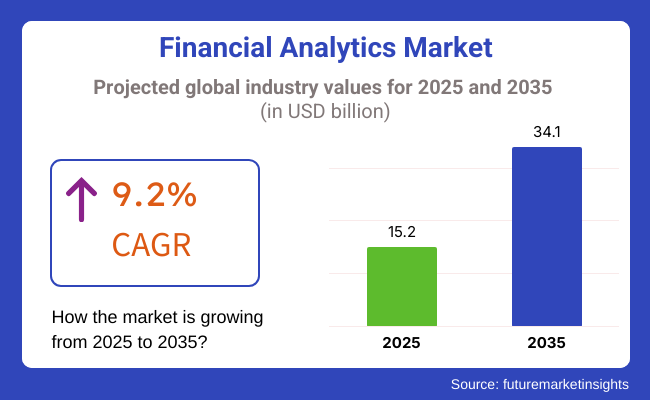

The financial analytics market is projected to reach USD 15.2 billion in 2025 and expand to USD 34.1 billion by 2035, reflecting a compound annual growth rate (CAGR) of 9.2% over the forecast period. This growth is driven by rising demand for AI-powered analytics, cloud-based financial modeling, and integrated big data solutions across industries.

Key drivers include the increasing need for real-time financial insights, the demand for efficient risk management and compliance tools, and the growing complexity of financial transactions requiring advanced analytics. Organizations are adopting analytics to optimize performance, ensure regulatory compliance, and enhance decision-making through predictive modeling.

Restraints involve high implementation costs, data privacy concerns, and the need for skilled professionals to manage complex analytics tools. Integration challenges with legacy systems and regulatory barriers in certain regions may also hinder adoption, especially among small and medium enterprises.

Opportunities are emerging from the growing adoption of blockchain for secure, transparent financial transactions, rising demand for fraud detection solutions, and the expansion of analytics applications in emerging industries. Cloud-based solutions and AI advancements are enhancing scalability and accessibility.

Trends include the shift toward AI-driven forecasting, real-time transaction monitoring, and automation in financial reporting. The use of blockchain, the growth of embedded analytics, and the focus on customizable dashboards for financial KPIs are transforming financial decision-making and enabling proactive risk mitigation strategies.

Explore FMI!

Book a free demo

Between 2020 and 2024, the industry expanded as businesses, banks, and investment firms adopted data-driven decision-making tools to enhance risk assessment, optimize investment strategies, and improve financial forecasting. Financial institutions implemented AI-driven platforms for fraud detection, compliance management, and process automation.

Regulatory bodies such as the SEC and ECB introduced guidelines to enhance data security and transparency, driving the adoption of predictive analytics, real-time financial modeling, and AI-powered risk management systems. Technological advancements in AI, machine learning, and big data enabled faster, more accurate financial decisions, while cloud-based platforms enhanced scalability and collaboration.

AI-driven sentiment analysis helped investors predict trends and optimize portfolios. However, challenges such as data privacy, cybersecurity risks, and AI integration complexities persisted. Companies addressed these issues with blockchain-based transaction tracking, encrypted financial reporting, and AI-powered fraud detection, alongside investments in automated financial planning and DeFi platforms.

Between 2025 and 2035, there will be evolution with quantum-enhanced risk modeling, decentralized AI ecosystems, and real-time predictive analytics. Quantum computing will revolutionize financial risk analysis by processing massive datasets at unprecedented speeds, while AI-powered financial advisors will automate trading, capital allocation, and personalized investment strategies. Blockchain-based smart contracts and DeFi platforms will enable secure, transparent, and cost-effective real-time financial transactions.

AI-driven financial simulations will help businesses stress-test economic scenarios and optimize strategies. Edge computing and 6G connectivity will enable instant financial data analysis, improving decision-making efficiency. Automated compliance monitoring will ensure regulatory adherence, reduce costs, and enhance transparency. Sustainability and cost efficiency will become key priorities, with AI-driven optimization tools enhancing economic resilience and competitiveness in a rapidly evolving financial landscape.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Authorities enforced financial transparency, anti-money laundering (AML) regulations, and data security policies. | AI-driven compliance monitoring, blockchain-secured financial reporting, and quantum-encrypted financial transactions will shape governance. |

| AI-powered risk modeling, real-time analytics, and cloud-based platforms improved financial decision-making. | Quantum-enhanced risk assessment, AI-driven decentralized finance ecosystems, and real-time predictive analytics will redefine financial markets. |

| Banks, investment firms, and enterprises adopted AI-driven analytics for financial forecasting and fraud detection. | AI-powered financial advisory, decentralized lending platforms, and smart contract-based asset management will expand financial analytics applications. |

| Organizations implemented cloud-based financial tools, predictive analytics, and AI-driven fraud prevention systems. | AI-powered financial simulations, blockchain-secured decentralized finance platforms, and 6G-connected financial ecosystems will drive adoption. |

| Businesses optimized resource allocation, automated financial reporting, and improved operational efficiency. | AI-driven financial planning tools, eco-friendly fintech solutions, and decentralized financial automation will enhance sustainability. |

| AI-driven sentiment analysis, trend forecasting, and anomaly detection improved financial strategies. | Quantum-powered financial modeling, AI-driven economic scenario simulations, and real-time financial anomaly detection will enhance decision-making. |

| Financial firms enhanced operational resilience, optimized data management, and automated compliance reporting. | AI-optimized financial operations, blockchain-secured financial transactions, and quantum-driven financial data processing will improve scalability. |

| AI-powered financial automation, cloud-based analytics, and digital transformation fueled growth. | Quantum computing in finance, AI-enhanced predictive analytics, and decentralized financial ecosystems will drive future expansion. |

The industry has been gaining quick acceptance across different sectors as firms look for data-backed insights to make decisions at the strategic level. The banking and financial services sectors are the largest beneficiaries, as financial analytics is used for fraud detection, risk assessment, and regulatory compliance purposes.

Retailers use analytics in pricing optimization, demand forecasting, and customer experience improvement. In the healthcare sector, financial analytics aid revenue cycle management and operational cost cutting. Producers are using analytics for cost reduction and the enhancement of the supply chain.

At the same time, IT and telecom companies apply it to ensure more accurate budget forecasting and financial planning. Real-time analytics, AI-based automation, and cloud-based financial solutions are the most important trends these days.

When it comes to picking an analytics solution, businesses value data accuracy, compatibility, and integration capacity. The recent trend of financial transparency, regulatory laws, and digital changes are the main drivers of the growth.

Contracts and Deals Analysis

| Company | Contract Value (USD million) |

|---|---|

| Clearwater Analytics and Enfusion | USD 1,500 |

| Euroclear and Microsoft | USD 1,800 |

In early 2025, there were significant strategic collaborations and acquisitions. Clearwater Analytics' USD 1.5 billion acquisition of Enfusion aims to expand its global footprint and venture into the hedge fund sector, reflecting a trend of consolidation in the financial analytics industry. Simultaneously, Euroclear's seven-year partnership with Microsoft focuses on leveraging advanced technologies such as cloud computing and AI to enhance the resilience and efficiency of financial industry infrastructures. These developments underscore the industry's commitment to innovation and the integration of cutting-edge technologies to meet evolving demands.

The industry is vulnerable to numerous risks, with data security and privacy being the paramount ones. Financial entities are susceptible to cyberattacks due to their exposure to massive amounts of sensitive data.

A single breach incident may result in financial losses, legal penalties, and tarnished business reputation, which could disincentivize the new adopters. The implementation of strictly regulated frameworks like GDPR, SOX, and PCI DSS not only derives operational costs but also imposes compliance burdens on dealerships.

Another issue is the integration complexity. Several companies are still working on legacy financial systems, and the migration process to data libraries is both time and cost-consuming. Smooth API connectivity, real-time data processing, and compliance with global financial regulations reduce the rate of adoption, specifically for small and medium enterprises with thin budgets.

Competition and pricing pressure jeopardize profitability. Dominated by companies like SAP, Oracle, and IBM, the marketplace has no available for the newcomers. Moreover, open-source analytics software and AI that work by itself have forced down prices, so vendors have to innovate fast to remain competitive. Times of recession with changes in market conditions could lead to enterprises downsizing their purchasing of advanced analytics technologies.

| Segment | Value Share (2025) |

|---|---|

| Database Management Systems (DBMS) | 19.7% |

The DBMS sector is anticipated to account for approximately 19.7% share of the market in 2025, owing to the emergence of cloud databases along with AI-based optimization and real-time analytics. Companies in industries ranging from finance and health care to e-commerce increasingly depend on database solutions that are scalable as well as secure and performant. Some of the dominant vendors (Oracle, AWS (DynamoDB, Aurora), Microsoft (SQL Server, Azure SQL)) evolve their already sophisticated multi-cloud, hybrid database architectures and continue to drive sophisticated learning-based query optimization to improve performance and secure access.

The query, reporting, and analysis segment has a strong presence in the market for financial analytics and has a share of about 20% of the overall market in 2025. The segment is essential for facilitating companies to derive actionable insights from immense amounts of financial data using intuitive query interfaces, real-time reporting dashboards, and sophisticated analytical tools.

Increasing requirements for flexible decision-making, regulatory obedience, and performance tracking are fueling the use of these solutions in industries like banking, insurance, and investment management. The combination of AI and machine learning further improves the accuracy of reporting and predictive power, making this segment a major driver of value in financial analytics.

| Segment | Value Share (2025) |

|---|---|

| Assets and Liability Management (ALM) | 22.8% |

By 2025, the assets and liability management (ALM) segment will account for 22.8% of the overall share, compared to 20.5% in 2023. Demand for ALM solutions is rising due to the increasing complexity of financial risk management and regulatory compliance requirements, combined with the growing adoption of AI-driven financial analytics, among other factors.

Insurance companies, banks, and corporate treasury departments are utilizing predictive modeling, scenario analysis, and real-time liquidity management tools to help maximise asset allocation, and to control financial risk. Companies like Moody's Analytics, Oracle Financial Services, and Wolters Kluwer are at the forefront of ALM solutions, driving the integration of AI, blockchain, and cloud-based risk assessment frameworks.

The payables management segment is expected to account for 21.3% of the share in 2025, driven by the rising adoption of automated accounts payable (AP) solutions, AI-powered invoice processing, and real-time payment tracking. The shift toward digital payments, e-invoicing, and blockchain-based transaction verification is fuelling growth, enabling businesses to enhance cash flow visibility and streamline payment cycles. With increasing demand for fraud detection, compliance automation, and vendor risk assessment, financial technology providers such as SAP Ariba, Coupa Software, and Tipalti are introducing advanced AP automation solutions to reduce processing costs and improve efficiency.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| France | 7.1% |

| Germany | 7.3% |

| Italy | 7% |

| South Korea | 7.6% |

| Japan | 7.4% |

| China | 8% |

| Australia | 6.9% |

| New Zealand | 6.8% |

The USA is growing at a tremendous pace due to the increasing adoption of AI-powered financial intelligence solutions, heightened compliance requirements, and the need for real-time information insights. It is likely to record a CAGR of 7.5% through 2035. Financial analytics is widely applied in the banking sector, with top banks employing predictive analytics to measure risk, identify fraud, and portfolio management. These fintech companies, such as Stripe and Plaid, are disrupting the industry with API-based financial services, while incumbents such as Goldman Sachs and JPMorgan Chase are accumulating analytics capabilities.

Cloud-based financial intelligence solutions and web-based payment solutions are driving investments. Visa and PayPal are implementing machine learning to secure payments and track client patterns. SEC filing reports and anti-money laundering laws are driving banks to make data-driven decisions using more complex measures. Greater adoption of blockchain and decentralized finance (DeFi) all over the world further accentuates the long-term growth trend within the USA.

The UK finance analytics industry is growing with a robust fintech ecosystem and rising financial openness needs with a CAGR of 7.2% during the forecast period. London's concentration of global finance hubs has made the nation AI-driven analytics adoption-centric. Revolut, Monzo, and Barclays are all heavily investing in real-time financial monitoring solutions to increase customer engagement and adapt to changing regulations.

Government-sponsored projects in digital finance, including Open Banking, are leading to the adoption of predictive analytics across financial services. The insurance industry also witnessed the mass adoption of financial analytics applied in risk and anti-fraud programs. Most significantly, AI-powered robo-advisors and automated investment platforms are revolutionizing wealth management. Technology-enhanced competition is also fueling the boom of the UK industry.

France is witnessing a rise in its sales with a CAGR of 7.1% during the forecast period. This is owing to the adoption of AI-driven financial solutions, high demand for digital banking, and strict regulatory norms. Banking giants of France, BNP Paribas and Société Générale, are implementing machine learning algorithms for improved fraud protection, credit risk assessment, and customer satisfaction. Fintech companies like Lydia and Qonto are also driving the strong growth of financial intelligence solutions.

The strong emphasis of the French government on cybersecurity and the protection of financial information in the domain of GDPR laws is compelling the banks and other financial institutions towards top-end analytics solutions. Also, the growing acceptance of blockchain technology for economic reports, along with adherence to rules, is accelerating momentum. The urgency of auto-trading alongside investment ideas provided through artificial intelligence makes it essential for France to emerge as a key player in the European market of financial analytics.

The industry in Germany is anticipated to record a CAGR of 7.3% during the forecast period. Industry is also growing due to the strong banking industry, technology, and compliance needs. Large banks such as Deutsche Bank and Commerzbank are utilizing big data analytics for enhanced risk management, fraud detection, and investment. Artificial intelligence-based financial insights are increasingly being looked for in asset management and lending products.

Germany's fintech industry is also thriving, with Solarisbank and N26 taking the lead in revolutionizing online banking. Germany's focus on data security and conformity with EU financial regulation is also influencing trends. Utilization of AI-based robo-advisors and algorithmic trading portals is also pushing financial firms towards data-driven decisions, further speeding up the overall growth.

The industry is likely to register a CAGR of 7% during the forecast period. The market in Italy is growing because of the demand for digital banking services, risk management services, and AI-driven financial forecasting. UniCredit and Intesa Sanpaolo are investing in newer analytics to enhance customer experience and verify compliance. The insurance industry also uses AI-driven analytics to identify fraud and predictive modeling.

The high-profile achievement of fintech companies like Satispay is driving the adoption of real-time analytics software. The compliance environment in Italy is boosting financial transparency and compelling banks and other financial institutions to implement compliance management solutions at a faster rate. Moreover, the increase in AI-based trade strategies and robo-investment products is driving the creation of analytics software in Italy.

The industry in South Korea is growing with the development of AI-based financial models, the use of real-time analytics, and positive government support for digital finance growth. The Financial Services Commission is making significant investments in big data and AI technologies to enable financial security and anti-fraud measures.

Key South Korean firms, such as KakaoBank and Samsung, are using machine learning-based analytics to streamline operations and customer experiences. South Korea's high-tech industry is spurring algorithmic trading and automated financial decision-making technology. Increased use of blockchain-based solutions is also supporting growth.

Japan's financial analysis industry is changing with increasing investments in AI-based financial intelligence, online banking, and government-sponsored programs for financial transparency. Japanese banks are implementing analytics-based solutions to combat fraud, investment analysis, and regulatory compliance at a faster pace.

Firms such as Mitsubishi UFJ Financial Group and SoftBank are innovators in adopting AI-based financial analysis for improved risk management and business efficiency. Growing demands for predictive models to examine economic opportunities also drive growth. Asset managers and insurance firms also utilize financial analysis to avoid risks.

The Chinese financial analytics market is growing at a CAGR of 8%, owing to the strong digital banking culture in the nation, AI-based financial intelligence solutions, and government-backed fintech initiatives. ICBC and Ant Group are some of the major banks that are making use of AI to automate regulatory requirements and financial decision-making.

China's fintech giants, such as Alibaba's Ant Financial and Tencent's WeBank, are at the forefront of AI-driven analytics horizons. China's push towards digital money and blockchain usage is setting the pace for financial intelligence in the future. The need for risk monitoring automation and anti-fraud capability further fuels growth.

The market is likely to grow on account of the rising shift toward AI-powered financial applications, digital banking, and compliance. Major banks, such as Commonwealth Bank and ANZ, are utilizing big data analytics to detect fraud and communicate with customers.

The country's fintech industry is growing strongly, with Afterpay and Judo Bank leading the finance intelligence solutions. Cybersecurity and AI-based compliance solutions are also defining market trends. The demand for algorithmic trading and real-time analytics platforms is also driving growth.

The New Zealand financial analytics industry is growing with higher adoption of fintech, higher banking digital demand, and higher investment in AI-based finance intelligence. Various important financial organizations are employing big data analytics, and a few of them include ANZ New Zealand and Kiwibank.

