High demand for fine chemicals in pharmaceutical, agrochemical and specialty chemicals sectors are expected to grow at a healthy CAGR in the period of 2025 to 2035. Pharmaceuticals, crop protection products, and other high-performance materials come directly from these fine chemicals, characterized by high purity and specificity.

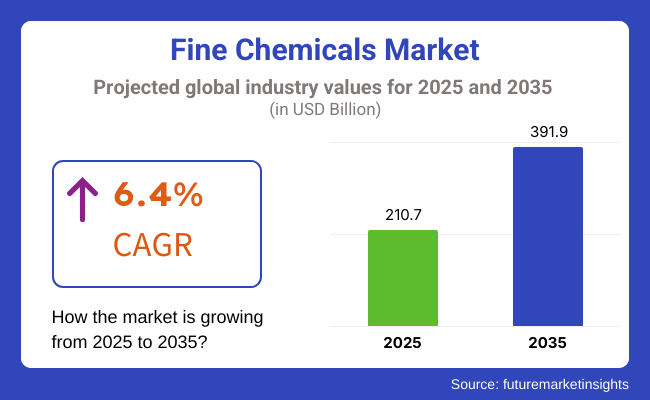

The Fine Chemicals Market size was valued at approx. USD 210.7 Billion in 2025 and is expected to reach USD 391.9 Billion by 2035, at a CAGR of 6.4%. The growth can be attributed to a rise in R&D investment, the demand for customized solutions in chemicals and applications in emerging fields such as biotechnology, electronics and renewable energy.

One more quadrant on the rise is the agrochemical industry with farmers always in the lookout for new and sustainable products to develop their crops with, and assisted by Government schemes driving agricultural yield.

Advancements in production processes have enabled the production of high purity of chemicals, leading to increased demand for both low and high amounts of such chemicals in a variety of sectors.

Explore FMI!

Book a free demo

Well-established pharmaceutical and biotechnology sectors continue to drive demand for fine chemicals in North America, which remains a prominent market for the segment. At the centre of this wave are the United States, where the big pharmaceutical companies and biotech firms depend on fine chemicals for new formulations of drugs, vaccines, and biologics.

The increasing focus on precision medicine and personalized therapies is driving the demand for tailor-made fine chemicals, while the investments in gene and cell therapy R&D are opening doors for advanced intermediates and specialty reagents. The chemical processing industry is also increasingly moving toward green chemistry, which is prompting a greater use of low-toxicity, high-efficiency fine chemicals.

North America is emerging significantly for the agrochemicals market, as there is an increase in the adoption of integrated pest management practices. As important ingredients of new-generation herbicides, insecticides, and fungicides, fine chemicals serve as a guarantee of targeted action with a minimum negative impact on the environment. The persistent government incentives for sustainable agriculture and relentless technological advancements point towards the continuity of strong market positioning for this region.

Fine chemicals market report during the last few decades, Europe has led the way in terms of regulatory compliance and sustainability. The fine chemicals market in Europe is dominated by Germany, France and Switzerland, which are home to many leading pharmaceutical companies and contract manufacturing organizations (CMOs).

Biotechnology investments are also a growing area of interest, where fine chemicals are critical for enzyme production, fermentation processes, and synthesis of sophisticated materials, in these nations.

Europe's agricultural landscape is gradually shifting towards biological and natural compounds as the demand for fine chemicals that serve as building blocks in bio-based crop protection ingredients is increasing. Fine chemical manufacturers are focusing on ‘greening up’ production processes and on sourcing renewable feedstock in the context of the European Union ambitions around the Green Deal and circular economy plans.

The Asia-Pacific region is expected to experience the highest growth in the fine chemicals market through the forecast period driven by rapid industrialization, urbanization, and increasing population of the Middle-Class segment. Increased Investments of pharmaceutical, agrochemical, specialty chemicals by China, India and Japan contribute to the market for high-purity intermediates and advanced chemical solutions.

According to an analysis of China fine chemical industry market demand and investment prospects, China is a major producer of fine chemicals, with impressive production facilities and export-oriented output. Its market dynamics are shifting from basic chemicals to value-added fine chemicals, particularly in pharmaceutical active pharmaceutical ingredients, dye and pigment intermediates, and high-performance coatings.

In Japan and South Korea, the emphasis on advanced materials and electronics is boosting the demand for high-purity fine chemicals in semiconductor manufacturing, display technologies, and renewable energy applications. The market for fine chemicals is also receiving a further boost from the region’s commitment toward green manufacturing processes and sustainability goals.

Challenge

Production Costs and Compliance with Regulations

The Fine Chemicals Market is hindered by the high costs of production, strict environmental regulations, and the complexity of fine chemical synthesis. Fine chemicals are produced via advanced production methods, high-purity raw materials, and controlled to high-quality standards, all of which lead to high costs.

Fine chemical production, especially in pharmaceuticals, agrochemicals, and specialty applications, are strictly regulated by respective authorization and regulatory agencies. To keep a step ahead of the game, companies need to invest in cutting-edge process optimization, green chemistry innovations and strategic regulatory compliance.

Opportunity

Rising Biomass Oil Production and Demand for High-Purity Specialty Chemicals

High-purity fine chemicals find numerous applications in pharmaceuticals, biotechnology, electronics, and agrochemicals, hence the increasing consumption across these end-user industries can be leveraged by the industry players as an opportunity to capitalize on growth. Fine chemicals are essential intermediates in drug synthesis, high-performance coatings, and electronic materials.

Key Driver of the Market: Increase in personalized medicine, investments in the semiconductor manufacturing, and increased application of bio-based chemicals. Among these are the companies using the most sophisticated synthesis techniques, the most sustainable production methods, and the most digital process automation and those companies will enjoy a significant advantage in this fast-changing fine chemicals landscape.

Due to the increasing need for high-performance materials in drugs, electronics, and specialty coatings, the Fine Chemicals Market saw constant expansion between 2020 and 2024. Improvements in chemical synthesis and precision manufacture allowed the manufacture of fine chemicals with greater purity and function.

But the sector struggled with supply chain issues, raw material shortages, and more regulatory scrutiny, hindering production schedules and costs. Manufacturers reacted by investing in digital monitoring systems, reinforcing supply chain resilience, and developing regional production capabilities that enable risk reduction.

From 2025 to 2035, the market is expected to see a rise in the adoption of artificial intelligence (AI) technologies and automation in chemical synthesis which will improve production efficiency and minimize waste. Also, innovation will be done with sustainable chemistry initiatives, such as bio-based fine chemicals and green catalytic processes.

Growth of high-tech industries such as semiconductors and high-level pharmaceutical products will heighten demand for ultra-pure fine chemicals. Digital Transformation Synthesis Sustainability Precision Companies will spur the advancement of the market and several companies will become the pillar of the global fine chemicals industry.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Tightened compliance requirements for pharmaceuticals and agrochemicals |

| Technological Advancements | Gain from enhanced chemical synthesis and purification |

| Industry Adoption | Higher demand in pharmaceuticals, agrochemicals and specialty materials |

| Supply Chain and Sourcing | Disruptions due to raw material shortages and global trade challenges |

| Market Competition | Presence of established specialty chemical firms and contract manufacturers |

| Market Growth Drivers | Rising pharmaceutical production, electronic advancements, and agrochemical demand |

| Sustainability and Green Chemistry | Growing investment in eco-friendly catalysts and waste reduction |

| Digitalization in Chemical Manufacturing | Early-stage adoption of process automation and digital monitoring |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global (bio) chemical recycling systems favouring green chemistry and greener production. |

| Technological Advancements | AI-powered optimizations, automation in chemical production, and biosynthetic technologies. |

| Industry Adoption | Foray into semiconductors, next-gen coatings and high performance specialty chemicals |

| Supply Chain and Sourcing | Strengthened regional supply networks and strategic partnerships for raw material security. |

| Market Competition | Rise of biotech-driven chemical companies and high-precision material innovators. |

| Market Growth Drivers | Increased adoption of bio-based chemicals, AI-enhanced synthesis, and personalized medicine innovations. |

| Sustainability and Green Chemistry | Full-scale implementation of green synthesis, carbon-neutral processes, and circular economy principles. |

| Digitalization in Chemical Manufacturing | AI-integrated quality control, real-time process optimization, and predictive analytics for efficiency gains. |

The United States fine chemical market is expanding at an extremely rapid pace owing to pharmaceutical, biotech, and specialty material demand. The United States pharma industry with the industry leaders Pfizer, Merck, and Johnson & Johnson is one of the major consumers of fine chemical APIs and intermediates.

Once again, one of the most important market drivers is the agrochemical sector with rising demand for high-purity crop care chemicals in order to maximize farm yields. In addition, expansion in precision chemistry in aerospace and electronics sectors is pushing demand for high-performance fine chemicals.

Growing demand for high-quality fine chemicals with sustainability, massive government support to biopharmaceuticals research, and novel chemical synthesis technologies are expected to propel the growth of the USA fine chemicals market in a steady manner.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

United Kingdom fine chemicals sector is growing based on the strength of increased expenditure on pharmaceutical R&D, strong demand for specialty chemicals, and positive regulation towards green chemical production. UK biopharmaceutical industry, spearheaded by AstraZeneca and GlaxoSmithKline (GSK), is one of the largest users of fine chemicals in drug development and vaccine production.

Personal care and cosmetics are also on the rise with more demand for high-purity excipients, preservatives, and actives in green and organic cosmetic products. Moreover, the UK government's green chemistry and bioprocessing initiative is driving fine chemical innovation from bio-based sources.

With growing R&D spending and growing installation of eco-friendly chemical processes, the UK fine chemicals market is expected to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

The European Union fine chemicals market is evolving very aggressively due to tough regulatory pressures for chemical safety, booming demand in pharmaceuticals and agrochemicals sectors, and increasing investment in biotechnology. Germany, France, and the Netherlands are major industrial and pharmaceutical grade fine chemicals producers and consumers and specialty coatings.

Demand is being stimulated in the EU for green fine chemicals, green chemistry technology, and bio-based chemicals by the REACH regulations within the EU, Germany, which is the greatest chemical production center in Europe, is investing substantially in specialty chemicals for medicine, coatings, and advanced materials.

Additionally, the EU focus on sustainable agriculture is strong demand for precision agrochemicals and bio pesticides and, in turn, fueling increased market expansion. Due to robust policy support for innovation and nature compatibility, the EU fine chemicals market will experience steady expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.5% |

Japanese market for fine chemicals keeps expanding steadily and is propelled by keen demand in the electronics, pharmaceutical, and specialty polymer markets. Japan is a leader in high-precision chemistry, and fine chemicals are one of the leading drivers for semiconductor production, lithium-ion battery manufacturing, and pharmaceutical formulation.

The pharmaceutical industry is the biggest client, which uses fine chemicals as APIs, drug intermediates, and excipients. Japan's industry electronics industry, based on industry giants such as Sony, Panasonic, and Toshiba, also uses high-purity specialty chemicals in semiconductor manufacturing and display technology.

With continued investment in green chemistry and sustainable material innovation, the Japanese fine chemical market will keep on growing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

South Korea's fine chemicals industry is booming because of rising demand for semiconductors manufacturing, biotech, and high-performance material manufacturing. South Korea has behemoth pharma players and semiconductors manufacturers such as Samsung and SK Hynix that need to manufacture drugs and chips using fine chemicals.

The biotechnology industry is also developing extremely rapidly, with more and more investment in the production of biopharmaceuticals, vaccine development, and gene therapy, all of which are dependent on high-purity fine chemicals. High-performance coatings, adhesives, and industrial specialty chemicals are also needed.

Thanks to government patronage to high-technology sectors and research in green chemicals, the South Korean fine chemicals sector is on the path to stable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.4% |

There are two strong subdivisions within the fine chemical sector, active pharmaceutical ingredients (APIs) and new products. As pharmaceutical and biotechnological sectors rely more and more on chemicals of the highest purity to ensure drug efficacy, formulary stability and to improve performance, those four countries mentioned above will have a tremendous chance to play in global situations because they are expert at precise drug formulation, drug delivery mechanisms and raising bioavailability. They are priceless in pharmaceutical, nutraceutical and biotechnology sectors.

Active Pharmaceutical Ingredients are one of the most widely used fine chemicals and their overall potency is very strong and therefore it has specific pharmacological activity as well as outstanding pharmaceutical performance. Compared to bulk chemicals, which have not been subject to highly stringent quality testing for purity, stability, pharma use regulation compliance.

With the rise in CPIs being applied to the treatment of chronic diseases, including things like cardio-cerebrovascular disease as well as diabetes and cancer, pharmaceutical firms 'in drug development and custom-made medicine strategies are considering side effects of greater endpoint-potency, specialty products.

Studies indicate that HPAPIs can make drugs more potent, reduce the amount of drug needed per dose yielding better patient results with minimal side effects than ever before.

The expansion of APIs in biologics and biosimilar pharmaceutical production such as complex monoclonal antibodies, cell therapies, and gene-editing medicines has led to market demand to accommodate the growing uptake in forthcoming biopharmaceutical therapies.

Adoption speeds up with the combination of synthetic and semi-synthetic APIs (with novel synthesis routes), continuous manufacturing, and drug formulation using AI (with a promise of better process efficiency, lower costs, and sustainability).

Realisation of niche APIs for orphan drugs and rare disease therapy with precision targeting in formulations and high affinity binding peptide molecules has driven maximum market growth, with escalating adoption in niche therapeutic areas.

The positive growth of the market has been propelled by the adoption of green chemistry (API synthesis) practices involving green solvent systems multiple reaction and low waste generation, increased observance of environmental laws and corporate sustainability targets.

APIs have benefits in drug effectiveness, accurate formulation, and therapeutic action, but they are challenged by the complex synthesis process, strict regulatory approval, and expensive production. However, imminent advancements in techniques for AI-assisted drug discovery, next-generation bioprocessing and continuous manufacturing, are improving efficiency, affordability, and scalability, promising an ever-growing market for API-based fine chemicals.

Excipients have gained a strong foothold in the market, particularly in drug formulation, controlled release products (CRPs), and bioavailability enhancement, as pharmaceutical companies increasingly use excipients to boost drug stability, ensure consistent release of the drug, and improve patient compliance. Unlike APIs, excipients are substances that serve as carriers, binders, preservatives, or stabilizers to enable the active drug to reach optimal performance levels and higher manufacturing efficiency.

The strong demand for multifunctional excipients in oral solid dosage forms, such as sustained-release coatings, fast-dissolving binders, and taste-masking agents, has been one of the major drivers encouraging the utilization of high-purity excipients by drug companies to improve patient experience and adherence. New excipients have been demonstrated to accelerate drug dissolution rates and consequently provide a more rapid therapeutic onset and improved bioavailability.

The upsurge of bio-based excipients has included natural polymers, cellulose sourced from plants, and biodegradable stabilizers, fuelling market demand and ensuring that the adoption of these products is going to be high in sustainable drug formulations that are clean-label.

The increased adoption of excipients in the biologics and vaccine products which includes protein stabilizers, cryoprotectants as well as the lipid carriers has also propelled the growth of the market maintaining better shelf stability, enhanced efficacy and enhanced immune response.

Nano-formulated excipients, including liposomal drug carriers, polymer-based nanoparticles and self-emulsifying excipient systems, are being introduced and are expected to drive the market and allow deeper penetration of advanced drug delivery technologies and personalized medicines.

This factors such as the use of excipients such as flavour enhancers, disintegrants, and hypoallergenic binders in drug formulations, especially for geriatric and pediatric populations, are and will continue to spur the growth of this market by promising enhanced patient compliance and improved treatment outcomes.

While excipients have always been at the forefront in terms of stability in drug formulation, controlled-release delivery, and patient-friendly formulation, they find themselves up against a wall of regulatory challenges, inconsistency in the quality of their supply chains, and some API incompatibility issues.

However, emerging efforts in the areas like AI-assisted formulation design optimization, biocompatible excipients synthesis and intelligent dosage delivery excipients are improving efficacy, scalability and regulatory acceptability to provide the market growth opportunities for excipient-based fine chemicals.

Pharmaceuticals & nutraceutical and agriculture industry segments are among the leading market drivers for this, with producers demonstrating an increasing reliance on fine chemicals for precise drug formulation, improving efficacy of crop protection agents, and sustaining product viability over long use periods.

Pharmaceuticals & nutraceuticals are now one of the largest consumers of fine chemicals as more drug companies and health supplement manufacturers are integrating high-purity ingredients into their products to improve therapeutic efficacy and functional health benefits. The fine chemicals pose better benefits and advantages over the traditional bulk chemicals by providing batch-to-batch consistency better bioavailability and formulation stability ensuring better performance of pharmaceutical and food products.

Growing adoption of intern and nutraceutical-based compositions such as botanical extracts, bioactive polypeptides, and functional food sustain of products is driving demand for fine chemicals in dietary supplements as consumers shift toward preventive health care formulations and wellness products.

The increasing usage of personalized drug products such as tailored API-excipient blends, patient-individualized dosage forms, and bioengineered therapeutic agents used specifically for the need of the patient, has shaped the evolution of precision medicine, subsequently driving the market to cater use in individualized healthcare applications.

However, its advantage in drug stability, formulation improvement, and therapeutic precision are challenged in fine chemicals of pharmaceuticals & nutraceuticals by stringent quality control needs, costs of regulatory comply, and shifting consumer behaviour toward clean-label products. The emerging technologies in AI-based pharma synthesis, bio-catalyst-based nutraceutical ingredient manufacturing & also newly developed formulation technologies to help improve in efficacy, economy & environmental sustainability by ensuring increase in market growth for pharmaceuticals & nutraceuticals.

The agrochemical industry has enjoyed growing acceptance on the agricultural market, particularly for herbicides, pesticides and biocides, since agribusinesses and farmers increasingly incorporate fine chemicals for improved product yield, pest management and sustainable long-term soil fertility. Fine chemicals diverge from conventional agricultural inputs as they offer precision target action, minimum environmental impact, and bioavailability optimization, ensuring enhanced efficacy in the new-age agriculture.

