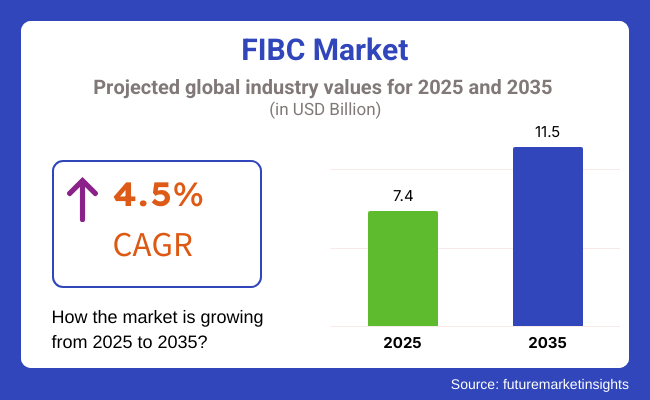

The FIBC market is anticipated to be valued at USD 7.4 billion in 2025, and USD 11.5 billion by 2035. Sales are predicted to expand at a 4.5% CAGR from 2025 to 2035. The revenue generated by FIBCs in 2024 was USD 7.2 billion.

Major applications of FIBCs are in the agriculture industry compared to others in the end-use segment in the forecast period, capturing more than 26% of the market share. FIBCs are used widely in agriculture because they are efficient in storing and transporting large volumes of bulk materials such as grains, seeds, and fertilizers. Their flexibility, cost-effectiveness, and ease of handling make them ideal for this industry, reducing packaging costs, improving logistics, and ensuring safe, secure transportation over long distances.

Type A FIBCs dominate the global market for FIBC and are going to occupy nearly 44% of the total market share by 2035. This is because they serve industries that deal with non-flammable, bulk dry goods in such a way that offers unmatched simplicity at lower costs. They are versatile in storage and transportation and easy to handle and custom-sized for optimal service in sectors like agriculture, construction, and food.

During the future forecast period, FIBC market is estimated to grow promisingly. Further, the market will also generate an incremental growth opportunity of USD 3.2 billion. It will increase 1.6 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global FIBC market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 2.0% (2024 to 2034) |

| H2 | 3.3% (2024 to 2034) |

| H1 | 3.1% (2025 to 2035) |

| H2 | 4.4% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 2.0%, followed by a slightly higher growth rate of 3.3% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.1% in the first half and remain relatively moderate at 4.4% in the second half.

In the first half (H1) the market witnessed a decrease of 110 BPS while in the second half (H2), the market witnessed an increase of 110 BPS.

Expanding Global Trade Increases Requirement for Versatile FIBC Packaging Solutions

The growing global trade in bulk materials including chemicals, pharmaceuticals, and food products drives rising demand for FIBCs. As businesses expand their global reach, the demand for efficient and dependable packaging solutions increases. FIBCs are a versatile option because they are designed for easy cross-border transportation, allowing for the movement of large quantities of goods.

With lightweight form and high storage capacity, the cost of transportation is saved, thus the firms, interested in improving their logistics, find these appealing. Additionally, FIBCs' ability to serve all sorts of commodities-from powders to granules-enables their wide use in various industries, such as agriculture, chemicals, and food processing, which stimulates further demand for FIBCs across different regions.

High Demand for FIBCs for Bulk Material Handling in Growing Construction Industry

The construction industry's growing reliance on bulk materials like sand, gravel, and cement is increasing demand for FIBCs. These containers are great for storing and transporting large amounts of stuff efficiently. Their lightweight, flexible shape simplifies handling, lowering labor costs and increasing efficiency on building sites.

FIBCs are a cost-effective alternative to rigid containers because they take up less space when not in use and lower storage costs. Furthermore, their durability and ability to handle heavy materials make them suitable for construction projects of varying scales. As the construction industry expands and demand for bulk materials rises, FIBCs become an indispensable packaging solution for satisfying logistical requirements and enhancing operational efficiency.

Lack of FIBC Standardization Issues and May Impact Industry Efficiency and FIBC Demand

The absence of uniformity in FIBCs creates considerable issues across businesses. Businesses frequently encounter compatibility challenges when using several types of equipment or systems, such as filling, lifting, and storage mechanisms, due to the wide range of designs, sizes, and material specifications. This unpredictability might result in operational inefficiencies, as businesses may have to invest in customized solutions or struggle to integrate FIBCs with existing infrastructure.

Furthermore, sourcing FIBCs becomes more complex and time-consuming as firms traverse several providers, each with their own set of standards. Without a universal standard, the risk of mishandling, delays, or equipment incompatibility increases, which may hamper efficiency and overall performance.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Eco-friendly Materials | Growing consumer demand for environmentally friendly solutions; regulatory pressures for reduced plastic waste. |

| Automation & Robotics in Production | Increasing demand for efficiency and cost-reduction; automation ensures high-quality, consistent production. |

| Advanced Safety Features | Rising concerns over safety in material handling; innovations like anti-static and fire-resistant fabrics ensure safe transport. |

| Digitalization & Smart Packaging | Integration of RFID, IoT, and tracking systems enables real-time monitoring, improving inventory management and logistics. |

| Customization & Multi-Functionality | Demand for tailored solutions across various industries; multi-use FIBCs can enhance logistics flexibility and product protection. |

The global FIBC market recorded a CAGR of 3.2% during the historical period between 2020 and 2024. Market growth of FIBC was positive as it reached a value of USD 7.5 billion in 2024 from 6.3 billion in 2020.

