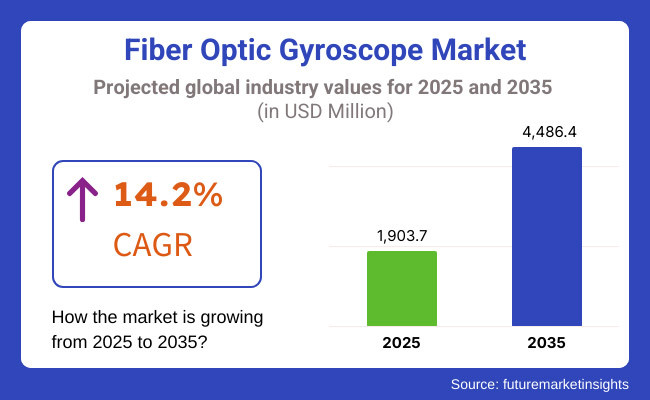

The global Fiber Optic Gyroscope market is projected to grow significantly, from USD 1,903.7 million in 2025 to USD 4,486.4 million by 2035 an it is reflecting a strong CAGR of 14.2%.

The market is expanding rapidly and for good reason as these components are crucial for high-precision navigation and motion sensing across a variety of sectors. From aerospace and defense to robotics and industrial automation, the FOG technology is gaining traction across multiple industries for accuracy and reliability. Because they are capable of offering precise measurements of angular velocity without relying on mechanical moving parts, fiber optic gyroscopes lend themselves well to applications that require durability and long-term stability.

Key market growth is attributed to the increased use of fat, oil and grease (FOG) based Inertial Navigation Systems and Inertial Measurement Units (IMUs). They are widely used for guidance in autonomous vehicles, aircraft, maritime navigation, and exploratory space missions where GPS signals are often unreliable or unavailable. Adoption is spurred on by the demand for always-on navigation in GPS-denied environments across all industries, driving interest in FOG versus conventional gyro-based solutions.

Additionally, stringent regulatory standards and safety requirements in the aerospace and defense sectors are further propelling the growth of market. The era of Globalization escalates the demands for high-accuracy gyroscopic solutions, which are extremely significant in Industry 4.0, Internet of Things, smart armed carriers, smart farms and smart home appliances, medical systems, and in various government agencies and defense organizations for navigation, targeting, and surveillance systems. The need to comply with industry-specific regulations is inducing the manufacturers to innovate advanced FOG-based navigation superlative technologies that address safety and performance targets, as well as, meet global standards.

The increase of digital transformation in automation and robotics. The advancement from smart manufacturing to robotic automation creates a growing need for precise motion sensing and orientation tracking. Having an FOG and angular rate sensors enable industrial robots, remotely operated vehicles, and autonomous machinery to perform optimally.

In North America, increase in investment in aerospace, defense, and autonomous technology development is aiding the region to capture more share of the market. The market is further bolstered by the concentration of large FOG manufacturers and extensive research and development activities. Conversely, nations such as India and China are witnessing increased adoption, fueled by their burgeoning defense and industrial sectors. This growing demand for accurate navigation solutions in these regions is predicted to contribute positively to the overall Fiber Optic Gyroscope market's growth.

Explore FMI!

Book a free demo

| Company | Northrop Grumman |

|---|---|

| Contract/Development Details | Awarded a contract by the USA Department of Defense to supply fiber optic gyroscopes for advanced missile guidance systems, enhancing targeting accuracy and system reliability in various defense applications. |

| Date | February 2024 |

| Contract Value (USD Million) | Approximately USD 50 |

| Renewal Period | 3 years |

| Company | Honeywell International |

|---|---|

| Contract/Development Details | Partnered with a leading aerospace manufacturer to integrate fiber optic gyroscopes into next-generation commercial aircraft, aiming to improve navigation precision and flight safety through enhanced inertial measurement units. |

| Date | September 2024 |

| Contract Value (USD Million) | Approximately USD 35 |

| Renewal Period | 5 years |

Growing adoption of Inertial Navigation Systems (INS) for GPS-denied environments

Inertial Navigation Systems (INS) have become an essential component for operations in environments where GPS is unavailable ie under water, underground or in high-interference areas. When an object or a person needs positioning, inertial navigation using inertial sensors like accelerometers and fiber optic gyroscopes (FOG) can offer continuous and accurate location information without external signal.

