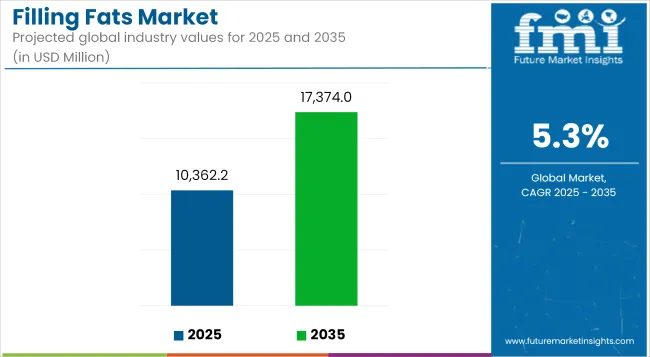

In 2025, the global filling fats market size is assessed at USD 10,362.2 million and is forecasted to witness sustained expansion, reaching USD 17,374.0 million by 2035, reflecting a CAGR of 5.3%. This growth is supported by a visible transformation in the processed food sector, especially within confectionery and bakery product lines, where manufacturers are increasingly opting for functional and economically viable fat alternatives.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 10,362.2 million |

| Projected Industry Value (2035F) | USD 17,374.0 million |

| Value-based CAGR (2025 to 2035) | 5.3% |

Filling fats, with their ability to replicate the texture and mouthfeel of premium fats like cocoa butter, are gaining traction as formulation-friendly ingredients across diverse product innovations.

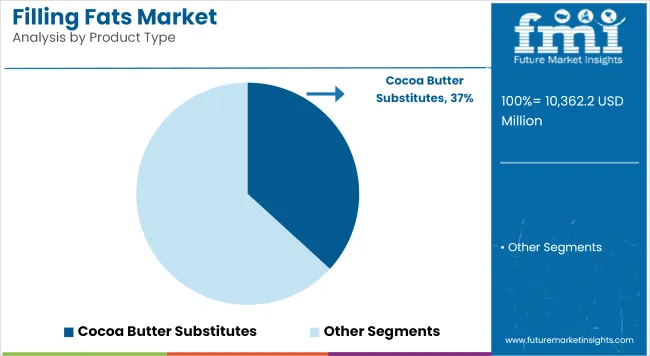

The market is being influenced by a convergence of factors. Rising demand for affordable yet indulgent chocolate products in both developed and emerging markets has intensified the adoption of cocoa butter alternatives, particularly in high-volume snack and dessert formats. Additionally, global cost volatility in traditional cocoa butter and palm oil is accelerating the shift toward customized blends of filling fats.

However, regulatory scrutiny concerning trans-fat content and sustainability challenges around palm-based ingredients are placing constraints on market expansion. Despite this, innovation around non-hydrogenated and clean-label fat systems is mitigating such risks. Key manufacturers have been observed scaling up R&D investments in multi-functional fat systems, catering to diverse product textures, melting points, and consumer health concerns.

By 2035, it is expected that structured lipid systems and enzyme interesterification technologies will become more mainstream, reshaping product formulation norms within the filling fats landscape. The confectionery and processed bakery sectors are projected to remain dominant end-use industries, supported by consistent product launches, evolving taste preferences, and expansion of premiumization trends.

Emerging markets across Asia-Pacific and Latin America are anticipated to offer high-growth opportunities, propelled by increased consumption of convenience foods and confectionery items. Overall, the filling fats market is poised for a stable yet value-driven decade of growth, with versatility and sustainability acting as core differentiators for future success.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global filling fats industry. This analysis reveals crucial shifts in performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.7% |

| H2 (2024 to 2034) | 5.1% |

| H1 (2025 to 2035) | 5.0% |

| H2 (2025 to 2035) | 5.3% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.7%, followed by a higher growth rate of 5.1% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase to 5.0% in the first half and remain high at 5.3% in the second half. In the first half (H1) the sector witnessed an increase of 30 BPS while in the second half (H2), the business witnessed an increase of 20 BPS.

Bakery applications are estimated to account for 27.5% of the filling fats market by 2025, with steady growth driven by demand for cost-effective and functional fat systems. The segment is evolving as industrial bakeries shift toward non-hydrogenated and palm-free blends to address labeling transparency and regulatory thresholds.

In the EU, bakery fat reformulations must comply with Regulation (EU) No 1169/2011 on food information to consumers, which mandates accurate trans-fat and allergen disclosures. This has intensified the focus on structured lipid systems that mimic shortening properties without compromising on crumb texture or sensory experience.

Companies like Bunge Loders Croklaan and AAK have launched specialty bakery filling fats that support extended shelf life and aeration stability. Furthermore, enzyme interesterified fats are gaining acceptance due to their low saturated fat profiles and improved plasticity, meeting evolving nutritional benchmarks.

Growth in artisanal, frozen, and ready-to-bake segments across Western Europe and Southeast Asia is anticipated to amplify demand for clean-label bakery filling fats with multifunctional attributes. While pricing volatility in core raw materials like palm and shea continues to affect procurement strategies, innovation in tailored fat matrices is expected to mitigate formulation costs. Overall, bakery applications are set to remain a critical innovation frontier for filling fats manufacturers.

Frozen desserts are projected to account for 12.6% of the filling fats market by 2025, underpinned by increased adoption in premium and plant-based ice cream fillings. This segment is being strategically leveraged to support creaminess and stable aeration across non-dairy and dairy formats, particularly in Western markets with high per capita frozen dessert consumption.

Regulatory alignment with FDA’s definition of “non-dairy” products and trans-fat reduction guidelines (21 CFR Part 101.9) has accelerated uptake of non-hydrogenated filling fat bases. Companies such as Fuji Oil Group and Wilmar International have expanded their frozen dessert fat portfolios, introducing blends that optimize overrun and cold-temperature stability.

These offerings are increasingly replacing anhydrous milk fats or palm kernel fractions in both indulgent and low-fat variants. Furthermore, hybrid dessert launches combining mousse textures with frozen formats are fueling demand for high-melting-point fat systems that resist bloom and flavor loss during freeze-thaw cycles.

Innovation in lipid crystallization technologies is enabling differentiation in texture across vegan, keto, and low-GI dessert formats. Given the ongoing indulgence-health tradeoff in frozen novelties, filling fat suppliers focusing on functionality, sustainability, and allergen-free labeling will remain competitive in this niche.

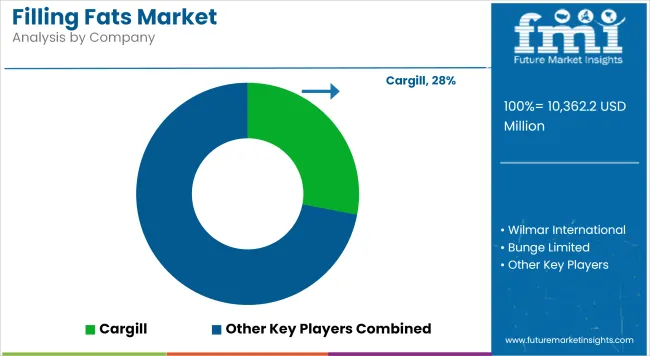

Tier 1 is dominated by multinational corporations with a wide range of operations worldwide, a diversified product portfolio, and, therefore, significantly large market influence. Cargill, Inc. is one such brand in Tier 1 providing an entire range of filling fats designed for bakery, confectionery, and dairy analogy purposes.

The company features a worldwide integrated supply chain, with commitment to investing heavily in innovation centres for filling-fat technology. Similarly, Bunge Limited coordinates through its infrastructure in agricultural business development to guarantee raw material quality of all its filling fat commodities.

Tier 2 will include more established regional players, some of whom would be strongly positioned in certain markets or applications. Wilmar International, along with IOI Group, has maintained strong positioning in the Asian markets whilst extending their presence worldwide through strategic acquisitions and joint ventures.

These companies usually present exhaustive portfolios in filling fats; however, emphasis would be placed more regionally in their selling ways. Mewah International has become an important player through specialization in confectionery filling fats while Fuji Oil Holdings has increased its market share through innovative plant-based formulations addressing health-conscious segments.

Tier 3 encapsulates small, specialized producers, which mostly deal with specific applications or niche markets. Intercontinental Specialty Fats has capitalized on the development of superior cocoa butter equivalents and replacers for high-end confectionery applications, whereas Musim Mas Group has focused on palm-based filling fat solutions that are fully traceable and vertically integrated.

Typically specializing, maintaining impressive customer service flexibility, and developing agility concerning market demands, nonetheless, these companies supply filling fat solutions to clients desiring differentiated or personalized offerings, thus becoming highly valuable suppliers despite a limited global presence.

