From 2025 to 2035, the global Fiber Optic Labels Market can be expected to grow bigger than anyone previously thought imaginable. More and more, telecommunications, data centres and industrial applications deploy fibrotic networks. Fiber optic labels are indispensable for identifying and organizing the fibers maintains at cable layout so as to maximize management efficiency with minimal downtime.

The acceleration of internet speed, 5G infrastructure's growth and more cloud computing services all drive expansion of this market. What's more, as development works in label materials and printing techniques progress, durability and performance are enhanced.

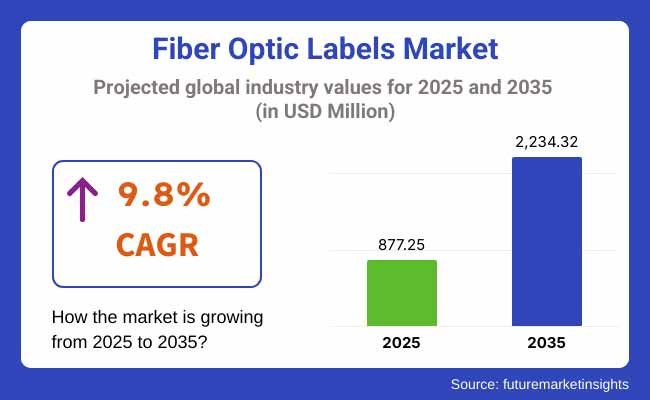

The market is projected to surpass USD 2,234.32 Million by 2035, growing at a CAGR of 9.8% during the forecast period.

North America is the leading market for fiber optic labels due to new high-speed broadband networks and increased 5G spending. With major telecommunications companies and cloud service providers, the USA is the largest market domestically in this region Demand for efficient cable management solutions in data centres and industrial automation is providing further impetus to market growth. Meanwhile, strict industry regulations and the need for durable yet high-performance labelling solutions are driving an ongoing wave of innovation in this area.

Europe's fiber optic labels market is expanding. This is due to a raise in capital for home bandwidth networks (FNTH) and the construction of data centers. Countries like Germany, France and the UK are leading the expansion of fiber optic networks, fuelling demand for high quality labelling solutions.

The EU’s focus on digital transformation and smart infrastructure mean growth in fiber optic labels markets there will be guaranteed. More importantly, manufacturers are developing labelling materials that are heat-resistant and environmentally friendly to comply with banded environmental regulations in regions such as the EU.

The Asia-Pacific region will be the fastest growing for fiber optic labels in anticipation of an extensive use of fiber optics networks coming up in China, India, South Korea, Japan, and Italy. Fast development of 5G networks also drives 5G penetration rates throughout this region, while increasing investments in smart cities and growing dependency on cloud computing provide additional impetus for growth. Furthermore, in data-hungry-sector industries high-contrast printing solutions are in demand to bear the brunt of market penetration.

Challenge

Durability and Performance Issues

The Fiber Optic Labels Market must be able to ensure that labels can survive even harsh climatic conditions, such as high humidity or temperature differences. In such circumstances, if the label is exposed on site it loses its function and performance abilities are diminished.

Regulatory Compliance and Standardization

Many standards regarding labelling of fiber optic components are strictly enforced. Businesses that wish to market their products in this global climate must hold internationally recognized security certificates to prove the high quality of products which comply fully with local regulatory standards for fear running into trouble with customs officers.

Opportunity

Growing Demand for High-Performance Labelling Solutions

As the telecommunication and data market grows, the importance of high-quality labels able to withstand fiber optic cables becomes more obvious. These labels can make a vital contribution to good cable management, convenience in positioning and maintenance - exclusive features that might tempt manufacturers into designing new models targeted at particular markets.

Advancements in Smart Labelling Technologies

RFID tracking, QR codes and laser-etched labels are being integrated into innovative new fiber optic labelling remedies. This type of technology will facilitate traceability, automation of stockpile management and better quality fiber network maintenance productivity.

Between 2020 and 2024, the fiber optic labels market moved from materials sensitive to heat and UV rays to those which are now durable and protected by those same factors--moving towards more durable, heatproof and now UV-protected products. Fiber optic networks draw ever closer to the borders of small towns in 2020. The combined CI systems and more liberal typeface design make printing much simpler, while on stark contrast the new labelling is easier to apply

In 2025, with the market for smart labelling systems heading up to 2035 as well (RFID and AI-directed models alike), tracking systems employing radio frequency identity or artificial intelligence shall control these installations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased compliance with industry standards |

| Market Demand | Growth in durable, UV-resistant labels |

| Industry Adoption | High demand in telecom and data centers |

| Supply Chain and Sourcing | Dependence on synthetic materials |

| Market Competition | Dominated by established labeling manufacturers |

| Market Growth Drivers | Need for durable and high-contrast labels |

| Sustainability and Energy Efficiency | Limited focus on eco-friendly labeling |

| Integration of Digital Innovations | Early adoption of RFID-based tracking |

| Advancements in Product Design | Standardized label formats |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global mandates on label safety and sustainability |

| Market Demand | Expansion of smart labeling solutions and digital tracking |

| Industry Adoption | Widespread use across smart cities, 5G networks, and industrial sectors |

| Supply Chain and Sourcing | Shift toward eco-friendly and biodegradable labeling solutions |

| Market Competition | Entry of tech-driven and sustainability-focused labeling companies |

| Market Growth Drivers | Integration of RFID, QR codes, and AI-assisted tracking |

| Sustainability and Energy Efficiency | Adoption of recyclable, non-toxic, and sustainable label materials |

| Integration of Digital Innovations | Full-scale implementation of smart, AI-driven inventory management |

| Advancements in Product Design | Development of customizable, high-durability, and interactive labels |

The USA fiber optic labels market is expanding, driven by the rapid increase in fiber optic network deployment by telecommunications, data centers and intelligent infrastructure Vietnam’s high-speed internet and 5G networks are more and more rapidly popularizing the usage of glass packing labels that are both durable and high performance; in order to properly identify and manage Optical Fiber cables for example.

Innovations in heat-resistant, UV-protected labelling are also promoting economic development of our product markets further brought-on by the expansion in cable joining technologies and parallel systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9.6% |

The UK’s Fiber Optic Labels market is rapidly growing. This is mainly a result of ongoing massive upgrades to fiber broadband and efforts by the British government to both construct materially stop energy networks. Both of these trends will lead to ever increasing requirements for improved solutions in terms of cable identification Labelling innovations such as RFID-integrated tag gates (which leave marks) for use with products coated by film and ecologically friendly materials are becoming more popular conditionally harmonious with future environmental protection goals under the new regulations

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.7% |

The European Union’s Fiber Optic Labels market is thriving due to the obsessive attention of government functionaries and ICT network managers. Test cases for the new policies established within individual countries have shown that achieving higher levels of initial output can lead to long-term growth in government fiber optic cable purchases along with it being easy to market these additional services within smart city clusters focused on tried-and true urban paradigms-whereas turning local industries into circular economy systems has been regarded as a step forward.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 9.9% |

South Korea's Fiber Optic Labels market is developing in the expanding telecommunications environment, and growing 5G technology. The rise in demand for highly durable, high-temperature resistant and precision-printed fiber-optic labels is in sharp contrast with the scale of the labelling industry which is reflected by annual labour statistics. The country is also involved in artificial intelligence-driven urban areas and smart cities, thus driving demand for better labelling solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 9.8% |

| Product Type | Market Share (2025) |

|---|---|

| Polyester Labels | 57.4% |

As highly durable, high-performance labelling solutions are in demand. A briskly expanding market is fast emerging for fiber optic labels, including both cable and signs. Fiber optic labels that provide clear identifications, traceability and safety information for fiber optic cables and the related infrastructure. To withstand high temperatures, moisture, UV exposure or mechanical forces are the sorts of features that must be possessed by these tough stickers. This makes the selection of label material an absolutely necessary factor.

As far as this market is concerned, polyester labels and nylon labels are the two varieties. Of these, polyester fiber optic labels possess the largest market share, since they are extremely durable and resistant to chemicals, abrasion-resistant as well as providing long-lasting printed materials. The demand for the high-quality labels, which will, however, withstand inclement weather and long periods of use, is on the rise now that fiber optic networks are expanding so rapidly in telecommunications, industrial automation and intelligent buildings.

By 2025, polyester fiber optic labels are estimated to capture 57.4% of the market, far outstripping the other segments of the market. Polyester labels can be made tamper-evident, providing a safety net for vital fibre-optic infrastructure in data centers or telecom networks. It means a more secure environment all around. Manufacturers are turning out flame-retardant, UV-resistant adhesive-backed polyester labels to meet the high standards of modern fiber optic systems.

| End-Use Industry | Market Share (2025) |

|---|---|

| Construction | 42.1% |

The largest consumer for fiber optic labels of any market constructor will still be by 2025 construction, taking up 42.1% share. The growing adoption of fiber optic technology in smart buildings, infrastructure projects and high-speed data transmission networks has led to greatly increased demand for high clarity and durable labelling solutions. As Fiber optic wires are being installed in construction projects today, they need elaborate markings to provide efficient maintenance and troubleshooting.

To ensure operational efficiency and safety compliance, it is essential to have dust-resistant, moisture-resistant, weather-resistant labels that will stand up to heavy industrial applications. As early as the beginning of the 21st century, polyester and nylon labels, which have become handy marks of cable routes, connection point’s specifications make it feasible to deploy networks more quickly and shave time off outages with repairs.

As strictures compliance becomes increasingly stringent, the construction sector has seen a growing demand for weatherproof fiber optic labels whose design lives will persist through any storm for more than a year. As smart city infrastructure, high-speed connectivity networks and so on become the focus of both governmental investment and private enterprise alike into the future; it is certain that the need for fiber optic labels servicing construction companies will grow equally well with demand system wide.

The fiber optic labels market is experiencing significant growth, driven by the increasing adoption of fiber optic networks across telecommunications, data centers, and industrial applications. These labels play a crucial role in cable identification, ensuring efficient network management and minimizing downtime. Key manufacturers are focusing on durable, heat-resistant, and tamper-evident labelling solutions to meet the evolving demands of the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Brady Corporation | 14-18% |

| 3M Company | 12-16% |

| Panduit Corp. | 10-14% |

| Avery Dennison Corporation | 8-12% |

| HellermannTyton Group | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Brady Corporation | In 2024, introduced a high-temperature fiber optic label series for data centers. In January 2025, expanded its product line with tamper-evident labels for enhanced security in telecom applications. |

| 3M Company | In 2024, launched weather-resistant fiber optic labels for outdoor cable installations. In February 2025, unveiled smart labels with RFID tracking for real-time cable management. |

| Panduit Corp. | In 2024, developed color-coded fiber optic labels for improved network organization. In March 2025, expanded production capacity to cater to the growing demand from global telecom providers. |

| Avery Dennison Corporation | In 2024, introduced self-laminating labels designed for long-term durability in harsh environments. In January 2025, launched an eco-friendly label line made from recycled materials. |

| HellermannTyton Group | In 2024, implemented laser-etched fiber optic labels for high-contrast readability. In February 2025, introduced a mobile app for quick label scanning and digital record management. |

Key Company Insights

Brady Corporation (14-18%)

A market leader in identification solutions, Brady Corporation focuses on high-performance fiber optic labels with tamper-evident and heat-resistant features, catering to telecom and data center applications.

3M Company (12-16%)

3M is known for its innovative label materials, including weather-resistant and RFID-enabled options that enhance tracking and maintenance of fiber optic networks.

Panduit Corp. (10-14%)

Panduit specializes in color-coded and high-visibility labeling solutions, supporting telecom providers in efficient cable management and network organization.

Avery Dennison Corporation (8-12%)

Avery Dennison emphasizes sustainability, offering eco-friendly and self-laminating labels designed for durability in high-demand fiber optic environments.

HellermannTyton Group (6-10%)

HellermannTyton leads in high-contrast laser-etched labeling and digital integration, providing advanced solutions for network infrastructure professionals.

Other Key Players (30-40% Combined)

The overall market size for Fiber Optic Labels market was USD 877.25 Million in 2025.

The Fiber Optic Labels market is expected to reach USD 2,234.32 Million in 2035.

The demand for fiber optic labels will be driven by increasing fiber optic network deployments, rising automation in manufacturing, growth in smart infrastructure, and the need for durable, high-performance labelling in automotive and construction sectors.

The top 5 countries which drives the development of Fiber Optic Labels market are USA, European Union, Japan, South Korea and UK.

Polyester Fiber demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Duct Wrap Insulation Market Size and Share Forecast Outlook 2025 to 2035

Fiber-Based Blister Pack Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Coding System Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer (FRP) Rebars Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Filters Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Light Poles Market Size and Share Forecast Outlook 2025 to 2035

Fiberboard Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Bottle Market Analysis-Size, Share, and Forecast Outlook 2025 to 2035

Fiber-reinforced Plastic (FRP) Recycling Market Growth- Trends and Forecast 2025-2035

Fibert Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA