There is a good market for filament tapes as companies prioritize strength, durability, and cost in their industrial packaging, bundling, and reinforcement applications. Due to rising demand from the logistics, automotive, and manufacturing sectors, manufacturers are innovating materials with high tensile strength, solvent-free adhesives, and eco-friendly reinforcement fibers. Companies are improving performance and reliability with cross-weave patterns, UV-resistant coatings, and custom branding.

Manufacturers are implementing artificial intelligence for quality control, automated production lines with state-of-the-art adhesive technologies to enhance the quality and sustainability of their products. The industry is transitioning towards high-performance and lightweight tapes that deliver superior adhesion with environmentally friendly characteristics.

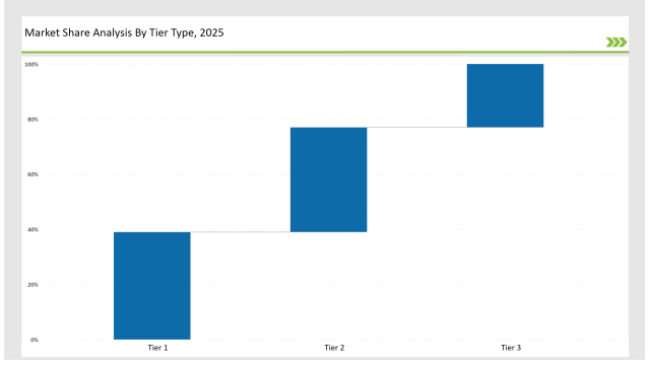

Tier 1 players, including 3M, Tesa SE, and Intertape Polymer Group, hold around 39% of the market share in the region of industrial-strength tapes, advanced adhesive solutions, and large distribution networks.

Tier 2 companies constructively gain 38% of the market by manufacturing low-cost, customizable, and durable filament tapes for multiple applications, including Avery Dennison, Scapa Group, and Berry Global.

Tier 3 would include regional and niche players in the area of tamper evident, biodegradable, and reinforced filament tapes occupying 23% of the market. These companies tend to focus on local manufacturing, specialized applications, and environmentally friendly packaging solutions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Tesa SE, Intertape Polymer Group) | 19% |

| Rest of Top 5 (Avery Dennison, Scapa Group) | 11% |

| Next 5 of Top 10 (Berry Global, Saint-Gobain, Nitto Denko, Shurtape Technologies, Sekisui Chemical) | 9% |

The filament tapes industry caters to multiple sectors where strength, adhesion, and reliable performance are paramount. The companies are developing performance-oriented tapes catering to both industrial and consumer needs. Lightweight fiber-reinforced tapes are being engineered to minimize material wastage while maintaining their strength. Manufacturers are improving adhesive formulations for better bonding onto a variety of surfaces. Furthermore, companies are applying temperature-resistant coatings for ensuring performance even in extreme environments.

Filament tapes are being optimized with environmental-friendly adhesive systems, reinforced fiber structures, and performance coatings. Manufacturers use a hybrid reinforcement of fibers to provide flexibility and better tensile strength. The companies also manufacture flame-retarded coatings to improve safety when used in industrial applications. Businesses are also incorporating anti-corrosive properties for long-lasting use even in tough environments.

The filament tapes industry has seen a transformation due to sustainability and innovation. The companies are striving to improve their performance by adopting AI-powered defect detection, automation in slitting and coating processes, and using lightweight reinforcement materials. Companies are now developing fiber-based reinforcements to substitute synthetic ones. Tamper-proof, high-visibility tapes are being launched by manufacturers to improve security. Firms are also incorporating RFID technology into filament tapes for improved tracking and authentication in packaging applications.

Technology suppliers should focus on automation, eco-friendly adhesives, and digital tracking solutions to support the evolving filament tapes market. Partnering with logistics, manufacturing, and e-commerce companies will drive innovation and adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Tesa SE, Intertape Polymer Group |

| Tier 2 | Avery Dennison, Scapa Group, Berry Global |

| Tier 3 | Saint-Gobain, Nitto Denko, Shurtape Technologies, Sekisui Chemical |

Major manufacturers are exploiting AI-enabled quality control, sustainable adhesives, and high-performing reinforcements to further develop filament tape technologies. Manufacturers are enhancing adhesive bonding strength to withstand extreme conditions. Also, companies are incorporating the self-repairing adhesive layers as a way to increase product lifespan. Lightweight filament tapes utilizing reinforced fiber technology are also being developed by manufacturers to preserve their strength while using less material.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Launched solvent-free, high-tensile filament tapes in March 2024. |

| Tesa SE | Developed UV-resistant and waterproof tapes in April 2024. |

| Intertape Polymer | Expanded eco-friendly filament tape portfolio in May 2024. |

| Avery Dennison | Released tamper-proof filament tapes with branding in June 2024. |

| Scapa Group | Strengthened high-strength, cross-weave filament tapes in July 2024. |

| Berry Global | Introduced lightweight, heavy-duty tapes for logistics in August 2024. |

| Saint-Gobain | Pioneered flame-retardant filament tapes in September 2024. |

The filament tapes market is transforming as companies dedicate resources toward sustainable adhesives, artificial intelligence fault detection, and next-generation reinforcement technologies in filaments. Manufacturers are engineering ultra-thin, high-strength tapes for optimum reduction of material consumption without compromising performance. In addition, self-healing adhesive formulations are being integrated by the manufacturers to prolong the product life; others are optimizing production processes by developing energy-efficient curing techniques for a reduced carbon footprint.

Manufacturers will persist in the integration of AI-driven quality control, biodegradable adhesives, and advanced fiber reinforcements. Companies will be working on the refinement of lightweight, high-strength designs to reduce material wastage. Businesses will add tamper-proof and digital authentication features for secure applications. Digital printing and automated production lines will lend support for branding and production efficiency. Smart tracking with RFID-enabled tapes will ensure better security for logistical operations. Furthermore, AI-driven predictive analytics will provide streamlined manufacturing processes, cost-cutting, and more precision-based operations.

Leading players include 3M, Tesa SE, Intertape Polymer Group, Avery Dennison, Scapa Group, Berry Global, and Saint-Gobain.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 39%.

Key drivers include sustainability, high-tensile strength, automation, and digital branding.

Explore Packaging Consumables and Supplies Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.