The following table shows the estimated growth rates of the top five territories. These are set to exhibit high consumption through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 4.1% |

| Germany | 4.6% |

| China | 6.3% |

| Japan | 5.1% |

| India | 6.7% |

The changes in the USA filling fats market are so profound that they take place in tandem with the changing attitudes of the consumers and regulatory developments. The priority now is with clean label demands. Here, companies have started to reformulate their products to remove artificial ingredients and simplify declarations.

Cargill and Bunge, for instance, have introduced non-hydrogenated filling fat solutions that deliver functionality along with clean label requirements. Specialized applications in the above-rich bakery and confectionery segments have resulted in demand for high-performance filling fats capable of specific textural properties.

Companies such as AAK are now developing custom solutions for artisanal producers. As regulations continue to evolve, FDA guidelines on trans fats have created incentives for the innovation of alternative formulations using interesterification and fractionation technologies.

Germany's filling fats market holds all characteristics of Europe's demanding approach both in this aspect as well as regarding quality standards. Certification has practically turned mandatory; RSPO sustainable palm certification, for instance, is taken as a baseline request and no longer as a premium feature for oils. Cargill and Olenex are among the major suppliers that have had built-up sustainability programs to meet market needs.

The country has a long-standing culture of high-quality bakery and confectionery products, so it has also developed niches that require filling fats with extremely specific high-performance technical specifications. Consumers are particularly averse to products with hydrogenated fats and hence drive the development of alternative physically refined products in the German market's clean label preferences.

Rapid growth of bakery chains in major urban centres has created a huge demand for consistency and high performance in filling fats. Wilmar International and Musim Mas Group are among those establishing dedicated production facilities to serve this market. Rising disposable incomes have driven a higher consumption of premium confectionary products using specialized filling fats, particularly in the first- and second-tier cities.

The immense geographical stretch of the country coupled with the superior diversity in climate conditions created the avenue for demanding filling fats with improved stability characteristics, hence driving innovation in heat-resistant formulations.

Food safety issues about many Chinese consumers widely benefit multinationals with established strong quality assurance systems, creating premium market segments for filling fats with international certifications and transparent supply chains.

A healthy competition in the global filling fats market is between a collection of multinational companies and some specific regional companies competing for market share through strategic means. The dominant pillar of product innovations remains the most vital competitive dimension, with most leading companies having put in place large R&D expenditure to develop their improved functional properties, nutritional profiles, and sustainability credentials in filling fats.

Increasingly, vertical integration strategies come to beat those of others, as in Wilmar International and Musim Mas Group, to ensure their supply security and quality consistency by controlling the entire operations from plantation through processing.

Application expertise now has emerged as a key differentiator with companies such as AAK AB and Cargill having created technical service teams that work directly with food manufacturers to develop customized filling fat solutions for specific products and processing conditions. Geographic expansion continues as established players target high-growth emerging markets, often through joint ventures or acquisitions that combine global technology with local market knowledge.

Long-term sustainability initiatives have shifted from compliance to competitive advantage, where all companies develop comprehensive programs on responsible sourcing, reducing environmental impacts, and doing social responsibility to capture those environmentally conscious customers and meet the more stringent requirements of retailers.

For instance

The global industry is estimated at a value of USD 10,362.2 million in 2025.

The market is projected to grow at a CAGR of 5.3% between 2025 and 2035.

Leading manufacturers include Cargill, Inc., Bunge Limited, AAK AB, Wilmar International, and IOI Group, among others.

Manufacturers are developing non-hydrogenated alternatives, reducing saturated fat content, and incorporating functional health ingredients like omega-3 fatty acids.

Sustainability has become a critical competitive factor, with companies implementing responsible sourcing programs, obtaining certifications like RSPO, and developing transparent supply chains.

The plant-based trend is driving development of specialized filling fats for dairy alternatives and vegan confectionery, while also increasing demand for fully plant-based filling fat solutions across applications.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Filling and Dispensing System for Nuclear Medicine Market Size and Share Forecast Outlook 2025 to 2035

Filling and Sealing Machine Market Size and Share Forecast Outlook 2025 to 2035

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Fillings and Toppings Companies

Cup Filling Machines Market Forecast and Outlook 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wine Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Vial Filling and Capping Machines Market

Spice Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Paste Filling Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Fats Market Trends - Sustainable Fat Innovations 2025 to 2035

Liquid Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Yellow Fats Market Size and Share Forecast Outlook 2025 to 2035

Capsule Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Granule Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA