The market for fiber packaging has stepped into a boom as the top priority for industries and consumers is creating sustainable, recyclable, and long-lasting packaging. Greater regulatory pressure to reduce plastic waste has led to a transition of businesses towards packaging solutions made from renewable and biodegradable sources. Fiber-based solutions such as corrugated boxes, molded pulp, and paper-based packaging have gained mass acceptance in food & beverage, e-commerce, and personal care sectors.

Manufacturers invest in the newest technology in high-strength paperboard and water-resistant coatings, as well as innovative structural design intended to enhance performance and fulfill consumer demand. Meanwhile, the move from the use of plastic in food service, retail, and logistics applications is onward toward molded fiber, coated paperboard, and barrier-enhanced fiber packaging.

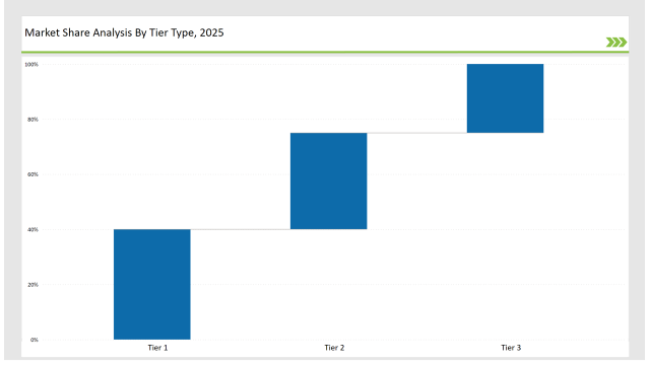

The tier1 players staining their brand equity and holding 40% of the market are International Paper, WestRock, and Smurfit Kappa. This advantage is due to their well-established international manufacturing networks, present innovations surrounding fiber-based materials, and equal footing partnerships with a substantial number of global brands.

DS Smith, Mondi Group, and Stora Enso form the tier2 which accounts for 35% of the market since they provide the cheapest and most sustainable packaging solutions designed for e-commerce, consumer goods, and industrial applications.

The tier 3 comprises regional players and niche players that specialize in biodegradable, compostable, and custom fiber-based packaging and starve on 25% of the market. They mainly focus on local production high-barrier coating and cater for specialized applications.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (International Paper, WestRock, Smurfit Kappa) | 22% |

| Rest of Top 5 (DS Smith, Mondi Group) | 12% |

| Next 5 of Top 10 (Stora Enso, Graphic Packaging, Sonoco, Pratt Industries, UPM-Kymmene) | 6% |

The fiber-based packaging industry serves multiple industries that require eco-friendly, durable, and customizable packaging solutions. Companies are developing advanced fiber-based materials to meet diverse market needs.

Manufacturers are optimizing fiber-based packaging with enhanced barrier properties, strength, and recyclability.

Sustainability and packaging efficiency are driving the fiber-based packaging industry. Companies are adopting AI-driven quality control, moisture-resistant coatings, and fiber-based innovations to improve recyclability and reduce waste. They are also developing fiber-based solutions with enhanced puncture resistance to improve durability. Manufacturers are integrating advanced printing technologies to enhance branding opportunities without compromising sustainability. Additionally, firms are focusing on reducing water and energy consumption in the fiber packaging production process.

Technology suppliers should focus on automation, material innovation, and fiber-based barrier solutions to support the evolving packaging industry. Partnering with major retailers and food brands will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | International Paper, WestRock, Smurfit Kappa |

| Tier 2 | DS Smith, Mondi Group, Stora Enso |

| Tier 3 | Graphic Packaging, Sonoco, Pratt Industries, UPM-Kymmene |

Leading manufacturers are advancing fiber-based packaging technology with enhanced recyclability, AI-driven production, and moisture-resistant coatings.

| Manufacturer | Latest Developments |

|---|---|

| International Paper | Launched lightweight, recyclable corrugated packaging in March 2024. |

| WestRock | Introduced compostable food containers with fiber-based coatings in April 2024. |

| Smurfit Kappa | Expanded biodegradable molded fiber packaging in May 2024. |

| DS Smith | Released fiber-based protective packaging for e-commerce in June 2024. |

| Mondi Group | Strengthened its range of barrier-coated, recyclable paper packaging in July 2024. |

| Stora Enso | Developed bio-based fiber packaging for personal care in August 2024. |

| Graphic Packaging | Innovated molded fiber trays to replace plastic in food packaging in September 2024. |

The fiber-based packaging market is evolving as companies focus on sustainable materials, advanced protective solutions, and barrier-enhanced packaging alternatives.

The sector will further implement AI-based material design, high-performance fiber coating, and biodegradable options. With increased regulations, producers will expand the use of recyclable and plastic-free fiber packaging. Companies will also enhance supply chain sustainability with blockchain-based traceability. Manufacturers will integrate water-resistant coatings to improve fiber packaging durability. They will adopt lightweight yet high-strength designs to optimize material efficiency. Additionally, firms will develop plant-based alternatives to synthetic coatings for enhanced environmental impact.

Leading players include International Paper, WestRock, Smurfit Kappa, DS Smith, Mondi Group, Stora Enso, and Graphic Packaging.

The top 3 players collectively control 22% of the global market.

The market shows medium concentration, with top players holding 40%.

Key drivers include sustainability, automation, lightweight design, and regulatory compliance.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.