The increasing need for robust, safe, and environmentally friendly packaging in textiles, agriculture, and transport is driving growth in the fiber bale packaging film market. This business is driven by increased demand for recyclable materials, film strength, and efficient manufacturing. Companies' primary goals are to increase sustainability, environmental resilience, and load stability in order to meet the changing needs of various industries.

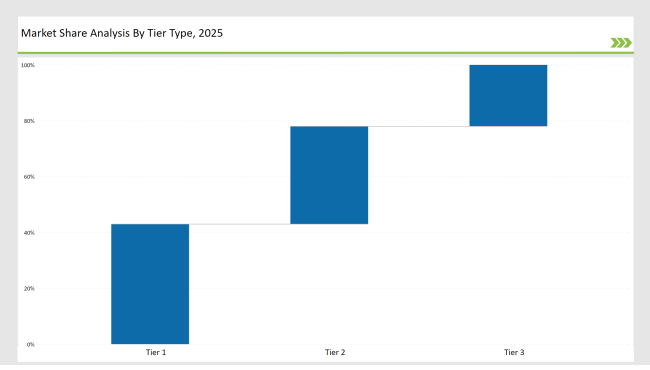

Tier 1: Some of the major producers own a 43% market share and are also market leaders; among them, Trioplast, RKW Group, and Berry Global. For them to hold on to this market share, they use some of the advanced production techniques and distribution systems in place, focusing on eco-friendly products.

Tier 2: A third of the market is occupied 35% by businesses like Polystar Packaging, Coveris, and Plastixx FFS Technologies that provide reasonably priced, custom packaging films for a variety of uses.

Tier 3: Regional and niche manufacturers make up the remaining 22%, focusing on specialized solutions such as biodegradable films, high-strength films for heavy loads, and UV-resistant packaging for agricultural applications.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share % |

|---|---|

| Top 3 (Trioplast, RKW Group, Berry Global) | 19% |

| Rest of Top 5 (Polystar Packaging, Coveris) | 14% |

| Next 5 of Top 10 | 10% |

The growing demand for efficient and sustainable packaging solutions is driving the adoption of fiber bale packaging films across several sectors

Manufacturers are innovating to offer diverse solutions tailored to industry needs

Industry leaders are driving innovation by introducing advanced materials, eco-friendly solutions, and high-strength films to meet evolving market demands.

Year-on-Year Leaders

Suppliers should prioritize sustainability, efficiency, and customization to remain competitive in the fiber bale packaging film market. Investments in advanced material technologies and scalable solutions are critical for growth.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Trioplast, RKW Group, Berry Global |

| Tier 2 | Polystar Packaging, Coveris, Plastixx FFS |

| Tier 3 | Global-Pak, BioBag, Supreme Films |

Leading manufacturers are investing in innovative materials, eco-friendly solutions, and advanced designs to cater to the growing demand for fiber bale packaging films. Below are notable advancements:

| Manufacturer | Latest Developments |

|---|---|

| Trioplast | Introduced advanced recyclable films for fiber bales (March 2024). |

| RKW Group | Launched UV-resistant and weatherproof films for agricultural applications (August 2023). |

| Berry Global | Expanded eco-friendly product lines with enhanced film durability (May 2024). |

| Polystar Packaging | Developed cost-effective customizable films for diverse industries (November 2023). |

| Coveris | Focused on high-performance films for secure and stable logistics (February 2024). |

The fiber bale packaging film market is advancing with a strong emphasis on sustainability, durability, and efficiency. Vendors are leveraging innovative materials and designs to meet the growing demand for secure and eco-friendly packaging solutions.

The fiber bale packaging film industry will evolve toward greater sustainability, advanced manufacturing techniques, and enhanced durability. Key focus areas include:

Rising demand for durable, eco-friendly, and efficient packaging solutions.

Trioplast, RKW Group, Berry Global, Polystar Packaging, and Coveris.

Biodegradable films, UV-resistant materials, and custom-printed solutions.

Asia-Pacific, North America, and Europe.

Companies are investing in recyclable and biodegradable materials, as well as energy-efficient production processes.

Explore Plastic Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.