This ability is important for defense, aerospace and autonomous applications that pose a challenge with GPS jamming/jamming or a lack of satellite coverage. Hence, governments all around the world have been investing on INS technology, both military and commercial. For example, defense agencies have increased investment in GPS-independent navigation systems, for example in UAVs and submarines.

Moreover, INS is also being integrated into a number of planetary rovers under space exploration programs, which directly aids in moving accurately on celestial bodies in the absence of GPS system. As geopolitical tensions rise and the demand for secure navigation increases, INS adoption is projected to increase exponentially, allowing for continued operational effectiveness in contested environments.

Increased military spending on advanced guidance and surveillance systems

Governments around the world are raising defense budgets to pay for more surveillance, intelligence and precision-guided weapons. This advanced guidance of the system, coupled with real-time situational awareness provided by the FOG-based INS ensures accurate targeting of the enemy during on-field combat.

His military forces are concentrating on high-tech surveillance platforms, including autonomous drones and next-generation fighter jets, with enhanced navigation and target-tracking capabilities. In recent years, military agencies have invested billions to modernizing military assets including precision-guided missiles, reconnaissance drones and naval vessels.

These rising expenditures are in response to the increasing demand for national security, border security, and counter terrorism. Moreover, in response to emerging threats like cyber warfare and electronic countermeasures, military forces are combining INS with artificial intelligence (AI) and sensor fusion technologies to improve resilience against jamming and spoofing attacks.

A FOG-based INS de facto provides the accuracy and precision necessary for weapon systems to function automatically and provides advanced situational awareness systems driving the demand for even higher LiFePO4 energy products to improve battle situations.

Rising adoption of autonomous vehicles and drones using FOG-based INS

The rising adoption of autonomous vehicles and drones in the individual and commercial sectors is surging the demand of such precise navigation solutions. FOG-based INS is a key component in achieving accurate positioning, motion tracking, and stabilization capabilities in systems such as self-driving vehicles, industrial robots, and UAVs.

This technology has been widely implemented across the defense sector, including autonomous reconnaissance drones and unmanned ground vehicles (UGVs) to navigate challenging terrain. The commercial sector, FOG-based INS are very important for drone deliveries, autonomous cargo ships, and industrial automation to run very smoothly without any interruption.

Governments have even legislated frameworks to help guide the safe incorporation of autonomous systems into civilian infrastructure. Moreover, the establishment of smart cities and the rise of intelligent transportation systems are also fueling the demand for advanced navigation technologies.

With industries increasingly advocating for automation solutions, the market for FOG-based INS is poised for a substantial growth, providing improved accuracy, reliability, and operational efficiency across varied applications.

Performance drift and signal noise will impact long-term accuracy in demanding applications

Performance drift is one of the startling issues in the data processing of fiber optic gyroscopes (FOG) with long-duration operations. Over time, small errors in the system build up because of internal effects like thermal expansion, aging of the optical components or variations of the laser source.

This continuous drift may affect the accuracy of navigation and guidance systems over time, which is critical in applications such as aerospace, defense, and underwater navigation that require a high level of precision. A slight wobble in the numbers can produce huge errors over time periods when no outside recalibration occurs.

Signal noise is a further fundamental issue with fiber optic gyroscopes that impacts measurement accuracy. Noise can result from many sources, such as optical backscatter, polarization drift, and electronics noise in the system. Correlation between gyroscopes is highest, but even small disturbances of the signal are sufficient to appear errors and, accordingly, to affect the stability of operation of navigation systems.

In defense applications, this noise of signals is a problem, because special forces of an army may lack proper positional readings while hunting a target in a prep-attacks phase, or in scanning the area for reconnaissance, reducing operational performance.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter defense and aerospace regulations increased demand for high-precision navigation systems. |

| Technological Advancements | Miniaturization improved performance in aviation and military applications. |

| Industrial Automation | Fiber optic gyroscopes were increasingly used in robotics and industrial machinery. |

| Cost Reduction Strategies | Manufacturing innovations reduced production costs, increasing commercial viability. |

| Market Growth Drivers | Growing reliance on GPS-denied navigation solutions boosted adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered calibration ensures ultra-precise measurements for autonomous systems. |

| Technological Advancements | Quantum-enhanced fiber optic gyroscopes enable near-zero drift navigation. |

| Industrial Automation | AI-driven inertial navigation enhances performance in autonomous industrial equipment. |

| Cost Reduction Strategies | Mass production techniques driven by AI optimize cost efficiency and scalability. |

| Market Growth Drivers | Expansion of space exploration and deep-sea navigation applications. |

Tier 1 vendors are leading companies with major market shares, large technological know-how and broad global footprints. These are the leaders-the movers and shakers of the industry who set innovation standards and market trends.

Some of the major Tier 1 players of the FOG market include Honeywell International Inc., EMCORE Corporation. Oct 2023, Global Fiber Optic Gyroscope (FOG) Market Report Industry has grown to become a leading player in this market by providing an extensive range of high-precision FOG goods for the use in aerospace, defense, and industrial fields.

With their international networks and solid investment in research and development, they continue to be at the forefront of the changing market.

Tier 2 vendors are mature companies that command a meaningful share of their respective markets and tend to serve particular applications or locations. They leverage market by providing focused FOG solutions for certain niche markets or customer needs.

Good examples of Tier 2 vendors include iXBlue and KVH Industries. A company dedicated to these solutions was iXBlue, whose product lineup leans towards navigation, positioning, and imaging solutions, ultimately focusing on FOG technology in a maritime and defense context.

Windward specializes in naval vessels, which benefits from integrated FOGs as part of KVH's mobile connection and baseline inertial navigation system products. Most of these companies solve a particular pain point in the market and partner with either Tier 1 vendors or end-users to provide the solution.

Tier 3 vendors are small companies, startups from recent years, and niche specialists that work within a specific region. These vendors may have a sense of innovations or very low-cost solutions that are more targeted to applications where larger players are not dominant.

Although they don't possess the widespread reach and scale of operations like Tier 1 and Tier 2 players, Tier 3 vendors are useful to the diversity and competition in the market. This agility enables them to adapt quickly to emerging trends and customer preferences, which fuels innovation in the industry.

The section highlights the CAGRs of countries experiencing growth in the Fiber Optic Gyroscope market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 17.9% |

| China | 16.7% |

| Germany | 12.3% |

| Japan | 13.6% |

| United States | 14.8% |

The growing demand for high-precision fiber optic gyroscope (FOGs) has largely been driven by China's concerted efforts to modernize its defense capabilities. The People's Liberation Army (PLA) has been developing cutting-edge methods of warfare and integrating cutting-edge technology to improve its military capabilities, by enabling systems including missile guidance, missile systems and various other precision-guided munitions as well as aircraft and naval vessels.

A significant trend is China’s breakthrough FOGs production capability at a low cost through the repurposing of current computer chip production lines and its rapid scaling of tactical weapons production. This advancement highlights the transition in China's aspirations towards self-sufficiency, particularly in key defense-related technologies, as well as a strategic play to just enhance its military-industrial complex.

Strategically, the PLA's embrace of FOGs complements its broader goals of attaining technological superiority and operational preparedness, thereby solidifying China's role in global defense equations. China is anticipated to see substantial growth at a CAGR 16.7% from 2025 to 2035 in the Fiber Optic Gyroscope market.

India has placed a greater emphasis on border protection, leading to an increase in the demand for fiber optic gyroscope for military applications.

Indian Army has developed high-end surveillance systems in which unattended ground sensors (UGS) have been fitted with FOG to monitor and track the movement of the enemies++ Real-time data from these sensors considerably augment army's ability to identify and block infiltration attempts.

Moreover, the establishment of optical fiber connectivity in Eco-sensitive zones such as Siachen and DBO is further augmenting communication and surveillance in these areas. This would exhibit India's aim to utilize state-of-the-art technology for enhancing its national security and awareness in neighboring borders. India's Fiber Optic Gyroscope market is growing at a CAGR of 17.9% during the forecast period.

Commercial space missions in the United States have surged recently, opening up a large market for hi-performance gyros. Private companies and public sector agencies are putting up satellites and planning deep-space expeditions, which requires reliable and precise navigation systems.

With high precision, long life, and relatively light weight, fiber optic gyroscopes can provide navigation points for the inertial measurement unit (IMU) of spacecraft.

Semantic: Space gyroscopes play a pivotal role in maintaining the stability needed for space missions, and as the commercial space sector expands, the demand for state-of-the-art FOGs has surged, leading to innovation and competition among manufacturers to create gyroscopes that meet the strict criteria set by space applications. USA is anticipated to see substantial growth in the Fiber Optic Gyroscope market significantly holds dominant share of 78.5% in 2025.

The section contains information about the leading segments in the industry. By Sensing Axis, the 3 Axis segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by application, Military & Defense segment hold dominant share in 2025.

| Type | CAGR (2025 to 2035) |

|---|---|

| 3 Axis | 15.9% |

3 Axis segment is expected to grow at a CAGR of 15.9% from the period 2025 to 2035. As these systems become common and the demand for both advanced and specialized control systems rise, the demand for 3-axis fiber optic gyroscopes (FOGs) is rising because of their availability and much higher precision.

These gyros also implement higher quality angular-rate sensing because they measure angular velocity across three axes which makes them suitable for aerospace, defense and autonomous systems. With the increased use of unmanned aerial vehicles (UAVs) and self-driving military vehicles, accurate positioning and navigation solution is highly demanded.

FOGs have historically been used on numerous terrestrial applications, but only recently have FOGs advanced to a stage where they can find themselves on space missions providing for satellite stabilization and interplanetary navigation.

These next-generation deep-space probes will use 3-axis FOGs for trajectory corrections, minimizing dependence on external positioning signals, the European Space Agency (ESA) said. This technological step change is expected to enhance mission success rates in space, but with guaranteed long-term reliability in the extreme environments of space.

| Core | Value Share (2025) |

|---|---|

| Military & Defense | 32.8% |

The Military & Defense segment is poised to capture share 32.8% in 2025. The rising investments in advanced warfare technologies. For high accuracy tracking with missiles guidance systems, armored vehicles navigation, and stabilization of the UAV, these fiber optic gyroscopes are crucial.

Governments around the world are looking to increase their defense budgets to improve military capabilities that, in turn, prop the adoption of FOG. Last month, the Pentagon revealed a USD10 billion investment into next-generation missile defense systems that utilize FOG based inertial navigation to enhance the accuracy of enemy targeting.

Likewise, The Indian Ministry of Defense has sent FOG-inscribed spying drones to sensitive border fortunes for real time monitoring and threat prevention. Soldiers can rely on these high-precision gyroscopes to provide situational awareness, minimizing the risks of working in the combat zone.

FOG technology also plays a crucial role in naval defense initiatives, including the development of autonomous submarines for accurate underwater navigation.

The highly competitive fiber optic gyroscope market is fueled by widespread innovation in navigation technology in aerospace, defense, and autonomous-systems applications. To gain a competitive advantage, companies work on improving accuracy, miniaturization and durability.

There is significant competition in the marketplace from established players as well as newer companies developing miniaturized and integrated sensor systems. Market leadership is shaped by strategic partnerships, government contracts, and ongoing investments in R&D.

Recent Industry Developments in Fiber Optic Gyroscope Market

The Global Fiber Optic Gyroscope industry is projected to witness CAGR of 14.2% between 2025 and 2035.

The Global Fiber Optic Gyroscope industry stood at USD 1,903.7 million in 2025.

The Global Fiber Optic Gyroscope industry is anticipated to reach USD 4,486.4 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 16.4% in the assessment period.

The key players operating in the Global Fiber Optic Gyroscope Industry Honeywell International Inc., Northrop Grumman Corporation, KVH Industries, Inc., EMCORE Corporation, iXblue (Exail), Fizoptika Corporation, Optolink LLC, Al Cielo Inertial Solutions Ltd., Inertial Labs, Inc., Safran S.A.

In terms of Sensing Axis, the segment is segregated into 1 Axis, 2 Axis and 3 Axis.

In terms of Device, the segment is segregated into Fiber Optic Gyrocompass, Inertial Measurement Units (IMUs), Inertial Navigation Systems and Others.

In terms of Industry, the application is distributed into Aeronautics and Aviation, Robotics, Remotely Operated Vehicle Guidance, Military & Defense, Industrial and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.