Global FIBC sales have been steadily expanding because to rising demand from industries such as agriculture, chemicals, and pharmaceuticals. Rising automation and efficient logistics have increased their use in bulk material handling. FIBC makers prioritized product strength, adaptability, and customization to improve performance and cost-effectiveness for businesses.

| Market Aspect | 2019 to 2024 (Past Trends) |

|---|---|

| Market Growth | Steady growth driven by demand in industries like chemicals, food, and agriculture. |

| Technological Advancements | Introduction of more durable, lightweight materials and custom designs. |

| Regulatory Factors | Increase in regulatory oversight, especially for food, pharmaceuticals, and chemicals. |

| Geographical Expansion | Growth in emerging markets (Asia-Pacific, Latin America) due to industrial development. |

| End-User Applications | Predominant use in construction, chemicals, and food industries. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Expected to accelerate due to expanding industrial applications and e-commerce. |

| Technological Advancements | Further innovations in material technology, smart packaging, and sustainability. |

| Regulatory Factors | Anticipated stricter regulations related to safety and environmental impact. |

| Geographical Expansion | Continued expansion in developing regions, with a focus on automation and logistics. |

| End-User Applications | Broader usage across sectors, including pharmaceuticals, cosmetics, and renewable energy. |

Looking ahead, FIBC demand is likely to rise further, driven by rising use in emerging economies and a growing desire for sustainable packaging. The increase in global trade, combined with a shift toward more environmentally friendly solutions, will drive the expansion of high-performance, recyclable FIBC materials, ensuring their supremacy in bulk packaging applications.

Tier 1 companies comprise market leaders capturing significant market share in global market. These industry leaders stand out for having a large product variety and a high production capacity. These industry giants are notable for their broad geographic reach, extensive production experience in a range of package types, and a loyal client base.

They provide a wide range of services, including recycling and manufacturing, employing cutting-edge equipment, according to regulatory regulations, and providing the highest possible quality. Among the well-known businesses in Tier 1 are Palmetto Industries International, Inc., LC Packaging International BV, Global-Pak, Inc. and Intertape Polymer Group

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. They are distinguished by having a significant international presence and in-depth industry expertise. These market participants may not have cutting-edge technology or a broad worldwide reach, but they do guarantee regulatory compliance and have good technology.

Among the well-known businesses in tier 2 are JohnPac, Conitex Sonoco, FlexiTuff Ventures International Ltd.. Euroflexfibc., Bulkbag Containers, Empac, MANICARDI, Rishi FIBC Solutions Pvt. Ltd, PEMA Verpackung BIG BAGS, Jumbo Bag Limited and KITE PACKAGING.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets Due to their specialization in serving the demands of the local market, these companies are classified as belonging to the tier 3 sharing sector.

They only operate on a small scale and within a limited geographic area. Within this specific context, Tier 3 is categorized as an unstructured market, denoting an industry that is significantly less formalized and structured than its organized rivals.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| Europe | Stable demand in Germany, UK, and France, driven by agriculture and pharma, with strict regulations influencing design. |

| North America | Strong demand in the USA and Canada, with sustainability concerns driving recyclable FIBCs. |

| Asia-Pacific (PAC) | Rapid growth in China, India, and Southeast Asia, driven by agriculture and chemicals. |

| Middle East & Africa | Moderate demand, growing in the UAE, Saudi Arabia, and South Africa, boosted by infrastructure development. |

| Latin America | Steady demand in Brazil and Argentina, mainly from agriculture and mining. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| Europe | Growth driven by automation, sustainability, and expansion in Eastern Europe. |

| North America | Continued growth, with innovations like RFID and increased demand in Mexico and USA manufacturing. |

| Asia-Pacific (PAC) | Expansion continues with rising demand in India and ASEAN, plus innovations in automation and sustainability. |

| Middle East & Africa | Gradual expansion with a focus on oil, chemicals, and tech advancements in the Middle East. |

| Latin America | Growth in agriculture, e-commerce, and sustainable FIBCs in Brazil, Argentina, and Mexico. |

The section below covers the future forecast for the FIBC market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 3.2% through 2035. In Western Europe, Spain is projected to witness a CAGR of 2.8% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

| Germany | 2.6% |

| China | 5.4% |

| UK | 2.5% |

| Spain | 2.8% |

| India | 6.2% |

| Canada | 2.4% |

The expanding agriculture exports in the USA fuel high demand for FIBCs, as bulk transport efficiency is crucial for grains, seeds, and fertilizers. Farmers and agribusinesses rely on these containers to move huge quantities while minimizing handling costs. The durability and stack ability of FIBCs allow safe storage and transportation in both domestic and foreign markets.

For example, the growing export of soybeans to China need efficient bulk packing to preserve product integrity and prevent waste. With global food demand rising, American exporters favor FIBCs due to their low cost and ability to handle large loads. As a result, the agriculture industry in the USA continues to drive FIBC market expansion throughout the supply chain.

The UK's specialized chemical industry is developing, which is generating demand for industrial bulk packaging such as FIBCs. Manufacturers are looking for efficient, cost-effective solutions for moving raw materials, powders, and chemical additives. The pharmaceutical, coating, and agrochemical sectors rely on FIBCs to keep products clean and safe.

For example, companies in the paint and coatings industry employ antistatic FIBCs to carry titanium dioxide, a vital pigment ingredient. These bulk containers reduce electrostatic discharge, which lowers the risk of ignition. As the UK's position in high-value chemical production grows, so does the demand for long-lasting, compliant, and tailored FIBC solutions that promote supply chain efficiency and regulatory compliance.

The section contains information about the leading segments in the industry. In terms of material, polypropylene (PP) is estimated to account for a share more than 80% by 2025. By capacity, 500 to 1,000 L FIBCs are projected to dominate by holding a share of 41.6% by 2025.

| Material | Market Share (2025) |

|---|---|

| Polypropylene (PP) | 80.1% |

Polypropylene is the most common material used for making FIBCs because it presents a perfect strength, durability, and affordability all together. It also ensures that the bags are able to withstand abrasiveness, chemicals, and environmental stresses. Its low weight contributes towards saving transport cost, while it is also quite flexible to enable easy storage and handling.

It is also very flexible, and with this flexibility, manufacturers can easily design FIBCs with varying capacities, shapes, and features that suit a particular requirement. The recyclable nature of the material also adds to its usage in bulk packaging applications.

| Capacity | Market Share (2025) |

|---|---|

| 500 to 1,000 L | 41.6% |

FIBCs with capacities ranging from 500L to 1,000L are recommended because they strike a balance between handling big volumes while remaining reasonable in size and weight. Chemicals, agriculture, and food processing industries rely on these sizes to store and transport bulk products including powders, grains, and granules.

The 500L to 1,000L range meets efficiency requirements while remaining manageable and transportable. These FIBCs also work with regular shipping and storage systems, making them extremely adaptable and cost-effective. This adaptability drives their considerable demand in a variety of industries.

Leading companies in the FIBC are creating and introducing new products with additional benefits and applications to the market. They are expanding their geographic reach and merging with other companies. Few of them are also working together to develop new products in partnerships with start-up businesses and regional brands.

Vendor Insights in FIBC Industry

| Manufacturer | Vendor Insights |

|---|---|

| Palmetto Industries International, Inc. | Known for producing custom FIBCs with a focus on innovative designs and high-quality materials. |

| LC Packaging International BV | Specializes in sustainable FIBC solutions with a strong presence in Europe and a global network. |

| Global-Pak, Inc. | Provides high-performance FIBCs tailored for a wide range of industries, focusing on quality control. |

| Intertape Polymer Group | Offers FIBC solutions known for strength and versatility, particularly in the agricultural and industrial sectors. |

| Rishi FIBC Solutions Pvt. Ltd. | Recognized for manufacturing cost-effective and durable FIBCs with an emphasis on customization. |

Key Developments in FIBC Market

The FIBC industry is projected to witness CAGR of 4.5% between 2025 and 2035.

The global FIBC industry stood at USD 7.2 billion in 2024.

Global FIBC industry is anticipated to reach USD 11.5 billion by 2035 end.

South Asia & Pacific is set to record a CAGR of 6.0% in assessment period.

The key players operating in the FIBC industry are Palmetto Industries International, Inc., LC Packaging International BV, Global-Pak, Inc and Intertape Polymer Group.

In terms of type, the market for FIBC is segmented into type a, type b, type c and type d.

In terms of capacity, the industry is segmented into up to 500 L, 500 to 1,000 L and above 1,000L.

In terms of material, the industry is segmented into polypropylene (PP), polyethylene (PP), nylon, composite materials, paper and recycled materials. Polyethylene further includes low density polyethylene (LDPE) and high density polyethylene (HDPE).

End uses for FIBC are food & beverage, chemical, agriculture, construction, pharmaceuticals, mining and textile. Food & beverage includes grains & cereals, sugar, salt, starch, spices, fruit juices and edible oils. Chemicals includes petrochemicals, dyes & pigments. Agriculture includes biomass, fertilizers, seeds and animal feed. Construction includes cement and sand & gravel. Pharmaceuticals includes APIs and nutraceutical. Mining includes ores, coal and minerals. Textile includes raw cotton, synthetic fiber and yarn.

Key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa are covered.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

North America PET Blow Molder Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.