Government initiatives towards innovation in digital finance and open banking are propelling the growth. Fintech start-ups like Xero are also revolutionizing financial management at the same pace through AI-driven analytics solutions. The rise in demand for predictive analytics and cloud-based financial intelligence platforms is also propelling the growth.

The market is rapidly expanding due to the growing demand for real-time insights, risk management, and data-driven decision-making. Organizations are employing AI-powered analytics, machine learning (ML), and cloud-based financial intelligence platforms to enhance forecasting accuracy, operational efficiency, and compliance.

The prominent players include SAP, Oracle, SAS Institute, IBM, and FIS, providing advanced services such as predictive modeling, automated reporting, and fraud detection. On the other hand, there are start-ups and niche providers who use AI-driven risk assessment, real-time expense tracking, and blockchain-based financial security.

The market is changing with the advances of such things as embedded analytics, self-service BI (business intelligence), and advanced automation that enable a streamlining of financial planning, budgeting, and scenario analysis.

Companies are looking first at seamless ERP integration, regulatory compliance solutions, and scalable analytics for enterprises of every size. Then there are strategic factors that include - the adoption of AI-driven financial forecasting, cloud-native deployment models, and partnerships with fintech providers. As financial institutions and enterprises are leading up to relying on data-driven decision-making, financial analytics features remain an enabling construct of efficiency and competitiveness in the changing landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SAP SE | 20-25% |

| Oracle Corporation | 15-20% |

| SAS Institute Inc. | 12-17% |

| IBM Corporation | 8-12% |

| FIS Global | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| SAP SE | Provides AI-powered solutions, real-time reporting, and cloud-based ERP. |

| Oracle Corporation | Offers comprehensive financial management software with predictive analytics and automation. |

| SAS Institute Inc. | Specializes in advanced statistical and risk analytics for financial institutions. |

| IBM Corporation | Develops AI-driven tools focused on fraud detection and compliance. |

| FIS Global | Focuses on cloud-based financial intelligence and risk management solutions. |

Key Company Insights

SAP SE 20-25%

SAP SE leads with AI-powered business intelligence solutions. Its cloud-based ERP systems and advanced predictive modeling enhance financial decision-making and operational efficiency.

Oracle Corporation (15-20%)

Oracle provides complete financial management software that includes features for automation and solid analytical capabilities for budgeting, forecasting, and compliance monitoring.

SAS Institute Inc. (12-17%)

SAS designs statistical analytics and risk assessment solutions to assist financial institutions with trend analysis to develop risk mitigation strategies.

IBM Corporation (8-12%)

IBM develops AI-driven tools, leveraging machine learning to traffic fraud detections and compliance with optimizing operations.

FIS Global (5-9%)

FIS Global provides next-gen financial intelligence solutions via cloud bases to enhance risk management and alleviate financial reporting across businesses.

Other Key Players (30-40% Combined)

The industry is projected to witness a CAGR of 9.2% between 2025 and 2035.

The industry stood at USD 15.2 billion in 2025.

The industry is anticipated to reach USD 34.1 billion by 2035 end.

North America is expected to record the highest CAGR, driven by the increasing adoption of AI-powered analytics and real-time financial data solutions.

The key players operating in the industry include SAP A.G., International Business Machines Corporation (IBM), Oracle Corporation, TIBCO Software Inc., MicroStrategy Inc., and others.

The segmentation is into data integration tools, database management systems (DBMS), query, OLAP and visualization tools, reporting and analysis, analytical solutions, consulting and support services, and others.

The segmentation is into data integration tools, database management systems (DBMS), query, OLAP and visualization tools, reporting and analysis, analytical solutions, consulting and support services, and others.

The report covers North America, Latin America, Europe, South Asia, East Asia, Oceania, and Middle East & Africa (MEA).

Semiconductor Substrate Market Insights - Trends & Forecast 2025 to 2035

Smart Bathroom Market Insights - Growth & Forecast 2025 to 2035

Non-volatile Dual In-line Memory Module (NVDIMM) Market Analysis - Growth & Forecast 2025 to 2035

Unattended Ground Sensors (UGS) Market Trends - Forecast 2025 to 2035

Ultrasonic Flowmeters Market Trends – Growth & Forecast 2025 to 2035

Cellular M2M Connections and Services Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.