Growth of bio-based agrochemicals, including plant-based insecticides, organic fungicides and biodegradable herbicide formulation, has facilitated the acceptance for fine chemicals in green agriculture as stringent guidelines on synthetic agrochemical usage are implemented by regulatory bodies.

Emerging needs for fine chemicals used in precision agriculture, including slow-release fertilizer, microencapsulated pesticides, and controlled-nutrition additives have increased market demand, resulting in a stronger adoption of intelligent farming based on data-based crop management.

Heightened demand for bio-based agrochemicals including plant-based insecticides, organic fungicides, and bio-based herbicide formulation has influenced increasing use of fine chemicals in green agriculture as regulatory bodies enforce rigid mandates on synthetic agrochemical use.

Increase in the demand for precision agriculture with include slow-release fertilizers, microencapsulated pesticides, and controlled-nutrient additives as fine chemicals also increases market demand and also enables higher adoption for intelligent farming and data-based crop management.

Growing demand of high purity specialty chemical among various industries such as medicines, agrochemicals, biotechnology and performing electronics is expected to spur growth of fine chemicals market. To improve efficiency, regulatory compliance, and environmental sustainability, companies are concentrating on custom synthesis, high-purity chemical formulations, and sustainable production processes.

Global chemical manufacturers and specialized fine chemical producers are part of the market for technological advancements in precision synthesis, AI-assisted chemical process optimization, and green chemistry solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lonza Group Ltd. | 12-17% |

| BASF SE | 10-14% |

| Royal DSM | 9-13% |

| Boehringer Ingelheim GmbH | 7-11% |

| Evonik Industries AG | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lonza Group Ltd. | Develops high-purity fine chemicals, APIs, and biopharmaceutical intermediates with AI-assisted synthesis optimization. |

| BASF SE | Specializes in fine chemicals for pharmaceuticals, agrochemicals, and specialty coatings with sustainable production processes. |

| Royal DSM | Manufactures nutritional fine chemicals, bio-based polymers, and high-performance ingredients for industrial applications. |

| Boehringer Ingelheim GmbH | Provides custom fine chemical synthesis, APIs, and contract development services for pharmaceuticals. |

| Evonik Industries AG | Offers high-performance specialty chemicals, biocatalysts, and precision synthesis for high-value applications. |

Key Company Insights

Lonza Group Ltd. (12-17%)

Lonza is the leading fine chemicals company, providing custom APIs, high-purity fine chemicals, and AI-powered synthesis optimization for pharmaceutical and biotech applications

BASF SE (10-14%)

BASF manufactures fine chemicals for industrial, agricultural, and pharmaceutical processes, emphasizing low-carbon synthesis and sustainable processing technologies.

Royal DSM (9-13%)

Ideal for the development of bio-based fine chemicals, high-performance specialty ingredients and more from sustainably-sourced chemicals.

Boehringer Ingelheim GmbH (7-11%)

Boehringer offers contract synthesis, pharmaceutical intermediates, and high-purity fine chemicals used in drug manufacturing and research.

Evonik Industries AG (5-9%)

Evonik is a manufacturer of fine chemical solutions for multiple industrial applications, integrating both biocatalysts and AI-driven optimization of chemical processes.

Other Key Players (40-50% Combined)

A number of specialty chemical manufacturers are engaged in next-generation fine chemical innovations, AI-enabled synthesis, and bio-based chemical production. These includes:

The overall market size for Fine Chemicals Market was USD 210.7 Billion in 2025.

The Fine Chemicals Market expected to reach USD 391.9 Billion in 2035.

The demand for the Fine Chemicals Market will be driven by the increasing demand for specialty chemicals in pharmaceuticals, agrochemicals, and food industries. Growth in biotechnology, personalized medicine, and the need for sustainable, high-performance chemicals will further propel market expansion.

The top 5 countries which drives the development of Fine Chemicals Market are USA, UK, Europe Union, Japan and South Korea.

Active Pharmaceutical Ingredients (APIs) and Excipients Drive Market Growth to command significant share over the assessment period.

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

LATAM Road Marking Paint & Coating Market Analysis by Material Type, Marking Type, Sales Channel, and Region Forecast Through 2035

Refinery and Petrochemical Filtration Market Analysis by Filter Type, Application, End-User and Region 2025 to 2035

Plastic Market Growth Analysis by Product, Application, End Use, and Region 2025 to 2035

Industrial Oxygen Market Report - Growth, Demand & Forecast 2025 to 2035

Medical Grade Coatings Market Trends – Demand, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.