for performance-driven, long-lasting lubrication has increased innovation in synthetic and biodegradable liquid lubricants, providing superior resistance to heat and corrosion.

Grease-based firearm lubricants are becoming more common, especially among the heavy, automatic, high-caliber firearms that run at extreme heat, pressure, and firing cycles and need serious lubrication. These lubricants offer thicker, longer-lasting protection, reducing wear and tear on bolt carriers, slides and recoil mechanisms on machine guns, AR-style rifles and high-round-count pistols.

While liquid lubricants flow away from contamination, the polymer elements in firearm grease are able to adhere in extreme environments, making it great for long shooting sessions and guns subject to the elements.

High temperature stability is of course why most law enforcement agencies and military personnel prefer grease-based lubricants for semi-automatic and fully automatic firearms, as these are the weapons for which heat dissipation and long-lasting lubrication stability are essential for consistent performance. Grease lubricants are particularly effective in collector-grade and antique firearms too, lubricating all the metal-on-metal components and providing protection against corrosion development.

Barrel lubricants account for the largest application segment in the firearm lubricant market, as barrels are the most critical and high wear component of any firearm. From military professionals to sports shooters and those who take to the field in search of game, proper barrel lubrication allows for smooth bullet passage, less fouling, and a longer barrel life, all critical aspects of firearm maintenance.

Newer barrel oils contain anti-fouling and anti-corrosive agents that stop powder residue, lead, and moisture from building up and chlorinating the bore and corrosion that can destroy your barrel. Growing trend towards the use of non-toxic, eco-friendly lubricants is also propelling the demand, as weapon owners prefer low-odor, biodegradable options that align with environmental and safety standards.

Rust inhibitors have witnessed robust growth in the market, particularly for firearm collectors, law enforcement, and military personnel, which are looking for long-term protection against humid, salt-influenced, and environmentally corrosive conditions. They create a protective film on metal surfaces to prevent oxidation and ensure that firearms are still serviceable after extended periods of storage.

They have superior water displacement properties than general-purpose lubricants, and these qualities make them well-suited for firearms stored in humid environments, marine environments, or field conditions. Such synthetic and polymer-based rust inhibitors, which offer long-lasting protection and will not affect the functionality or accuracy of the arms portions are working as a catalyst in the growth of this segment.

Increasing demand for firearm lubricant products from military, law enforcement, civilian firearm owners, and sporting applications are some of the factor driving the growth of the global firearm lubricant market. As the name, Firearm lubricants serve an important function of minimizing friction, preventing corrosion, consistent operating of the gun under varying conditions, be it extremely hot or cold temperatures, high humidity and/or dry dusty environments.

Growing gun ownership, upward military and defence budgets are propelling the growth, along with the improvement in synthetic lubricants that help parsing of the weapon. As an industry leader, manufacturers specialize in bio-based, high-temperature-resistant and long-lasting lubricants to serve military, law enforcement, and commercial firearm users around the globe.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Clenzoil Unlimited | 9-11% |

| Lucas Oil Products Inc. | 8-10% |

| Break-Free (Safariland Group) | 7-9% |

| Ballistol GmbH | 5-7% |

| FrogLube | 4-6% |

| Other Companies (combined) | 57-67% |

| Company Name | Key Offerings/Activities |

|---|---|

| Clenzoil Unlimited | Pioneers of the firearm cleaning and lubrication space, providing all-in-one CLP (cleaner, lubricant and protectant) solutions. |

| Lucas Oil Products Inc. | Specializes in high-performance synthetic firearm lubricants designed to offer extended wear protection and extreme temperature resistance. |

| Break-Free (Safariland Group) | Offers military-grade firearm lubricants with Teflon-based formulas for corrosion resistance and smooth operation. |

| Ballistol GmbH | Develops eco-friendly, biodegradable firearm lubricants, used for hunting, military, and law enforcement applications. |

| Frog Lube | Trains on bio-based, non-toxic lubricants, so firearms function properly without toxic chemical residues. |

Clenzoil Unlimited

Clenzoil is a leading manufacturer of gun cleaning and lubrication products, offering their award-winning CLP (cleaner, lubricant and protectant) formulas, which remove carbon build-up, prevent rust and elongate firearm life. Military, law enforcement, and sport shooters use the company’s lubricants to keep good action and proper build-up of residue. Clenzoil expands its eco-friendly & synthetic lubricant product lines to meet growing consumer demand for multi-purpose firearm maintenance products.

Lucas Oil Products Inc.

Lucas Oil is widely regarded for its extreme temperature and high rate of fire synthetic-based firearms oils and grease products. The company’s Gun Oil and Extreme Duty Gun Grease are well-known within law enforcement, military and sport shooting markets for keeping firearms operating smoothly in severe conditions. Lucas Oil, which specializes in advanced polymer and synthetic oil formulations, is at the forefront of making lubricants not only more efficient in their task, but also offering a measure of protection from wear and tear.

Break-Free (Safariland Group)

Break-Free is a well-known name for military and tactical firearms maintenance, and Break-Free CLP, a PTFE (Teflon)-based lubricant, allows for long-term corrosion protection with low friction. The company’s Break-Free CLP and LP lubricants see heavy use in defense, law enforcement, and competitive shooting, delivering low and high-temperature performance with great fouling qualities. Break-Free continues to expand its lubricant technology for high-performance firearms, automatic weapons, and extreme weather conditions.

Ballistol GmbH

Ballistol pioneered eco-friendly and biodegradable firearm lubricants with its multi-purpose oil that protects metal, wood and synthetic firearm components. Its non-toxic, alkaline-based formula prevents rust, neutralizes acids, and keeps firearms functioning in harsh environments. Ballistol is widely used by hunters, military personnel, and firearm enthusiasts, ensuring non-toxic and long-lasting lubrication.

FrogLube

FrogLube produces and specializes in bio-based, non-toxic firearm lubricants that make all-natural CLP solutions to cut carbon fouling and make the best of your firearm performance. The company’s lubricants are popular with tactical professionals, hunters, and sport shooters, providing firearm maintenance that is safe and environmentally friendly. They take their bio-based gun products one step further by helping gun owners meet the demand for advanced anti-friction, chemical-free gun care products with their froglube product line.

The global firearm lubricant market is projected to reach USD 327.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 3.2% over the forecast period.

By 2035, the firearm lubricant market is expected to reach USD 448.2 million.

The Military & Law Enforcement segment is expected to dominate due to the increasing demand for high-performance lubricants that ensure firearm reliability, reduce wear and tear, and enhance durability under extreme operational conditions.

Key players in the firearm lubricant market include Break-Free (Safariland), Lucas Oil Products, Inc., Ballistol USA, Mil-Comm Products Company, and Clenzoil.

Mineral Oil-Based Lubricants, Synthetic Lubricants, Bio-Based Lubricants

Liquid Lubricants, Grease-Based Lubricants, Dry Lubricants (PTFE/Ceramic/Graphite-Based)

Barrel Lubricants, Bolt and Slide Lubricants, Trigger and Action Lubricants, Rust Inhibitors & Corrosion Protectants.

Military & Law Enforcement, Sporting & Hunting Firearms, Civilian & Self-Defense Firearms, Competition & Professional Shooting.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.